| Aug-2020 ($m) | Jul-2020 to Aug-2020 (% change) | Aug-2019 to Aug-2020 (% change) | |

|---|---|---|---|

| Turnover at current prices | |||

| Trend | na | na | na |

| Seasonally Adjusted | 29,481.1 | -4.0 | 7.1 |

na not available

Monthly and quarterly estimates of turnover and volumes for retail businesses, including store and online sales.

| Aug-2020 ($m) | Jul-2020 to Aug-2020 (% change) | Aug-2019 to Aug-2020 (% change) | |

|---|---|---|---|

| Turnover at current prices | |||

| Trend | na | na | na |

| Seasonally Adjusted | 29,481.1 | -4.0 | 7.1 |

na not available

There are no revisions to the original estimates.

This issue includes updated online retail turnover estimates for the August 2020 reference month. This data can be found in the experimental online time series spreadsheets which provide data for online on a new consolidated industry split.

The World Health Organisation (WHO) commenced daily situation reports of the coronavirus (COVID-19) outbreak on 21 January 2020 and identified it as an international health emergency on 30 January. From 1 February, the Australian Government placed travel restrictions on those travelling to Australia from mainland China and restrictions on inbound tourism have remained in place. In March, regulations to encourage social distancing saw further impacts on the ability of businesses to trade as normal. This included restrictions on dining-in at restaurants and restrictions on the number of people that could be in a shop at a particular time. Restrictions were eased gradually in May and June 2020. In July 2020, a spike in coronavirus cases in Victoria saw restrictions tightened, especially in Melbourne. Stage 4 restrictions in Melbourne, and Stage 3 restrictions across the rest of Victoria, were in place for much of August. Movement across state borders have been restricted.

The trend series attempts to measure underlying behaviour in retail activity. In the short term, this measurement will be significantly affected by changes to regular patterns in retail spending that will occur during this time, as certain businesses are restricted from trading for example. If the trend estimates in this publication were to be calculated without fully accounting for this irregular event, they would likely provide a misleading view of underlying retail activity.

The retail trend series was therefore suspended from February 2020, and now published only to June 2019. The trend series will be reinstated when more certainty emerges in the underlying trend in retail.

Food retailing fell 0.2% in August, in seasonally adjusted terms.

By industry subgroup, the seasonally adjusted estimate:

Household goods retailing fell 6.0% in August, in seasonally adjusted terms.

By industry subgroup, the seasonally adjusted estimate:

Clothing, footwear and personal accessory retailing fell 10.5% in August, in seasonally adjusted terms.

By industry subgroup, the seasonally adjusted estimate:

Department stores fell 8.9% in August, in seasonally adjusted terms.

Other retailing fell 5.1% in August, in seasonally adjusted terms.

By industry subgroup, the seasonally adjusted estimate:

Cafes, restaurants and takeaway food services fell 6.6% in August, in seasonally adjusted terms.

By industry subgroup, the seasonally adjusted estimate:

To enhance the understanding of the economic impacts of COVID-19, scanner data was used to conduct analysis on supermarkets and grocery store spending.

For the purpose of this analysis, supermarket products were split into three categories. Perishable goods contain fresh food items such as fruit, vegetables, meat and dairy. Non-perishable goods contain food items with a long shelf life such as flour, sugar, canned fruit, canned vegetables, canned and dry mix soups, confectionary and long-life milk products. All other products contain non-food items such as cleaning products, medicinal products, toiletries and toilet paper.

Turnover fell for Non-perishable goods (-0.5%), and rose for Perishable goods (1.6%) and All other products (0.1%) in August 2020 compared to July 2020, in original terms.

Retail turnover for all three categories continue to remain at higher levels when compared to August 2019. Annually, Perishable goods rose 14.0%, Non-perishable goods 12.5%, and All other products 11.1%. The higher levels of revenue reflect a continuation of more food being prepared and consumed at home due to social distancing.

