Financing resources and investment table

Financial market summary table

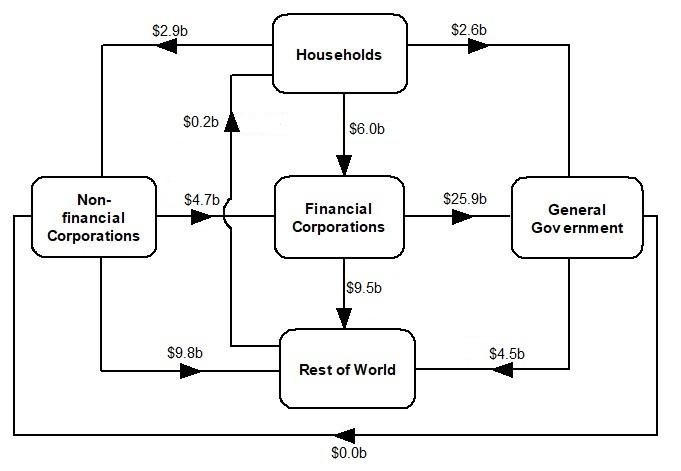

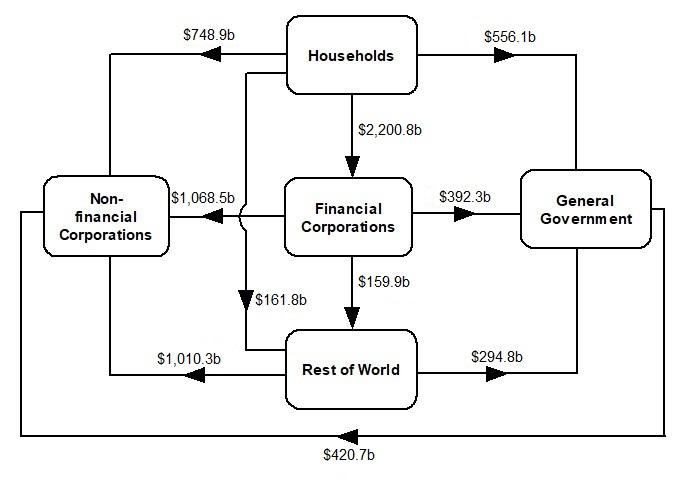

Flow of funds diagrams

National investment

National investment decreased $13.5b to $107.4b in the March quarter.

- General government investment decreased by $1.2b to $21.0b driven by a decrease in both national and state and local government gross fixed capital formation.

- Non-financial corporations' investment decreased $7.1b to $44.7b, driven by a decrease in private non-financial corporations gross fixed capital formation.

- Household investment decreased $5.0b to $39.0b, down from $44.0b in the previous quarter.

Financial investment

Australia was a net lender of $15.3b, the eight consecutive quarter of net lending. The main contributors were a:

- $20.0b in net maturities of bonds held by ROW

- $16.7b acquisition of ROW equities, driven by pension funds, other private non-financial corporations (OPNFC) and non-money market funds

Net maturities of authorised deposit taking institution (ADI) bonds led to a decrease in bond liabilities. Pension funds, OPNFC and non-money market funds continued to invest in overseas equities markets as economic conditions continued to improve.

Households

Households' $4.0b net lending position was the result of a $34.1b acquisition of assets and a $30.0b incurrence of liabilities, driven by a:

- $19.3b transaction in net equity in pension funds

- $15.5b transaction in deposits

- partly offset by $26.6b loan borrowing

The deposits transactions reflects increased saving due to ongoing government income support packages. With improvements in the housing market households increased their loan borrowings. Net equity in pension funds transactions reflect improving labour market conditions as household contributions and drawdowns in superannuation stabilised following the conclusion of the government policy for early access to superannuation in December quarter 2020.

Non-financial corporations

Non-financial corporations' $7.6b net lending position was due to a $19.6b acquisition of financial assets and a $12.0b incurrence of liabilities. The acquisition in assets was driven by a:

- $16.1b acquisition of deposits

- $6.6b in loan borrowing

Deposits increased as non-financial corporations continued to save. Businesses increased loan borrowings as the economic outlook improved.

General government

General government's $13.4b net borrowing position was due to a $3.2b acquisition of assets and $16.6b incurrence of liabilities and driven by:

- $15.0b drawdown of deposit assets

- $23.9b net issuance of bonds

- $1.4b repayment of loans

Government drew down on deposits and issued debt to finance expenditure while reducing loan borrowings.