| Tourism | Total Economy | ||

|---|---|---|---|

| Gross Domestic Product (GDP) | |||

| Current prices | -17.6 | 1.7 | |

| Chain volume measure | -18.9 | -0.3 | |

| Gross Value Added at basic prices | |||

| Current prices | -17.3 | 1.8 | |

| Chain volume measure | -18.7 | 0.0 | |

| Employed persons | -6.6 | 0.1 | |

| Hours worked index | -10.9 | -0.8 | |

| Gross value added per hour worked | -8.7 | 0.8 |

Australian National Accounts: Tourism Satellite Account

Estimates of tourism’s direct contribution to the economy including GDP, value added, employment and consumption by product and industry

Key statistics

- Tourism gross domestic product (GDP) fell 18.9% in chain volume terms.

- Tourism's contribution to economy GDP fell from 3.1% to 2.5%.

- Domestic tourism consumption fell 19.7%, and international fell 22.3% in chain volume terms.

- Tourism employed persons fell 6.6% to 621,000 people.

2019-20 tourism overview

Tourism economic activity this financial year was impacted by bushfires and the COVID-19 pandemic, leading to all tourism key statistics falling for the first time in the 16-year published time series. Whilst these events impacted the entire Australian economy, tourism has been affected disproportionately with all measures falling more than each of the corresponding economy-wide measures.

Direct tourism

All references to "tourism" are referring to "direct tourism" unless otherwise specified. A direct tourism impact occurs where there is a direct (physical and economic) relationship between the visitor and producer of a good or service. For more information, refer to the Methodology section.

(a) Chain volume measures source: Australian System of National Accounts (cat. no. 5204.0).

(b) There are some scope differences between Labour Force, Australia, Detailed, Quarterly (LFS) (cat. no. 6291.0.55.003) and TSA's total employment measure. Please refer to the Methodology section for details.

Chain volume measures

- GDP fell 18.9% to $49.6b, the lowest level since 2013-14. The corresponding 0.3% fall to $1,947.1b in the economy-wide measure represents a level between 2017-18 and 2018-19.

- Gross value added (GVA) fell 18.7% to $45.8b, the lowest level since 2013-14. This compares to the 0.0% growth in the corresponding economy-wide measure.

- Internal tourism consumption fell 20.4% to $121.6b. This is made up of a 19.7% fall to $90.8b in domestic and a 22.3% fall to $30.7b in international consumption, which are now at the lowest level since 2011-12 and 2013-14 respectively.

- The 19.7% fall in domestic tourism consumption is made up of household consumption which fell 18.7% to $73.3b, and business consumption which fell 23.7% to $17.5b.

- Tourism labour productivity measured as GVA per hours worked fell 8.7%, the lowest since 2010-11. This compares to the 0.8% increase in the corresponding economy-wide measure.

Current price measures

- GDP fell 17.6% to $50.4b, the lowest level since 2014-15.

- GVA fell 17.3% to $46.5b, the lowest level since 2014-15.

- Tourism contributed 2.5% to total economy GVA, which is the smallest contribution in the 16-year time series.

Tourism employment

- There were 621,000 people employed in tourism, a fall of 43,900 people.

- Share of total employment was 4.8%, the lowest since 2013-14.

- Full-time fell 4.9% to 331,700 and part-time fell 8.5% to 289,200 employed persons.

- Male employment fell 6.2% to 290,200 and female employment fell 7.0% to 330,700.

- Hours worked fell 10.9%, this compares to a 0.8% fall in the corresponding economy-wide measure.

Key considerations in data interpretation

Key 2019-20 bushfire and COVID-19 dates

Tourism estimates

One of the key assumptions made in the methodology of the TSA is that the structure of the economy changes slowly over time and therefore structural relationships within the account are relatively stable from year to year. For this reason the relationships are generally updated every 3 years as part of the benchmark process (see the Methodology section for more information). This assumption holds well except when there are sudden economic shocks that result in structural changes in the economy. COVID-19 is such an event. When shocks occur, best practise is to review and update the underlying relationships to ensure estimates accurately reflect the events. However the 2019-20 Supply-Use tables, which are the main source of data for updating the relationships during this period, are not available until late 2021.

Since the 2019-20 Supply Use tables were not available at the time of preparing this release, relationships are based on the structure of the economy in 2016-17. Changes in tourism estimates reflected in this release are largely driven by changes in the demand for tourism as measured in the International and National Visitor Surveys that are conducted by Tourism Research Australia. Users should note these points when using the data and also expect future revisions to these estimates.

Tourism employment estimates

ABS has been publishing a new experimental publication on quarterly tourism labour statistics since March quarter 2020. Users are reminded that the estimates in this annual release are based on a different data source and are not directly comparable to the estimates provided in the quarterly tourism labour statistics publication. For more information on the strengths and differences between the two employment measures, please refer to the article published in March quarter 2020.

The data sources and methodology of the employment statistics produced in this annual publication are consistent with those used in the previous annual TSA.

