Financing resources and investment table

Financial market summary table

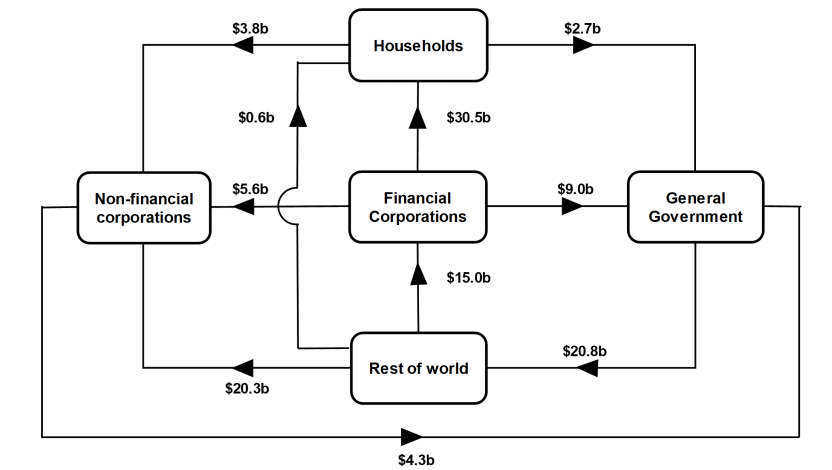

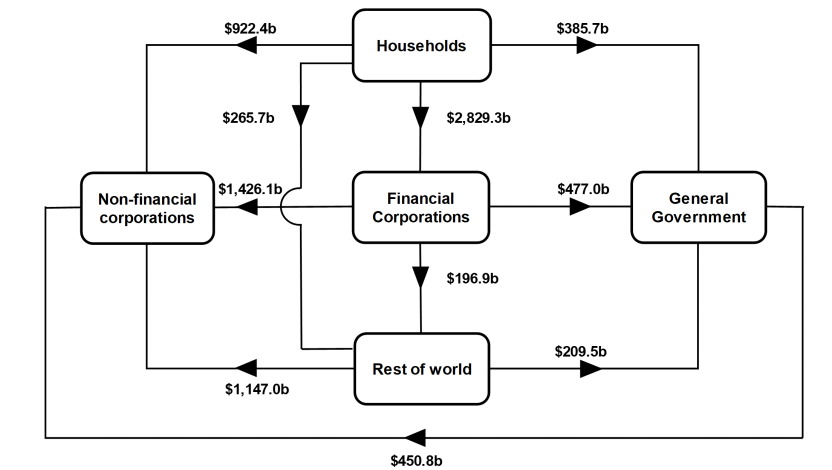

Flow of funds diagrams

National investment

National investment increased by $25.6b to $175.1b in the June quarter.

- General government investment increased by $11.2b to $35.3b, driven by increases in gross fixed capital formation for both state and local general government and national general government.

- Non-financial corporations' investment increased by $10.2b to $83.0b, driven by increases in gross fixed capital formation for both private and public non-financial corporations.

- Households' investment increased by $3.8b to $53.3b, driven by an increase in gross fixed capital formation.

Financial investment

Australia was a net borrower of $9.4b from rest of world (ROW). The main contributors were a:

- $55.2b acquisition by ROW of debt securities issued by Australia

- $13.1b placement of deposits by ROW

- $13.0b acquisition by ROW of equity issued in Australia

- Partly offset by $16.3b in loans borrowed by ROW

ROW acquired bonds and one name paper issued by banks, as banks shifted towards raising funds through debt security issuance with the maturity of funds provided under the Term Funding Facility (TFF) occurring during the quarter. ROW also acquired bonds issued by central borrowing authorities, who are continuing to issue bonds to raise funds to finance government expenditure. The acquisition of equity by ROW reflected merger and acquisition activity during the quarter.

Households

Households' $10.3b net borrowing position was due to a $60.1b incurrence of liabilities partly offset by a $49.7b acquisition of assets. Liabilities were driven by:

- $57.7b in loan borrowing

While assets were driven by:

- $39.5b in net equity in pension funds

- Partly offset by $8.1b withdrawal of deposit asset

Increased contributions into pension funds reflected additional contributions made by households prior to the end of the financial year. Households drew down on deposit balances for a second consecutive June quarter, withdrawing deposits from transaction deposit accounts. Weakness in household deposit balances reflects the current low household saving ratio. Strength in loan borrowings reflected rising demand for housing over the quarter.

General government

General government’s $14.8b net borrowing position was due to $18.3b incurrence of liabilities partly offset by $3.6b acquisition of assets. Liabilities were driven by:

- $16.2b in loan borrowings

- Offset by $18.0b in bond maturities

Acquisition of assets was driven by:

- $6.0b acquisition of equity assets

- $3.8b in deposits

The National general government was in a net lending position for a second consecutive quarter, driven by bond maturities occurring over the quarter. Elevated tax receipts also allowed the Commonwealth to maintain its holding of deposit assets, despite needing to meet those bond maturities. State and territory governments continued to borrow funds from their respective central borrowing authorities to finance operational expenditures, social benefits to households, and continued investments into transport and health infrastructure.