This paper was written by Bill Becker and Alexander Hanysz, with data analysis supported by Jonathan Wu. Many other ABS staff have contributed feedback and technical advice, including Lauren Binns, Jason Dias, Robert Ewing, Ben Faulkner, Andy Peisker, James Pham and Peter Williams. The ABS is grateful to all data providers and to the many data users who’ve provided feedback.

Interpreting the Monthly Household Spending Indicator

A guide to understanding the Monthly Household Spending Indicator

This article is a practical guide to interpreting the Monthly Household Spending Indicator (MHSI) as of early 2025, including comparisons between MHSI, Retail Trade and quarterly National Accounts.

Introduction

When you spend $100 at the supermarket, what's in your trolley? Did you buy $100 worth of food and nothing but food? Or did you buy a new frying pan, a pair of socks, some shampoo and some toilet rolls? And why does the ABS care?

Household spending is an important part of the economy and makes up about half of Australia’s Gross Domestic Product (GDP), as calculated by the expenditure method. It is important to understand the types of businesses where this spending is happening (measured by industry – such as turnover for supermarkets), and what is being purchased (measured by product – such as expenditure on food products). Both play important roles in shaping government policy and helping the community make informed decisions.

On average, the ABS estimates that out of every $100 spent in supermarkets, somewhere between $70 and $80 is spent on food. The Retail Trade publication counts this as $100 spent within the Food retailing industry group. However, for the National Accounts, when estimating Household Final Consumption Expenditure (HFCE), the same $100 is counted as $70–80 spent on Food products, and the rest spent on other products, including:

- Cosmetics, which is included under Miscellaneous goods and services

- Pet food: Recreation and culture

- Alcohol: Alcoholic beverages and tobacco.

From July 2025, the ABS will be discontinuing the Retail Trade publication, which is a monthly measure of retail spending by industry. Similar data can instead be found in two publications:

- The MHSI, which provides a view of spending by product using the COICOP classification

- Monthly Business Turnover Indicator (MBTI), which provides an industry view of business turnover using the ANZSIC classification.

Why MHSI?

For several years now, the ABS has been exploring administrative data to supplement or replace surveys, for National Accounts inputs, labour statistics, agricultural statistics, and much more. During the COVID-19 pandemic, we established new partnerships with several banks and maximised our use of Business Activity Statement (BAS) data from the Australian Tax Office (ATO).

Making use of a wide range of other administrative data opens up two types of opportunities:

- New insights. The Retail Business Survey covers businesses who predominantly sell to households. This excludes businesses such as petrol stations and car dealers where a significant proportion of sales is to commercial or government customers. With administrative data, we can easily include the sales to these other businesses, as well as household spending on service sectors such as health, recreation and culture, and accommodation, giving a more complete picture of household spending in the economy. In 2024, MHSI counted $886 billion of household expenditure, compared with $437 billion for Retail Trade.

- Reduced provider burden. The ABS is committed to reducing the number of businesses selected for our surveys and the time spent filling out survey forms. As well as using administrative data, see our survey participant FAQ page for the other steps we’re taking.

MHSI and MBTI provide new insights of economic activity, such as spending and turnover in the services sector, while also covering retail spending captured by the Retail Business Survey. This provides the ABS with a pathway to cease the Retail Business Survey, reducing red tape for 3,400 businesses each month.

To assist with the transition, the ABS consulted with key users to design an enhanced MHSI. A key goal for the enhanced product is to improve its suitability as a forward indicator of HFCE. Since HFCE is produced on a COICOP basis, the ABS has focussed on improving the MHSI COICOP estimates, rather than producing MHSI on an industry basis.

With this goal in mind, the ABS has been aligning the data sources and methods for MHSI and HFCE for some of the spending categories. For example, the ABS has progressively transitioned from Retail Trade data to bank transactions as an input into quarterly National Accounts compilation. Going forward, this will improve the alignment between MHSI and HFCE data for categories like Food, Clothing and footwear, and Furnishings and household equipment.

MHSI data sources have also been updated to align with HFCE, such as transitioning to motor vehicle sales data from the Federal Chamber of Automotive Industries (FCAI) to estimate spending on motor vehicle purchases.

In August 2024, the ABS released an updated version of MHSI, to align with HFCE as closely as possible within a monthly publication timetable.

For some spending categories, the MHSI figures will look a little different from the similarly named Retail Trade category, because it actually has a different scope. There are also some differences between MHSI and quarterly HFCE, but for a different reason: HFCE allows more processing time before publication. This means it can include input data sources that are not available in time for the MHSI publication, such as quarterly surveys. It also allows more time for analysts to reconcile different data sources and make adjustments as needed.

When the Retail Trade publication ceases in July 2025, you will have spending information in the MHSI in seasonally adjusted, current price and volume terms going back to 2019 for most categories, and 2012 for other categories. We also have plans to improve the indicator over time. In our publication on 5 August 2025, we will extend all the series back to 2012. We are also assessing the feasibility of publishing data for selected retail industries.

