More information

| Mnemonic | Variable | Release | |

|---|---|---|---|

| BEDD | Number of bedrooms in private dwelling | June 2022 | |

| BEDRD | Number of bedrooms in private dwelling (ranges) | June 2022 | |

| DLOD | Dwelling location | June 2022 | |

| DWIP | Dwelling type indicator for persons | April 2023 | |

| DWTD | Dwelling type | June 2022 | |

| HOSD | Housing suitability | June 2022 | |

| LLDD | Landlord type | June 2022 | |

| MAID | Mortgage affordability indicator | June 2022 | New |

| MRED | Mortgage repayments (monthly) dollar values | June 2022 | |

| MRERD | Mortgage repayments (monthly) ranges | June 2022 | |

| NPDD | Type of non-private dwelling | June 2022 | |

| OPGP | Homelessness operational groups | April 2023 | |

| RAID | Rent affordability indicator | June 2022 | New |

| RLNP | Residential status in a non-private dwelling | June 2022 | |

| RNTD | Rent (weekly) dollar values | June 2022 | |

| RNTRD | Rent (weekly) ranges | June 2022 | |

| STRD | Dwelling structure | June 2022 | |

| TEND | Tenure type | June 2022 | |

| TENLLD | Tenure and landlord type | June 2022 | |

This variable records the count of bedrooms in each occupied private dwelling. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

This variable is available as a single Count of all bedrooms (BEDD) and in ranges (BEDRD).

In standard Census products (Quickstats, Community Profiles), number of bedrooms data are generally published in the range categories for BEDRD.

Occupied private dwellings

| Code | Category |

|---|---|

| 00 | None (includes studio apartments or bedsitters) |

| 01-29 | 1 to 29 bedrooms singly |

| 30 | 30 or more bedrooms |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 33

Not applicable (@@) category comprises:

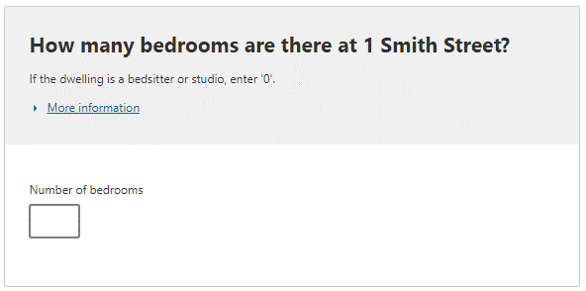

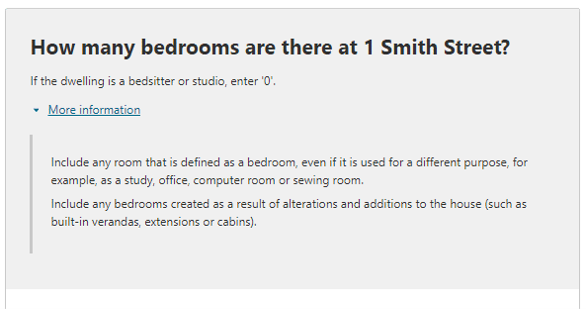

This variable is created based on responses given for the Number of bedrooms question on the Census form. The responses are captured automatically from written numeric responses, or from the 'None' mark box on the paper form.

Number of bedrooms in private dwelling codes numeric responses from 0 to 29 bedrooms as reported and responses of 30 or more bedrooms are coded into the grouped category '30 or more bedrooms'.

A question on the number of rooms/bedrooms has been included in every Australian Census since 1911. However, the question relating to number of bedrooms in a private dwelling was first asked in the 1976 Census.

The 1986 Census form asked householders to indicate the numbers of various room types within the dwelling. Only the number of bedrooms was retained in the computer record. The 1991 and 1996 censuses collected data on the number of bedrooms only.

Since the 2001 Census, respondents have been asked to write in the number of bedrooms in their dwelling rather than mark a response category. An additional 'None' mark box was added to the paper form in 2006.

In 2021, the category has been reworded from ‘None (includes bedsitters)’ to ‘None (includes studio apartments or bedsitters)’.

Number of bedrooms data is commonly used to provide an indication of:

When calculating occupancy ratios, it is preferable to use the number of people usually resident in the home, rather than the number of people present in the household on Census Night. This data can be used with Dwelling structure (STRD) and Dwelling location (DLOD) to provide more context to the number of bedrooms.

The data may include a small proportion of dwellings with unusually high number of bedrooms, as all numeric responses are accepted as reported.

The non-response rate for Number of bedrooms in private dwelling (BEDD) was 5.4% in 2021. This is a decrease from 7.4% in 2016.

This variable records the number of bedrooms in each occupied private dwelling in ranges. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

In standard Census products (Quickstats, Community Profiles) number of bedrooms data is generally published in ranges.

Number of bedrooms is also available as a single count of all bedrooms (BEDD).

Occupied private dwellings

| Code | Category |

|---|---|

| 0 | None (includes studio apartments or bedsitters) |

| 1 | One bedroom |

| 2 | Two bedrooms |

| 3 | Three bedrooms |

| 4 | Four bedrooms |

| 5 | Five bedrooms |

| 6 | Six bedrooms or more |

| & | Not stated |

| @ | Not applicable |

Number of categories: 9

Not applicable (@) category comprises:

This variable is created based on responses given for the Number of bedrooms question on the Census form. The responses are captured automatically from written numeric responses, or from the 'None' mark box on the paper form.

The Number of bedrooms in private dwelling (ranges) (BEDRD) variable groups responses to this question. Responses from 0 to 5 are reported singly while responses for 6 or more bedrooms are coded into the grouped category of '6 or more bedrooms'.

A question on the number of rooms/bedrooms has been included in every Australian Census since 1911. However, the question relating to number of bedrooms in a private dwelling was first asked in the 1976 Census.

The 1986 Census form asked householders to indicate the numbers of various room types within the dwelling. Only the number of bedrooms was retained in the computer record. The 1991 and 1996 Censuses collected data on the number of bedrooms only.

