Financing resources and investment table

Financial market summary table

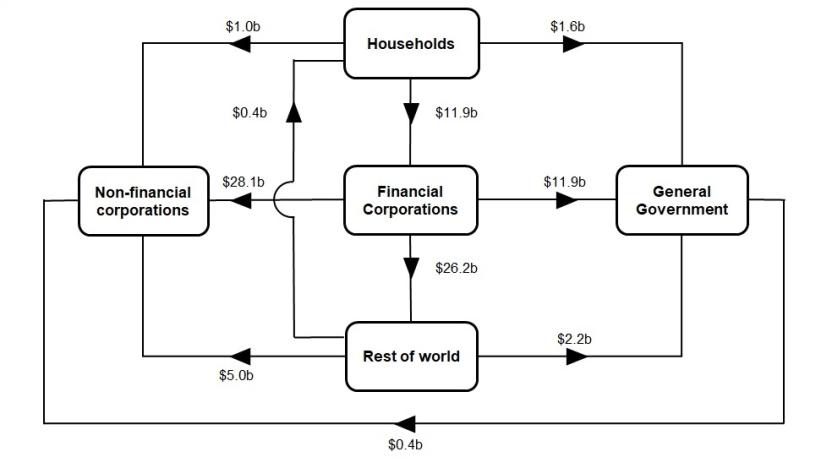

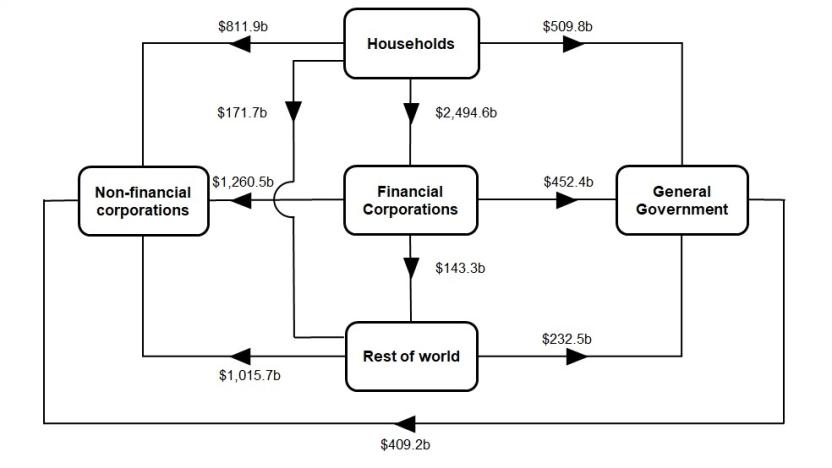

Flow of funds diagrams

National investment

National investment decreased $14.9b to $125.1b in the March quarter.

- General government investment decreased by $0.2b to $22.4b driven by a decrease in gross fixed capital formation in both state and local general government and national general government. This was partially offset by an increase in acquisitions less disposals of non-produced non-financial assets.

- Non-financial corporations' investment decreased by $8.3b to $55.5b, driven by decreases in gross fixed capital formation and acquisitions less disposals of non-produced non-financial assets.

- Household investment decreased by $6.1b to $44.3b, driven by decreases in gross fixed capital formation and changes in inventories.

Financial investment

Australia was a net lender of $2.7b to rest of world (ROW). The main contributors were a:

- $119.6b acquisition of ROW equity assets, driven by other private non-financial corporations (OPNFCs)

- offset by $120.5b of OPNFC-issued equity held by ROW

Heightened levels of equity issuance during the quarter was dominated by a corporate restructure, which resulted in investor funds from ROW repatriated to the Australian stock market (ASX) and the corporation acquiring significant amounts of ROW equity assets. Other merger and acquisition activity by OPNFCs contributed to Australia's net acquisition of ROW equity assets.

Households

Households' $7.8b net lending position was due to a $52.4b acquisition of financial assets, partly offset by a $44.5b incurrence of liabilities.

The acquisition of assets was driven by:

- $35.4b in deposits

- $28.2b in net equity in pension funds

While liabilities were driven by:

- $41.9b in loan borrowings

Deposits assets continued to grow, though at a reduced pace as spending continued to increase following the easing of COVID-19 restrictions. Acquisition of net equity in pension funds reflected continued growth in employment. Decreased activity in the property market in the early months of the new year and repayments made on outstanding credit card balances following the holiday spending period contributed to lower demand for loan borrowings by households this quarter.

Non-financial corporations

Non-financial corporations' $45.1b net borrowing position was due to a $119.4b acquisition of financial assets, offset by $164.5b incurrence of liabilities. Liabilities were driven by:

- $135.4b in equity raising

- $17.4b in loan borrowing

The significant corporate restructure during the quarter was reflected in non-financial corporations raising equity. Loan borrowing by private non-financial corporations continued to strengthen as economic activity increased due to a positive economic outlook over the quarter.

General government

General government's $5.9b net borrowing position was due to a $19.7b incurrence of liabilities partly offset by a $13.8b acquisition of assets. Liabilities were driven by:

- $23.1b net issuance of bonds

The Commonwealth government continued to undertake steady issuance of bonds over the quarter, with funds raised assisting government support measures relating to floods in south-east Queensland and northern NSW, as well as support relating to the Omicron variant. Level of net issuance of bonds was higher than the previous quarter due to a minimal amount of bond maturities during the quarter.