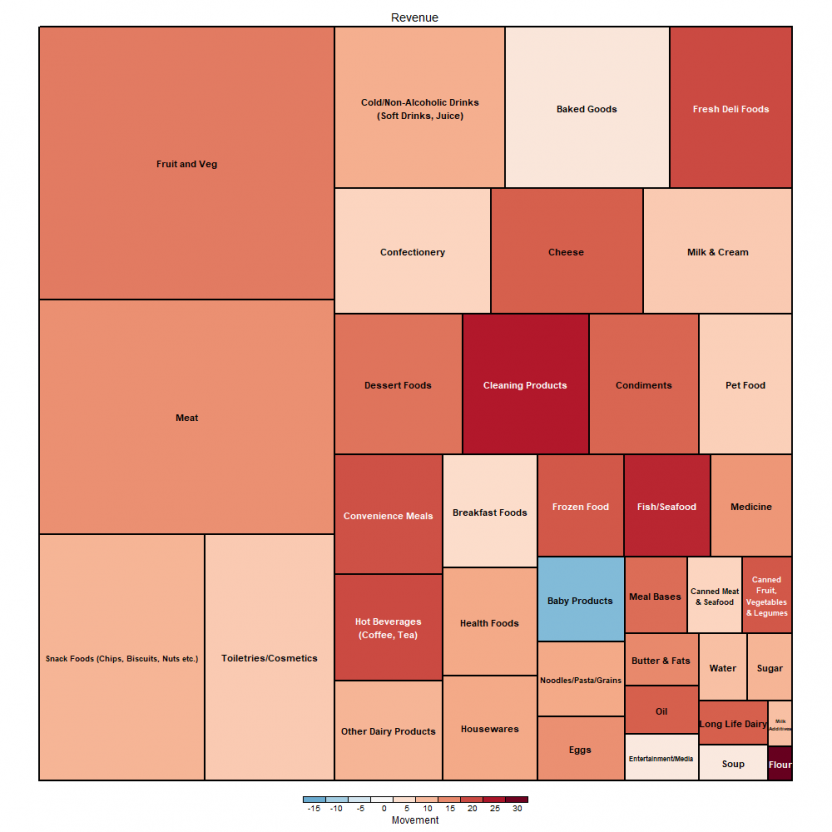

The below tree map describes the annual revenue movements as well as the contribution to total revenue for each product. The colour of each tile denotes the annual revenue percentage movement for August 2020 compared to August 2019, whereas the size denotes the contribution to total revenue in August 2020.

Annual rises were observed for a number of food categories in August 2020. The largest rises included, Flour (30.2%), Cleaning Products (24.3%) and Fresh Fish/Seafood (23.0%).

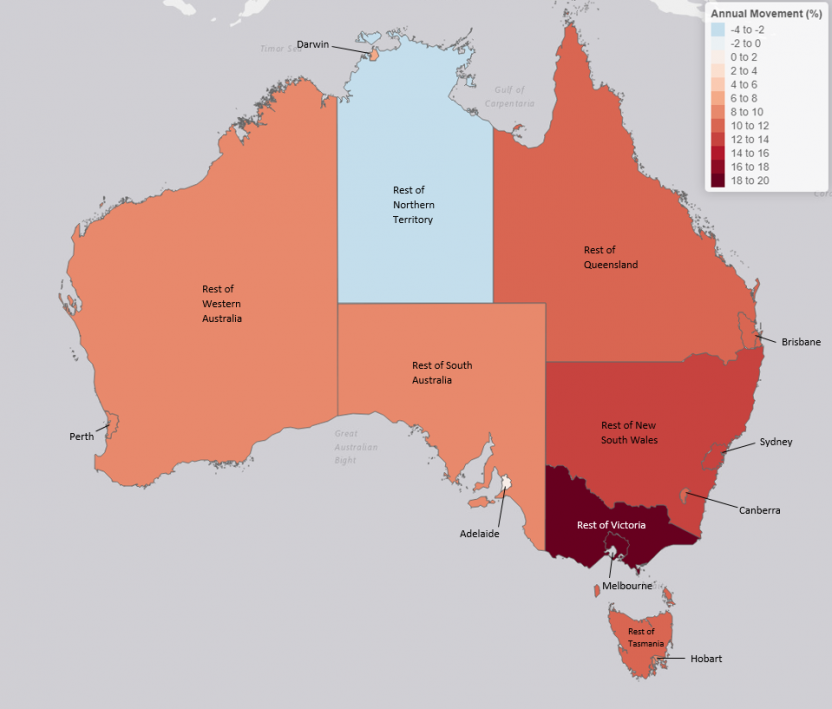

The heat map below denotes the annual revenue movements for each capital city, state and territory, at the Greater Capital City Statistical Area (GCCSA) level, where the colour of each region denotes the annual revenue percentage movement for August 2020 compared to August 2019.