Overview of expenditure statistics

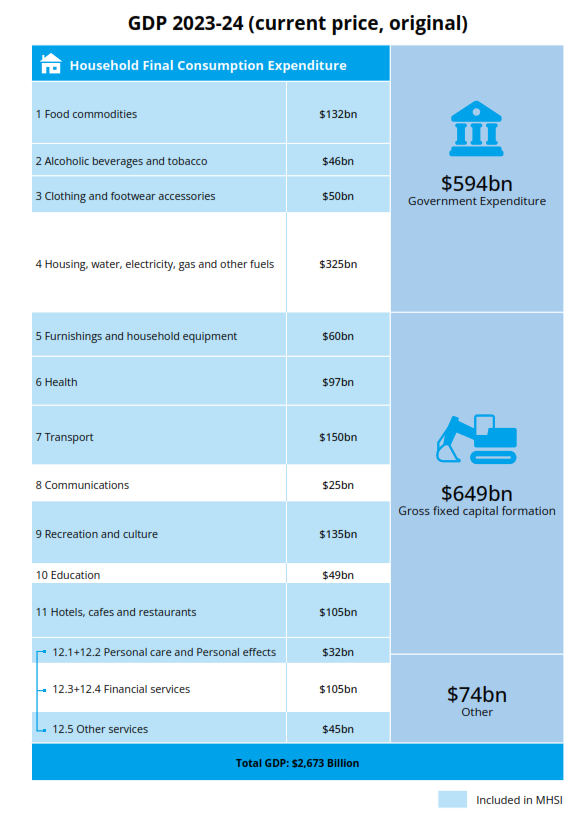

Australia’s Gross Domestic Product in 2023–24 was approximately $2.7 trillion. As shown in the infographic below, household expenditure (HFCE) makes up just over half of this total. For national accounting purposes, we break down HFCE into 12 broad categories by purpose of consumption, according to the United Nations Classification of Individual Consumption by Purpose (COICOP) standard. MHSI measures 8½ of those categories (excluding the Insurance and other financial services component of Miscellaneous goods and services), covering just over 60% of HFCE. By comparison, Retail Trade covered around 32% of HFCE in 2023–24.

Image

Description

The graphic provides a breakdown of Gross Domestic Product in the 2023–24 financial year into four broad categories: Household Final Consumption Expenditure or HFCE ($1356 billion), Government expenditure ($594 billion), Gross fixed capital formation ($649 billion), and Other ($74 billion). All figures are in original, current price terms. The HFCE part is divided into sections according to COICOIP category, and shaded to show which categories are included in MHSI. The categories are:

1. Food commodities, $132 billion, included in MHSI. This is one of the larger categories.

2. Alcoholic beverages and tobacco, $46 billion, about a third the size of food, included in MHSI.

3. Clothing and footwear accessories, $50 billion, included in MHSI.

4. Housing, water, electricity, gas and other fuels, $325 billion, not in MHSI. This is the largest category overall, and more than twice the size of the next largest.

5. Furnishings and household equipment, $60 billion, included in MHSI.

6. Health, $97 billion, included in MHSI.

7. Transport, $150 billion, included in MHSI. This is the largest of the MHSI categories, and the second largest category overall.

8. Communications, $25 billion, not in MHSI.

9. Recreation and culture, $135 billion, included in MHSI. This is one of the larger MHSI categories, similar in size to food.

10. Education, $49 billion, not in MHSI.

11. Hotels, cafes and restaurants, $105 billion, included in MHSI.

The last category is broken down into three sub-categories:

12.1+12.2. Personal care and Personal effects, $32 billion, included in MHSI.

12.3+12.4. Financial services, $105 billion, not in MHSI.

12.5 Other services, $45 billion, included in MHSI.

Data sources and methods for each product category

The sections below provide an overview of the data sources and methods used to create the indicator series for each spending category (COICOP division) in MHSI. Indicator series measure monthly changes in spending for a given COICOP category.

For most categories, the indicator series are derived from bank transactions data. The banks classify the transactions data by ANZSIC, or another industry-based classification which we map to ANZSIC. The COICOP category may simply be a sum of included ANZSIC classes, or some ANZSIC classes may be pro-rated across multiple categories. The sections below list the ANZSIC classes (and proportions where applicable) for each category.

For the Food and Transport indicator series, we combine bank transactions with other data: supermarket scanner data for Food, and motor vehicle sales data for Transport.

The indicator series for some COICOP divisions are aggregated from finer level series, for example at the COICOP group or class level. These may be referred to in this paper (for example, Alcoholic beverages and Cigarettes and tobacco are COICOP groups in the Alcoholic beverages and tobacco COICOP division), but estimates at these lower levels are not available for publication at this time.

Further transformations are applied to each MHSI indicator series, including an adjustment for cash spending and benchmarking to annual HFCE. Benchmarking adjusts the MHSI annual levels to be equal to HFCE, while preserving the monthly growth rates as much as possible. Benchmarking provides consistency with HFCE in the composition of spending across COICOP categories and States/territories.

