Financing resources and investment table

Financial market summary table

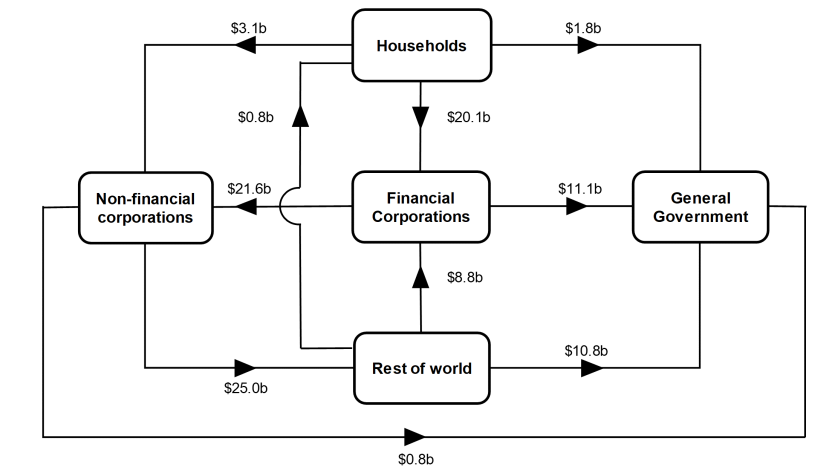

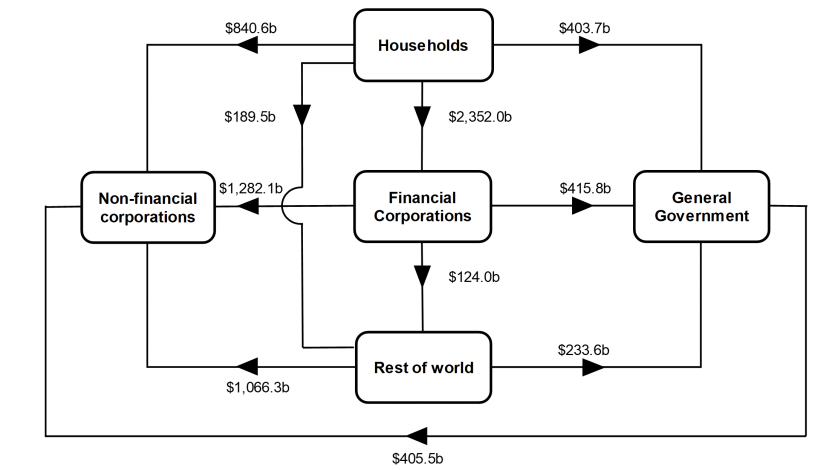

Flow of funds diagrams

National investment

National investment increased $13.7b to $155.3b in the December quarter.

- General government investment increased by $3.3b to $24.9b driven largely by increases in total gross fixed capital formation in state and local general government and national general government.

- Non-financial corporations' investment increased by $3.3b to $72.3b, driven largely by an increase in total gross fixed capital formation in private non-financial corporations, and an increase in change in inventories in public non-financial corporations.

- Household investment increased $6.8b to $55.0b, predominately driven by an increase in change in inventories, and to a lesser extent an increase in total gross fixed capital formation.

Financial investment

Australia was a net lender of $9.9b to rest of world (ROW). The main contributors were a:

- $41.5b acquisition by Australia of ROW equity

- $16.0b repayment of loans borrowed by Australia from ROW

- Partly offset by $29.0b acquisition by ROW holdings of debt securities, driven mainly by debt securities issued by banks and national general government (NGG)

Acquisition of ROW equity by Australia reflected merger and acquisition activity during the quarter. ROW acquired bank-issued debt securities as banks increased overseas wholesale funding as deposit inflows have slowed.

Households

Households $21.2b net lending position was due to a $56.8b acquisition of financial assets, offset by $35.5b incurrence of liabilities

The acquisition of assets was driven by:

- $32.5b in deposits

- $26.0b in net equity in superannuation.

While liabilities were driven by:

- $31.7b in loan borrowings

Growth in households’ deposit assets was weaker than the previous quarter as the rising cost of living put pressure on households’ ability to save. Growth in deposit assets favoured term deposit products which have benefitted from higher interest rates. Year-on-year growth in contributions into pension funds reflected growth in employment and the increase to the rate of compulsory superannuation contributions.

Non-financial corporations

Non-financial corporations’ $2.0b net borrowing position was due to $13.6b acquisition of financial assets offset by $15.6b incurrence of liabilities. The acquisition of assets was driven by:

- $30.4b of equities

Acquisitions of assets were offset by:

- $5.5b withdrawal of deposits

- $5.1b decrease in loans

Liabilities were driven by:

- $21.6b in equities

Non-financial corporations used previously built-up deposit balances to repay loans with ROW. The acquisition of equities reflects firms’ involvement in merger and acquisition activity. Private non-financial corporations benefitted from strong gross operating surplus, with reinvested earnings increasing firms' equity capital.

General government

General government’s $20.5b net borrowing position was due to a $12.3b disposal of financial assets and $8.2b incurrence of liabilities.

Assets were driven by:

- $13.8b withdrawals of deposits.

Liabilities were driven by:

- $8.2b in loans

- $3.0b issuance of long-term debt securities

Deposits previously placed by state and territory general governments were withdrawn to fund government expenditure. State and territory governments also continued to borrow funds from their respective central borrowing authorities to fund transport and healthcare capital investment. Bond issuance has wound back from pandemic highs as the national general government's financial position improves.