Since the 2001 Census, respondents have been asked to write in the number of bedrooms in their dwelling rather than mark a response category. An additional 'None' mark box was added to the paper form in 2006.

In 2021, the category has been reworded from ‘None (includes bedsitters)’ to ‘None (includes studio apartments or bedsitters)’.

Number of bedrooms data is commonly used to provide an indication of:

When calculating occupancy ratios, it is preferable to use the number of people usually resident in the home, rather than the number of people present in the household on Census Night. This data can be used with Dwelling structure (STRD) and Dwelling location (DLOD) to provide more context to the number of bedrooms.

The data may include a small proportion of dwellings with unusually high number of bedrooms, as all numeric responses are accepted as reported.

This variable is derived from the Number of bedrooms in a private dwelling (BEDD) variable. The non-response rate for Number of bedrooms in private dwelling (BEDD) was 5.4% in 2021. This is a decrease from 7.4% in 2016.

This variable describes the location of dwellings. It classifies them into large communal locations, such as caravan parks and marinas. The majority of Private dwellings are in the ‘other’ category because they are not located within these types of communal locations.

The Dwelling structure for Private dwellings at these locations can be identified by using the variable Dwelling structure (STRD).

The term ‘residential park’ refers to caravan parks with predominantly long-term residents.

Private dwellings

| Code | Category |

|---|---|

| 1 | Caravan/residential park or camping ground |

| 2 | Marina |

| 3 | Manufactured home estate |

| 4 | Retirement village (self-contained) |

| 5 | Other |

| @ | Not applicable |

Number of categories: 6

Not applicable (@) category comprises:

This variable is not collected from a question on the Census form.

Information on Dwelling location is mainly sourced from the Address Register.

Dwelling location data was recorded by ABS Address Canvassing Officers in the lead up to the 2016 Census as a once-off part of establishing the Address Register as a mail-out frame for designated areas. Dwelling location was also verified or collected by ABS Field Officers during the 2016 and 2021 Census collection periods.

If the Dwelling location can not be determined it is set to 'Other'. Most Private dwellings fall into the 'Other' category for this data item.

This variable was introduced for the 1996 Census to cater for changes in the scope of Private dwellings.

For the 2006 and 2011 censuses, information regarding this variable was collected by ABS Field officers rather than being included on the Census form.

Dwelling location has been sourced from the ABS Address Register since 2016. It is verified during field and office processes.

From 2006, the description for category 1 changed from 'Caravan park' to 'Caravan/residential park or camping ground', and the description for category 4 changed from 'Accommodation for the retired or aged (self-care)' to 'Retirement village (self-contained)'.

As this variable is mainly determined by the ABS Address Register, the risk of misclassifying is low.

While the misclassification of Dwelling location (DLOD) is rare, on occasion identification and amendments were made to correct a small number of dwellings. In rare cases, an establishment may fall into more than one category of dwelling location, such as a retirement village that contains manufactured homes, or a residential park that is made up of a mixture of caravans and manufactured homes. However, a dwelling can only be allocated to a single category and in these cases a determination was made during Census processing of the most appropriate category for the dwellings in question.

Dwelling location (DLOD) does not have a non-response rate as it is sourced from the Address Register, or during Census enumeration or Processing.

This variable indicates whether a person was enumerated in a private or a non-private dwelling. It is included in the microdata products as a way of allowing users to more easily distinguish between those people enumerated in private dwellings and those enumerated in non-private dwellings without having to link to the household file.

A dwelling is a structure which is intended to have people live in it, that is it was established for short-stay or long-stay accommodation.

All persons enumerated within an occupied private or non-private dwelling.

As this is a person indicator, unoccupied private dwellings are out of scope.

| Code | Category |

|---|---|

| 1 | Enumerated in an occupied private dwelling |

| 2 | Enumerated in a non-private dwelling |

| 3 | Enumerated in other dwellings |

Number of categories: 3

This variable is not collected from a question on the Census form.

This variable is derived from the Dwelling Type (DWTD) variable.

The correspondence between the two variable's categories is highlighted below.

| DWTD | DWIP |

|---|---|

| 1 Occupied private dwellings | 1 Enumerated in an occupied private dwelling |

| 2 Unoccupied private dwellings | Out of scope |

| 3 Non-private dwellings | 2 Enumerated in a non-private dwelling |

| 4 Migratory | 3 Enumerated in other dwellings |

| 5 Off-shore | 3 Enumerated in other dwellings |

| 6 Shipping | 3 Enumerated in other dwellings |

This indicator has been included in every Census basic and detailed microdata product since 2006. There have been no changes made to this variable.

A data error has been discovered with this variable, there is a small number of people with incorrectly coded migratory, off-shore, or shipping statuses.

The ABS does its best to have accurate Dwelling type information. However it can sometimes be difficult to determine Dwelling type for dwellings with mixed occupancy or where we were not able to make contact with the residents to confirm the type of dwelling.

| Private dwelling | Non-private dwelling | |

|---|---|---|

| Self-contained apartments | Long-term private apartment accommodation | Short-term hotel-style accommodation |

| Aged care and retirement villages | Private self-contained dwellings | Communal accommodation with supported nursing care |

Some non-private dwellings such as group homes for the disabled or convents and monasteries may not be easily identifiable as Non-private dwellings and may be treated as Private dwellings.

There may be misclassification between Unoccupied private dwellings and out-of-scope Private dwellings; non-residential premises and construction sites may have dwellings that are not habitable but are identified as Unoccupied private dwellings.

This variable classifies dwellings into the following types:

A dwelling is a structure which is intended to have people live in it, that is it was established for short-stay or long-stay accommodation.

The definitions for the dwellings that make up the following categories, are described below.

All dwellings

| Code | Category |

|---|---|

| 1 | Occupied private dwellings |

| 2 | Unoccupied private dwellings |

| 3 | Non-private dwellings |

| 4 | Migratory |

| 5 | Off-shore |

| 6 | Shipping |

Number of categories: 6

This variable is not collected from a question on the Census form.

