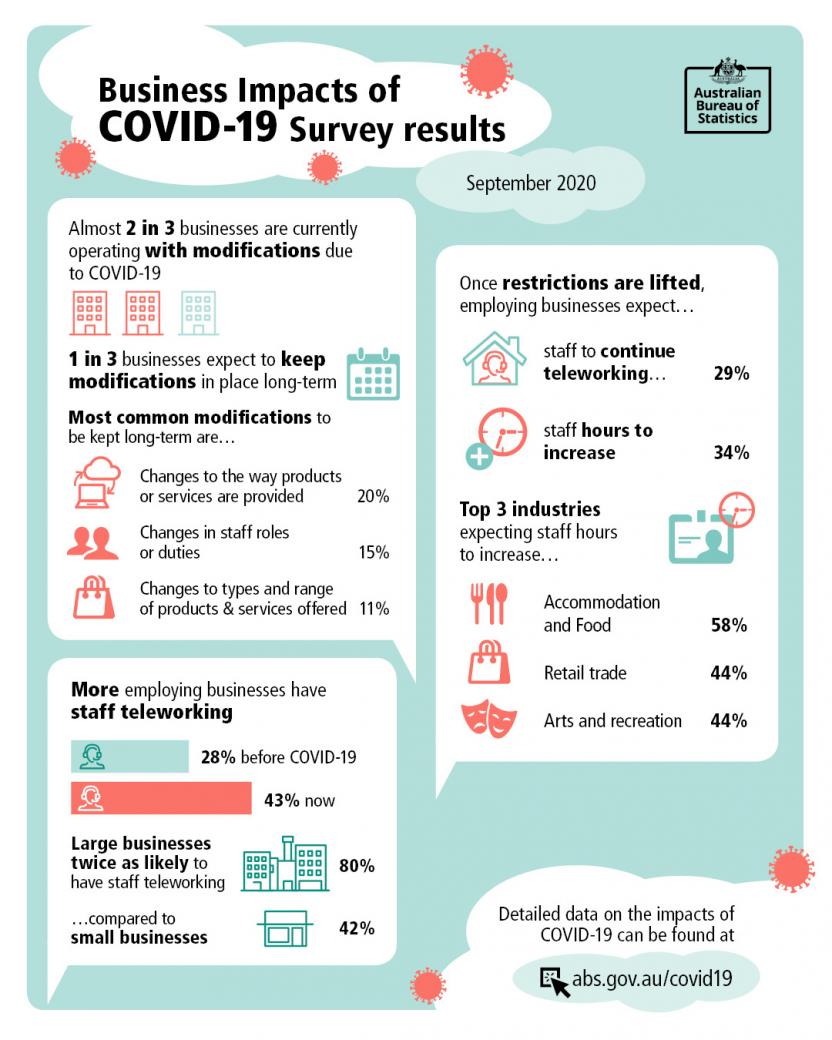

Topics covered in this release include:

- Modifications to business operations

- Teleworking and expected changes to working hours

- Business revenue, operating expenses and employment

The collection was conducted through a telephone survey between 10 September and 16 September 2020. The sample size was 2,000 businesses and the final response rate was 64% (1,279 responding businesses).

This release forms part of the suite of additional products that the ABS is producing to measure the impact of COVID-19. Future information collected in this survey will evolve to maintain relevance in a changing environment.