Part B - The treatment of debt in Australian GFS

13.2.

Debt is defined as liabilities payable to creditors within the life of the accounting entity. The non-debt liabilities (under this definition) can therefore be described as equity. Paragraph 7.165 of the IMF GFSM 2014 describes equity as consisting of all instruments and records that acknowledge claims on the residual value of a corporation or quasi-corporation, after the claims of all creditors have been met. Therefore, all liabilities that rank before equity upon liquidation are payable, and are therefore considered to be debt.

13.3.

Public sector debt is defined as the level of debt liabilities owed by a government to its creditors. Gross public sector debt consists of all liabilities that are debt instruments. It is described as the stock position in financial claims that require payment(s) of interest and / or principal by the debtor to the creditor at a date (or dates) in the future. Net public sector debt is described as gross debt minus the stock position in financial assets corresponding to debt instruments.

Valuation of debt

13.4.

The Australian GFS records all financial instruments on a gross basis at their market value using the creditor approach - see Chapter 8 of this manual for the definitions. This is because the market value and creditor approach is considered to be the best reflection of the market reality in terms of valuing a financial instrument and the interest that accrues over its life. The valuation of debt is also consistent with the commercial accounting principle of fair valuation.

13.5.

The Australian GFS method for the valuation of debt deviates from the international approach, which is to record the nominal value of debt. The three valuation principles produce different results when used for valuation purposes, and are defined as follows:

- Market value is conceptually equal to the required future payments of principal and contractual interest discounted at the existing market yield interest rate.

- Nominal value is conceptually equal to the required future payments of principal and interest discounted at the contractual interest rate.

- Face value is the undiscounted amount of principal to be repaid.

13.6.

The essential difference between market and nominal valuation is the use of current yield instead of contractual interest rate(s) as the discount rate(s) applicable. The use of historical (contractual) interest rates under the nominal value to determine current valuation is not supported by the ABS. The ABS applies the market valuation principle under the creditor approach in all circumstances in macroeconomic statistics. It should be noted that for consistency, valuation of debt at current market values requires measurement of interest payments and receipts at current market yield, not contractual rates. This is a departure from the international standards, but provides a more realistic measure of debt for Australia and promotes coherence within the Australian national accounts. Debt data will be sought at market value, but if it is only available on a nominal value basis the ABS will work with providers to find a suitable solution which may entail modelling to estimate the market value using the data which is available.

Debt instruments

13.7.

Both the IMF GFSM 2014 and the 2008 SNA use a common definition and classification of financial instruments. Note that monetary gold is a contract restricted to central banks and for which asset positions exist without a counterpart liability, and SDRs are contracts between the IMF and national governments. Table 13.1 below shows financial instruments as they are presented in Australian GFS (AGFS15).

| Financial Instruments IMF GFSM 2014 | Financial Instruments AGFS15 |

|---|---|

| Monetary gold Currency and deposits | Monetary gold (bullion) (ETF 8413, SDC) Monetary gold (allocated and unallocated) (ETF 8414, SDC) Cash and deposits (ETF 8511, SDC) |

| Special Drawing Rights (SDRs) | Special Drawing Rights (ETF 8412, SDC) (ETF 8512, SDC) |

| Currency and deposits | Cash and deposits (ETF 8411, SDC) (ETF 8511, SDC) |

| Debt securities | Debt securities (ETF 8421, SDC) (ETF 8521, SDC) |

| Financial derivatives | Financial derivatives (ETF 8422, SDC) (ETF 8522, SDC) |

| Employee stock options | Employee stock options (ETF 8423, SDC) (ETF 8523, SDC) |

| Equity | Equity including contributed capital (ETF 8424, SDC) (ETF 8524, SDC) |

| Investment fund shares or units | Investment fund shares or units (ETF 8425, SDC) (ETF 8525, SDC) |

| Loans | Financial leases (ETF 8431, SDC) (ETF 8531, SDC) |

| Loans | Advances - concessional loans (ETF 8432, SDC) (ETF 8532, SDC) Advances other than concessional loans (ETF 8433, SDC) (ETF 8533, SDC) |

| Loans | Other loans and placements not elsewhere classified (ETF 8439, SDC (ETF 8539, SDC) |

| Non-life insurance technical reserves | Non-life insurance technical reserves (ETF 8441, SDC) (ETF 8541, SDC) |

| Life insurance and annuities and entitlements | Life insurance and annuities and entitlements (ETF 8442, SDC) (ETF 8542, SDC) |

| Pension entitlements | Provisions for defined benefit superannuation (ETF 8443, SDC) (ETF 8543, SDC) |

| Claims of pension funds on pension manager | Claims of superannuation funds on superannuation manager (ETF 8444, SDC) (ETF 8544, SDC) |

| Provisions for calls under standardised guarantee schemes | Provisions for calls under standardised guarantee schemes (ETF 8445, SDC (ETF 8545, SDC) |

| Miscellaneous other accounts receivable Miscellaneous other accounts payable | Provisions for employee entitlements other than superannuation (ETF 8451, SDC) (ETF 8551, SDC) |

| Other accounts receivable Other accounts payable | Accounts receivable (ETF 8452, SDC) Accounts payable (ETF 8552, SDC) |

| Miscellaneous other accounts receivable Miscellaneous other accounts payable | Other financial assets not elsewhere classified (ETF 8459, SDC) Other liabilities not elsewhere classified (ETF 8559, SDC) |

13.8.

