Complete monthly measure of the CPI

The Australian Bureau of Statistics (ABS) released the first complete Monthly CPI on Wednesday, 26 November 2025. This marks the transition from the quarterly CPI to the Monthly CPI as Australia’s primary measure of headline inflation. This important release provides more timely and comprehensive insights into economic conditions experienced by Australian consumers. Below are some questions and answers about the new Monthly CPI.

Why has the ABS moved to a Monthly CPI?

A Monthly CPI represents a valuable addition to Australia’s economic statistics and keeps Australia abreast of global best practice in consumer price data. The move to a Monthly CPI responds to strong demand from government, businesses, economists and the broader community for more timely and frequent data on household inflation. As inflationary pressures can shift rapidly, monthly data provides a more up-to-date picture of prices in the economy and can more quickly detect changes in the trajectory of inflation. This provides better information for monetary and fiscal policy decisions that have a direct impact on all Australians. Until now, Australia was the only G20 country that did not produce its CPI on a monthly basis.

When do Monthly CPI time series start?

The CPI is made up of 87 Expenditure Classes (ECs), each representing a group of related goods and services commonly purchased by households. These ECs form the foundation of the CPI and capture price movements for specific sets of items within the CPI basket. Some of these ECs have been monthly for many years and their time series in the Monthly CPI will begin from when they switched to monthly data collection.

As part of the transition to the Monthly CPI additional monthly collection for most of the other Expenditure Classes began in April 2024. Time series for these Expenditure Classes and aggregated indexes in the Monthly CPI will start from April 2024.

Is the ABS still producing quarterly CPI data?

Yes. The ABS will continue to produce a quarterly CPI data series (calculated as the average of the three relevant Monthly CPIs) to support those needing quarterly CPI figures for indexation, contracts or other purposes. Starting from the December quarter 2025 (publication date 28 January 2026) quarterly tables will be released in every third monthly publication (i.e. December, March, June and September monthly publications).

Some existing quarterly price indexes have been discontinued. Guidance is provided below on how users can construct their own quarterly indexes using the Monthly CPI series.

Why does the ABS produce a monthly seasonally adjusted CPI?

A monthly CPI is more variable than a quarterly CPI, which reflects the dynamic nature of prices. A monthly seasonally adjusted CPI adjusts for calendar related or seasonal events that impact on prices. This can help smooth some of the price variability. While the primary measure of household inflation is the Monthly CPI in original terms, a seasonally adjusted CPI can provide additional insights into inflation, particularly for the most recent monthly movement. A seasonally adjusted CPI is routinely revised, unlike headline CPI, when new price data becomes available.

What is the index reference period for the new complete Monthly CPI?

The index reference period for the Monthly CPI is September 2025 (or September 2025 = 100.00). The quarterly CPI index will also be re-referenced to September 2025 month at the time of the December 2025 CPI release, scheduled for publication on Wednesday, 28 January 2026.

What does the monthly Trimmed mean tell us?

The Monthly CPI delivers a more frequent and timely read on inflation. However, monthly data is more variable than quarterly data because quarterly data smooths out the short-term fluctuations by averaging over three months. The monthly Trimmed mean removes large price movements in either direction and provides a measure of underlying inflation each month.

The Monthly CPI time series is a relatively short 18 months. By contrast, the quarterly Trimmed mean has been published by the ABS since 2007 and produced in its current form since 2011 (Underlying Inflation Measures: Explaining the Trimmed Mean and Weighted Median | Australian Bureau of Statistics).

At the request of the RBA, the ABS will continue producing seasonally adjusted quarterly data, including the quarterly Trimmed mean series, for at least 18 months. Continuing to produce the quarterly series will enable users to track developments in this measure of underlying inflation that has been available for 14 years while seasonal patterns in the Monthly CPI become better identified over time.

How long will you publish the pre-October 2025 quarterly Trimmed mean for?

