Financing resources and investment table

Financial market summary table

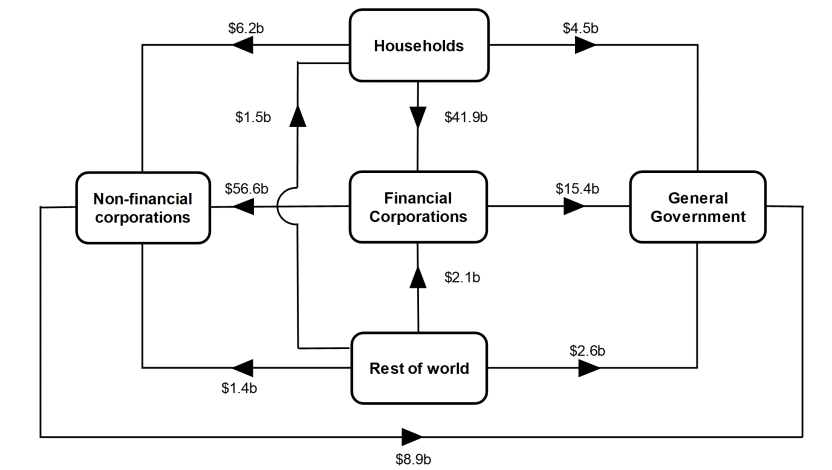

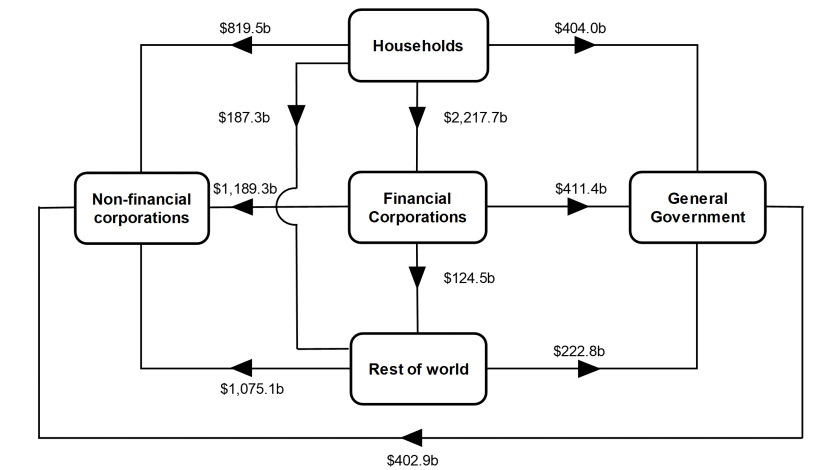

Flow of funds diagrams

National investment

National investment decreased $4.5b to $141.9b in the September quarter.

- General government investment decreased by $10.0b to $21.1b driven largely by a decrease in gross fixed capital formation in both state and local general government and national general government.

- Non-financial corporations' investment increased by $5.6b to $69.6b, driven largely by an increase in change in inventories in private non-financial corporations. This was partially offset by a decrease in gross fixed capital formation in private non-financial corporations and public non-financial corporations.

- Household investment was flat, remaining at $48.1b, with a decrease in change in inventories being offset by an increase in gross fixed capital formation.

Financial investment

Australia was a net borrower of $8.1b from rest of world (ROW). The main contributors were a:

- $31.1b acquisition of equities by ROW

- $11.0b acquisition of debt securities by ROW, primarily issued by banks and national general government

- Partly offset by $23.3b acquisition by Australia of ROW equity and $11.2b acquisition of bonds issued by ROW.

The ROW remains a significant holder of bonds issued by banks and national general government. Acquisition of equity by Australian companies reflect merger and acquisition activity occurring over the quarter. ROW acquired shares issued by Australian companies and also reinvested the profits of Australian subsidiaries.

Households

Households $52.7b net lending position was due to a $79.9b acquisition of financial assets, offset by $27.2b incurrence of liabilities.

The acquisition of assets was driven by:

- $50.1b in deposits

- $27.5b in net equity in superannuation.

While liabilities were driven by:

- $26.5b in loan borrowings

Deposit assets grew strongly this quarter as households received proceeds from tax returns. Households favoured placing excess funds in deposit accounts to take advantage of rising interest rates, particularly in term deposits. Increased contributions into pension funds reflected continued growth in employment and legislative changes to compulsory superannuation contributions on July 1. Demand for home loan borrowing has softened as interest rates increase and house prices fell.

Non-financial corporations

Non-financial corporations’ $50.9b net borrowing position was due to $10.8b acquisition of financial assets offset by $61.7b incurrence of liabilities. The acquisition of assets was driven by:

- $24.1b of equities

Acquisitions of assets were offset by:

- $21.2b withdrawal of deposits

Liabilities were driven by:

- $31.6b in equities

- $33.5b in loan borrowings

Non-financial corporations drew on deposits to make dividend payments and to facilitate merger and acquisition activity. The merger and acquisition activity was reflected in non-financial corporations’ acquisition of equities. Loan borrowings by private non-financial corporations increased as firms sought loan funding to further facilitate merger and acquisition activity and to fund investment in non-dwelling construction projects. Non-financial corporations continue to benefit from strong trade surpluses and gross operating surplus, with reinvested earnings increasing firms' equity capital.

General government

General government’s $31.5b net borrowing position was due to a $13.2b disposal of financial assets and $18.2b incurrence of liabilities.

Assets were driven by:

- $7.0b sale of equity holdings

- $6.7b withdrawals of deposits

Liabilities were driven by:

- $19.7b in loans

Sale of equity assets were driven by state and local general government's involvement in merger and acquisition activity. Deposit balances were drawn down to meet a bond maturity. State and territory governments continued to borrow funds from their respective central borrowing authorities to fund investment in transport and healthcare infrastructure.