This variable is either inherited from the existing ABS Address Register (see ABS Address Register, User’s Guide) or created by Census field staff on a case by case basis. Census field staff check with some areas and establishments prior to, and after Census Night to confirm dwelling information. New dwellings may be discovered through this process and added to the the count of Census dwellings, along with any updates to dwelling types for existing addresses.

The occupancy for the majority of dwellings in Australia is determined by the returned Census form:

Dwellings from which no form is received have their occupancy determined by using a number of sources of information, including:

Where these methods cannot determine dwelling occupancy, outcomes from a newly introduced Census Occupancy Model are used.

This topic has been included in every Census release.

Since 2006:

A data error has been discovered with this variable, there is a small number of people with incorrectly coded migratory, off-shore, or shipping statuses.

The ABS does its best to have accurate Dwelling type information. However it can sometimes be difficult to determine Dwelling type for dwellings with mixed occupancy or where we were not able to make contact with the residents to confirm the type of dwelling.

Dwelling Type (DWTD) does not have a non-response rate as it is sourced from the ABS Address Register or created during Census enumeration.

| Private dwelling | Non-private dwelling | |

|---|---|---|

| Self-contained apartments | Long-term private apartment accommodation | Short-term hotel-style accommodation |

| Aged care and retirement villages | Private self-contained dwellings | Communal accommodation with supported nursing care |

Some non-private dwellings such as group homes for the disabled or convents and monasteries may not be easily identifiable as Non-private dwellings and may be treated as Private dwellings.

There may be misclassification between Unoccupied private dwellings and out-of-scope Private dwellings; non-residential premises and construction sites may have dwellings that are not habitable but are identified as Unoccupied private dwellings.

This variable is a measure of housing utilisation based on a comparison of the number of bedrooms in a dwelling with a series of household demographics, such as:

The criteria are based on the Canadian National Occupancy Standard. It can be used to identify if a dwelling is either under or over utilised.

Occupied private dwellings

| Code | Category |

|---|---|

| 01 | Four or more extra bedrooms needed |

| 02 | Three extra bedrooms needed |

| 03 | Two extra bedrooms needed |

| 04 | One extra bedroom needed |

| 05 | No bedrooms needed or spare |

| 06 | One bedroom spare |

| 07 | Two bedrooms spare |

| 08 | Three bedrooms spare |

| 09 | Four or more bedrooms spare |

| 10 | Unable to determine |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 12

Not applicable (@@) category comprises:

This variable is derived from responses to housing and household demographic questions from the Census form. The criteria used to derive the variable are based on the Canadian National Occupancy Standard for housing appropriateness and are sensitive to both household size and composition. The measure assesses the bedroom requirements of a household by specifying that:

The Housing suitability variable compares the number of bedrooms required with the actual number of bedrooms in the dwelling. It can be used to analyse the under or over utilisation of dwellings and the dwelling's suitability for the resident household.

The data has been available through customised data requests prior to the 2016 Census. In 2016, this variable was first reported.

No changes have been made for 2021.

There is no single standard measure for Housing suitability. However, the Canadian National Occupancy Standard is widely used in Australia and internationally.

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.

This variable records the landlord type of rented dwellings. It applies to all occupied private dwellings that are being rented, including being occupied rent free. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

Rented dwellings are classified in Tenure type (TEND).

Occupied private dwellings being rented (including being occupied rent free)

| Code | Category |

|---|---|

| 10 | Real estate agent |

| 20 | State or territory housing authority |

| 21 | Community housing provider |

| 31 | Person not in the same household - parent/other relative |

| 32 | Person not in the same household - other person |

| 40 | Owner/Manager of a residential park (including caravan parks and manufactured home estates) |

| 51 | Employer – Government (includes Defence Housing Australia) |

| 52 | Employer – other employer |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 10

Not applicable (@@) category comprises:

This variable is created based on responses from the Tenure type and Landlord type questions on the Census form.

Only one response can be given for this item. If respondents provide more than one response to this question in error, the first response is used.

The question about landlord type was first asked in the 1954 Census and has been included in every subsequent Census.

In 1971, the response categories increased to three: State Housing Authority; Employer; and Other landlord. The number of response categories continued to increase from three (from 1971 until 1991) to seven (in 1996 and 2001) and then to eight for subsequent censuses.

For 2021, instructional text has been added for the Community housing provider category and the response order changed to place this category closer to the top. Additionally, the following categories have been amended as follows:

| 2016 | 2021 | ||

|---|---|---|---|

| Code | Category | Code | Category |

| 60 | Housing co-operative/community/church group | 21 | Community housing provider |

| 40 | Residential park (includes caravan parks and marinas) | 40 | Owner/manager of a residential park (includes caravan parks and manufactured home estates) |

| 51 | Employer - Government (includes Defence Housing Authority) | 51 | Employer - Government (includes Defence Housing Australia) |

Landlord type allows data to be produced for studies of the socioeconomic characteristics of different tenants. It also allows for comparisons with residents in privately owned accommodation.

This data can be used with Dwelling structure (STRD) and Dwelling location (DLOD) to provide more context to the Landlord type.

The non-response rate for Landlord type (LLDD) was 0.9% in 2021. This is a decrease from 1.8% in 2016.

This variable allocates an in scope household to one of two categories:

Occupied private dwellings owned with a mortgage or purchased under a shared equity scheme

| Code | Category |

|---|---|

| 1 | Households where mortgage repayments are less than or equal to 30% of household income |

| 2 | Households where mortgage repayments are more than 30% of household income |

| 3 | Unable to be determined |

| @ | Not applicable |

Number of categories: 4

Not applicable (@) category comprises:

The Mortgage affordability indicator is calculated by dividing Mortgage repayments (MRED) by an imputed household income. Both variables are expressed as single dollar values. The calculation determines whether mortgage repayments are:

The Census collects the income of each person in the household aged 15 years or over in ranges. To sum these personal income values to calculate a household income, a specific dollar amount is allocated to each person. A median dollar value for each range, derived using data from the Survey of Income and Housing, is used for this purpose. For more information about this survey see the Survey of Income and Housing, User Guide.

