Family income derivation indicator (FIDF)

Definition

This variable identifies families where one or more family members were temporarily absent, did not state their income or stated a negative income. It can be used to estimate the impact on total family income caused by negative or no income or where people were absent from the household on Census Night.

Scope

Families in family households

Categories

| Code | Category |

|---|---|

| No members aged 15 years and over temporarily absent | |

| All incomes stated | |

| 1 | No negative incomes stated |

| 2 | One or more negative incomes stated |

| One or more incomes not stated | |

| 3 | No negative incomes stated |

| 4 | One or more negative incomes stated |

| One or more members aged 15 years and over temporarily absent | |

| Incomes stated for all members present | |

| 5 | No negative incomes stated |

| 6 | One or more negative incomes stated |

| One or more incomes of members present not stated | |

| 7 | No negative incomes stated |

| 8 | One or more negative incomes stated |

| Not applicable | |

| @ | Not applicable |

Number of categories: 9

Not applicable (@) category comprises:

- Non-family/Non-classifiable households

- Unoccupied private dwellings

- Non-private dwellings

- Migratory, off-shore and shipping SA1s

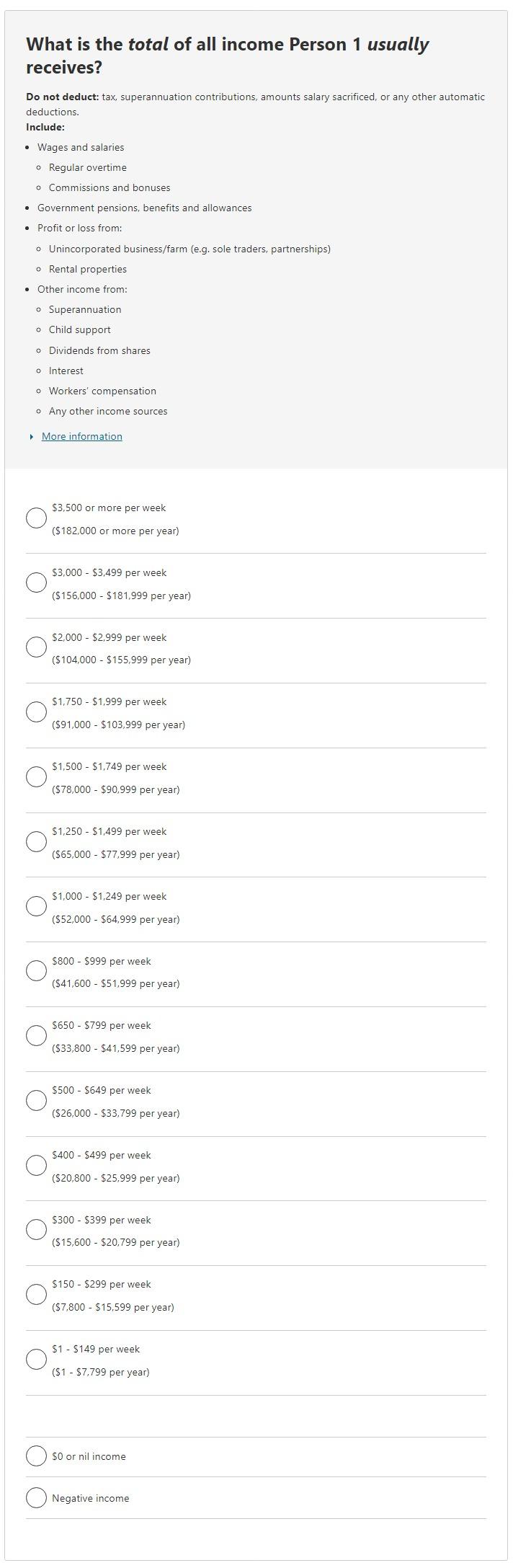

Question(s) from the Census form

What is the person’s relationship to Person1/Person 2?

What is the total of all income the person usually receives?

For each person away, complete the following questions:

How this variable is created

Data for this variable is collected from the Relationship in household and Income questions on the Census form. It also uses the questions asked of people who were away from the household on Census Night.

This variable is derived from the Family composition (FMCF) and Total personal income (INCP) variables. It also uses the Count of persons/dependent children temporarily absent from family variables (CPAF and CDCAF) to isolate families with members aged 15 and over temporarily absent on Census Night.

History and changes

This variable was first introduced in 1991.

No changes have been made for 2021.

Data use considerations

This variable can be used in conjunction with Total personal income (weekly) (INCP) to create a new family income variable.

Usual residents may not be included in the household’s Census form because they were away from the dwelling on Census Night. In this case they should be included in the section of the form for people who were away on Census Night. This can occur in both family and group households. Due to form limitations a maximum of three people can be reported and coded as temporarily absent from the dwelling. If more than three people are absent from the household, the additional people are unable to be included on the form.

Family income derivation indicator (FIDF) should be used with caution when comparing to other family data from within the ABS and for external organisations or agencies. The definition of a family can differ between different statistical collections and may not match Census definitions.

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.