In Australian GFS, both gross public sector debt and other liabilities and net public sector debt and other liabilities are derived from the data supplied by state and territory treasuries, the Department of Finance, local government units and universities.

Gross public sector debt

13.9.

Gross public sector debt (often referred to as 'total debt' or 'total debt liabilities') consists of all liabilities that are debt instruments and is an economic measure that is recorded as a memorandum item to the balance sheet in GFS. It is described as the stock position in financial claims that require payment(s) of interest and / or principal by the debtor to the creditor at a date (or dates) in the future. All liabilities in the GFS balance sheet are considered to be debt instruments, except for equity including contributed capital (ETF 8524) and investment fund shares or units (ETF 8525) because they entitle the holders to dividends and a claim on the residual value of the unit. In GFS, gross debt is recorded at the current market value basis.

Financial derivatives

13.10.

The Australian GFS includes financial derivatives as part of the concept of debt. The Australian GFS differs from the international standard and recognises financial derivatives as regular financial instruments, and therefore as liabilities. In the IMF GFSM 2014, financial derivatives are excluded from the concept of debt because interest does not accrue on them.

13.11.

A financial derivative is a financial instrument that is linked to another specific financial instrument, or indicator, or commodity, and through which specific financial risks (such as interest rate risk, foreign exchange risk, equity and commodity price risks, credit risk, and so on) can be traded in their own right in financial markets. Paragraph 7.204 of the IMF GFSM 2014 describes financial derivatives as financial instruments where the underlying contracts involve the transfer of risk.

13.12.

There are two broad types of financial derivatives: options and forward-type contracts. Paragraphs 7.209 and 7.212 of the IMF GFSM 2014 state that in an option contract, the purchaser acquires from the seller a right to buy or sell (depending on whether the option is a call (buy) or a put (sell)) a specified underlying item at a strike price on or before a specified date. A forward-type contract is an unconditional contract by which two counter-parties agree to exchange a specified quantity of an underlying item (real or financial) at an agreed-on contract price (the strike price) on a specified date.

Equity

13.13.

Equity and investment fund shares issued by corporations and similar legal forms of organisation are treated as liabilities of the issuing units even though the holders of the claims do not have a fixed or predetermined monetary claim on the corporation. Equity and investment fund shares entitle their owners to benefits in the form of dividends and other ownership distributions, and they often are held with the expectation of receiving holding gains. In the event that the issuing unit is liquidated, shares and other equities become claims on the residual value of the unit after the claims of all creditors have been met. If a public corporation has formally issued shares or another form of equity, then the shares are a liability of that corporation and an asset of the government or other unit that owns them. If a public corporation has not issued any type of shares, then the existence of other equity is imputed.

Presentation of debt and other liabilities in Australian GFS

13.14.

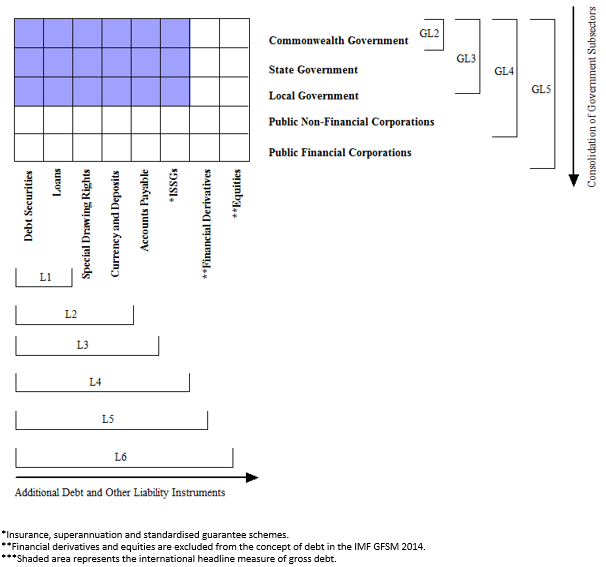

To provide reliable and comprehensive statistical data on public sector debt and other liabilities for fiscal policy makers, debt and other liabilities are presented on a gross basis, by type of financial instrument and level of government subsector in GFS. The Australian GFS is based on the presentation of gross debt based on the IMF staff discussion note What Lies Beneath: The Statistical Definition of Public Sector Debt , IMF Staff Discussion Note. IMF July 27, 2012. This shows debt reported as a matrix, with widening debt instrument coverage on one axis (D1 to D5 and beyond), and widening institutional coverage on the other axis (GL2 to GL5). Note that the GL2 level of government is used as the starting point for Australia's level of government in the IMF debt grid. This is because in the IMF staff discussion note, the GL1 level of government represents the budgetary central government only, while the GL2 level of government incorporates the budgetary central government, the extra-budgetary central government and the social security fund levels of government. For the purpose of the IMF debt grid, the level of government that best represents Australia's central government is the GL2 level (bearing in mind that there is no separate social security fund sector in Australia). Australia has expanded the concept set out in that paper to show the total level of government liabilities including debt and equity - see Diagram 13.1 below. The Australian GFS has also adopted the internationally comparable public sector debt ‘headline’ measure for gross debt of the consolidated general government as GL3 / L4 on the grid – see shaded area in Diagram 13.1 below.