Changes in this issue

The previous TSA release was impacted by a series break in the 2018-19 Tourism Research Australia's (TRA) National Visitor Survey. TRA indicated that the move to 100% mobile sampling from March quarter 2019 resulted in a level shift in the domestic expenditure and visitors estimates. Therefore, in the 2018-19 TSA, the ABS maintained the level of the existing time series by estimating what the level of the 2018-19 data would have been without the series break. For more details on the 2018-19 treatment, please refer to the 2018-19 TSA release.

In the 2019-20 TSA, the ABS has continued to maintain the level of the existing time series by applying the percentage movement between 2018-19 and 2019-20 National Visitor Survey estimates to the level of the existing TSA series. The ABS will continue with this time series level until the next benchmark when the full time series of the TSA will be updated to reflect the revised levels of the National Visitor Survey data. This is in accordance with ABS' revision rules and will also allow sufficient time to determine the time period to apply the revisions to.

Similar to 2018-19, no estimates of visitor numbers are included in this release due to the series break in the National Visitor Survey. Likewise, estimates of average visitor expenditure are not included in this release.

Analysis of results

In TSA, the contribution of tourism to the Australian economy has been measured using the demand generated by visitors and the supply of tourism products by domestic producers.

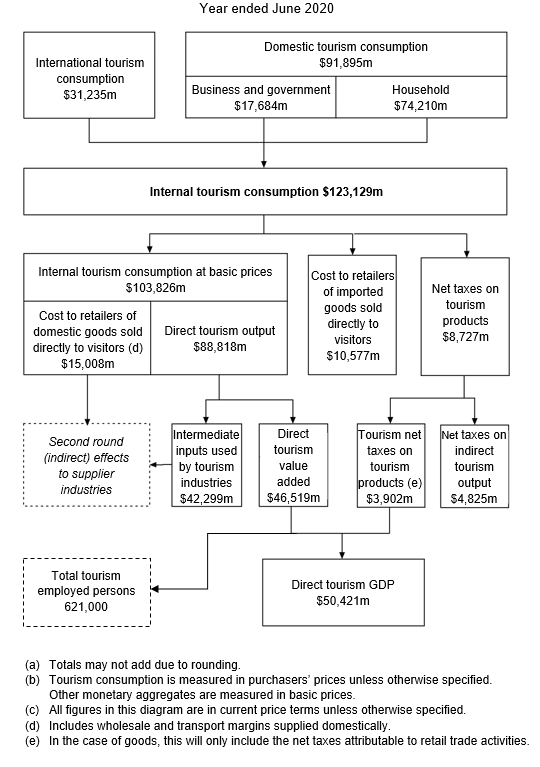

The diagram below provides a graphical depiction of the flow of tourism consumption through the Australian economy in 2019-20. What the diagram highlights is that unlike traditional ANZSIC industries in the Australian National Accounts, tourism is not measured by the output of a single industry, but rather from the demand side i.e. the activities of visitors. It is the products that visitors consume that define what the tourism economy produces. The diagram shows how the value of internal tourism consumption (as measured by the sum of international and domestic tourism consumption in purchasers prices, i.e. the price the visitor pays) is disaggregated to either form part of tourism GVA and tourism GDP, or is excluded as it either forms part of the "second round" indirect effects of tourism or the output was not domestically produced.

Flow of tourism consumption through the Australian Economy (a)(b)(c)

Image

Description

Revisions

Revisions are a necessary and expected part of accounts compilation as data sources are updated and improved over time. This issue includes revisions to tourism aggregates for the years subsequent to the latest (2016-17) benchmark.

Revisions in the 2019-20 release include:

- Revisions to both domestic and international tourism expenditure as a result of the TSA annual balancing and confrontation process. This is particularly the case for tourism products where the estimates have been modelled using a range of source data.

- Replacing modelled 2018-19 net taxes, imports and margins data with the latest issue of Australian National Accounts: Supply Use Tables (cat. no. 5217.0) (available on a T-1 basis) for 2018-19.

- Additional revisions to international tourism consumption due to the incorporation of updated data from the Survey of International Trade in Services (SITS). The TSA uses short term visitor data from SITS to estimate education consumption by international visitors. Data for 2017-18 and 2018-19 have been revised since the last TSA release.

In addition, economy wide national accounting aggregates have also been revised across the entire series to ensure consistency with published estimates in the 2019-20 issue of Australian System of National Accounts (cat. no. 5204.0) published on 30th October 2020. These revisions affect tourism's share of GDP and GVA presented in Tables 1, 2 and 5 of the TSA data cube.

Similarly, economy wide consumer price index (CPI) has also been revised across entire series to ensure consistency with published estimates in the September quarter 2020 issue of Consumer price Index, Australia (cat. no. 6410.0). This is presented in table 1 of the TSA data cube.

Please note, the revisions to the chain volume estimates level across the time series are an expected part of re-referencing the indexes to 100 in the latest reference year (2018-19) each year.

Data downloads

Australian National Accounts: Tourism satellite account

Inquiries

For further information about these and related statistics, please contact the National Information and Referral Service on 1300 135 070. The ABS Privacy Policy outlines how the ABS will handle any personal information that you provide to us.

Previous catalogue number

This release previously used catalogue number 5249.0.