Financing resources and investment table

Financial market summary table

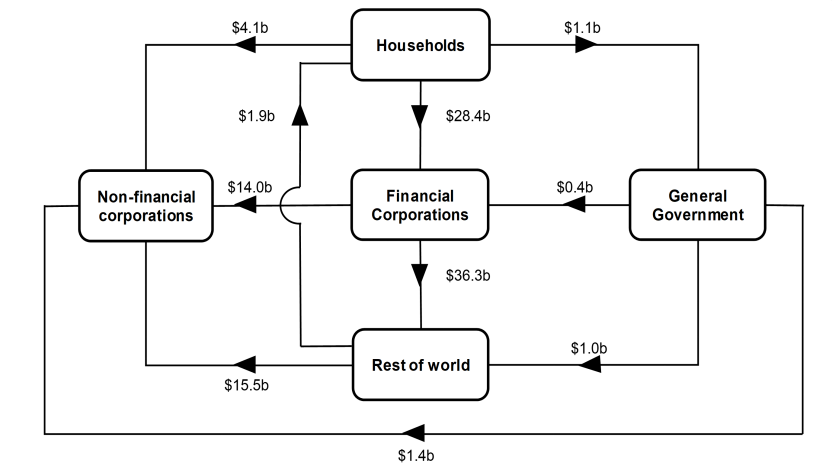

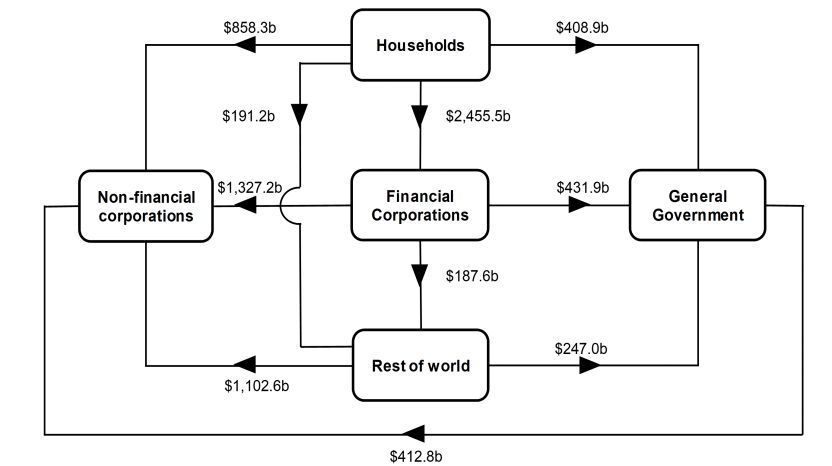

Flow of funds diagrams

National investment

National investment decreased $21.0b to $134.9b in the March quarter.

- General government investment decreased by $2.2b to $22.6b driven by decreases in gross fixed capital formation for both national general government and state and local general government.

- Non-financial corporations' investment decreased by $9.2b to $63.5b, driven largely by a decrease in total gross fixed capital formation by private non-financial corporations.

- Household investment decreased $9.3b to $45.9b, driven by decreases in total gross fixed capital formation and change in inventories.

Financial investment

Australia was a net lender of $5.6b to rest of world (ROW). The main contributors were a:

- $34.1b withdrawal of deposits by ROW

- $27.4b acquisition of ROW equity by Australia

- Partly offset by $27.1b acquisition of equity issued by Australia by ROW; and

- $12.7b acquisition of debt securities by ROW, driven mainly by long-term debt securities issued by banks and central borrowing authorities

Reductions in deposits reflected funding and liquidity management by Authorised deposit taking institutions and offshore related parties. ROW reinvested profits of Australian subsidiaries. ROW acquired bonds issued by banks as banks returned to wholesale funding sources in preparation for Term Funding Facility (TFF) maturities. ROW also pivoted to acquiring bonds issued by central borrowing authorities who continued to issue bonds to meet funding requirements.

Households

Households $23.9b net lending position was due to a $44.5b acquisition of financial assets, offset by a $20.6b incurrence of liabilities. The acquisition of assets was driven by:

- $26.3b in deposits

- $24.6b in net equity in superannuation

While liabilities were driven by:

- $19.0b in loan borrowings

Growth in households’ deposit assets weakened reflecting a fall in the household saving ratio. Growth in deposit assets favoured other non-transaction deposit account types, such as high interest savings accounts whose interest rates have increased similar to rises in the cash rate. Contributions into pension funds reflect strong labour market conditions.

Non-financial corporations

Non-financial corporations’ $42.8b net borrowing position was due to a $12.2b acquisition of financial assets offset by a $55.1b incurrence of liabilities. The acquisition of assets was driven by:

- $7.6b of equities

- $7.3b of loans

Liabilities were driven by:

- $29.7b of equities

- $16.6b of loan borrowings

Private non-financial corporations benefitted from strong gross operating surplus, with reinvested earnings increasing firms' equity capital. Firms borrowed to invest in machinery and equipment and engineering construction.

General government

General government’s $5.6b net lending position was due to a $25.8b acquisition of financial assets offset by a $20.2b incurrence of liabilities. The acquisition of assets was driven by:

- $18.6b in deposits

- $5.4b in equities

Liabilities were driven by:

- $11.1b issuance of long-term debt securities

- $5.9b in loans

The general government’s net lending position is the first since March quarter 2017. Stronger than expected income tax receipts contributed to the national general government's build up of deposits. The rate of issuance of long-term debt securities by the national general government has significantly reduced compared to COVID peaks, as government outlays have declined. State and territory governments continued to borrow funds from their respective central borrowing authorities to fund investment in transport infrastructure.