Image

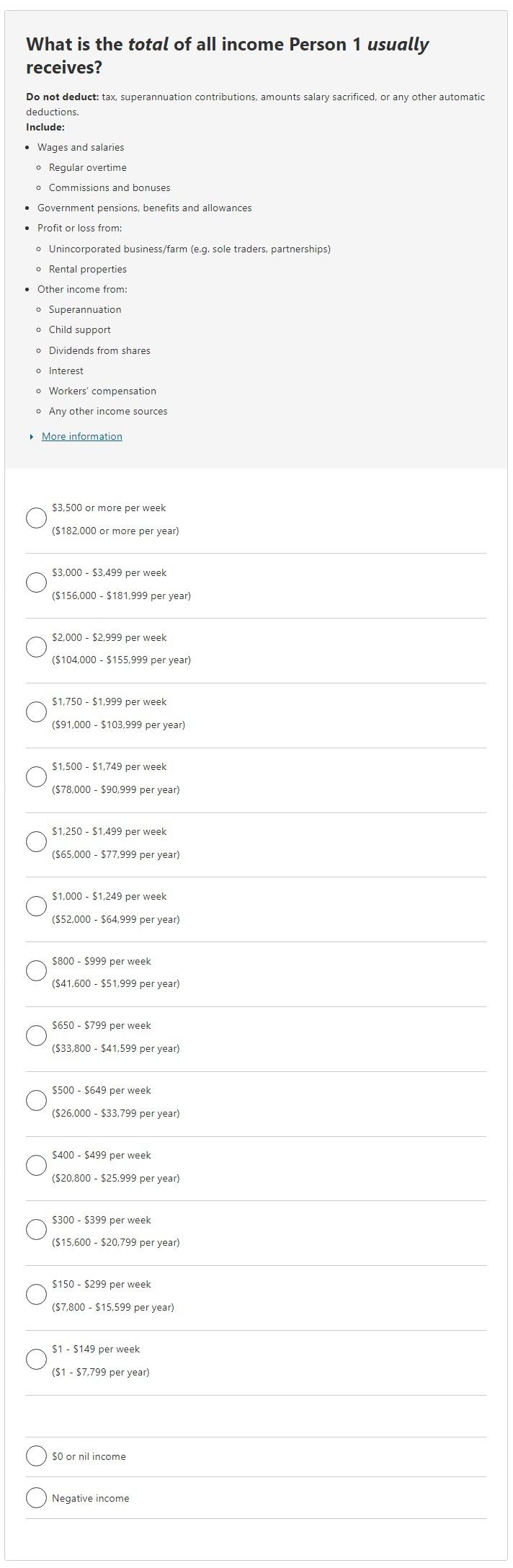

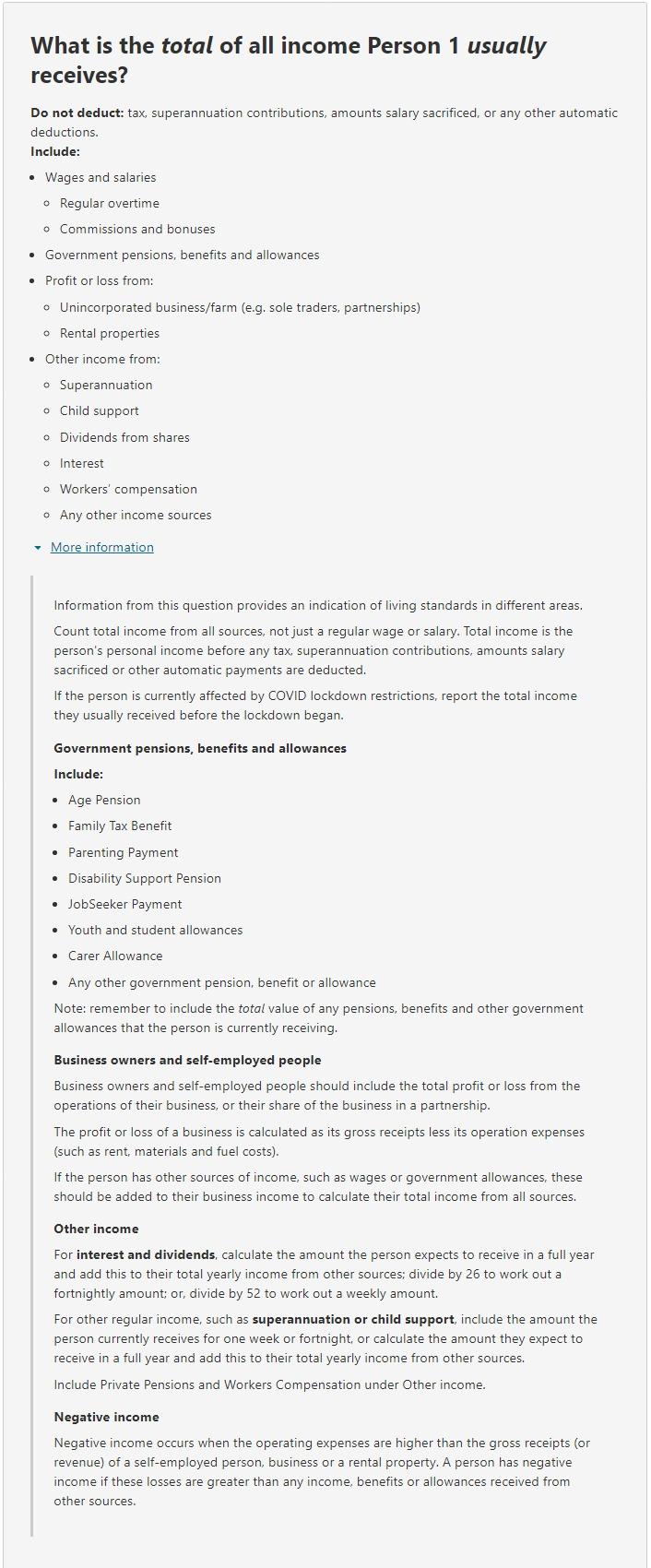

Description

More Information

Image

This variable allocates an in scope household to one of two categories:

Occupied private dwellings owned with a mortgage or purchased under a shared equity scheme

| Code | Category |

|---|---|

| 1 | Households where mortgage repayments are less than or equal to 30% of household income |

| 2 | Households where mortgage repayments are more than 30% of household income |

| 3 | Unable to be determined |

| @ | Not applicable |

Number of categories: 4

Not applicable (@) category comprises:

The Mortgage affordability indicator is calculated by dividing Mortgage repayments (MRED) by an imputed household income. Both variables are expressed as single dollar values. The calculation determines whether mortgage repayments are:

The Census collects the income of each person in the household aged 15 years or over in ranges. To sum these personal income values to calculate a household income, a specific dollar amount is allocated to each person. A median dollar value for each range, derived using data from the Survey of Income and Housing, is used for this purpose. For more information about this survey see the Survey of Income and Housing, User Guide.

Mortgage repayments are already collected in a single dollar amount.

Mortgage affordability indicator is coded to ‘Unable to be determined’ where:

This is a new variable for 2021. QuickStats will use the Mortgage affordability indicator variable, and therefore comparisons shouldn’t be made with previous Census data in QuickStats.

In previous censuses, a measure of mortgage affordability could only be obtained from QuickStats. This measure was different from MAID as it used all occupied private dwellings whether owned outright, owned with a mortgage or rented, as the denominator population.

MAID only applies to dwellings owned with a mortgage or purchased under a shared equity scheme, which is a more accurate representation of the population to measure mortgage affordability.

As housing costs are usually a major component of total living costs they are often analysed in relation to income and referred to as a housing affordability ratio. However, comparisons using these measures are subject to certain limitations.

As described above, the Census collects personal income in ranges. For this purpose, a single median value for each income range is calculated. It should also be noted that individuals may tend to understate their incomes on the Census, compared with the amounts that would be reported in surveys designed specifically to measure incomes. As a result of these limitations, the use of Census imputed incomes in the calculation of each household’s housing costs to income ratio may significantly overstate the true proportion of households with mortgage repayments greater than 30% of income.

Mortgage repayments may be greater than 30% of income for a number of reasons, and do not necessarily indicate being in financial stress.

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.