Diagram 13.1 - Presentation of gross public sector debt and other liabilities by type of debt or equity instrument and by level of government subsector

Image

Description

Source: Adapted from What Lies Beneath: The Statistical Definition of Public Sector Debt , IMF Staff Discussion Note. IMF July 27, 2012. http://www.imf.org/external/pubs/ft/sdn/2012/sdn1209.pdf

13.15.

The types of debt and other liabilities instruments recognised as part of the presentation of gross public sector debt and other liabilities in Australian GFS are defined in Table 13.2 below.

Table 13.2 - Presentation of gross public sector debt and other liabilities by type of debt or equity instrument

Image

Description

Source: Based on 'What Lies Beneath: The Statistical Definition of Public Sector Debt ', IMF Staff Discussion Note. July 27, 2012

13.16.

The levels of government subsector recognised as part of the presentation of gross public sector debt and other liabilities in Australian GFS are defined in Table 13.3 below.

Table 13.3 - Presentation of gross public sector debt and other liabilities by level of government subsector

Image

Description

Note: Universities and multi-jurisdictional units are not shown in the above table.

Source: Based on 'What Lies Beneath: The Statistical Definition of Public Sector Debt ', IMF Staff Discussion Note. July 27, 2012.

Other aspects of debt in GFS

13.17.

The rest of this section discusses other aspects of debt in GFS including:

- Non-performing loans;

- Concessional loans;

- Debt reorganisation in the context of debt forgiveness, debt rescheduling, debt conversion, and debt assumption;

- Bailout operations; and

- Capital injections.

Non-performing loans

13.18.

The current market value of non-performing loans is recorded as part of memorandum items balance sheet (ETF 71) and is classified as non-performing loans at current market value (ETF 7131). Memorandum items in GFS differ to those of commercial accounting in that they are compulsory in GFS rather than optional. In order to facilitate and enhance good decision making, it is beneficial to record information on non-performing loans as well as loans whose principal and interest payments are being met. Paragraph 7.262 of the IMF GFSM 2014 defines non-performing loans as those for which:

- Payments of principal and interest are past due by three months (90 days) or more; or

- Interest payments equal to three months (90 days) interest or more have been capitalised (reinvested to the principal amount) or payment has been delayed by agreement; or

- Evidence exists to reclassify a loan as non-performing even in the absence of a 90 day past-due payment, such as when the debtor files for bankruptcy.

Debt concessionality

13.19.

Concessional loans occur when units lend to other units and the contractual interest rate or some other condition is intentionally set below the market interest rate or with a less onerous condition than would otherwise apply. Paragraph 3.123 of the IMF GFSM 2014 notes that while there is no precise definition of concessional loans in macroeconomic statistics, it is generally accepted that they are loans that occur when public sector units lend to other units and the contractual interest rate is intentionally set below the market interest rate that would otherwise apply. The degree of concessionality can also be enhanced with grace periods and frequencies of payments and maturity periods favourable to the debtor.

13.20.

Government units may acquire or dispose of financial assets on a non-market basis as an element of their fiscal policy rather than as a part of their liquidity management. For example, they may lend money at a below-market (also known as concessional) interest rate, or purchase shares of a corporation at an inflated price. The current market value of stocks of concessional loans are recorded as part of financial assets and liabilities in the GFS balance sheet under advances - concessional loans (ETF 8432 and ETF 8532).

13.21.

The nature of concessional loans means that they effectively include an implied transfer made up of the difference between the market (concessional) value of the loan and the current market value of similar loans without the concessionality. Paragraph 7.246 of the IMF GFSM 2014 recommends that the value of the implied transfer is recorded as a memorandum item. In GFS, the implied transfer is recorded under implicit transfers receivable from concessional loans (ETF 7111) or implicit transfers payable due to concessional loans (ETF 7112) in the supporting information (ETF 7).

Debt reorganisation

13.22.

Debt reorganisation (also referred to as debt restructuring in GFS) is defined as an arrangement involving both the creditor and the debtor (and sometimes third parties) that alters the terms established for servicing an existing debt. Paragraph A3.3 of the IMF GFSM 2014 indicates that debt reorganisation usually relieves the debtor from the original terms and conditions of their debt obligations. Debtors of the government seek debt reorganisation in response to liquidity constraints where the debtor does not have the cash to meet debt service payments due, or sustainability issues where the debtor is unlikely to be able to meet its debt obligations in the medium term. Government can be involved in debt reorganisation as either debtor, creditor, or guarantor.