Annual revenue percentage movements at the capital city, state and territory level are showing larger increases in revenue in the south-eastern regions of Australia. Of the capital cities, Melbourne (20.2%) and Sydney (12.6%) recorded the largest annual rises. For the rest of state/territory areas, Rest of Victoria (19.0%) and Rest of New South Wales (12.8%) recorded the largest annual rises. In Victoria, physical distancing measures continue to put upwards pressure on spending at supermarkets. Rest of Northern Territory recorded the only fall in annual revenue.

The Retail Trade survey has been collecting online sales since the March quarter 2013. The data was previously published as an experimental series, in original data only, as an Appendix to the Retail Trade publication. It was disaggregated by whether the retailer was "Pure-play" (online only) or "Multi-channel" (mix of online and physical stores).

The Pure-play and Multi-channel split will remain available on request but will no longer be published in the Appendix on a regular basis.

Over time, the split between Pure-play and Multi-channel remained stable, with Pure-play online retailers averaging 38.3% of total online sales.

In August 2020, Pure-play retailers made up 32.0% of online sales and 3.5% of total sales. Online sales for multi-channel retailers made up 7.5% of total retail sales.

From July 2020, the Online series will be published with a grouped industry split; a Food group (including the Food retailing, and Cafes, restaurants and takeaway food services), and a Non-food group (all other industries). Due to the limitations of online data collection, a finer split by industry is not possible at this stage.

The online series continues to use the same source data, and represents purchases made via the internet from employing retail businesses who predominately sell to households. The series excludes direct imports (e.g. purchased directly from an overseas website) and sales from 'households-to-households' through third party websites for example. More information can be found in the information paper Measurement of Online Retail Trade in Macroeconomics (cat. no. 8501.0.55.007).

Online sales, including click-and-collect, have become increasing popular during the coronavirus pandemic. It is worth noting that retailers have had to adapt sales channels very quickly during the pandemic, and it is possible that the value of online purchases has been under-reported since April 2020. Importantly, total retail sales will not be under-reported.

Seasonal adjustment has been calculated for the new series using the concurrent seasonal adjustment method, meaning that seasonal factors are re-estimated each time a new data point becomes available. Unusual real-world events, such as COVID-19, can distort estimates calculated using the method. The Online series remains experimental, and caution should be used in interpreting the results. Like the total retail series, trend cannot be calculated due to the volatility of the retail series during COVID-19.

The total online series rose 7.0% in seasonally adjusted month-on-month terms in August 2020, following a rise of 6.3% in July, and a fall of 2.5% in June 2020.

These results followed large rises in March and April 2020, as consumers turned to online shopping as a way of complying with regulations introduced to encourage social distancing. Stage 3 and 4 restrictions in Victoria saw closures of stores in August, especially in Melbourne, and this has led to a further rise in online sales.

In through-the-year terms, the seasonally adjusted series rose 81.1% in August 2020 compared to August 2019. In the 12 months from March 2019 to February 2020, total online sales averaged growth of 14.4%. Coinciding with the shift to online purchasing at the outset of the COVID-19 pandemic in Australia, total online sales saw a large rise in through-the-year growth in March and April. The series has maintained a new level since that time.

August saw the largest rise since April, as restrictions in Victoria saw physical stores close in Melbourne, and retailers and customers again focused on online retailing. Unlike April, stores remained open across the rest of the country, so the rise of 7.0% is well below the 27.1% monthly rise recorded in April 2020.

The seasonally adjusted level of online sales for the Food group rose 6.8% in August, while Non-Food saw a 7.0% rise from July to August.

As a proportion of total grouped industry turnover, Non-food online sales were 17.6% of total Non-food sales in August 2020, in original terms. This remains elevated compared to pre-COVID-19 levels but is down on the heights seen in April (20.5%). While online sales as a proportion of total Non-food sales would have seen a large rise in Victoria, sales in other states continued to return to more established patterns.

The proportion of total Food sales made online saw a small rise to 5.8% in August. Food online sales made up 5.2% of total Food sales in July. The proportion of Food sales in March was 3.1%.

Total online sales remain elevated at 11.0% of total sales in August. This is a slight fall from the peak of 11.1% in April 2020, when restrictions were in place across the whole country.

Inquiries about these and related statistics, contact the National Information and Referral Service on 1300 135 070. The ABS Privacy Policy outlines how the ABS will handle any personal information that you provide to us.

This release previously used catalogue number 8501.0.