Mortgage repayments are already collected in a single dollar amount.

Mortgage affordability indicator is coded to ‘Unable to be determined’ where:

This is a new variable for 2021. QuickStats will use the Mortgage affordability indicator variable, and therefore comparisons shouldn’t be made with previous Census data in QuickStats.

In previous censuses, a measure of mortgage affordability could only be obtained from QuickStats. This measure was different from MAID as it used all occupied private dwellings whether owned outright, owned with a mortgage or rented, as the denominator population.

MAID only applies to dwellings owned with a mortgage or purchased under a shared equity scheme, which is a more accurate representation of the population to measure mortgage affordability.

As housing costs are usually a major component of total living costs they are often analysed in relation to income and referred to as a housing affordability ratio. However, comparisons using these measures are subject to certain limitations.

As described above, the Census collects personal income in ranges. For this purpose, a single median value for each income range is calculated. It should also be noted that individuals may tend to understate their incomes on the Census, compared with the amounts that would be reported in surveys designed specifically to measure incomes. As a result of these limitations, the use of Census imputed incomes in the calculation of each household’s housing costs to income ratio may significantly overstate the true proportion of households with mortgage repayments greater than 30% of income.

Mortgage repayments may be greater than 30% of income for a number of reasons, and do not necessarily indicate being in financial stress.

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.

This variable records the monthly mortgage repayments being paid by a household for the dwelling in which they were counted on Census Night. It is applicable to occupied private dwellings. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

The Census collects this information in single dollar values. For practical purposes this information is recoded to a specific number of ranges for standard Census products (such as QuickStats and Community Profiles). The ranges are listed in Mortgage repayments (monthly) ranges (MRERD).

Occupied private dwellings that are owned with a mortgage (including being purchased under a shared equity scheme)

| Code | Category |

|---|---|

| 0000 - 9999 | $0 to $9,999 singly |

| &&&& | Not stated |

| @@@@ | Not applicable |

Number of categories: 10,002

Not applicable (@@@@) category comprises:

Data for this variable is derived from the Tenure type and Housing costs questions on the Census form. Household repayments data is automatically captured from numeric text responses.

The question relating to Mortgage repayments (monthly) dollar values was first asked for the 1976 Census, though in some previous years this variable has been referred to as ‘Housing loan repayments (monthly)’. Since 2011, Nil repayments is recorded as $0 in Mortgage repayments (monthly) dollar values and as a separate category called ‘Nil repayments’ in Mortgage repayments (monthly) ranges. Prior to 2011 a response of nil was coded as ‘Not Stated’.

No changes have been made for 2021.

The data in these variables is important for the analysis of home ownership and for providing benchmark data for evaluating housing needs, housing finance and housing demand.

Processing Mortgage repayments (monthly) dollar values is subject to some recognition error for responses provided on paper Census forms, particularly when responses incorrectly include cents and the decimal point is missing or unclear. Some high or low values when combined with income may form unlikely combinations. While the data is subject to data assurance checks to ensure an acceptable level of quality, numeric responses are accepted as reported by the respondents on the form.

The non-response rate for Mortgage repayments (monthly) dollar values (MRED) was 6.0% in 2021. This is an increase from 4.2% in 2016.

This variable records the mortgage repayments being paid by a household in ranges. It is applicable to occupied private dwellings on Census Night. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

For practical purposes this information is recoded to a specific number of ranges for standard Census products (such as QuickStats and Community Profiles).

The Census also collects this information in single dollar values (MRED).

Occupied private dwellings that are owned with a mortgage (including being purchased under a shared equity scheme)

| Code | Category |

|---|---|

| 01 | Nil repayments |

| 02 | $1-$149 |

| 03 | $150-$299 |

| 04 | $300-$449 |

| 05 | $450-$599 |

| 06 | $600-$799 |

| 07 | $800-$999 |

| 08 | $1,000-$1,199 |

| 09 | $1,200-$1,399 |

| 10 | $1,400-$1,599 |

| 11 | $1,600-$1,799 |

| 12 | $1,800-$1,999 |

| 13 | $2,000-$2,199 |

| 14 | $2,200-$2,399 |

| 15 | $2,400-$2,599 |

| 16 | $2,600-$2,799 |

| 17 | $2,800-$2,999 |

| 18 | $3,000-$3,499 |

| 19 | $3,500-$3,999 |

| 20 | $4,000-$4,999 |

| 21 | $5,000 and over |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 23

Not applicable (@@) category comprises:

Data for this variable is derived from the Tenure type and Housing costs questions on the Census form. Household repayments data is automatically captured from numeric text responses.

The question relating to Mortgage repayments (monthly) dollar values was first asked for the 1976 Census, though in some previous years this variable has been referred to as ‘Housing loan repayments (monthly)’. Since 2011, Nil repayments is recorded as $0 in Mortgage repayments (monthly) dollar values and as a separate category called ‘Nil repayments’ in Mortgage repayments (monthly) ranges. Prior to 2011 a response of nil was coded as ‘Not Stated’.

No changes have been made for 2021.

The data in these variables is important for the analysis of home ownership and for providing benchmark data for evaluating housing needs, housing finance and housing demand.

Processing Mortgage repayments (monthly) dollar values is subject to some recognition error for responses provided on paper Census forms, particularly when responses incorrectly include cents and the decimal point is missing or unclear. Some high or low values when combined with income may form unlikely combinations. While the data is subject to data assurance checks to ensure an acceptable level of quality, numeric responses are accepted as reported by the respondents on the form.

This variable is derived from Mortgage repayments (monthly) dollar values (MRED). The non-response rate for Mortgage repayments (monthly) dollar values (MRED) was 6.0% in 2021. This is an increase from 4.2% in 2016.