Food

This COICOP division includes expenditure on food and non-alcoholic beverages for preparation and consumption at home. It only includes food that’s intended for human consumption; pet food is classified under Recreation and culture. Dining out and takeaway orders are not included here, but are counted in the Hotels, cafes and restaurants category instead.

For MHSI, the indicator series is based on bank card spending, with an adjustment to exclude non-food products sold at supermarkets. Total supermarket spending is multiplied by the proportion of spending that was on food products in that month. This ratio is calculated each month using supermarket scanner data and ranged between 77% and 78% in 2024.

Spending at other businesses also contributes to the MHSI Food indicator series. For example, 96% of spending at Other specialised food retailers (such as a local butcher or bakery) is counted as food spending. Similarly, a small proportion of liquor store spending (1.3%) is counted as food: this covers things like a bag of chips from the front counter. These ratios are based on the 2012/13 Retail and Wholesale Industries Survey (RISWIS).

The RISWIS is a survey of businesses in the Retail and Wholesale industries. These businesses were asked to provide their turnover data by product type. Using this information, we can estimate the proportion of turnover for each product per industry.

The bank card spending data for each relevant ANZSIC class is multiplied by the RISWIS proportion. For example, for every $100 of spending at a business classified as Liquor retailing, $1.30 of this will contribute to the MHSI Food indicator. This step will be referred to as the “RISWIS proportions method” throughout the article.

In the Retail trade publication, the Food retailing category includes alcoholic beverages and tobacco products. MHSI and HFCE have a separate category for this expenditure.

Comparing the MHSI and Retail trade Food monthly movements in original terms (not seasonally adjusted), we see similar patterns, marked by strong rises in December as households get ready for Christmas, and a spike in March 2020 due to COVID-19 related shopping. Retail trade has slightly stronger rises in December months, due to the inclusion of liquor retailing.

The data sources and methods for HFCE are similar to MHSI, and are described in more detail at: Using scanner data to estimate household consumption, September 2021 | Australian Bureau of Statistics, noting bank transactions data has been used in place of the Retail Trade Survey since the December 2023 quarter. Differences between MHSI and HFCE include:

- Given the shorter time frame to produce MHSI outputs, scanner data is mapped to broader categories compared to HFCE.

- MHSI does not adjust for food products purchased from non-retail stores.

Alcoholic beverages and tobacco

The Alcoholic beverages and tobacco COICOP division includes two COICOP groups:

- Cigarettes and tobacco

- Alcoholic beverages.

This division includes expenditure on alcoholic beverages that are intended to be consumed at home. If you buy a glass of wine with dinner at a restaurant, that’s counted in the Hotels, cafes and restaurants COICOP division instead.

For Alcoholic beverages, the MHSI indicator series is derived using the RISWIS proportions method and supplemented with bank transactions data for ANZSIC class 4520 Pubs, taverns and bars to account for packaged liquor sales consumed off-premises. There are three main industries that contribute to this group:

- Liquor retailing (98% of its spending contributes to this COICOP group)

- Supermarket and grocery stores (5%)

- Pubs, taverns and bars (25%).

The HFCE indicator series for Alcoholic beverages has largely been the same as MHSI since the March 2024 quarter. Before this, Retail Trade data was used instead of bank transactions. Differences between HFCE and MHSI include:

- HFCE uses the supermarket scanner data to update the contribution from supermarkets each quarter, whereas MHSI uses a fixed proportion from the RISWIS. As a result, supermarkets make a larger contribution to MHSI estimates of Alcoholic beverages compared to HFCE.

- HFCE also includes a small contribution from ANZSIC class 9201 Casino operation.

For MHSI, the method for estimating Cigarettes and tobacco indicator series is similar to Food. Total supermarket spending (from the bank transactions data) is multiplied by the proportion of spending on cigarettes and tobacco products in that month (using supermarket scanner data). This ratio ranged between 4% and 6% in 2024.

Spending on cigarettes and tobacco at non-supermarket businesses (for example at tobacconists) does not contribute to the indicator series. Non-supermarket sales of tobacco are included in the MHSI dollar levels via the annual benchmarking process, since they are included in annual HFCE estimates, but it is not clear how much illicit tobacco sold by legal establishments is captured in HFCE. There is no attempt to estimate the value of tobacco distributed illegally. There is an implicit assumption that the monthly growth rates for the MHSI indicator series are the same as monthly changes in spending on cigarettes at non-supermarket businesses and illicit sales.

In HFCE, the indicator series for Cigarettes and tobacco is derived from supermarket scanner data by aggregating sales for cartons, packs (normal cigarettes and cigars), grams of leaf tobacco sold, filters and papers.

Comparing the published MHSI and HFCE estimates for Alcoholic beverages and tobacco, we see broadly similar patterns, with some notable differences. MHSI recorded weaker growth in the June 2024 and September 2024 quarters compared to HFCE. This is partly due to the different data sources and methods for MHSI and HFCE.

HFCE have a longer time from the end of the reference period to the publication date: about 9 weeks, compared with 4 or 5 weeks for MHSI. Therefore, they can compare the tobacco estimates with a wider range of other data sources, such as survey data from the Quarterly Business Indicators Survey (QBIS), administrative data from Business Activity Statements, and information about tobacco imports. National Accountants use these additional data sources to improve economic coherence of national accounts statistics.

