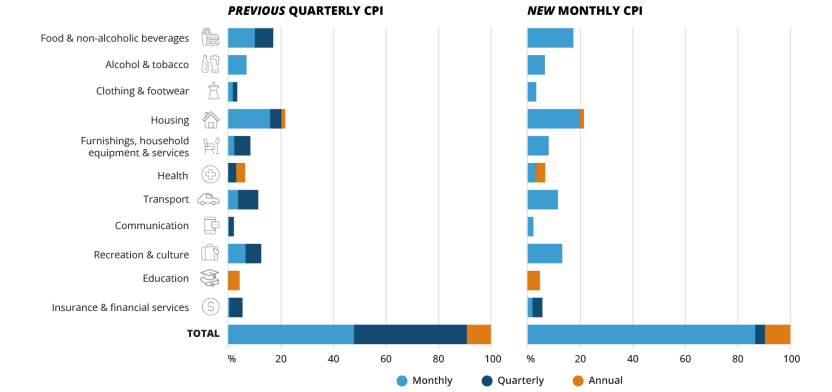

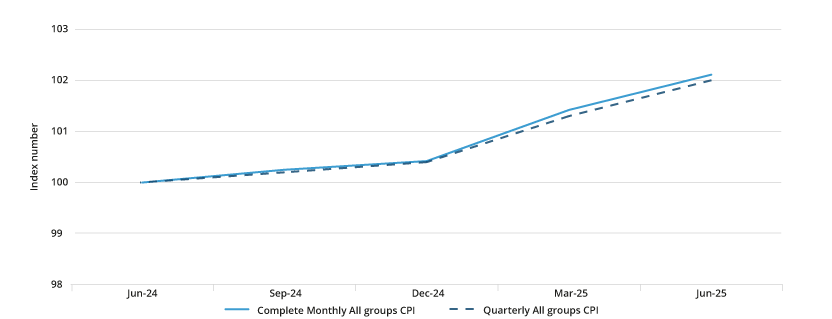

The change from quarterly price collection to monthly for many ECs has significantly increased the volume and frequency of data that underpins the CPI. In addition to improving the overall quality of the CPI, the data provides timelier and better insights into the behaviour of prices for those ECs.

Goods indexes

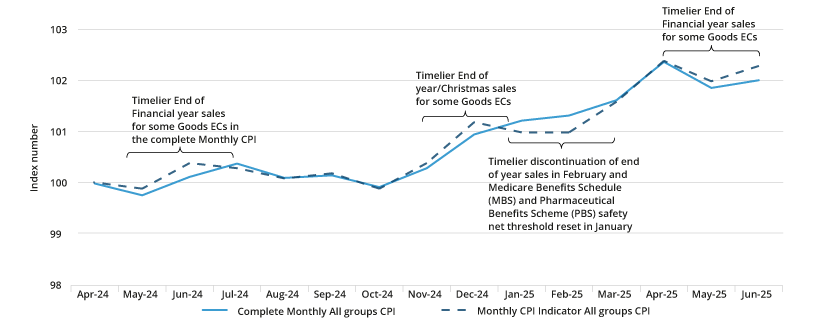

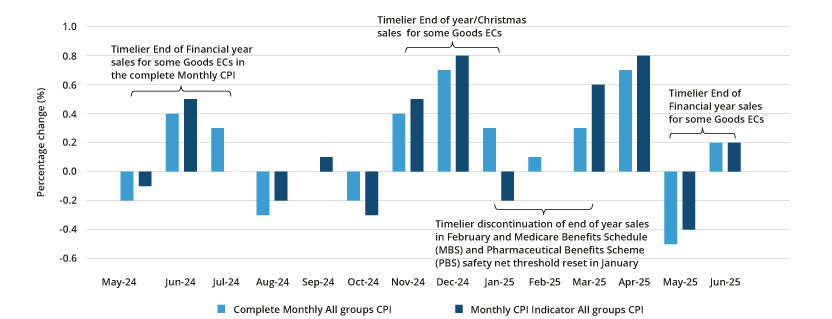

Monthly price collection has increased visibility of discounting activity in many indexes – particularly for goods. While this additional information means that these indexes are more variable than the quarterly, it is both more timely and more reflective of the prices being paid by households, particularly given that many households target known sales periods to purchase products³.

A good example is the Furniture EC. In the graph below, discounting activities related to end-of-financial year (EOFY) and Black Friday sales are clearly represented in the monthly index. When these discounting periods fell between the months in which prices were collected quarterly, the sale events could be missed in the Quarterly CPI, with it only showing the before and after price points. Depending on when prices were collected sales periods could also be reported in a later period than when they started. For example, the monthly Indicator showed a small increase between April 2024 and July 2024 reflecting the change in prices that happened in the first month of each quarter when prices were collected. Monthly price collection shows that a small increase in prices occurred between April and May 2024, followed by end-of-financial year discounting in June before July prices returned to a level slightly above March 2024. It is possible to compare the depth of discounts offered between like sales events – for example between end-of-financial year discounting for Furniture in June 2024 and June 2025. As the length of this, and other similar time series, extend users will be able to track whether there are changes in the magnitude and frequency of discounting activity.

Monthly seasonally adjusted EC indexes, which will be available from the first release of the complete Monthly CPI in November 2025, will also help build the picture of what is happening to prices over time. These indexes remove the impact of strong seasonal price variation at various times of the year, such as the short-term effects of end-of-financial year sales. These seasonally adjusted series can therefore help answer the question: ‘how does this price change compare to the price changes that usually occur at this time of year?’. Together with the non-seasonally adjusted indexes these data will provide early indications of changes in prices, including for sales items, and by extension provide insights into the performance of the macroeconomy.

Notes: (i) The new complete monthly index will be re-referenced to a base period of September 2025=100.0 when it is published at the end of November. This will not impact the movements of the indexes but will change the level of the index numbers.

(ii) Prices for furniture were collected in the first month of each quarter. There is therefore good alignment between the previously published Furniture EC index levels and the new monthly index in those months. Small differences between these index levels in some months are due to differences in how sample changes such as quality adjustments and new specifications are applied in monthly versus quarterly indexes.

Appendix 1 includes a complete list of goods indexes that are changing as part of the shift from the quarterly to complete Monthly CPI and highlights the types of new information about pricing behaviour that can be seen in the monthly data.

Services indexes

The new monthly data show that trends for products that don’t have strong sales/discounting activity – particularly services – are relatively smooth. Wages are a significant component of the cost of providing most services and these indexes are often important indicators of how wage changes are flowing through the economy. Monthly data will ensure that any impact on prices from changes in wages will be clearer, earlier.

The following graph of the new monthly data for the Restaurant meals EC is an example of a monthly time series with a smooth trend. As the graph shows, collecting this data every month avoids the ‘step’ pattern seen in the monthly Indicator indexes. The ‘step’ pattern arose because when prices were collected quarterly two out of three months’ prices were carried forward followed by an increase in the third month representing the price change across all three months.

Notes: (i) The new complete monthly index will be re-referenced to a base period of September 2025=100.0 when it is published at the end of November. This will not impact the movements of the indexes but will change the level of the index numbers.

(ii) Prices for restaurant meals were collected in the second month of each quarter. There is therefore good alignment between the previously published Restaurant meals EC index levels and the new monthly in those months. Small differences between these index levels in some months are due to differences in how quality adjustments and new specifications are applied in monthly versus quarterly indexes.

Appendix 2 lists the Services ECs which are changing as part of the shift from the quarterly headline to complete Monthly CPI and highlights the new information about pricing behaviour that can be seen in the monthly data.