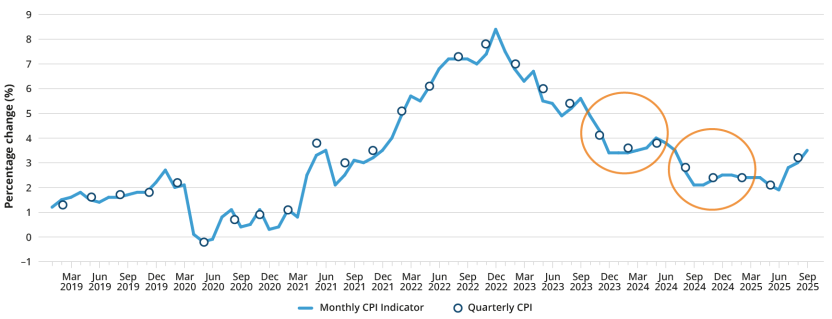

Annual CPI movement (%)

[["1950","1950","1950","1950","1951","1951","1951","1951","1952","1952","1952","1952","1953","1953","1953","1953","1954","1954","1954","1954","1955","1955","1955","1955","1956","1956","1956","1956","1957","1957","1957","1957","1958","1958","1958","1958","1959","1959","1959","1959","1960","1960","1960","1960","1961","1961","1961","1961","1962","1962","1962","1962","1963","1963","1963","1963","1964","1964","1964","1964","1965","1965","1965","1965","1966","1966","1966","1966","1967","1967","1967","1967","1968","1968","1968","1968","1969","1969","1969","1969","1970","1970","1970","1970","1971","1971","1971","1971","1972","1972","1972","1972","1973","1973","1973","1973","1974","1974","1974","1974","1975","1975","1975","1975","1976","1976","1976","1976","1977","1977","1977","1977","1978","1978","1978","1978","1979","1979","1979","1979","1980","1980","1980","1980","1981","1981","1981","1981","1982","1982","1982","1982","1983","1983","1983","1983","1984","1984","1984","1984","1985","1985","1985","1985","1986","1986","1986","1986","1987","1987","1987","1987","1988","1988","1988","1988","1989","1989","1989","1989","1990","1990","1990","1990","1991","1991","1991","1991","1992","1992","1992","1992","1993","1993","1993","1993","1994","1994","1994","1994","1995","1995","1995","1995","1996","1996","1996","1996","1997","1997","1997","1997","1998","1998","1998","1998","1999","1999","1999","1999","2000","2000","2000","2000","2001","2001","2001","2001","2002","2002","2002","2002","2003","2003","2003","2003","2004","2004","2004","2004","2005","2005","2005","2005","2006","2006","2006","2006","2007","2007","2007","2007","2008","2008","2008","2008","2009","2009","2009","2009","2010","2010","2010","2010","2011","2011","2011","2011","2012","2012","2012","2012","2013","2013","2013","2013","2014","2014","2014","2014","2015","2015","2015","2015","2016","2016","2016","2016","2017","2017","2017","2017","2018","2018","2018","2018","2019","2019","2019","2019","2020","2020","2020","2020","2021","2021","2021","2021","2022","2022","2022","2022","2023","2023","2023","2023","2024","2024","2024","2024","2025","2025","2025"],[[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[null],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3],[2,3]],[[7.7],[7.5],[7.3],[12.2],[14.3],[18.6],[20.5],[23.9],[22.9],[19.6],[17],[10.5],[6.8],[4.9],[4.8],[1.6],[3.2],[1.6],[0],[1.6],[0],[1.5],[1.5],[3.1],[3.1],[6.1],[7.6],[6],[6],[2.9],[1.4],[1.4],[1.4],[0],[0],[1.4],[1.4],[1.4],[2.8],[2.7],[2.7],[4.1],[4.1],[4],[4],[3.9],[1.3],[0],[0],[-1.3],[0],[0],[0],[0],[1.3],[1.3],[2.6],[2.6],[2.5],[3.8],[2.5],[3.8],[3.7],[3.7],[4.9],[3.6],[2.4],[2.4],[2.3],[3.5],[4.7],[3.4],[3.4],[2.2],[2.2],[2.2],[3.3],[3.3],[3.3],[3.3],[2.1],[3.2],[3.2],[5.3],[5.2],[5.2],[7.1],[7],[6.9],[6.9],[5.7],[4.7],[5.6],[8.3],[9.9],[12.5],[14],[14.4],[16.4],[16.7],[17.7],[17],[12],[14.3],[13.1],[12],[13.8],[14.3],[13.3],[13.6],[13.3],[9.4],[8.7],[8],[7.8],[7.6],[8],[8.8],[9.5],[10.2],[10.4],[11],[9.9],[9.2],[9.4],[8.4],[9],[11],[10.8],[10.9],[12.4],[11.3],[11.4],[11.1],[9.2],[8.6],[5.8],[4],[3.7],[2.5],[4.4],[6.6],[7.6],[8.3],[9.2],[8.5],[8.8],[9.6],[9.4],[9.3],[8.3],[7.2],[6.8],[7.2],[7.3],[7.6],[6.8],[7.5],[8],[7.8],[8.7],[7.7],[6.1],[6.9],[4.8],[3.3],[3.1],[1.5],[1.7],[1.2],[0.8],[0.3],[1.2],[1.8],[2.2],[1.8],[1.5],[1.8],[2],[2.6],[3.7],[4.5],[5.1],[5.1],[3.8],[3.1],[2.1],[1.5],[1.4],[0.3],[-0.4],[-0.3],[-0.1],[0.7],[1.4],[1.5],[1.2],[1],[1.8],[1.9],[2.8],[3.1],[6.1],[5.8],[6],[6.1],[2.5],[3.1],[3],[2.8],[3.2],[2.9],[3.3],[2.6],[2.6],[2.4],[2],[2.5],[2.3],[2.5],[2.4],[2.5],[3.1],[2.8],[2.9],[4],[4],[3.3],[2.5],[2.1],[1.8],[2.9],[4.3],[4.4],[5],[3.7],[2.4],[1.4],[1.2],[2.1],[2.9],[3.1],[2.9],[2.8],[3.3],[3.5],[3.4],[3],[1.6],[1.2],[2],[2.2],[2.5],[2.4],[2.2],[2.7],[2.9],[3],[2.3],[1.7],[1.3],[1.5],[1.5],[1.7],[1.3],[1],[1.3],[1.5],[2.1],[1.9],[1.8],[1.9],[1.9],[2.1],[1.9],[1.8],[1.3],[1.6],[1.7],[1.8],[2.2],[-0.3],[0.7],[0.9],[1.1],[3.8],[3],[3.5],[5.1],[6.1],[7.3],[7.8],[7],[6],[5.4],[4.1],[3.6],[3.8],[2.8],[2.4],[2.4],[2.1],[3.2]]]