13.23.

Paragraph A3.4 of the IMF GFSM 2014 warns that a simple failure by a debtor to honour its debt obligations (e.g., default) does not constitute debt reorganisation because it does not involve an arrangement between the creditor and the debtor. Similarly, a creditor can reduce the value of its debt claims on the debtor in its own accounts through debt write-off. These are unilateral actions that arise (for example) when the creditor regards a claim as unrecoverable (perhaps because of bankruptcy of the debtor), and as a result no longer carries the claim on its balance sheet. Again, this is not considered debt reorganisation in GFS.

13.24.

There are four main types of debt reorganisation recognised in GFS. A debt reorganisation agreement between a debtor and creditor may include elements of more than one of the types mentioned below. Paragraph A3.5 of the IMF GFSM 2014 lists the types of debt reorganisation as:

- Debt forgiveness - this is a reduction in the amount of a debt obligation, or the extinguishing of a debt by a creditor via a contractual agreement with the debtor.

- Debt rescheduling (also known as refinancing or debt exchange) - this is a change in the terms and conditions of the amount owed, which may result in a reduction in debt burden in present value terms.

- Debt conversion and debt prepayment (also known as debt buybacks for cash) - this is where a creditor exchanges a debt claim on a debtor for something of economic value other than another debt claim. Examples of debt conversion are debt-for-equity swaps, debt-for-real-estate swaps, or debt-for-development swaps.

- Debt assumption - this is when a third party is also involved.

Debt forgiveness

13.25.

Debt forgiveness (or debt cancellation) is defined as the voluntary cancellation of all or part of a debt obligation within a contractual arrangement between a creditor and a debtor. Paragraph A3.7 of the IMF GFSM 2014 states that with debt forgiveness, there is a mutual agreement between the parties involved to cancel the debt, and an intention to convey a benefit. In contrast, with debt write-off there is no such agreement or intention, but rather a unilateral recognition by the creditor that the amount is unlikely to be collected.

13.26.

Paragraph A3.7 of the IMF GFSM 2014 further states that debt forgiven may include all or part of the principal outstanding, inclusive of any accrued interest. Debt forgiveness includes forgiveness of some (or all) of the principal amount of a credit-linked note arising from an event affecting the entity on which the embedded credit derivative was written. Also included is forgiveness of principal that arises when the debt contract stipulates that the debt will be forgiven if a specified event occurs, such as forgiveness in the case of a type of catastrophe. Debt forgiveness does not arise from the cancellation of future interest that has not yet accrued. In such a case the revised contract would be treated as outlined in 13.30 to 13.39 below.

13.27.

In GFS, debt forgiveness is recorded as a capital grant or transfer from the creditor to the debtor, which extinguishes the financial claim and the corresponding debt liability. Paragraph A3.8 of the IMF GFSM 2014 states that a government or public sector unit may be involved in debt forgiveness as either a creditor or a debtor. Current market prices are the basis for valuing debt forgiveness.

Bad debts written off (not previously allowed for)

13.28.

Bad debts written off (not previously allowed for) describes bad debts that have been directly written off without previous provision. Ideally, bad debts written off need to be distinguished between those which are written off by some form of mutual agreement (as a type of debt forgiveness) between debtor and creditor, and those written off unilaterally since their treatment in the macroeconomic accounts differ. In the macroeconomic accounts, bad debts written off by mutual agreement are treated as revenue from capital grants (ETF 1151) or capital grant expenses (ETF 1261), whereas those written off unilaterally are treated as other changes in the volume of financial assets (ETF 5211, TALC 439) or other changes in the volume of liabilities (ETF 5213, TALC 539) (for further information, see paragraph 11.137 of this manual). The distinction between bad debts written off by mutual agreement or unilaterally has not been made in GFS, as data sourced from financial statements cannot be readily split in this manner. Government entities operating on a non-commercial basis (such as government aid agencies), may not provide for bad debts and may directly write them off by mutual agreement.

Provisions for doubtful debts

13.29.

In GFS, provisions are not recognised other than those relating to employee expenses. In the AGFSM 2015, provisions for doubtful debts (ETF 73) are recorded as part of the supporting information (ETF 7) to enable the ABS to derive the face value of financial assets and liabilities for international statistical reporting. This is because the ABS values financial assets and liabilities at the current market value in macroeconomic statistics, while the IMF GFSM 2014 requires these to be reported at the nominal value. The Australian GFS diverges from the IMF GFSM 2014 in the valuation of all government assets and liabilities at the current market value using the creditor approach.

Allowances for doubtful debts

13.30.

Allowances for doubtful debts are not recognised in macroeconomic statistics and are excluded from GFS output. Accounts receivable in the GFS balance sheet are recorded net of such allowances. Bad debts written off by mutual agreement are classified as revenue from capital grants (ETF 1151) or capital grant expenses (ETF 1261), whereas those written off on a unilateral basis are treated as other changes in the volume of financial assets (ETF 5211, TALC 439) or other changes in the volume of liabilities (ETF 5213, TALC 539) (for further information, see Chapter 11 of this manual).