This variable classifies the Type of non-private dwelling in which people were counted on Census Night. Non-private dwellings (NPDs) are establishments which provide a communal and often short-term type of accommodation.

'Other and non-classifiable' includes all other types of NPDs not listed, including ski lodges and youth or backpacker hostels.

Non-private dwellings

| Code | Category |

|---|---|

| 01 | Hotel, motel, bed and breakfast |

| 02 | Nurses’ quarters |

| 03 | Staff quarters |

| 04 | Boarding house, private hotel |

| 05 | Boarding school |

| 06 | Residential college, hall of residence |

| 07 | Public hospital (not psychiatric) |

| 08 | Private hospital (not psychiatric) |

| 09 | Psychiatric hospital or institution |

| 10 | Hostel for the disabled |

| 11 | Nursing home |

| 12 | Accommodation for the retired or aged (not self-contained) |

| 13 | Hostel for homeless, night shelter, refuge |

| 14 | Child care institution |

| 15 | Corrective institution for children |

| 16 | Other welfare institution |

| 17 | Prison, corrective institution for adults |

| 18 | Immigration detention centre |

| 19 | Convent, monastery, etc |

| 20 | Other and non-classifiable |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 22

Not applicable (@@) category comprises:

This variable is not collected from a question on the Census form.

The types of Non-private dwelling is sourced from the ABS Address Register. For information on how the Address Register is maintained, refer to ABS Address Register, Users' Guide.

It is reviewed by Census enumeration management staff prior to Census Night and verified by Census Field Officers after calls or visits to the establishments. Non-private dwellings can also be created or have their details modified throughout this time.

Information on the types of Non-private dwellings that people are located in on Census Night has been collected in every Census since 1911.

Since the 2006 Census, additional response options were introduced to identify immigration detention centres, youth or backpacker hostels and ski lodges.

Since 2016, NPD type is sourced from the ABS Address Register and is updated as needed from information collected by ABS field officers during enumeration.

The output categories for this classification were unchanged for 2021.

Hotels (01) and private hotels (04) are categorised differently within Type of non-private dwelling (NPDD). This is mainly because of differences in length of residency, service provision, and how the hotel or private hotel classifies itself.

‘Accommodation for the retired or aged (not self-contained)’ (12) is accommodation where meals are provided.

Self-contained retirement villages where the residents live independently are not classified as Non-private dwellings. These are Occupied private dwellings and can be identified by the variable Dwelling location (DLOD).

'Other welfare institutions' (16) have increased in 2021. Address lists are sourced from state and territory governments and non-government organisations to identify accommodation for the homeless. These lists were more comprehensive in the 2021 Census than in previous censuses.

The 2021 Census also requested tenure information from these list providers so that addresses could be more accurately classified as 'Hostels for the homeless' (13) or 'Other welfare institutions' (16). Short-term accommodation was coded as 'Hostels for the homeless' (13) while medium-term accommodation/transitional housing and long-term accommodation was coded as 'Other welfare institutions' (16).

The coding is based on the Australian Institute of Health and Welfare (AIHW) definition of Supported accommodation type that also informs the Supported Accommodation flag that indicates homelessness.

Type of non-private dwelling (NPDD) does not have a non-response rate as it is sourced from the ABS Address Register.

This variable allocates an in scope household to one of two categories:

Occupied private dwellings being rented

| Code | Category |

|---|---|

| 1 | Households where rent repayments are less than or equal to 30% of household income |

| 2 | Households where rent repayments are more than 30% of household income |

| 3 | Unable to be determined |

| @ | Not applicable |

Number of categories: 4

Not applicable (@) category comprises:

The Rent affordability indicator is calculated by dividing rent payments (RNTD) by an imputed household income. Both variables are expressed as single dollar values. The calculation determines whether rent payments are:

The Census collects the income of each person in the household aged 15 years or over in ranges. To sum these personal income values to calculate a household income, a specific dollar amount is allocated to each person. A median dollar value for each range, derived using data from the Survey of Income and Housing, is used for this purpose. For more information about this survey see the Survey of Income and Housing, User Guide.

Rent payments are already collected in a single dollar amount.

Rent affordability indicator is coded to ‘Unable to be determined’ where:

This is a new variable for 2021. QuickStats will use the Rent affordability indicator (RAID) variable, and therefore comparisons shouldn’t be made with previous Census data in QuickStats.

In previous censuses, a measure of rental affordability could only be obtained from QuickStats. This measure was different from RAID as it used all occupied private dwellings whether owned outright, owned with a mortgage or rented, as the denominator population.

RAID only applies to dwellings being rented, which is a more accurate representation of the population to measure rental affordability.

As housing costs are usually a major component of total living costs they are often analysed in relation to income, and referred to as a housing affordability ratio. However, comparisons using these measures are subject to certain limitations. As described above, the Census collects personal income in ranges. For this purpose, a single median value for each income range is calculated. It should also be noted that individuals may tend to understate their incomes on the Census, compared with the amounts that would be reported in surveys designed specifically to measure incomes. As a result of these limitations, the use of Census imputed incomes in the calculation of each household’s housing costs to income ratio may significantly overstate the true proportion of households with rent payments greater than 30% of income.

Households are often reimbursed some of their housing costs, but these reimbursements may not be offset in housing costs reported in the Census but included instead in income. Employer subsidies and Commonwealth Rent Assistance (CRA) are examples where the housing costs to income ratio is significantly affected by the default treatment of these amounts in Census reporting. This is particularly important when comparing ratios for households in public housing with those who are in receipt of CRA.

Rent payments greater than 30% of income may not necessarily indicate that a household is in financial stress.

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.

This variable describes the residential status of each person in a non-private dwelling. It records whether people enumerated in non-private dwellings (such as motels, hospitals and colleges) are staying there as:

Housing and family relationship information is not available for people in non-private dwellings because they are counted using Personal forms.