The Trimmed mean series is derived from seasonally adjusted data. Seasonal patterns can be more effectively detected with a longer time series. There are some monthly Expenditure Classes (ECs) with relatively short time series starting in April 2024. The seasonal factors will mature as the monthly time series lengthens. We will revisit, in consultation with key users, the need to continue publishing the quarterly Trimmed mean in 2027, at which point we will have 3 years of monthly data.

How are the monthly Trimmed mean and quarterly Trimmed mean different?

There are three steps involved in calculating the Trimmed mean. Firstly, the seasonally adjusted movements for each of the 87 CPI Expenditure Classes (ECs) are calculated and ranked from lowest to highest. Each EC has a weight that represents the proportion of expenditure spent on it out of total household expenditure. The second step uses these weights to work out which ECs (including parts of the ECs that are on the 15 per cent and 85 per cent borders) make up the top and bottom 15 per cent of the distribution. These are the ECs that are 'trimmed out'. Finally, the Trimmed mean is calculated as the weighted average of the movements for the remaining 70 per cent of ECs by weight.

The existing quarterly Trimmed mean and new Monthly Trimmed mean measures are both produced using this approach. There are, however, a number of important differences between the two which mean that the two measures are not expected to exactly align including that the new monthly Trimmed mean measure:

- Makes use of all the monthly price data, whereas the quarterly Trimmed mean uses less price data for around half the CPI basket.

- Includes new data sources for childcare and insurance as outlined in Introducing the Consumer Price Indexes' new monthly time series | Australian Bureau of Statistics

- Uses monthly seasonal adjustment, whereas the quarterly Trimmed mean uses quarterly seasonal adjustment.

- Trims the distribution of monthly seasonally adjusted movements, while the quarterly Trimmed mean trims the distribution of quarterly seasonally adjusted movements.:

Advantages of the monthly Trimmed mean are that it makes use of all the monthly price data and will be published on a monthly basis.

Advantages of the quarterly Trimmed mean are that it uses seasonal adjustment derived from a longer time series and is consistent with the historical quarterly Trimmed mean.

While the two Trimmed mean indexes are not identical, our analysis shows that, to date, there is no obvious bias in either series, and they both provide valid and useful measures of underlying inflation.

What is the difference between the monthly CPI indicator and the complete Monthly CPI?

Since its introduction in September 2022, the Monthly CPI Indicator has provided a helpful earlier read on inflation. However, the Indicator was an incomplete measure of Australian inflation. The complete Monthly CPI will deliver a more comprehensive and reliable measure of inflation. The final Monthly CPI Indicator was released on 29 October 2025 for the September 2025 reference period.

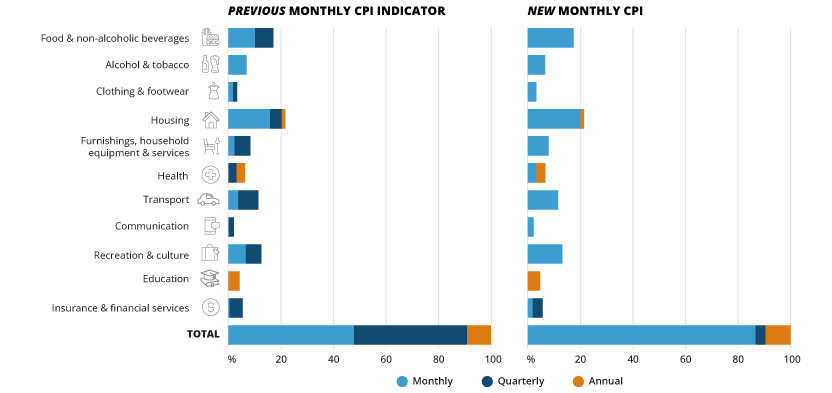

The following tables show the differences between the collection frequencies of data in the monthly Indicator and the complete Monthly CPI. The complete Monthly CPI will have monthly data for 87% of the CPI basket, compared to 50% of the basket for the monthly indicator. A small number of prices will continue to be collected annually or quarterly in line with when price changes typically happen for those items. This is consistent with international best practice as price collection frequency should align with the likely frequency of change.