Debt rescheduling and refinancing

13.31.

Debt rescheduling and refinancing involve a change in an existing debt contract and its replacement by a new debt contract, generally with extended debt service payments. Paragraph A3.10 of the IMF GFSM 2014 states that debt rescheduling involves re-arrangements on the same type of instrument, with the same principal value and the same creditor as with the old debt, while debt refinancing involves a different debt instrument, generally at a different value, and possibly with a different creditor. If the original terms of a debt contract state that the maturity or interest rate terms (or both) change as a result of (for example) a default or decline in credit rating, then this involves a rescheduling of the debt. In contrast, if the original terms of a debt contract are changed through renegotiation by the parties, then this is treated as a transaction in the repayment of the original debt and the creation of a new debt liability.

Debt rescheduling

13.32.

Debt rescheduling is defined as a bilateral arrangement between the debtor and the creditor that constitutes a formal postponement of debt service payments and the application of new and generally extended debt maturities. Paragraph A3.11 of the IMF GFSM 2014 indicates that the new terms normally include one or more of the following elements: extending repayment periods, reductions in the contracted interest rate, adding or extending grace periods for payments fixing the exchange rate at favourable levels for foreign currency debt, and rescheduling the payment of arrears, if any.

13.33.

With debt rescheduling, the applicable existing debt is recorded as being repaid and a new debt instrument (or instruments) created with new terms and conditions.

13.34.

A debt rescheduling transaction should be recorded at the time agreed to by both parties (the contractually agreed time), and at the value of the new debt (which, under a debt rescheduling, is the same value as that of the old debt maybe of a different value, which implies amendment of debt forgiveness). Paragraph A3.13 of the IMF GFSM 2014 indicates that if no date is set, the time at which the creditor records the change of terms is decisive. If the rescheduling of obligations due beyond the current period is linked to the fulfilment of certain conditions, entries are recorded only in the period when the specified conditions are met.

13.35.

In the specific case of zero coupon securities, a reduction in the principal amount to be paid at redemption to an amount that still exceeds the principal amount outstanding at the time the arrangement becomes effective, could be classified as either an effective change in the contractual rate of interest, or a reduction in principal with the contractual rate unchanged. Paragraph A3.11 of the IMF GFSM 2014 states that such a reduction in the principal payment to be made at maturity should be recorded as debt forgiveness, or debt rescheduling if the bilateral agreement explicitly acknowledges a change in the contractual rate of interest.

Debt refinancing

13.36.

Debt refinancing involves the replacement of an existing debt instrument or instruments (including any arrears) with a new debt instrument or instruments. Paragraph A3.14 of the IMF GFSM 2014 states that debt refinancing can involve the exchange of the same type of debt instrument (such as a loan for a loan), or different types of debt instruments (such as a loan for a bond). For example, a public sector unit may convert various export credit debts into a single loan, or exchange existing bonds for new bonds through exchange offers given by its creditor (rather than a change in terms and conditions).

13.37.

The treatment of debt refinancing transactions is similar to that of debt rescheduling. This is because the debt being refinanced is extinguished and replaced with a new financial instrument (or instruments). Paragraph A3.15 of the IMF GFSM 2014 indicates that under this arrangement, the old debt is extinguished at the value of the new debt instrument owed to official creditors.

13.38.

If the refinancing involves a direct debt exchange, such as a loan-for-bond swap, then the debtor should record a reduction in liabilities under the appropriate debt instrument and an increase in liabilities to show the creation of the new obligation. Paragraph A3.16 of the IMF GFSM 2014 recommends that the transaction be recorded at the value of the new debt (reflecting the current market value of the debt), and the difference between the value of the old and new debt instruments is recorded as debt forgiveness.

13.39.

However, if the debt is owed to official creditors and is non-marketable (for example a loan), then the old debt is extinguished at its market value with the difference in market value with the new instrument recorded as debt forgiveness. Paragraph A3.16 of the IMF GFSM 2014 states that where there is no established market price for the new bond, an appropriate proxy should be used. For example, if the bond is similar to other bonds being traded, then the market price of a traded bond would be an appropriate proxy for the value of the new bond. If the debt being swapped was recently acquired by the creditor, then the acquisition price would be an appropriate proxy. Alternatively, if the interest rate on the new bond is below the prevailing interest rate, then the discounted value of the bond (using the prevailing interest rate) may serve as a proxy.

13.40.

In GFS, the balance sheet records any changes in the stock position of assets and liabilities resulting from extinguishing old debt instruments and creating new debt instruments, and any subsequent valuation changes. Paragraphs A3.17 to A3.19 of the IMF GFSM 2014 recommend that if the proceeds from the new debt are used to partially pay off the old (existing) debt, then the remaining old debt should be recorded as being extinguished. A new debt instrument is then created that is equal to the value of the remaining old debt extinguished. If the terms of any new borrowings are concessional, then the creditor is seen as providing a transfer to the debtor that is equal to the difference between the concessional rate and the current market value.

Debt conversion or swap

13.41.