There is no single series in the Retail Trade publication that can be compared to MHSI’s Alcoholic beverages and tobacco series. Alcohol and cigarette sales are mainly captured across the following Retail trade industries:

- Liquor retailing

- Supermarket and grocery stores and non-petrol sales (convenience stores) of selected fuel retailing

- Other retailing n.e.c., which includes tobacconists.

Clothing and footwear

This COICOP division includes spending on clothing garments, materials, and accessories, with the exception of watches and jewellery, which are counted as part of Miscellaneous goods and services.

For MHSI, the indicator series for this COICOP division is estimated using the RISWIS proportions method. There are three main industries that contribute to this division:

- Clothing retailing (91% of its spending contributes to this COICOP division)

- Department stores (43%)

- Footwear and other personal accessory retailing (92%).

The monthly movements for MHSI and Retail trade follow a similar pattern. Differences can be seen in April and May 2020, when Retail trade fell more steeply in April and had a stronger rise in May. This is due to the inclusion of Department store spending in MHSI, which was less volatile over this period. This could be attributed to wider online shopping options for department stores compared to smaller clothing and footwear retailers.

Since the March 2024 quarter, HFCE has used the same sources and method as MHSI, with one key exception. Department store spending is sourced from QBIS rather than the bank transactions dataset. This is because bank transactions for online retailers are sometimes combined into the same merchant category code as department stores, making it difficult to separate the two for HFCE purposes.

MHSI and HFCE quarterly movements are well-aligned, especially since the March 2024 quarter when bank transactions also became a key source of the HFCE indicator series.

Furnishings and household equipment

This COICOP division includes furniture, household textiles (like curtains and blinds), appliances, glassware, crockery, utensils, and garden tools.

As for Clothing and footwear, the indicator series for this COICOP division is derived using the RISWIS proportions method. There are several key industries that contribute to this division:

- Hardware, building and garden supplies retailing (79% of spending contributes to this COICOP division)

- Electrical and electronic goods retailing (31%)

- Furniture, floor coverings, houseware and textile goods retailing (98%)

- Other retailing n.e.c. (24%)

- Supermarket and grocery stores (4%)

- Department stores (19%).

The Retail Trade industry category that most closely resembles the Furnishings and household equipment category is Household goods retailing. However, only three industry groupings are included in Household goods retailing. All turnover for businesses classified to these industries contributes to the Retail Trade estimate:

- Furniture, floor coverings, houseware and textile goods retailing

- Electrical and electronic goods retailing

- Hardware, building and garden supplies retailing.

This differing scope gives rise to different levels and movements for MHSI Furnishings and household equipment and Retail trade Household goods retailing. The most significant differences are the relatively small contribution from Electrical and electronic goods retailing to this category in MHSI (it mainly contributes to the Recreation and culture category), and contributions from other industries that are classified elsewhere in Retail trade statistics (such as Department stores).

Since the June 2024 quarter, HFCE has used the same sources and method as MHSI, with two significant exceptions:

- Department store and Electrical and electronic goods retailing spending is sourced from QBIS rather than the bank transactions dataset.

- HFCE uses scanner data from hardware retailers as a more up to date source (than the RISWIS) for the share of tools spending in the Hardware, building and garden supplies retailing industry group.

This difference gives rise to slightly different quarterly movements in the published MHSI and HFCE series for Furnishings and household equipment:

Health

The Health COICOP division includes three COICOP groups:

- Medicines, medical aids and therapeutic appliances

- Ambulatory health care (for example, doctors and dental services)

- Hospital services.

In MHSI, the indicator series for the Medicines, medical aids and therapeutic appliances COICOP group is estimated using the RISWIS proportions method. The main industry that contributes is Pharmaceutical, cosmetic and toiletry goods retailing, for which 86% of spending contributes to this group.

The main ANZSIC classes that contribute to the Ambulatory health care and Hospital services COICOP groups are:

- 8511 General Practice Medical Services

- 8531 Dental Services

- 8532 Optometry and Optical Dispensing

- 8401 Hospitals (Except Psychiatric Hospitals)

- 8599 Other Health Care Services n.e.c.

The MHSI Health series largely represents out-of-pocket expenses for health-related goods and services. It does not include the contribution from the government via Medicare or from the patient’s private insurance company. For HFCE, government benefits are also excluded, but private insurance benefits are included.

There are a few data sources that feed into HFCE indicator series for the Health COICOP division.

HFCE data sources for Medicines, medical aids and therapeutic appliances:

- Bank transactions from the December 2024 quarter onwards (Retail trade before this).

HFCE data sources for Ambulatory health care:

- Services Australia data on the fees charged for medical services and procedures where Medicare benefits were paid

- Private health insurance statistics from the Australian Prudential Regulation Authority (APRA)

- Government Finance Statistics on benefits paid under Medicare.