Image

Description

Two bar graphs comparing the frequency of data collection for each CPI Group by expenditure weight for the previous Monthly CPI (bar graph on the left) and the new complete Monthly CPI (bar graph on the right). The frequency of data collection includes monthly, quarterly and annual.

Is the quarterly series in the complete Monthly CPI a continuation of the quarterly series previously published by the ABS?

Yes. The new quarterly CPI series derived from the Monthly CPI is a continuation of the existing quarterly series.

Has the quarterly CPI series been revised?

No. There is an overlap period between April 2024 and September 2025 where quarterly movements that can be derived from the complete Monthly CPI may be different to those already published quarterly. This is due to the increased frequency of price collection in the complete Monthly CPI beginning from April 2024. This results in only small differences in the data at the All groups CPI level. Data for the quarterly CPI published between the June 2024 quarter and September 2025 quarter will not be revised.

More information is available in Introducing the Consumer Price Indexes' new monthly time series | Australian Bureau of Statistics.

Some quarterly indexes are no longer being published. How can I calculate these quarterly indexes and their movements?

The ABS will continue to publish some, but not all, quarterly indexes to support those needing quarterly CPI figures for indexation, contract or other purposes. The method that will be used to calculate these published indexes can also be used to calculate quarterly indexes for any quarterly indexes that will no longer be published.

From the October 2025 reference month, quarterly indexes will be derived by calculating the average of the relevant 3 monthly indexes. For example, to calculate a quarterly index figure for December quarter, the monthly indexes for October, November and December will be averaged. Quarterly movements can then be calculated by comparing two quarterly indexes.

The following example illustrates the method of calculating changes in index points and percentage changes between any two periods:

December Quarter 2025 = 104.00 (average of October (102.00), November (104.00) and December (106.00) monthly indexes)

Less September Quarter 2025 = 98.00 (average of July (96.00), August (98.00) and September (100.0) monthly indexes)

Change in index points = 6.0 (104.00 - 98.00)

Percentage change = 6.0/98.00 x 100 = 6.1%

Has the quarterly CPI index been re-referenced and is this considered a revision?

The previously published quarterly index will be re-referenced and aligned to the new monthly series. This process will create a continuous historical time series for the quarterly CPI. While the levels of the quarterly CPI index will change due to re-referencing, the percentage movements of the index will not be revised.

Any changes to movements will be due to rounding and a result of re-referencing. This does not constitute a revision.

What is the new quarterly index reference period?

The reference period is the period for which the CPI index equals 100.00. The current reference period for the quarterly CPI is the 2011-12 financial year. The new quarterly index will be referenced to September month 2025. Re-referencing the historical quarterly series is a critical step in ensuring consistency between the historical and new quarterly series.

September 2025 will serve as the link period where the index will equal 100.00. A conversion factor will be applied to adjust index values in the periods prior to September 2025. This adjustment resets the index levels while preserving the underlying quarterly movements.

The re-referenced quarterly indexes will be published for the first time in the December 2025 CPI release, scheduled for publication on Wednesday, 28 January 2026.

The following example illustrates the method of calculating a conversion factor that can be used to convert quarterly index numbers to the current index reference period (September 2025).

A conversion factor is calculated as follows:

Index number for the September quarter 2025 (index reference period 2011-12 = 100.0) = 143.6

Average of monthly index in July 2025, August 2025 and September 2025 on the new index reference period = (99.63 + 99.55 + 100) / 3 = 99.73

Conversion factor (rounded) = Average of monthly index on the new index reference period / quarterly index on the old index reference period = 99.73 / 143.6 = 0.69450

Index number for the September quarter 2025 (index reference period September 2025 = 100.0) = 143.6 x 0.69450 = 99.73

Note that the conversion factors are not rounded when calculating the new index values.

Have the expenditure weights changed with the Monthly CPI?

No, the Monthly CPI will be compiled using the same expenditure weights as the quarterly CPI and monthly Indicator CPI. More information about the most recent 2025 CPI weight update can be found in Annual weight update of the CPI and Living Cost Indexes.