Financing resources and investment table

Financial market summary table

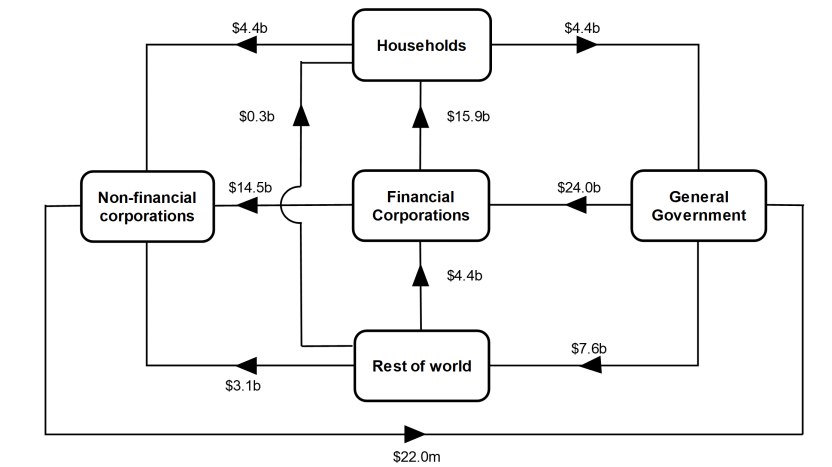

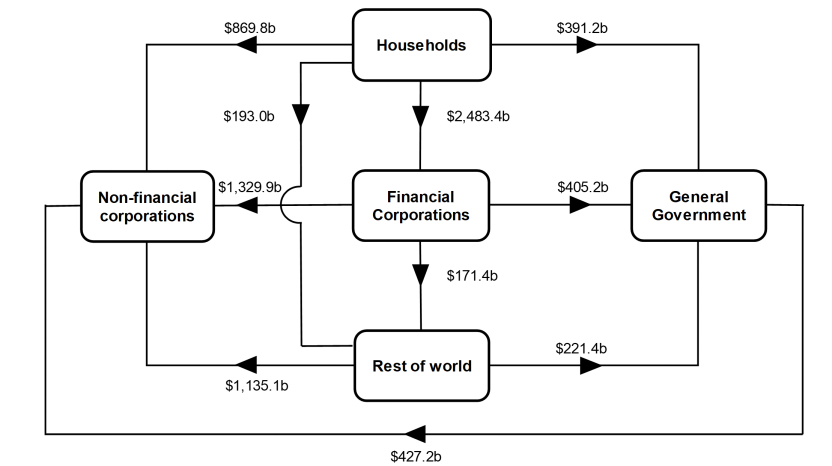

Flow of funds diagrams

National investment

National investment increased $19.8b to $156.0b in the June quarter

- General government investment increased by $11.4b to $34.0b driven by increases in gross fixed capital formation for both state and local general government and national general government.

- Non-financial corporations' investment increased by $4.3b to $68.8b, driven by increases in gross fixed capital formation for both private non-financial and public non-financial corporations.

- Household investment increased $3.6b to $49.7b, driven by an increase in total gross fixed capital formation.

Financial investment

Australia was a net lender of $16.9b to rest of world (ROW). The main contributors were a:

- $21.9b disposal of equity issued by Australia by ROW

- $19.1b withdrawal of deposits by ROW

- $9.2b acquisition of debt securities issued by ROW by Australia

- Partly offset by $19.2b disposal of ROW equity by Australia; and

- $7.0b acquisition of bonds by ROW, driven mainly by those issued by banks and other private non-financial corporations

An increase in dividends remitted overseas and falling commodity prices resulted in ROW reinvesting lower amounts of profit in foreign owned resource companies. Reductions in deposits reflected funding and liquidity management by Authorised deposit taking institutions and offshore related parties. ROW acquired bonds issued by banks as banks sought additional funding as the Term Funding Facility (TFF) started to mature. Pension funds favoured investment in overseas bonds.

Households

Households $4.1b net lending position was due to a $38.7b acquisition of financial assets, offset by $34.6b incurrence of liabilities. The acquisition of assets was driven by:

- $36.5b in net equity in superannuation

- partly offset by $6.1b withdrawal of deposit assets

While liabilities were driven by:

- $37.8b in loan borrowings

Increased contributions into pension funds reflected additional contributions made by households prior to the end of the financial year. The household sector drew down on deposit assets for the first time since June quarter 2007. The withdrawal of deposits reflected a fall in the household savings ratio as households face high cost of living pressures. Loan borrowing by households reflected renewed activity in the housing market.

General government

General government’s $1.4b net lending position was due to a $13.5b acquisition of financial assets, offset by $12.1b incurrence of liabilities.

The acquisition of assets was driven by:

- $14.3b in deposits

- $6.0b in short-term debt securities

Liabilities were driven by:

- $9.9b in loans

- offset by $11.3b in bond maturities

The national general government built up deposits this quarter as tax receipts remain elevated. The national general government also experienced its largest net maturity of bond liabilities. State and territory governments continued to borrow funds from their respective central borrowing authorities to fund investment into transport and health infrastructure.