HFCE data sources for Hospital services:

- Private health insurance statistics from APRA

- Department of Health and Aged Care data on fees charged for medical services and procedures where Medicare benefits were paid.

The quarterly movements for MHSI and HFCE follow a similar pattern, although the alignment is not as close as some of the other categories. There are two main reasons for this. Firstly, MHSI does not capture benefits paid by private health insurers, which is included in HFCE.

Secondly, the source of the HFCE indicator series for Medicines, medical aids and therapeutic appliances only switched to bank transactions in the December 2024 quarter and used Retail Trade data before this.

Retail Trade provides turnover estimates for the Pharmaceutical, cosmetic and toiletry goods retailing industry but does not cover the services side of this COICOP division (such as doctor, dentist, and hospital fees).

Transport

The Transport COICOP division includes three COICOP groups:

- Operation of vehicles: includes spending on automotive petrol and diesel, and repairs and maintenance to vehicles

- Transport services: includes spending on air fares, taxis, and public transport

- Purchase of vehicles.

This COICOP division is not included in Retail Trade data.

The main ANZSIC classes that contribute to MHSI Operation of vehicles indicator series are:

- 4000 Fuel Retailing

- 3921 Motor Vehicle Parts Retailing

- 9419 Other Automotive Repair and Maintenance

- 6611 Passenger Car Rental and Hiring

- 9533 Parking Services

- 3922 Tyre Retailing

- 9412 Automotive Body, Paint and Interior Repair

- 6619 Other Motor Vehicle and Transport Equipment Rental and Hiring.

The main ANZSIC classes that contribute to MHSI Transport services indicator series are:

- 4900 Air and Space Transport

- 4623 Taxi and Other Road Transport

- 5010 Scenic and Sightseeing Transport

- 4720 Rail Passenger Transport

- 4622 Urban Bus Transport (Including Tramway).

Three sources are used to estimate Purchase of Vehicles spending in MHSI:

- Motor vehicle sales from the Federal Chamber of Automotive Industries (FCAI)

- Electric vehicles sales from the Electric Vehicle Council (EVC)

- Bank transactions data for Motorcycle Retailing.

The FCAI and EVC datasets are important for improving our estimates, because people use a variety of payment methods for car purchases: credit and debit cards only cover about a third of this spending.

There are a few data sources that feed into HFCE indicator series for the Transport division. Bank transactions are not used in any component of the HFCE indicator series.

HFCE data sources for Operation of vehicles:

- Petroleum sales volumes from the Department of Climate Change, Energy, and the Environment and Water)

- Motor vehicle registrations

- Various Consumer Price Indexes.

HFCE data sources for Transport services:

- Revenue data from major airlines

- Airport passenger data from the Bureau of Infrastructure and Transport Research Economics

- Revenue data of government transport authorities from Government Finance Statistics

- Data from private operators of rail and bus services

- Imports of transportation services from Balance of Payments

- Various Consumer Price Indexes.

For the Purchase of vehicles COICOP group, the data sources for HFCE are largely the same as MHSI. HFCE includes estimates of expenditure on used vehicles from other sectors, and dealers’ margins for new and used vehicle sales. These are not accounted for in MHSI.

The quarterly transport movements for MHSI and HFCE don’t align as closely as for other COICOP divisions.

Looking at the three COICOP groups, we see good alignment for Operation of vehicles and Purchase of vehicles, but poor alignment for Transport services. The main source of the difference is the treatment of air travel. In MHSI, spending on air travel is recorded when the fare is paid for, while in HFCE, it is recorded when the flight occurs. Given air fares can be purchased as far as 12 months in advance, this can result in differences in the two series.

Recreation and culture

The Recreation and culture COICOP division is comprised of two COICOP groups, with both being estimated using bank transactions data:

- Goods for recreation and culture: includes spending on audiovisual equipment, recreational items and equipment, pets, and newspapers, books and stationery

- Recreational and cultural services: includes spending on sporting services, cultural and entertainment services (such as cinemas, TV and video hire), veterinary services, and net losses from gambling.

For Goods for recreation and culture, the MHSI indicator series is derived using the RISWIS proportions method. There are few key industries that contribute to this division:

- Electrical and electronic goods retailing (69% of spending contributes to this division)

- Other retailing n.e.c. (45%)

- Newspaper and book retailing (95%)

- Other recreational goods retailing (69%)

- Department stores (28%).

From the December 2024 quarter, HFCE largely uses the same sources and method as MHSI, with two exceptions:

- Department store and Electrical and electronic goods retailing spending is sourced from QBIS rather than the bank transactions dataset.

- ATO BAS data is used for spending relating to audiovisual services.

The main ANZSIC classes that contribute to MHSI Recreational and cultural services are:

- 9209 Other Gambling Activities

- 9112 Sports and Physical Recreation Clubs and Sports Professionals

- 9001 Performing Arts Operation

- 8219 Adult, Community and Other Education n.e.c.

- 6970 Veterinary services

- 5622 Cable and Other Subscription Broadcasting

- 5513 Motion Picture Exhibition

- 9139 Amusement and Other Recreational Activities n.e.c.