Debt conversion (also known as a debt swap) is defined as an exchange of debt (typically at a discount) for a non-debt claim (such as equity), or for counterpart funds that can be used to finance a particular project or policy. Under this arrangement, paragraph A3.20 of the IMF GFSM 2014 states that public sector debt is extinguished and a non-debt liability is created.

13.42.

A common example of debt conversion is a debt-for-equity swap. Paragraph A3.21 of the IMF GFSM 2014 indicates that often, a third party is involved in a debt-for-equity swap where they buy the claims from the creditor and receive equity in a public corporation (the debtor). Under such an arrangement, determining the value of the equity can be difficult if the equity is not actively traded on a market. If the equity is not publicly traded, then its valuation may be based on the current market value of similar publicly traded equity.

13.43.

Paragraph A3.22 of the IMF GFSM 2014 describes other examples of debt conversions (or swaps) such as external debt obligations for exports (also known as 'debt-for-exports') or debt obligations for counterpart assets that are provided by a debtor to a creditor for the creditor to use for a specified purpose, such as wildlife protection, health, education, and environmental conservation (also known as 'debt-forsustainable-development).

Debt prepayment

13.44.

Debt prepayment is defined as a repurchase or early payment of debt at conditions that are agreed between the debtor and the creditor. Paragraph A3.24 of the IMF GFSM 2014 states that the debt is extinguished in return for a cash payment agreed between the debtor and the creditor. The transaction is recorded at the value of the debt prepaid. In the AGFSM 2014, the transaction will be recorded at the current market value using the creditor method.

13.45.

If the debt is owed to official creditors and is non-marketable, then paragraph A3.25 of the IMF GFSM 2014 indicates that debt forgiveness may be involved if the prepayment occurs within an agreement between the parties with an intention to convey a benefit. In this situation, a capital transfer (or capital grant) from the creditor to the debtor is recorded for debt forgiveness, which reduces the value of the outstanding liability/claim.

Debt assumption

13.46.

Debt assumption is defined as a trilateral agreement between a creditor, a former debtor, and a new debtor (typically a government unit), under which the new debtor assumes the former debtor’s outstanding liability to the creditor and is liable for repayment of debt. Paragraph A3.26 of the IMF GFSM 2014 states that calling a guarantee is an example of debt assumption. If the original debtor defaults on its debt obligations, then the creditor may invoke the contract conditions permitting the guarantee from the guarantor to be called. The guarantor unit must either repay the debt or assume responsibility for the debt as the primary debtor (i.e., the liability of the original debtor is extinguished). A public sector unit can be the debtor that is defaulting or the guarantor. A government can also, through agreement, offer to provide funds to pay off the debt obligation of another government unit or a private sector unit owed to a third party.

13.47.

Paragraph A3.27 of the IMF GFSM 2014 indicates that the statistical treatment of debt assumption depends on (i) whether the new debtor acquires an effective financial claim on the original debtor, and (ii) if there is no effective financial claim, the relationship between the new debtor and the original debtor and whether the original debtor is bankrupt or no longer a going concern. An 'effective financial claim' is a claim that is supported by a contract between the new debtor and the original debtor, or (especially in the case of government) an agreement, with a reasonable expectation that it be honoured, for the original debtor to reimburse the new debtor. A 'going concern' is an entity in business that is operating for the foreseeable future.

13.48.

Paragraph A3.27 of the IMF GFSM 2014 states that this implies three possibilities:

- The debt assumer (new debtor) acquires an effective financial claim on the original debtor. The debt assumer records an increase in debt liabilities to the original creditor, and an increase in financial assets, such as in the form of loans, with the original debtor as the counterparty. The original debtor records a decrease in the original debt liability to the creditor and an increase in liabilities (such as in the form of a loan) to the debt assumer. The value of the debt assumer’s claim on the original debtor is the present value of the amount expected to be received by the assumer. If this amount is equal to the liability assumed, no further entries are required. If the amount expected to be recovered is less than the liability assumed, the debt assumer records an expense in the form of capital transfer/grant to the original debtor for the difference between the liability incurred and the financial asset acquired in the form of loans. For the debt assumer, gross debt increases by the amount of debt assumed.

- The debt assumer (new debtor) does not acquire an effective financial claim on the original debtor. This may be the case when the original debtor is bankrupt or no longer a going concern, or when the debt assumer seeks to convey a benefit to the original debtor. The debt assumer records an expense in the form of a capital transfer / capital grant to the original debtor, and an increase in debt liabilities to the original creditor. The original debtor records revenue in the form of a capital transfer / capital grant, which extinguishes the debt liability on its balance sheet. The exception to this case is when the original debtor is a public corporation that continues to be a going concern, which is discussed next.

- The debt assumer (new debtor) does not acquire an effective financial claim and the original debtor is a public corporation that continues to be a going concern. The debt assumption amounts to an increase in the equity owned by the debt assumer in the public corporation (original debtor). The debt assumer records an increase in debt liabilities to the original creditor, and an increase in financial assets in the form of equity and investment fund shares. The public corporation records a decrease in the debt liability to the original creditor, and an increase in non-debt liabilities in the form of equity and investment funds shares.