[{"value":"2020-23 Covid-19","annote_text":null,"x_value":"291","y_value":"7.8","x_axis":"0","y_axis":"0","x_offset":"20","y_offset":"-50","cell_row":null,"cell_column":null},{"value":"2008-09 Global Financial Crisis","annote_text":null,"x_value":"237","y_value":"1.4","x_axis":"0","y_axis":"0","x_offset":"40","y_offset":"50","cell_row":null,"cell_column":null},{"value":"2000 Introduction of GST","annote_text":null,"x_value":"202","y_value":"6.1","x_axis":"0","y_axis":"0","x_offset":"80","y_offset":"-30","cell_row":null,"cell_column":null},{"value":"1997 Asian Financial Crisis","annote_text":null,"x_value":"190","y_value":"-0.4","x_axis":"0","y_axis":"0","x_offset":"-20","y_offset":"55","cell_row":null,"cell_column":null},{"value":"1991 Recession","annote_text":null,"x_value":"164","y_value":"4.8","x_axis":"0","y_axis":"0","x_offset":"35","y_offset":"-16","cell_row":null,"cell_column":null},{"value":"1982-83 Recession","annote_text":null,"x_value":"131","y_value":"11.3","x_axis":"0","y_axis":"0","x_offset":"50","y_offset":"-16","cell_row":null,"cell_column":null},{"value":"1979-80 Second OPEC oil price shock","annote_text":null,"x_value":"121","y_value":"11","x_axis":"0","y_axis":"0","x_offset":"50","y_offset":"-55","cell_row":null,"cell_column":null},{"value":"1973-74 First OPEC oil price shock","annote_text":null,"x_value":"100","y_value":"17.7","x_axis":"0","y_axis":"0","x_offset":"20","y_offset":"-35","cell_row":null,"cell_column":null},{"value":"1950-51 'Korean War boom'","annote_text":null,"x_value":"7","y_value":"23.9","x_axis":"0","y_axis":"0","x_offset":"35","y_offset":"-20","cell_row":null,"cell_column":null},{"value":"September 1960 CPI first Published, linked back to 1948","annote_text":null,"x_value":"42","y_value":"4.1","x_axis":"0","y_axis":"0","x_offset":"50","y_offset":"100","cell_row":null,"cell_column":null},{"value":"1960-61 Recession","annote_text":null,"x_value":"45","y_value":"3.9","x_axis":"0","y_axis":"0","x_offset":"0","y_offset":"-50","cell_row":null,"cell_column":null}][{"value":"0","axis_id":"0","axis_title":"","axis_units":"","tooltip_units":"","table_units":"","axis_min":"1950","axis_max":"2025","tick_interval":"5","precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"","table_units":"","axis_min":"-10","axis_max":"30","tick_interval":"5","precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]