- 9002 Creative Artists, Musicians, Writers and Performers

- 6639 Other Goods and Equipment Rental and Hiring n.e.c.

There are a few data sources that feed into HFCE indicator series for Recreational and cultural services, with bank transactions data only being used to estimate TV and video hire, and veterinary services. Data sources for the other components include:

- Revenue data from the Motion Picture Distributors Association of Australia

- Revenue data from major television service providers

- Net losses by resident households on gambling from Government Finance Statistics

- ATO BAS data for digital services spending, such as streaming services

- Estimated resident population

- Various Consumer Price Indexes.

Quarterly movements at the division level (including both Goods and Services) for MHSI and HFCE align fairly well since mid-2022, and alignment will continue to improve from the December 2024 quarter when HFCE switched from Retail Trade to bank transactions as the main source for its Goods for recreation and culture indicator series.

Hotels, cafes and restaurants

The Hotels, cafes and restaurants COICOP division includes two COICOP groups:

- Catering services, including cafes, restaurants and pubs.

- Accommodation services.

The ANZSIC classes that contribute to the MHSI Catering services indicator series are:

- 4511 Cafes and Restaurants

- 4512 Takeaway Food Services

- 4513 Catering Services

- 4520 Pubs, Taverns and Bars.

The main ANZSIC classes that contribute to the MHSI Accommodation services indicator series are:

- 4400 Accommodation

- 8601 Aged Care Residential Services.

There are a few data sources that feed into the HFCE indicator series for the Hotels, cafes and restaurants division.

For the Catering services indicator series, HFCE has used bank transactions since the June 2024 quarter, in place of Retail Trade data. HFCE adopts a different method to MHSI though. Rather than mapping 100% of spending from the relevant ANZSIC classes to this COICOP group, weights are applied to each ANZSIC class based on data from the Services Industry Survey (last run in 2007). The purpose of the weighting is to exclude spending that is outside the scope of this COICOP group, such as gambling at pubs.

For Accommodation services, HFCE uses the following data sources:

- Accommodation turnover data from QBIS

- Estimated resident population

- Consumer Price Index, All groups.

Quarterly movements for Hotels, cafes and restaurants in MHSI and HFCE align fairly well since 2022. The main driver for discrepancies can be attributed to the Accommodation services COICOP group, where different data sources are used across MHSI and HFCE.

There is strong alignment between the two series for the Catering services COICOP group, and this should continue in the future as HFCE now uses bank transactions as the source for its indicator series.

Retail Trade provides turnover estimates for the Cafes, restaurants and takeaway food services industry. However, this only contains the ANZSIC classes 4511, 4512, and 4513, and therefore does not cover the full scope of this COICOP division.

Miscellaneous goods and services

The Miscellaneous goods and services COICOP division includes five COICOP groups:

- Personal care, including hairdressers and beauty salons

- Personal effects, including watches and jewellery

- Insurance services

- Financial services

- Other services, such as childcare, legal services, employment agencies and real estate agents.

Since bank card transactions provide low coverage of Insurance services and Financial services, and there is a lack of alternative timely monthly data sources, these two groups are excluded from MHSI.

For the remaining three groups, bank transactions data is the source for the MHSI indicator series.

The Personal care COICOP group is broken down into two classes:

- Hairdressers and beauty salons

- Perfumes and cosmetics.

For Hairdressers and beauty salons, the indicator series is bank transactions data categorised to ANZSIC class 9511 Hairdressing and Beauty Services.

For Perfumes and cosmetics, the indicator series is derived using the RISWIS proportions method. The main industries that contribute to the MHSI Personal care indicator series are:

- Supermarkets and grocery stores (5% of its spending contributes to this COICOP group)

- Other retailing n.e.c. (5%)

- Pharmaceutical, cosmetic and toiletry goods retailing (12%)

- Department stores (8%).

For the Personal effects COICOP group, the indicator series is derived using the RISWIS proportions method. The main industries that contribute to the MHSI Personal effects indicator series are:

- Watches and jewellery (97% of its spending contributes to this COICOP group)

- Other retailing n.e.c. (8%).

The main ANZSIC classes that contribute to the MHSI Other services indicator series are:

- 7220 Travel Agency and Tour Arrangement Services

- 7299 Other Administrative Services n.e.c.

- 5700 Internet Publishing and Broadcasting

- 8790 Other Social Assistance Services

- 9539 Other Personal Services n.e.c.

Retail Trade provides partial coverage of this COICOP division. It captures Personal effects spending, mainly through businesses classified as Watch and jewellery retailing or Other personal accessory retailing. It also captures Perfumes and cosmetics spending by sampling a range of businesses like supermarkets, pharmacies, and department stores. However, it does not capture spending at Hairdressers and beauty salons, or Other services spending.

For HFCE, the indicator series for the Personal care and Personal effects COICOP groups have used bank transactions data since the December 2023 quarter. Before this, they used Retail Trade data. For the Other services COICOP group, the following data sources are used:

- Estimated resident population

- Consumer price index.

