This information paper presents the 2020 annual re-weight of the Consumer Price Index (CPI) and Selected Living Cost Indexes (SLCIs). The 2020 re-weight will apply from the December 2020 quarter for the CPI, which will be released on 27 January 2021. The SLCIs will be released on 3 February 2021.

The ABS has annually re-weighted the CPI since 2018, predominantly using Household Final Consumption Expenditure (HFCE) data, which is lagged by 18 months. Annually re-weighting the CPI ensures that the CPI basket continues to be representative of spending by Australian households. Further details on annually re-weighting the CPI can be found in the information paper An Implementation Plan to Annually Re-weight the Australian CPI, 2017.

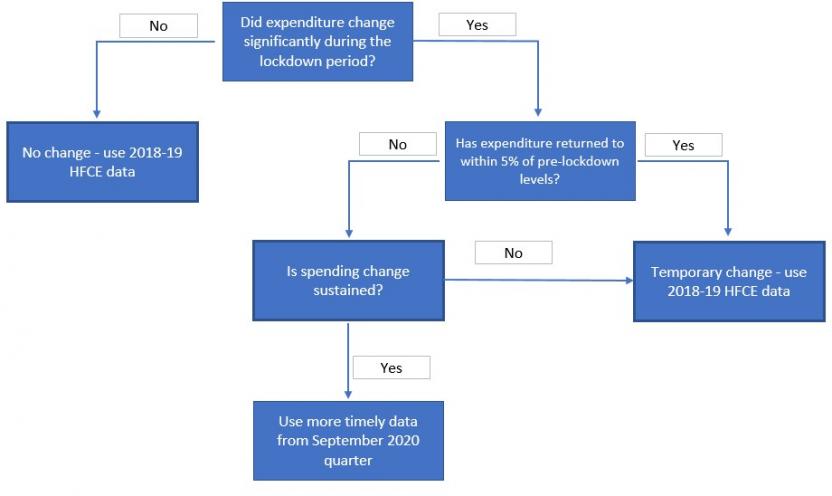

Normally household spending patterns change slowly. The COVID-19 pandemic has caused a sudden, and in some cases, sustained change in household spending patterns. To reflect this, the 2020 annual re-weight uses a range of more timely data sources (e.g. Retail Trade data and scanner data) for approximately 20 per cent of the weight of the CPI. This ensures that the underlying weighting patterns for the CPI continue to be reflective of spending by Australian households. To guide the re-weight decision-making process, the ABS developed a framework, which has been used to guide the use of more timely data sources.

For 80 per cent of the CPI, the updated weights were derived in the usual way outlined by the 2017 information paper. For the 20 per cent of the CPI where more timely data sources were used, it was for CPI components such as food, alcohol, electricity and domestic and international travel – for more details see appendix 1.

The ABS will continue to monitor expenditure throughout 2021 to ensure that the CPI weights are reflective of spending patterns by Australian households.

This information paper provides an overview of the changes to the CPI and SLCIs that will be introduced with the 2020 re-weight and presents the updated weighting patterns.

For further information contact prices.statistics@abs.gov.au