When you connect to accounting software in ABS Business Reporting, the ABS uses the information you have authorised us to access to help you complete your survey.

ABS Business Reporting uses information from a business’ chart of accounts or categories to show a list of accounts on screen as you answer questions. You will be able to select accounts or categories to include for each survey question. ABS Business Reporting also uses information from the business’ profit and loss reports, and trial balance or balance sheet reports, to calculate and display a total value for each question based on the accounts you selected.

Only these totals will be submitted and processed by the ABS. This is the same as what you would enter manually into a form.

The ABS may also use account or category names to identify broad patterns and improve how ABS Business Reporting works for you.

ABS Business Reporting also saves a record of which accounts you selected for each survey question. This information is used to pre-fill a survey for you to review and submit if you need to report again next quarter. This saves you from having to repeat the process of selecting accounts each time you report.

Information from accounting software is also used to show how the business you are reporting for compares to all businesses within an industry.

The 'Compare your business' feature allows you to see data for the business you are reporting for next to industry statistics from Quarterly Business Indicators.

When you select this feature, ABS Business Reporting will use information from the business’ profit and loss reports, and trial balance or balance sheet reports. It will calculate and display a total value for each quarter in the time frame you have selected (up to 2 years). Totals will be calculated based on the accounts selected for each question in the most recent survey completed. Totals generated when you select this feature are not sent to the ABS and are displayed on screen for your use only.

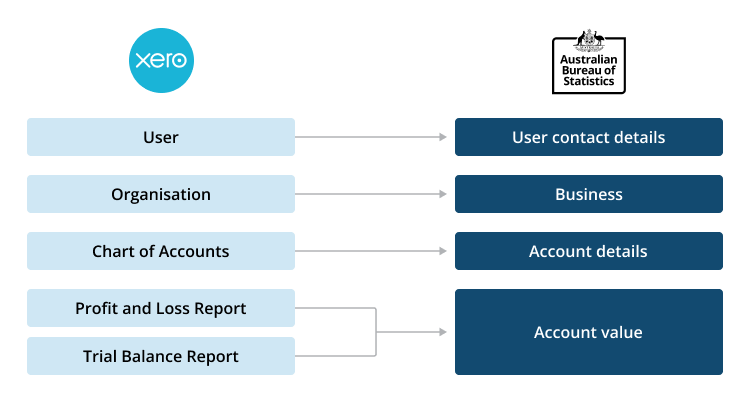

If you connect to Xero accounting software in ABS Business Reporting, your user contact details are collected and stored so that the ABS can contact you if they have any queries about your survey, or as part of our data collection activities.

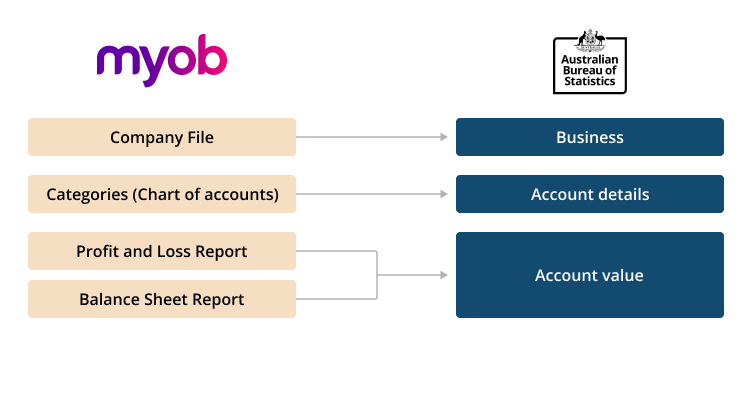

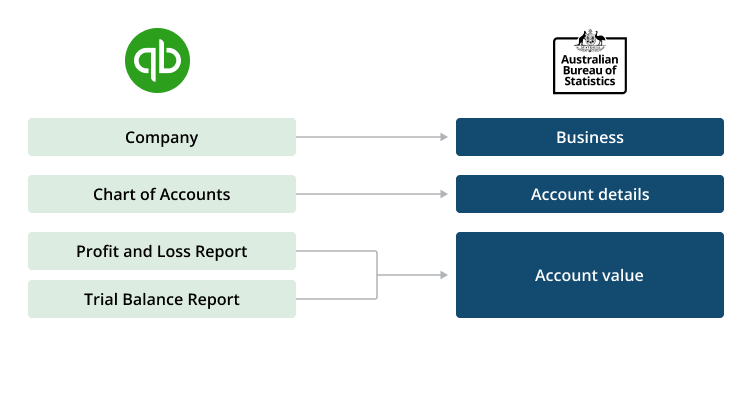

The diagrams below indicate how data from accounting software is used by the ABS for Xero, MYOB and QuickBooks.