The graph below compares the quarterly movements for the Miscellaneous goods and services COICOP division, excluding Insurance services and Financial services.

Excludes Insurance services and Financial services.

While the series generally move in the same direction each quarter, the alignment isn’t as strong as some of the other categories. Looking at the contributing COICOP groups, the main difference is in Other services, where different sources are used: MHSI is based on bank transactions, while HFCE uses Estimated Resident Population and the Consumer Price Index.

What’s not in MHSI

MHSI covers categories where credit and debit card transactions are well representative of total consumption, or where the ABS has been able to find a good alternative data source that’s available on a monthly basis. For some categories, there are significant amounts of spending through other payment channels, or discrepancies between the timing of payment and of consumption. Therefore, MHSI does not include the following COICOP categories:

- Rent and other dwelling services

- Electricity, gas and other fuels

- Communication services

- Education services

- Insurance and other financial services.

For more information, see the quality summary table in the previous information paper from early 2022: Development of the new experimental monthly household spending indicator

Adjustments

Cash Adjustment

The bank transactions data supplied to the ABS is focussed on credit and debit card spending, and does not always cover other payment types such as direct debit, cryptocurrency, BPAY and cash.

We make a monthly adjustment to address changes over time in cash spending, by combining Reserve Bank of Australia (RBA) statistics on ATM withdrawals with RBA insights from their Consumer Payments Survey.

Given the lack of a comprehensive source of when cash is spent in the economy, the adjustment assumes that all cash withdrawn is spent in the same month.

When MHSI data for the latest month is published for the first time, the ATM withdrawals data is not yet available. Therefore, the cash adjustment for the latest month is nowcasted using an ARIMA model. The nowcasted adjustment factor is replaced in the following publication, when the ATM withdrawal data is available for that month.

Adjustments made to HFCE, but not MHSI

The following adjustments are made to HFCE as part of the National Accounts compilation, but are not applied to MHSI:

- Net expenditure overseas: this type of expenditure is largely excluded from the bank data supplied to the ABS

- Net expenditure interstate: not required for MHSI as the State/territory in the data represents the location of the household, rather than the location of the business.

- Tourist refund scheme

- Low value threshold

- Underground economy

- Repair and maintenance.

Further information about these adjustments can be found at: Adjustments made to HFCE | Australian Bureau of Statistics.

Sources of revisions

Like most ABS publications, MHSI data is revised in each monthly publication to reflect the most current information and data available.

There are a few potential sources of revisions for the MHSI:

- Incorporating source data updates from the data providers, including the bank card transactions, motor vehicle sales from the FCAI and EVC, and the ATM withdrawals series from the RBA, which is used in the cash adjustment. Revisions to source data are generally small (within 0.1 percentage points).

- Updating the nowcasted cash adjustment with the latest ATM withdrawals data from the RBA. This is usually small, but has caused the occasional larger revision (around half a percentage point). As of March 2025, the methodology is under review.

- Revisions to seasonally adjusted data due to the re-estimation of seasonal factors, on a similar basis to other publications.

- Methods changes. Examples include the change to the seasonal adjustment aggregation structure in the August 2024 publication, and the removal of the “Other Financial Institutions” adjustment in the October 2024 publication. Methods changes will always be clearly flagged in the publication, and should be less frequent in the future.

- Benchmarking an additional financial year of MHSI to HFCE. This will occur once a year, in the October publication. Benchmarking will change the average level of the historical series, but should have minimal effect on the month-to-month movements.

- Undertaking the Annual Seasonal Reanalysis process, which involves reviewing the seasonally adjusted series to ensure they are fit for purpose. This will occur once a year, in the June publication, and will only affect the seasonally adjusted series.

States and territories

In MHSI and HFCE, spending is assigned to a State or territory based on the person’s home address. This differs from Retail Trade, where it is assigned based on the location of the business where the money is spent.

An advantage of the bank transactions data is that the State/territory represents the home address of the customer, providing conceptual alignment with HFCE.

Seasonality

To create seasonally adjusted MHSI series, we take the following steps:

- Assess whether the series exhibits a seasonal pattern.

- Determine the most appropriate seasonal and trend filters.

- For Food, Clothing and footwear, and Furnishings and household equipment, assess whether seasonal breaks should be applied when the data source switched from Retail Trade to banks transactions in January 2019.

- Apply adjustments in months affected by COVID-19 to minimise the effect of extreme values on the seasonal factors and trend series.

- Determine whether a trading day adjustment should be applied.

- Determine whether Easter and Father’s Day proximity adjustments should be applied.

When comparing MHSI and Retail Trade series such as Clothing and footwear in original terms, they exhibit similar seasonal patterns, marked by stronger spending in November and December, and weaker spending in January.

However, when comparing the seasonally adjusted month-on-month movements we can see some noticeable differences. This is partly due to the choice of aggregation structure:

- In Retail Trade, the Clothing retailing and Footwear and other personal accessory retailing industry series are directly adjusted at the national level.

- In MHSI, the state-level series for the Clothing and footwear COICOP division are directly adjusted. These series are aggregated to provide the national seasonally adjusted estimates.

