The Australian Bureau of Statistics (ABS) produces a wide range of labour market statistics, derived from various sources, and designed to meet differing user needs. Forming an overall picture of the labour market from the variety of available datasets – that are compiled with differing scopes and purposes – can be challenging. The Australian Labour Account addresses this challenge by applying a conceptual framework and analysing a range of labour market data to produce a coherent and consistent set of aggregate labour market statistics. These statistics support macro-economic analyses of people’s participation in paid employment and related production over time.

The ABS commenced publishing annual Australian Labour Account estimates in 2017, with an initial time series starting from 2010-11. In July 2018, the available information was expanded to include quarterly estimates starting from September quarter 2010. In December 2019, historical Labour Account data was included that extended the quarterly time series to September 1994 and the annual series to 1994-95.

The Labour Accounts are released approximately two months after the end of the reference quarter. Quarterly estimates are available from September quarter 1994 onwards at the industry division level, in original, seasonally adjusted and trend terms.

The annual (financial year) Labour Accounts are usually released around November of each year with data available from 1994-95 onwards at the industry subdivision and division levels, and are produced in original terms only. Unbalanced tables are also available as original data only.

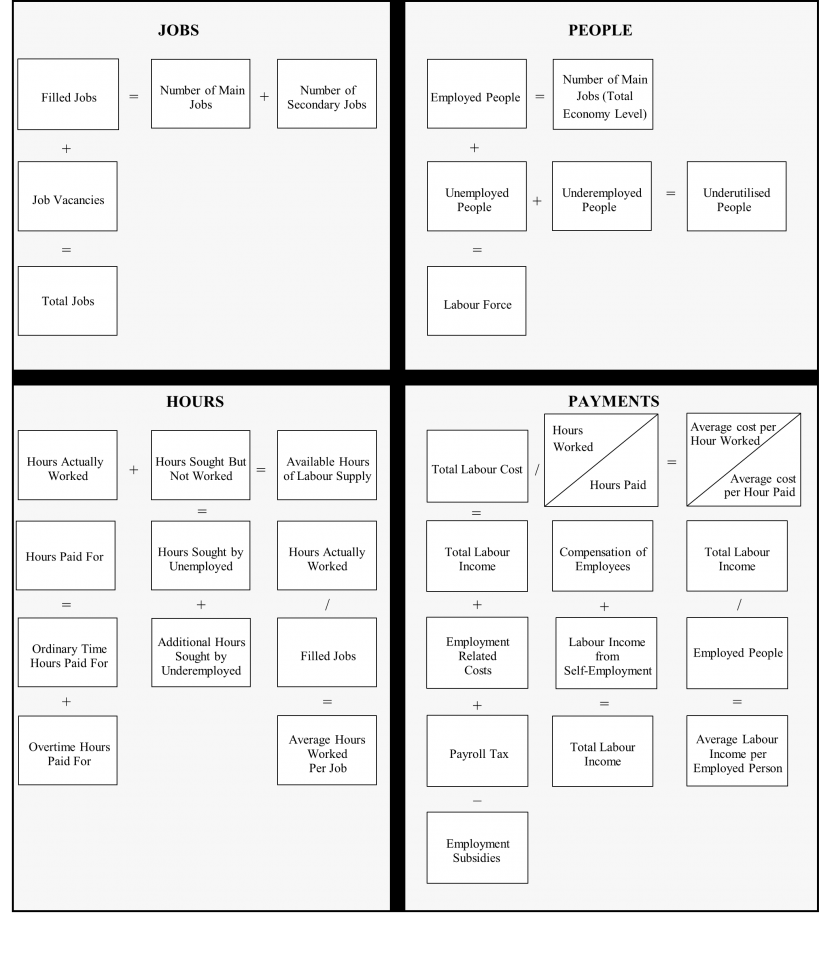

The concepts and definitions underlying the Australian Labour Account are built on International Labour Organisation (ILO) fundamentals and expand them to ensure consistency with the System of National Accounts (SNA08). The result provides a set of core macro-economic labour market variables derived through data integration, with both an industry focus and time series dimension. Descriptions of the underlying concepts of the Australian Labour Account, and the sources and methods used in compiling the estimates, are presented in Labour Statistics: Concepts, Sources and Methods.