All persons in a non-private dwelling on Census Night

| Code | Category |

|---|---|

| 1 | Owner, proprietor, staff and family |

| 2 | Guest, patient, inmate, other resident |

| & | Not stated |

| @ | Not applicable |

| V | Overseas visitor |

Number of categories: 5

Not applicable (@) category comprises:

See Understanding supplementary codes for more information.

This variable is collected through the Census Personal form. Data is captured from the Residential status in this dwelling question, and responses are captured in 8 separate mark box responses. These responses are then grouped into two output categories.

A question on status in a non-private dwelling was first asked in the 1976 Census and has been asked for every Census since then.

No changes have been made for 2021.

Residential status in a non-private dwelling is only applicable to persons who were in a non-private dwelling on Census Night and were enumerated on a Census Personal form.

The non-response rate for Residential status in a non-private dwelling (RLNP) was 42.0% in 2021. This is an increase from 27.6% in 2016. Non-response is generally higher for persons who were staying at a non-private dwelling on Census Night than those counted in an occupied private dwelling.

The higher percentage of non-response may be related to COVID-19, the uptake of the online form and the introduction of a new pathway to complete a Census form without receiving Census material in the mail. COVID-19 related restrictions limited the ability to enumerate non-private dwellings using the Personal Form. Additionally, some people staying in non-private dwellings accessed the Household form rather than the Personal form using the new pathway to the Census website. The Household form does not capture details on NPD type and Residential status that are collected on Personal Forms.

This variable records the individual dollar amounts of rent paid by households on a weekly basis for the dwelling in which they were counted on Census Night. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

In standard Census products (Quickstats, Community profiles), ranges are used rather than individual dollar amounts. The ranges are listed in Rent (weekly) ranges (RNTRD).

Occupied private dwellings being rented

| Code | Category |

|---|---|

| 0001-9999 | $1 to $9,999 singly |

| &&&& | Not stated |

| @@@@ | Not applicable |

Number of categories: 10,001

Not applicable (@@@@) category comprises:

This variable is derived from the Tenure type and Household payments questions on the Census form.

Household payments data is automatically captured from numeric text responses. If rental payment responses are reported as a fortnightly or monthly figure they are derived to a weekly figure. Responses to the tenure type question are used to determine whether payments are recorded as rent or mortgage repayments.

Information on how much rent is paid for a private dwelling has been collected for all censuses since 1911.

Since the 1996 Census, the actual dollar amount paid for a dwelling has been collected rather than the range.

In 2021, the applicability has changed so that dwellings with the Tenure type of 'Occupied rent free' are included in the Not applicable category. Consequently $0 (category 0000) has been removed.

The Census is the only source of rent data for small areas and for small groups of the population. Such data is important for housing policy and planning, and for studying the housing conditions of small populations.

Processing Rent (weekly) dollar values (RNTD) is subject to some recognition error for responses provided on paper Census forms, particularly when responses incorrectly include cents and the decimal point is missing or unclear. While the data is subject to data assurance checks to ensure an acceptable level of quality, numeric responses are accepted as reported by respondents on the form.

The non-response rate for Rent (weekly) dollar values (RNTD) was 3.9% in 2021. This is an increase from 3.4% in 2016.

This variable records the rent paid for a dwelling on a weekly basis in ranges. It is applicable to the dwelling the household was counted in on Census Night. A private dwelling is defined in Dwelling structure (STRD) and can include caravans in caravan parks, occupied tents, and houseboats.

This data is output in standard Census products (QuickStats, Community profiles) in ranges.

Rent is also captured in individual dollar amounts in Rent (weekly) dollar values (RNTD).

Occupied private dwellings being rented

| Code | Category |

|---|---|

| 01 | $1 - $74 |

| 02 | $75 - $99 |

| 03 | $100 - $124 |

| 04 | $125 - $149 |

| 05 | $150 - $174 |

| 06 | $175 - $199 |

| 07 | $200 - $224 |

| 08 | $225 - $249 |

| 09 | $250 - $274 |

| 10 | $275 - $299 |

| 11 | $300 - $324 |

| 12 | $325 - $349 |

| 13 | $350 - $374 |

| 14 | $375 - $399 |

| 15 | $400 - $424 |

| 16 | $425 - $449 |

| 17 | $450 - $474 |

| 18 | $475 - $499 |

| 19 | $500 - $524 |

| 20 | $525 - $549 |

| 21 | $550 - $649 |

| 22 | $650 - $749 |

| 23 | $750 - $849 |

| 24 | $850 - $949 |

| 25 | $950 and over |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 27

Not applicable (@@) category comprises:

This variable is derived from the Tenure type and Household payments questions on the Census form.

Household payments data is automatically captured from numeric text responses. If rental payment responses are reported as a fortnightly or monthly figure they are derived to a weekly figure. Responses to the Tenure type question are used to determine whether payments are recorded as rent or mortgage repayments.

Information on how much rent is paid for a private dwelling has been collected for all censuses since 1911.

Since the 1996 Census, the actual dollar amount paid for a dwelling has been collected rather than the range.

In 2021, the output categories for the dollar ranges have been revised. Category 18 splits into four $25 intervals (categories 18-21), increasing the number of categories from 25 in 2016 to 27 in 2021. The applicability has changed so that now dwellings with the Tenure type of 'Occupied rent free' are included in the Not applicable category and the 01 category starts at $1.

The Census is the only source of rent data for small areas and for small groups of the population. Such data is important for housing policy and planning, and for studying the housing conditions of small populations.

Processing Rent (weekly) dollar values (RNTD) is subject to some recognition error for responses provided on paper Census forms, particularly when responses incorrectly include cents and the decimal point is missing or unclear. While the data is subject to data assurance checks to ensure an acceptable level of quality, numeric responses are accepted as reported by respondents on the form.

This variable is derived from Rent (weekly) dollar values (RNTD). The non-response rate for Rent (weekly) dollar values (RNTD) was 3.9% in 2021. This is an increase from 3.4% in 2016.