Differences can also arise due to seasonal adjustment settings. For example, seasonal breaks have been applied to the MHSI state-level Clothing and footwear series in January 2019 when the data source for the original series switched from Retail Trade to bank transactions.

However, in the Retail Trade publication, there are no seasonal breaks applied to the Clothing and footwear or the Footwear and other personal accessory retailing.

Seasonal breaks are applied if there is evidence that the seasonality has changed significantly at a point in time. This decision is based on both a statistical significance test and visual inspection of the series. The reason for applying seasonal breaks to Clothing and footwear in MHSI, but not Retail Trade, is likely due to the inclusion of department store spending in MHSI.

The Retail Trade team have recently applied seasonal breaks to the Department store series, which is reported separately in the Retail Trade publication. For further information, see: Retail Trade, Australia, December 2024 | Australian Bureau of Statistics.

Where bank transactions data contributes to HFCE, it is used in original terms, and goes through a separate seasonal adjustment process which is independent of MHSI seasonal adjustment. This was also the practice when HFCE used Retail Trade data. Where there are discrepancies between MHSI and Retail Trade seasonal patterns, this does not influence the HFCE estimates.

Chain Volume Measures

In the MHSI publication, you can view the data on a “current price” basis, or on a “volumes” basis (also known as Chain Volume Measures, or CVMs).

Current price estimates reflect both price and volume changes and are published every month.

Meanwhile, CVMs measure changes in value after the direct effects of price changes have been eliminated, and hence only reflect volume changes. These estimates are published on a quarterly basis, in the March, June, September and December publications. Roughly speaking, you can think of CVMs as inflation-adjusted spending. For more information, see the feature article Demystifying Chain Volume Measures.

The reason for calculating spending on volumes basis is that it provides a gauge for whether the economy is growing or shrinking. The headline GDP figures in the National Accounts are also measured on a volumes basis.

The availability of volumes data assists users with the interpretability of MHSI statistics. For an example, look at Food spending for Australia in the June 2022 quarter.

In current price terms, MHSI data shows a 2.5% rise for Food products compared to the previous quarter. However, on a volumes basis, spending fell 0.3%. This indicates that the growth in Food prices was stronger than the quantity of Food products purchased. In simpler terms, Australians spent more at the checkout despite having less in their trolley.

The Consumer Price Index (CPI) is the main source of the MHSI price indexes, which are used to construct CVMs. As the ABS moves to a more comprehensive monthly CPI, there is a longer-term aspiration to produce monthly MHSI volumes.

For more information on MHSI CVMs, see: Monthly Household Spending Indicator methodology, January 2025 | Australian Bureau of Statistics.

Resident and non-resident spending

In the National Accounts, a person is considered an Australian resident or a non-resident based on their country of main economic interest. This means that some people may be counted as non-residents from a National Accounts perspective even if they are included as residents in population counts such as Census and Estimated Resident Population. In particular, international students are generally considered to be non-residents for National Accounts, even if they remain in Australia for more than a year. They are considered to be residents when they develop the intention to remain in the country. For more information, see the paper Recording of international students in the balance of payments.

MHSI, HFCE and Retail Trade have differing coverage when it comes to Australian resident spending overseas and non-Australian resident spending in Australia. The table below provides a summary of the differences.

| Resident spending overseas | Non-resident spending | |

|---|---|---|

| MHSI | Excluded | Only included if spending is on a card that is linked to an Australian bank account |

| HFCE | Included via the Net Expenditure Overseas adjustment | Excluded via the Net Expenditure Overseas adjustment |

| Retail trade | Excluded; the Retail Business Survey only includes Australian businesses | Included; retail businesses are unable to differentiate between resident and non-resident spending |

More information

Monthly Household Spending Indicator

- Development of the new experimental monthly household spending indicator | Australian Bureau of Statistics

- Output and methodological updates to the Monthly Household Spending Indicator | Australian Bureau of Statistics

- Retail Trade Replacement Program – Monthly Household Spending Indicator | Australian Bureau of Statistics

- Monthly Household Spending Indicator, latest release | Australian Bureau of Statistics

- Monthly Household Spending Indicator methodology, January 2025 | Australian Bureau of Statistics

Household Final Consumption Expenditure

- Sources and methods - Quarterly | Australian Bureau of Statistics

- Enhancing household consumption measures in the National Accounts | Australian Bureau of Statistics

- Australian National Accounts: National Income, Expenditure and Product, latest release | Australian Bureau of Statistics

Retail Trade

- Retail Trade, Australia, latest release | Australian Bureau of Statistics

- Retail Trade, Australia methodology, January 2025 | Australian Bureau of Statistics

Other publications related to spending, consumption or retail businesses

- Monthly Business Turnover Indicator, latest release | Australian Bureau of Statistics

- Business Indicators, Australia, latest release | Australian Bureau of Statistics

- Australian Industry, latest release | Australian Bureau of Statistics

- Australian National Accounts: State Accounts, latest release | Australian Bureau of Statistics

Please send feedback and questions to household.spending@abs.gov.au