Financing resources and investment table

Financial market summary table

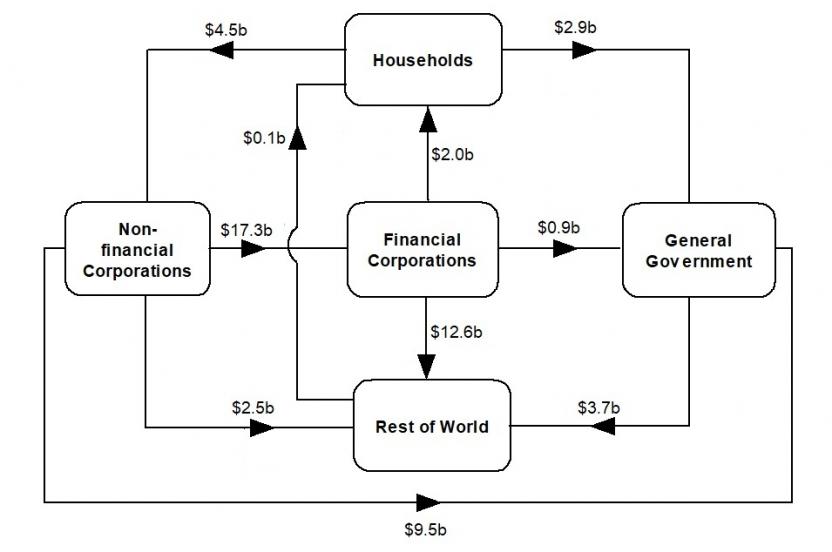

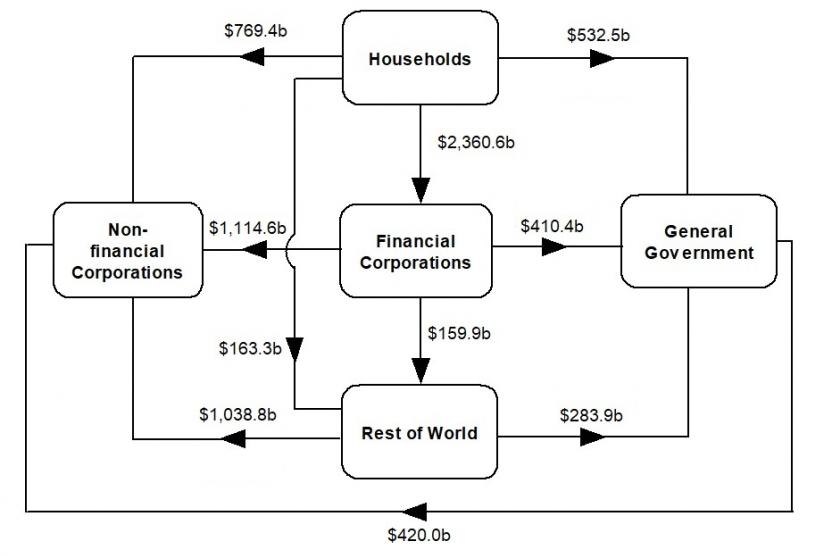

Flow of funds diagrams

National investment

National investment grew $23.0b to $131.2b in the June quarter.

- General government investment increased by $7.6b to $28.4b driven by an increase in gross fixed capital formation in both national and state and local general government.

- Non-financial corporations' investment increased by $9.3b to $54.7b driven by an increase in gross fixed capital formation in both public and private non-financial corporations.

- Household investment increased by $5.7b to $45.1b driven by an increase in gross fixed capital formation.

Financial investment

Australia was a net lender of $24.2b, the ninth consecutive quarter of net lending. The main contributors were a:

- $36.9b acquisition in rest of world (ROW) equities, driven by pension funds, other private non-financial corporations (OPNFC) and non-money market funds

- offset by $7.7b maturities of general government short term debt securities held by ROW

Pension funds, OPNFC and non-money market funds continued to invest in overseas markets as economic conditions continued to improve. Continued maturities of treasury notes decreased the general government's liability with ROW investors.

Households

Households' $16.0b net lending position was due to a $61.5b acquisition of assets, offset by a $45.5b incurrence of liabilities,

The acquisition of assets was lead by:

- $29.4b in net equity in pension funds

While liabilities were driven by:

- $45.1b in loan borrowings

Net equity acquisition in pension funds was due to continued improvement in the labour market. Increased activity in the property market and the low interest rate environment saw strength in demand for housing loans by owner-occupiers and investors.

Non-financial corporations

Non-financial corporations' $22.4b net lending position was due to a $51.9b acquisition of financial assets offset by $29.5b incurrence of liabilities. The acquisition in assets was driven by:

- $38.9b in deposits

While liabilities were driven by:

- $17.9b in equity raising

Deposits increased as non-financial corporations continued to save. Businesses sought to raise funds through equities markets driven by high investor demand.

General government

General government's $12.0b net borrowing position was due to a $8.1b acquisition in assets offset by $20.1b incurrence of liabilities. Liabilities were driven by:

- $7.4b in loan borrowings

- $7.1b net issuance of bonds

The loan borrowings was in line with growth in public investment by state and local general government. Bond issuance by the national general government stabilised over the quarter as the Commonwealth government completed it's funding task for the 2020-21 financial year.