This release contains preliminary data from the 2020-21 Survey of Income and Housing (SIH). The SIH collects information on household income, wealth, housing costs and financial stress from Australian households over the financial year. This issue presents data collected from the September collection quarter.

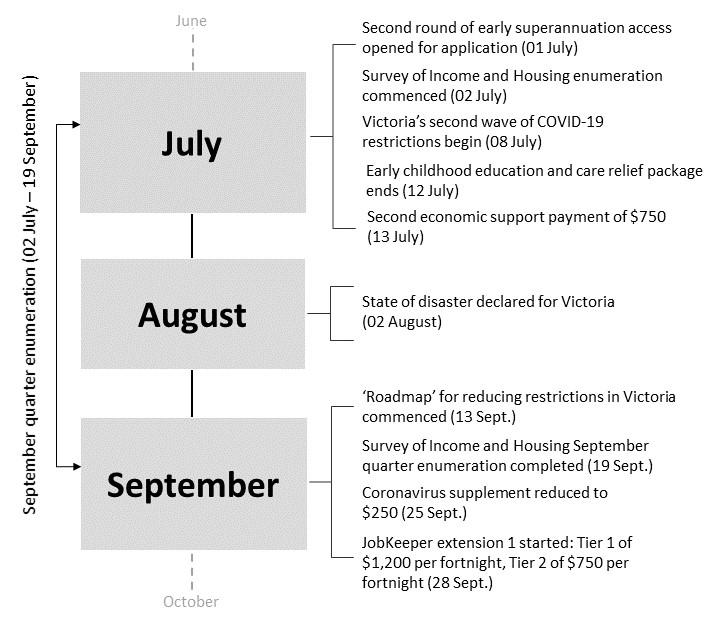

Events timeline, September 2020 quarter

Image

Description

Final SIH estimates for the full financial year are published in Household income and wealth, and Housing occupancy and costs. Preliminary quarterly estimates in this release will provide a more immediate insight into the financial impact of the Coronavirus (COVID-19) pandemic on Australian households.

Data from September 2019 is adjusted in real terms, using changes in the Consumer Price Index.

Due to the smaller quarterly sample size, estimate reliability should be considered when comparing results (see the Methodology page for further guidance).

To see more measurements and impacts of COVID-19 on the economy and society please visit our COVID-19 page.