Deviations from International Standards

22.35 The I-O tables are an analytical tool which is compiled using the balanced S-U tables as a starting point. They can deviate to an extent from ASNA and 2008 SNA treatments in order to serve particular analytical purposes. The two main deviations are described below in more detail. They are:

- the 1968 SNA transport margin adjustment; and

- the c.i.f./f.o.b. adjustment.

22.36 The following is the list of aggregates where consistency is ensured between the I-O tables and the rest of the national accounts:

- household final consumption expenditure;

- government final consumption expenditure (total only);

- private gross fixed capital formation (total only);

- public corporations gross fixed capital formation (total only);

- general government gross fixed capital formation (total only);

- changes in inventories (total only);

- exports (total only including re-exports);

- imports (total only);

- compensation of employees (total only);

- gross operating surplus and gross mixed income (total only);

- taxes less subsidies on products;

- other taxes less subsidies on production and imports;

- income from dwelling rent - total gross rent;

- income from dwelling rent - consumption of financial services; and

- industry value added (industry level).

The 1968 SNA transport margin adjustment

22.37 The 1968 SNA Transport Margin Adjustment (SNA68 TMA) aims to capture the transport charges for goods delivered by a third party, arranged by the producer without a separate invoice. I-O tables depart from the 2008 SNA in the definition of output at basic prices due to user requirements. SNA68 TMA ensures the same product is not being valued differently depending regardless of whether the producer charged separately for the delivery of the product or not.

22.38 The transport charges are removed from Australian production and added to the transport margins and thus reducing supply at basic prices. The amount of the adjustment is sourced from the Economic Activity Survey (EAS) at the ANZSIC06 class level and aggregated to IOIG and disaggregated to product. The adjustment is applied to the products in four divisions; Agriculture, Forestry and Fishing; Mining; Manufacturing; and Arts and Recreation Services (applied to only one product of artistic originals).

22.39 SNA68 TMA is only applied to primary production of Australian goods; wholly imported goods have zero SNA68 TMA. The adjustment is only applied to five transport margin types; Road, Rail, Water, Air and Stevedoring. For row balancing purposes, the margin allocated to that product is increased respectively as the output is decreased. The increase in the margin columns is offset by a decrease in Australian production at basic price. To balance the margin products in the output matrix, the margin product is increased and the transport non-margin product is decreased to balance the column. To complete the process, the imbalance in the output matrix of the non-margin product is offset with a respective decrease in the Intermediate Use of that product.

22.40 Overall, the supply at basic prices is reduced and the margins increased with the same amount, and supply at purchaser prices remains the same, except for transport non-margin products. There are four quality checks that ensure the adjustment is applied properly:

- no negative supply at BP;

- no negative margins (except in margin products);

- no change in supply at PP except for transport non-margin products; and

- the sum of margins equals zero.

The c.i.f./f.o.b. adjustment

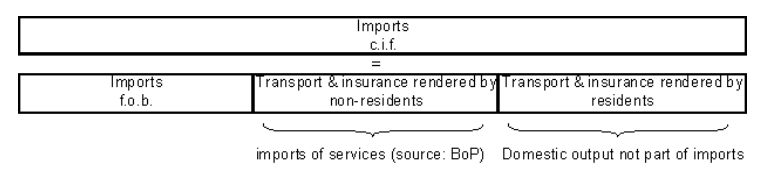

22.41 Each imported good in the input-output tables is valued cost insurance and freight (c.i.f.) since it is the equivalent to the basic price of the same domestic product. However, total imports has to be valued free-on-board (f.o.b.) in accordance with BOP and National Accounts methodology. Transport and insurance services on imported goods may be performed by residents and non-residents. If the latter is a genuine import of services, the former is a domestic output and should not be treated as imports. Two operations are therefore necessary: firstly, to reconcile detailed c.i.f. values with total imports f.o.b., and secondly, to avoid the double counting of resident services:

The c.i.f./f.o.b. adjustment

Image

Description

22.42 The total adjustment corresponding to the transport and insurance services rendered by residents is, by construction, negative:

| – transport and insurance services rendered by residents |

| = (imports f.o.b. - imports c.i.f.) + (transport and insurance rendered by non-residents) |

22.43 The UN Handbook of Input-Output Table Compilation and Analysis recommends the presentation of the c.i.f./f.o.b. adjustment as a separate item in the I-O tables. This presentation has not been adopted in the ABS I-O tables, where the adjustment is added to the transport and insurance services rendered by non-residents as explained above. These two items are allocated to non-margin water transport and non-margin air freight products. The sum of these two components is, by construction, negative.

22.44 A negative value in imports is conceptually correct and complies with the UN handbook. Because negative values are incompatible with some analytical models, the ABS also compiles a different view of the tables by re-allocating this negative adjustment on imports to a positive adjustment on exports. The consequence is an increase by the same amount of both imports and exports.

22.45 An alternative view of the I-O tables is also published to support the needs of users who apply the data in large and sophisticated models. The tables mirror the main I-O tables except for the different treatment of the c.i.f./f.o.b. adjustment.