Image

Description

More information

Image

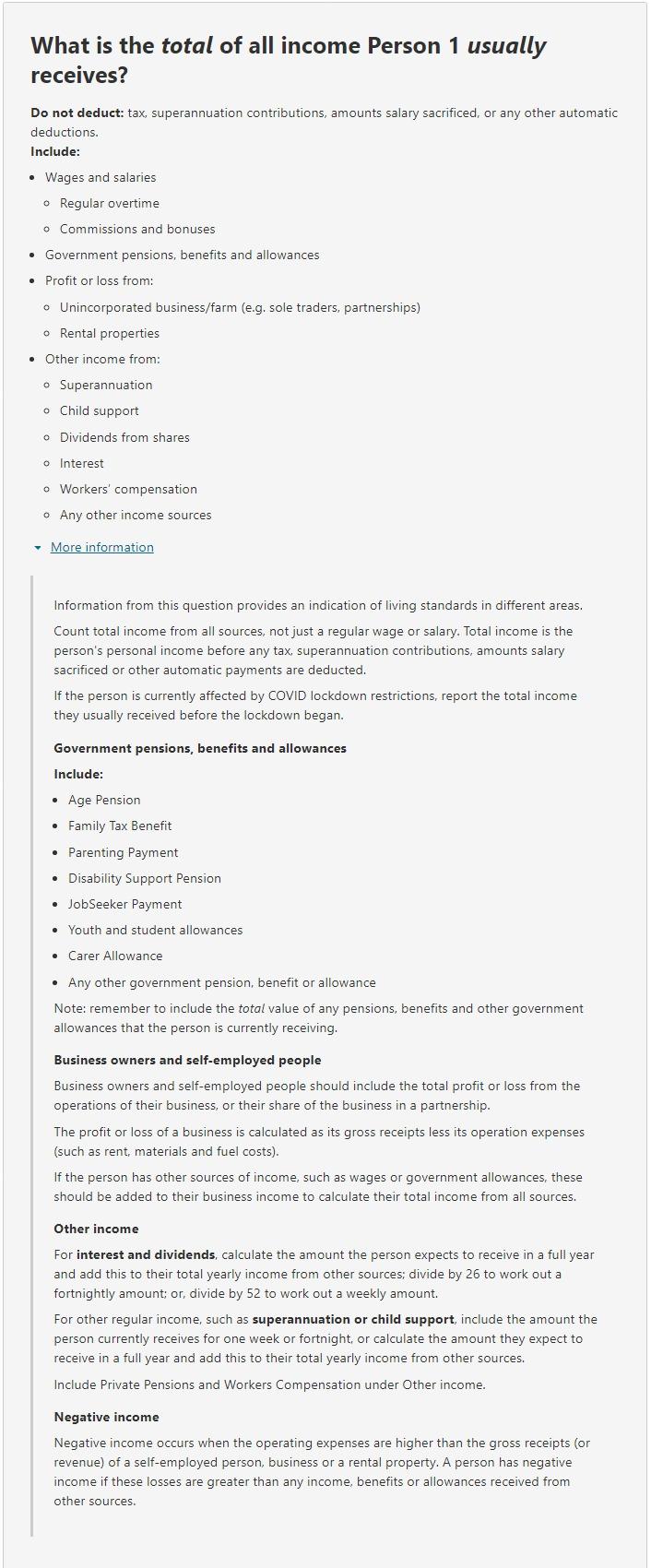

This variable indicates the total income (in ranges) that a person usually receives each week. Equivalent annual income amounts appear in brackets.

Persons aged 15 years and over

| Code | Category |

|---|---|

| 01 | Negative income |

| 02 | Nil income |

| 03 | $1-$149 ($1-$7,799) |

| 04 | $150-$299 ($7,800-$15,599) |

| 05 | $300-$399 ($15,600-$20,799) |

| 06 | $400-$499 ($20,800-$25,999) |

| 07 | $500-$649 ($26,000-$33,799) |

| 08 | $650-$799 ($33,800-$41,599) |

| 09 | $800-$999 ($41,600-$51,999) |

| 10 | $1,000-$1,249 ($52,000-$64,999) |

| 11 | $1,250-$1,499 ($65,000-$77,999) |

| 12 | $1,500-$1,749 ($78,000-$90,999) |

| 13 | $1,750-$1,999 ($91,000-$103,999) |

| 14 | $2,000-$2,999 ($104,000-$155,999) |

| 15 | $3,000-$3,499 ($156,000-$181,999) |

| 16 | $3,500 or more ($182,000 or more) |

| && | Not stated |

| @@ | Not applicable |

| VV | Overseas visitor |

Number of categories: 19

Not applicable (@@) category comprises:

See Understanding supplementary codes for more information.

This variable is captured automatically from mark box responses on the Census form. Respondents are asked to only mark one response. Where a respondent provides more than one response, the responses are accepted in the order they appear on the form and the extra responses are rejected.

Questions on income were first included in the Census in 1933 and have been asked in each Census since 1976. In 2006, this variable was referred to as 'Individual Income (weekly)'.

Income ranges were updated in 2016.

For 2021, an additional income range has been added to reflect changes to the personal income question options. '15 $3,000 or more ($156,000)' has been split into two categories:

This change accounts for higher income ranges.

Even though the Census and other ABS surveys, such as the Survey of Income and Housing and Personal Income in Australia, 2011-2012 to 2017-2018, collect similar data relating to personal income, they are not directly comparable. This is due to differences in scope, collection methodology, the time period the collection relates to, and conceptual differences. It is likely that data from each of these collections will deliver different outcomes making it important for data users to understand the key conceptual differences between each collection in order to most appropriately use it.

Negative income in the Census includes people who own their own business and report negative income due to losses or negative gearing of rentals.

A number of regions across the country were in various stages of lockdown on Census Night, and the week preceding it, resulting in a greater number of people being temporarily stood down, which impacted their income. To gain a better understanding of the true income levels of Australians, guidance for people in lockdown on how to correctly respond was provided at the time on the Census website, as follows:

'Please reflect your usual income, as it was before the commencement of the current COVID-19 lockdown period.'

The non-response rate for Total personal income (weekly) (INCP) was 7.2% in 2021. This is a decrease from 9.0% in 2016.