June key statistics

The seasonally adjusted WPI:

- rose 0.2% in June quarter 2020. The lowest quarterly rise since the commencement of the series in September quarter 1997.

- rose 1.8% over the year to June quarter 2020, dipping below the previous lowest annual rate of growth recorded in June quarter 2017 (1.9%).

| Mar Qtr 2020 to Jun Qtr 2020 | Jun Qtr 2019 to Jun Qtr 2020 | |||

|---|---|---|---|---|

| % change | % change | |||

| Wage Price Index (WPI) | ||||

| Total hourly rates of pay excluding bonuses | ||||

| Trend(a) | ||||

| Australia | na | na | ||

| Sector | ||||

| Private | na | na | ||

| Public | na | na | ||

| Seasonally Adjusted(b) | ||||

| Australia | 0.2 | 1.8 | ||

| Sector | ||||

| Private | 0.1 | 1.7 | ||

| Public | 0.6 | 2.1 | ||

| Original | ||||

| Australia | 0.0 | 1.7 | ||

| Sector | ||||

| Private | -0.1 | 1.7 | ||

| Public | 0.4 | 2.1 | ||

a. See Explanatory Notes paragraphs 39-40, 42 on the Methodology page.

b. See Explanatory Notes paragraphs 32-38, 42 on the Methodology page.

Sector

Quarterly seasonally adjusted:

- The Private sector rose 0.1%.

- The Public sector rose 0.6%.

Through the year

Through the year seasonally adjusted:

- The Private sector rose 1.7% over the twelve months to the June quarter 2020.

- The Public sector rose 2.1% over the twelve months to the June quarter 2020.

- Both the Private and Public sector annual growth is the lowest recorded since the commencement of the series.

Measuring the impact of Coronavirus (COVID-19)

The ABS published an article on 23 July 2020 (Measuring the Wage Price Index during the COVID-19 pandemic) explaining the impact of COVID-19 on the measurement of the WPI in June quarter 2020.

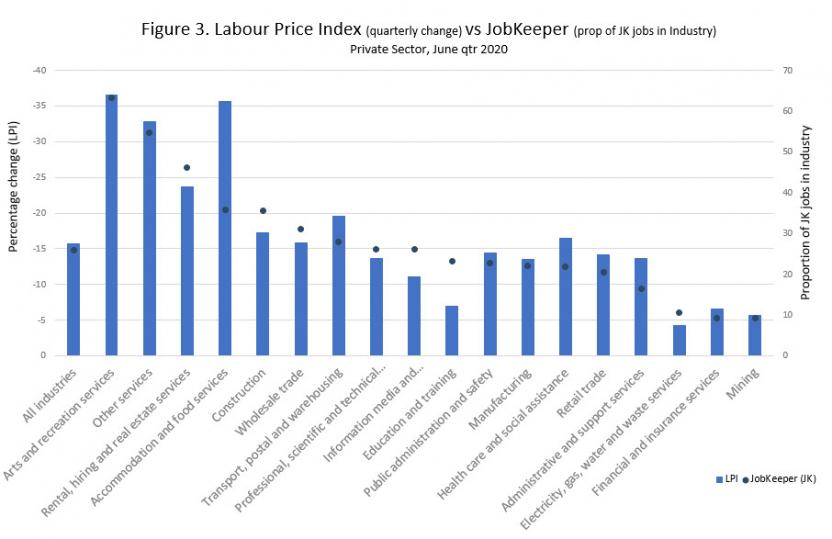

Wage subsidies (JobKeeper) and payroll tax changes fall outside of the collection scope of the Wage Price Index.

Suspension of trend series

The Wage Price Index trend series have been suspended from June quarter 2020 until more certainty emerges in the underlying trend in labour market activity over the COVID-19 period. This is in recognition of the time series shocks in the labour market between the March quarter 2020 and June quarter 2020 data points. While trend estimates are generally the best measure of the underlying behaviour of the labour market, any large changes in the labour market as a result of COVID-19 will likely make it difficult to estimate a reliable short-term indicator of the trend.

Existing spreadsheets containing trend, seasonally adjusted and original data will continue to be published in the same format, however trend columns will be populated with ‘na’.

Quality

It is important to note that the reference period for the June quarter was the pay period on or before 15 May 2020, which was after a global pandemic was declared and during the peak period of nation-wide restrictions that impacted business activity. There was no notable impact on survey collection operations or the quality of June quarter data, with the response to the survey at a similar level as previous quarters.

Use of price indexes in contracts

Price indexes published by the Australian Bureau of Statistics (ABS) provide summary measures of the movements in various categories of prices over time. They are published primarily for use in Government economic analysis. Price indexes are also often used in contracts by businesses and government to adjust payments and/or charges to take account of changes in categories of prices (Indexation Clauses).

Use of Price Indexes in Contracts sets out a range of issues that should be taken into account by parties considering the inclusion of an Indexation Clause within a contract utilising an ABS published price index.

Frequently asked questions

The Wage Price Index FAQs page has answers to a number of common questions to do with price indexes and the Wage Price Index, in particular.