Financing resources and investment tables

Financial market summary table

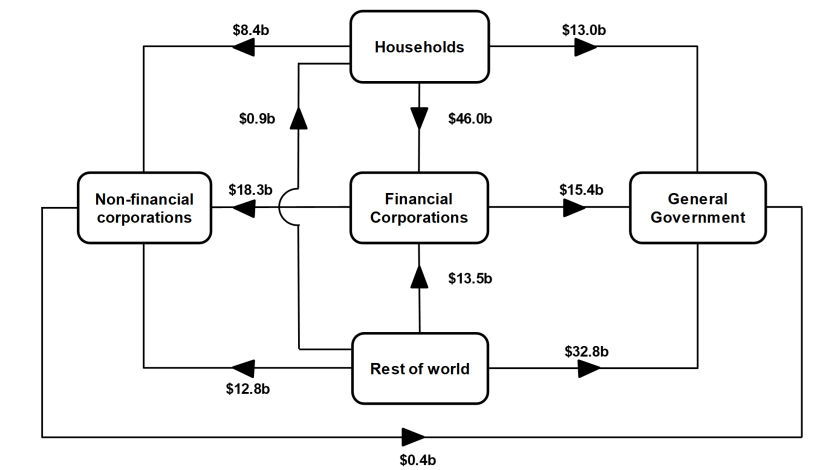

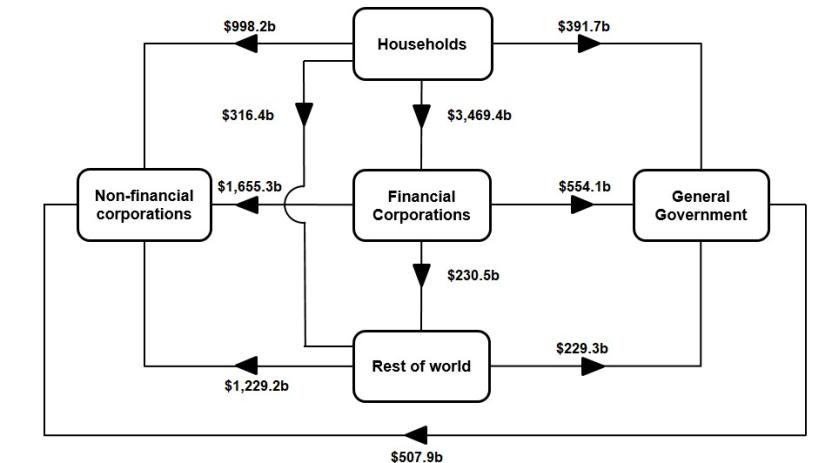

Flow of funds diagrams

National investment

National investment decreased by $7.0b to $171.9b in the September quarter.

- General government investment decreased by $8.7b to $24.9b, driven by a decrease in gross fixed capital formation for both state and local general government and national general government.

- Non-financial corporations' investment decreased by $0.8b to $85.4b, driven by a decrease in gross fixed capital formation for both private and public non-financial corporations.

- Households' investment increased by $2.5b to $57.4b, driven by an increase in gross fixed capital formation.

Financial investment

Australia was a net borrower of $31.2b from rest of world (ROW). The main contributors were a:

- $63.7b acquisition by ROW of debt securities issued by Australia

- $31.1b acquisition by ROW of equity issued by Australia

- Partly offset by $28.3b disposal by ROW of equity issued by Australia

Australia recorded is largest net borrowing position in the September quarter, which reflected strong ROW investment in Australian company shares, and debt securities issued by the government and banks.

Households

Households' $67.5b net lending position was due to a $97.6b acquisition of financial assets, partly offset by a $30.1b incurrence of liabilities. The acquisition of assets was driven by:

- $63.3b in deposits

- $28.6b net equity in superannuation

While liabilities were driven by:

- $30.3b in loan borrowings

Household deposits grew strongly in September, largely due to the seasonal timing of tax refunds.

General government

General government’s $54.4b net borrowing position was due to a $69.2b incurrence of liabilities, partly offset by a $14.8b acquisition of financial assets. The acquisition of assets was driven by a:

- $12.7b increase in other accounts

- $9.8b increase in deposits

- Partly offset by a $8.5b reduction in loan assets

Liabilities were driven by:

- $46.0b net bond issuance

- $23.2b in loan borrowings

The national general government remained in a net borrowing position for a fifth consecutive quarter. Net issuance of Treasury bonds this quarter was driven by ongoing funding requirements. State and territory governments continued to borrow funds from their respective central borrowing authorities to fund infrastructure projects.