Diagram 13.2 - Decision tree for the statistical treatment of debt assumption

Image

Description

Source: Figure A3.1, International Monetary Fund Government Finance Statistics Manual, 2014

13.49.

Paragraph A3.28 of the IMF GFSM 2014 mentions a special case where debt assumption involves the transfer of non-financial assets (such as non-financial produced assets or land) from a public corporation (original debtor) to the debt assumer (new debtor). In this case, the debt assumer records an increase in debt liabilities to the original creditor and the acquisition of a non-financial asset(s). If the current market value of the non-financial asset(s) is equal to the value of the liability assumed, then no further entries are recorded. However, if there is any difference between the value of the liability assumed and the current market value of the non-financial asset(s), then a capital transfer / capital grant between the debt assumer and original debtor is recorded.

Debt payments on behalf of others

13.50.

Rather than assuming a debt, a public sector unit may decide to repay that debt or make a specific payment on behalf of another institutional unit (original debtor) without a guarantee being called, or the debt being taken over. In this case, paragraph A3.30 of the IMF GFSM 2014 states that the debt should stay recorded solely on the balance sheet of the other institutional unit, which is the only legal debtor. While this activity is similar to debt assumption (because the existing debt remains with unaltered terms), debt payment on behalf of others is not considered debt reorganisation.

13.51.

The treatment of debt payments on behalf of others depends on whether the public sector unit paying the debt acquires an effective financial claim on the debtor or not. Paragraph A3.31 of the IMF GFSM 2014 states:

- If the paying unit obtains an effective financial claim on the original debtor, the paying unit records an increase in financial assets (e.g., loans) and a decrease in currency and deposits. The recipient (debtor) records a decrease in the original debt liability and an increase in another liability to the paying unit. If the claim of the paying unit on the debtor is in the form of a debt instrument, the gross and net debt of the paying unit and recipient (debtor) do not change. However, if the claim of the paying unit on the debtor is in the form of a non-debt instrument (for example equity), then:

- for the paying unit, gross debt remains unchanged, but net debt increases (due to the reduction in its financial assets in the form of currency and deposits); and

- for the recipient (debtor), gross and net debt decrease (due to the reduction in the debt liability).

- If the paying unit does not obtain an effective financial claim on the original debtor, the paying unit records an expense in the form of a capital transfer / capital grant and a decrease in financial assets in the form of currency and deposits. The receiving unit (debtor) records revenue in the form of a capital transfer / capital grant and a decrease in the original debt liability.

Debt write-offs and write-downs

13.52.

Debt write-offs or write-downs are defined as unilateral reductions by a creditor of the amount owed to it. The financial asset is removed from the balance sheet of the creditor but the liability remains on the balance sheet of the debtor through an other changes in the volume of assets and liabilities entry in the accounts. Unlike debt forgiveness (which is a mutual agreement and therefore considered to be a transaction), paragraph A3.33 of the IMF GFSM 2014 states that a debt write-off or write-down is a unilateral action, and is subsequently recorded as other changes in the volume of assets and liabilities. With debt forgiveness, the financial asset is removed from the balance sheet of the creditor and the corresponding liability is removed from the balance sheet of the debtor, and also through an other changes in the volume of assets and liabilities entry in the accounts.

13.53.

Debt is commonly written off because the debtor goes bankrupt or is forced into liquidation. However, paragraph 10.57 of the IMF GFSM 2014 states that debt may sometimes be written off for other reasons, such as a court order. The write-off may be full or partial; partial write-offs may arise under a court order, or if the liquidation of the debtor’s assets allows some of the debt to be settled. Court orders though are regarded as involving mutual agreement as outlined in paragraph 3.8 of this manual. They are analogous to tax or court imposed fines. Debt write downs as a result of a court order are treated as debt rescheduling as described in paragraph 13.31 of this manual.

New money facilities

13.54.

To assist a debtor to overcome temporary financing difficulties, new money facilities may be agreed with the creditor to repay maturing debt obligations. Paragraphs A3.35 and A3.36 of the IMF GFSM 2014 indicate that the two debt instruments involved (the maturing debt obligation and the new money facility) are treated separately in GFS. Under this arrangement, the creditor records a reduction in the original claim on the debtor and an increase in a new claim on the debtor. Similarly, the debtor records a reduction in the original liability to the creditor and an increase in a new liability to the creditor. If the terms of the new borrowings are concessional, the creditor is seen as providing a transfer to the debtor that is equal to the difference between the concessional rate and the current market value.

Debt defeasance

13.55.

