Financing resources and investment tables

Financial market summary table

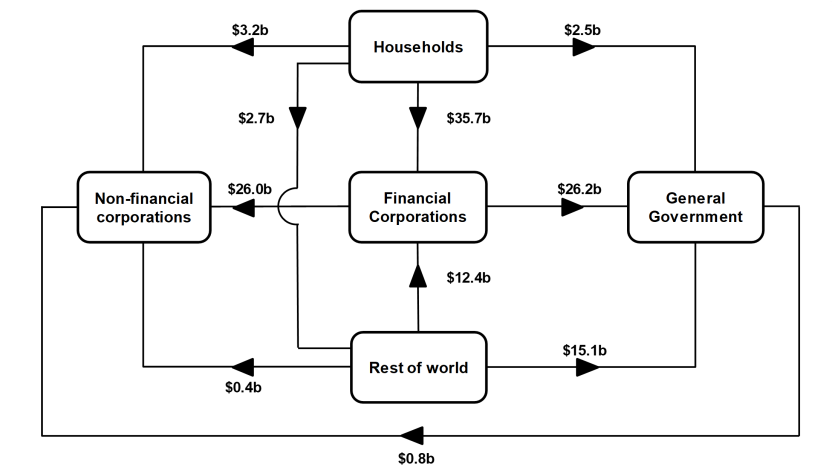

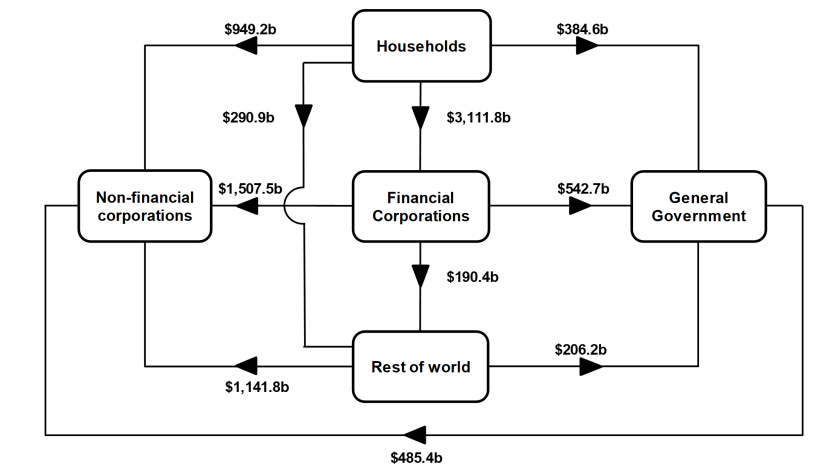

Flow of funds diagrams

National investment

National investment increased by $14.9b to $179.7b in the December quarter.

- General government investment increased by $3.7b to $29.3b, driven by rises in gross fixed capital formation for both state and local general government and national general government.

- Non-financial corporations' investment increased by $6.4b to $87.0b, driven by rises in gross fixed capital formation for both private and public non-financial corporations.

- Households' investment increased by $4.5b to $59.1b, driven by an increase in change in inventories.

Financial investment

Australia was a net borrower of $14.4b from rest of world (ROW). The main contributors were a:

- $54.3b placement of deposits by ROW

- $44.3b acquisition by ROW of debt securities issued by Australia

- Partly offset by $46.3b in loans borrowed by ROW

Placements of deposits and loans borrowed by ROW largely reflected intra-group funding arrangements between Australian subsidiaries and offshore related parties. ROW acquired bonds and one name paper issued by banks, as banks continued to return towards traditional sources of funding following the end of the Term Funding Facility (TFF) in June 2024. ROW also continued to acquire bonds issued by government.

Households

Households $44.3b net lending position was due to an $82.5b acquisition of assets, partly offset by a $38.2b incurrence of liabilities. The acquisition of assets was driven by:

- $52.7b in deposits

- $29.0b in net equity in superannuation

While liabilities were driven by:

- $37.3b in loan borrowing

The rise in deposits was supported by income growth and government cost-of-living policy relief including stage 3 tax cuts and energy bill rebates. Contributions into pension funds rose year on year, reflecting legislative changes to compulsory superannuation contributions and strength in employment.

General government

General government’s $38.0b net borrowing position was due to a $39.9b disposal of financial assets partly offset by a $1.9b reduction in liabilities. The disposal of assets was driven by a:

- $38.2b draw down of deposits

- $5.7b disposal of debt securities

The reduction in liabilities was driven by a:

- $23.3b net maturity of bonds

- Partly offset by $17.8b in loan borrowing

The net maturity of government bonds in the December quarter was the largest on record as the Commonwealth Government began repaying debt issued during the early stages of the COVID-19 pandemic. Maturing debt placed additional pressure on the government's deposit balances. State and territory governments continued to borrow funds from their respective central borrowing authorities to finance investment in health and transport infrastructure.