This variable records the structure of private dwellings.

Private dwellings

| Code | Category |

|---|---|

| 11 | Separate house |

| 21 | Semi-detached, row or terrace house, townhouse etc. with one storey |

| 22 | Semi-detached, row or terrace house, townhouse etc. with two or more storeys |

| 31 | Flat or apartment in a one or two storey block |

| 32 | Flat or apartment in a three storey block |

| 33 | Flat or apartment in a four to eight storey block |

| 34 | Flat or apartment in a nine or more storey block |

| 35 | Flat or apartment attached to a house |

| 91 | Caravan |

| 92 | Cabin, houseboat |

| 93 | Improvised home, tent, sleepers out |

| 94 | House or flat attached to a shop, office, etc. |

| && | Not stated |

| @@ | Not applicable |

Number of categories: 14

Not applicable (@@) category comprises:

This variable is not collected from a question on the Census form.

Initially, this data is sourced from the ABS Address Register. For more details, refer to the ABS Address Register, Users' Guide.

In some cases the Dwelling structure is updated after information is returned from ABS field officers during their visits to dwellings.

New dwellings added by Census staff can have their Dwelling structure added by the field officer or imputed from the surrounding dwellings during processing.

Depending on Dwelling structure type and the method by which the Address Register is updated, the private dwelling’s structure can be derived from the Address Register (with Building Approvals data also assisting in some cases) or information obtained by Census field officers. Structure for Non-private dwellings (NPDs) are set to ‘not applicable’.

Certain types of dwelling structures, such as 'Improvised homes, tent, sleepers-out' are given particular attention during data processing to quality assure the homeless population.

Some information on the structure of Private dwellings has been collected for all censuses since 1911, though the specific types of classification used have varied significantly.

Prior to the 1986 Census, occupied craft in marinas were treated as Non-private dwellings, however occupied houseboats and occupied small boats are now treated as Occupied private dwellings.

From 1976 to 2011, the information on Dwelling structure was collected by Census Field Officers in the Collector Record Book at the time the Census forms were delivered instead of being on the Census form.

In 2016 there was a change in the way the data was collected. It was initially recorded by ABS Address Canvassing Officers in the lead up to the Census, as part of establishing the Address Register as a mail-out frame for designated areas (93% of Australian addresses). In areas enumerated using the traditional approach of delivering forms, the information was collected by ABS Field Officers during the Census collection period. Location of private dwelling data was also updated as required by ABS Field Officers during the Census enumeration period. Dwellings in remote areas continue to have their structure collected solely by field officers.

In 2021, the Address Register is considered the main source of Dwelling location data, and real-world frame amendments are made when appropriate, by Field and Office staff.

For the 2016 Census, there was a change to one of the response categories for this variable. The previous category of 'Caravan, cabin or houseboat' was separated into two categories:

In 2021, there has been further disaggregation of the flat/apartment categories to align with different building rules in place for buildings with a height greater than 25 metres and to meet increasing stakeholder demand for more data about high rise apartment buildings. The previous category ‘In a four or more storey block’ is separated into two categories:

For the 2021 Census, there is a change to the half a metre rule that had previously distinguished separate houses from semi-detached dwellings. The new definition is purely structural in which a separate house (constructed in the last 20 years) must be structurally independent, regardless of separation from adjacent dwellings. This change aligns with the way structure data is provided for the Building Approvals collection. See Housing variables for more information.

For the 2021 Census, addresses that do not have Dwelling structure recorded from observation or by the ABS address register can have the information populated by imputation.

Data on Dwelling structure is used to monitor changes in housing characteristics, to help formulate housing policies and to review existing housing stock.

Minor inconsistencies in Dwelling structure counts may exist between censuses due to updated information on structure to the ABS Address Register and the subjective interpretation of structural definitions between individual Field Officers.

Although a review has been conducted to update Dwelling structure in light of changes to the half a metre rule for buildings constructed in the last 20 years, some older dwellings may still reflect the old definition.

Flats attached to houses are at a high risk of being missed as they are hard to identify, this is also the case for flats above shops.

The non-response rate for Dwelling structure (STRD) was 0.3% in 2021. This is a decrease from 0.5% in 2016.

Non-response for this variable was largely caused by previously unidentified dwellings being added to the census frame. This can occur when a member of the public submits their form online for an address that is not on the ABS Address Register or contacts the Census Inquiry Service. This results in dwelling structure not being recorded and is therefore left as a not stated response.

Dwellings with no dwelling structure coded went through an imputation process to try and assign a structure code based on surrounding dwellings. Where a structure was unable to be assigned, the dwelling structure remained as not stated.

This variable describes whether a dwelling is owned, being purchased or rented.

The tenure category 'Being purchased under a shared equity scheme' refers to households who are purchasing less than 100% equity in the dwelling, and may or may not be paying rent for the remainder.

‘Occupied under a life tenure scheme' refers to households or individuals who have a 'life tenure' contract to live in the dwelling but usually have little or no equity in the dwelling. This is a common arrangement in retirement villages.

Occupied private dwellings

| Code | Category |

|---|---|

| 1 | Owned outright |

| 2 | Owned with a mortgage |

| 3 | Purchased under a shared equity scheme |

| 4 | Rented |

| 5 | Occupied rent free |

| 6 | Occupied under a life tenure scheme |

| 7 | Other |

| & | Not stated |

| @ | Not applicable |

Number of categories: 9

Not applicable (@) category comprises:

This variable is derived from responses to the Tenure type question on the Census form which asks if the dwelling is owned, being purchased or being rented.

Respondents are asked to only mark one response. Where a respondent provides more than one response, the responses are accepted in the order they appear on the form and the extra responses are rejected.

The question relating to Tenure type (TEND) was first asked for the 1911 Census. From 1976 to 1991, nature of occupancy data was derived from mortgage and rent questions. For all other censuses a direct question on nature of occupancy was included.

Since 2006, the question on tenure type has changed to remain consistent with the current ABS statistical standard for tenure type. It captures the difference between owners with and without a mortgage. Prior to this it differentiated whether a dwelling was owned outright or being purchased.

For 2021, minor changes were made to category labels.

There are no known data use considerations at this time.

The non-response rate for Tenure type (TEND) was 5.4% in 2021. This is a decrease from 7.7% in 2016.

Occupied private dwellings

| Code | Category |

|---|---|

| 1 | Owned outright |

| 2 | Owned with a mortgage |

| 3 | Rented: Real estate agent |

| 4 | Rented: State or territory housing authority |

| 5 | Rented: Community housing provider |

| 6 | Rented: Person not in same household |

| 7 | Rented: Other landlord type |

| 8 | Rented: Landlord type not stated |

| 9 | Other tenure type |

| & | Tenure type not stated |

| @ | Tenure type not applicable |

Number of categories: 11

Not applicable (@) category comprises:

This variable is derived from responses to the Tenure type and Landlord type questions on the Census form.

The Tenure and landlord type (TENLLD) combined variable was first available for use during the 2011 Census. Prior to this, data was obtained by manually combining the Tenure type (TEND) and Landlord type (LLDD) variables.

For 2021, the category ‘Rented: Housing co-operative, community or church group’ has been reworded to ‘Rented: Community housing provider’, and it has been repositioned to category 5, moving the category ‘Rented: Person not in same household’ to category 6.

‘Other tenure type’ has been rescoped for 2021 to include houses being occupied rent free, which in previous censuses have been covered by the rented categories (4-8), to align with the ABS Standard for Tenure Type.

'Other tenure type' includes dwellings occupied under a life tenure scheme and dwellings occupied rent free. 'Owned with a mortgage' includes dwellings being purchased under a shared equity scheme (termed a rent/buy scheme in 2011).

This variable does not have a non-response rate as it is created during Census processing by using responses from more than one question on the Census form.

This variable records the operational group of persons estimated to be homeless or marginally housed on Census Night.

All persons who are estimated to be homeless or marginally housed

| Code | Category |

|---|---|

| Homelessness operational groups | |

| 1 | Persons living in improvised dwellings, tents or sleeping out |

| 2 | Persons in supported accommodation for the homeless |

| 3 | Persons staying temporarily with other households |

| 4 | Persons living in boarding houses |

| 5 | Persons in other temporary lodgings |

| 6 | Persons living in ‘severely’ crowded dwellings |

| Other marginal housing groups | |

| 7 | Persons living in other crowded dwellings |

| 8 | Persons in other improvised dwellings |

| 9 | Persons who are marginally housed in caravan parks |

| Not applicable | |

| @ | Not Applicable |

Number of categories: 10

Not applicable comprises:

The homelessness enumeration strategy uses support from service providers and a range of Census forms to capture the data. Rough sleepers were captured using the Special short form. Couch surfers and other people in temporary lodgings were captured using the Census Household form and were instructed to respond 'none' to the usual address question. Some Aboriginal and Torres Strait Islander discrete communities were captured using the Interviewer household form.

Homelessness is not a characteristic that is directly measured in the Census. Estimates of the homeless population are derived from the Census using analytical techniques, based on both the characteristics observed in the Census and assumptions about the way people may respond to Census questions.

The categories listed under Homeless operational groups (categories 1-6) can be summed to form a Total estimate of homelessness.

The categories listed under Other marginal housing groups (categories 7-9) are considered to be ‘Marginally housed’. This means that the living arrangements are close to the statistical boundary of homelessness and the person may be at risk of homelessness. Other types of marginal housing, such as housing with major structural problems or where residents are in constant threat of violence, cannot be obtained from the Census and are therefore not included.

While these categories will overlap in a small number of circumstances, people are only assigned to one category to avoid double counting. This is done by only including them in the group that is the highest on the hierarchy. For example, a person in supported accommodation for the homeless may also be living in 'severely' crowded dwellings, but the person will only be coded to the category 2 Persons in supported accommodation for the homeless. This category is higher on the hierarchy than category 6 Persons living in 'severely' crowded dwellings'.

There is a long history of collecting information relevant to identifying homeless people in the Census.

1933-1991:

1996

For the first time there was a special targeted strategy for the homeless population. The strategy aimed to maximise the coverage of the population and to provide information to policy makers and services providers. This information included the number and characteristics of people experiencing homelessness.

1996-2006

Experimental estimates of homelessness were published for the 1996, 2001 and 2006 Censuses based on a ‘cultural’ understanding of homelessness that distinguished between primary, secondary and tertiary homelessness.

2012

The statistical definition was first developed in 2012. The first official estimates of prevalence of homelessness were published in 2012 using data from 2011 and back-cast to the 2001 Census. Estimated since have been produced on this definitional basis.

No changes have been made for 2021.

The ABS statistical definition of homelessness is:

When a person does not have suitable accommodation alternatives, they are considered homeless if their current living arrangement:

The definition has been constructed from a conceptual framework centred around the following elements:

People must lack one or more of these elements to be defined as homeless. However, people who lack one or more of these elements may not necessarily be classified as homeless if they are living in special circumstances (for example, in hospitals, prisons, student halls or religious orders). While homelessness is not a choice, some people may choose to live in situations that might parallel the living situations of people who are homeless. For example, people may be living in a shed while building a home on their own property, or on holiday travelling and staying with friends. These people have choice because they have the capacity to access other accommodation that is safe, adequate and provides for social relations. Having access to accommodation alternatives is contingent on having the financial, physical, psychological and personal means to access these alternatives. For more information, see Information Paper - A Statistical Definition of Homelessness.

The homeless and marginally housed categories represent an operationalisation of this definition of homelessness within the limits of the data collected in the Census.

To calculate the total homeless population, use only the Homeless Operational categories 1 to 6.

This variable does not have a non-response rate as it is derived from responses to the Census.