Under debt defeasance, a debtor unit removes liabilities from its balance sheet by pairing them with financial assets, the income and value of which are sufficient to ensure that all debt-service payments are met. Paragraph A3.37 of the IMF GFSM 2014 states that defeasance may be carried out by placing the assets and liabilities in a separate account within the institutional unit concerned, or by transferring them to another unit. In either case, GFS does not recognise defeasance as affecting the outstanding debt of the debtor. Thus, no transactions with respect to defeasance are recorded in the GFS framework, as long as there has been no change in the legal obligations of the debtor. When the assets and liabilities are transferred to a separate account within the unit, both assets and liabilities should be reported on a gross basis. If a separate entity resident in the same economy is created to hold the assets and liabilities, that new unit should be treated as an ancillary entity and consolidated with the defeasing unit.

Debt arising from bailout operations

13.56.

The term 'bailout' is used to describe a situation where a government unit provides either short-term financial assistance to a corporation in financial distress to help it survive a temporary period of financial difficulty, or a more permanent injection of financial resources to help recapitalise a corporation. Paragraph A3.42 of the IMF GFSM 2014 notes that a bailout may result in the reclassification of the assisted corporation into the public sector if the government acquires control of the corporation it is bailing out. Bailouts frequently involve highly publicised, one-time transactions and large amounts, and so they can be easily identified in the accounts.

13.57.

The term 'capital injection' refers to situations where significant financial support is provided by a government unit to capitalise or recapitalise a corporation in financial distress. Paragraph A3.43 of the IMF GFSM 2014 uses the term capital injection to reflect a direct intervention that is recorded in macroeconomic statistics either as a capital transfer, a loan, an acquisition of equity, or a combination of these. Direct intervention by general government units may take various forms, for example:

- Providing recapitalisation through an injection of financial resources (capital injection) or the assumption of a failed corporation’s liabilities;

- Providing loans and / or acquiring equity in the corporations in distress (i.e., requited recapitalisation) on favourable terms, or not; or

- Purchasing assets from the financially distressed corporation at prices greater than their true market value.

13.58.

There are two main issues that need to be examined when recording the effects of bailout operations for GFS purposes. The first issue relates to the correct sectorisation of the entity or unit that finances or manages the sales of assets and / or liabilities of the distressed corporation. The second issue relates to the correct statistical treatment of capital injections.

Sectorisation of units involved in a bailout operation

13.59.

Assessing the sector of the units involved in a bailout operation is important for determining whether transactions, other economic flows, and stock positions (debt liabilities and other assets and liabilities) are within the general government sector or public corporations sector.

13.60.

A government may create a restructuring agency (also known as a defeasance structure) in the form of a Special Purpose Entity (or other type of public body), to finance or to manage the defeasance of impaired assets or repayment of liabilities of the distressed corporation. Paragraph A3.46 of the IMF GFSM 2014 states that the sector of the restructuring agency should correctly reflect the underlying economic nature of the entity. Therefore, the sectorisation rules (as outlined in Chapter 2 of this manual) should be applied to determine whether such an entity or unit belongs as part of the general government sector or public financial corporations sector:

- If a public institutional unit is created by government solely to assume management of the assets or liabilities of the distressed corporation and is not a market producer, the unit should be classified in the general government sector because it is not involved in financial intermediation.

- If the new unit has other functions and the management of the assets or liabilities of the distressed corporation is a temporary task, then its classification as a general government unit or a public financial corporation needs to made according to the rules described in Chapter 2 of this manual.

Statistical treatment of capital injections

13.61.

As mentioned in paragraph 6.86 of this manual, a capital injection refers to a situation where significant financial support is provided by a government unit to capitalise or recapitalise a corporation in financial distress. This significant financial support is recorded as a loan, a capital transfer, an acquisition of equity, or a combination of these.

13.62.

When a public sector unit (as the investor unit) intervenes by means of a capital injection that is legally in the form of a loan to the corporation in distress, paragraph A3.48 of the IMF GFSM 2014 indicates that the statistical treatment depends on whether the investor unit obtains an effective financial claim on the corporation. An effective financial claim is a claim that is supported by a contract between the new debtor and the original debtor, or (especially in the case of government) an agreement, with a reasonable expectation to be honoured, that the original debtor will reimburse the new debtor.

13.63.

When a public sector unit intervenes by means of a capital injection other than a loan to the corporation in distress, the statistical treatment depends on whether a realistic return can be expected on this investment or not. Paragraph A3.49 of the IMF GFSM 2014 notes that a realistic rate of return on funds is indicated by the intention to earn a rate of return that is sufficient to generate dividends or holding gains at a later date and that there is a claim on the residual value of the corporation. Under this method:

- If the public sector unit (investor unit) can expect a realistic return on the investment, the investor unit records an increase in financial assets in the form of equity and investment fund shares, and a decrease in financial assets (e.g., currency and deposits) or an increase in liabilities, depending on how the acquisition of equity is financed. The corporation in financial distress records an increase in financial assets (e.g., currency and deposits), and an increase in non-debt liabilities in the form of equity and investment fund shares.

- The portion of the investment on which no realistic return can be expected (which may be the entire investment) is treated as a capital transfer / capital grant.

13.64.

Paragraph A3.50 of the IMF GFSM 2014 states that a capital injection in the form of a capital transfer / capital grant (full or partial) is recorded when the funds are provided:

- Without receiving anything of equal value in exchange; or

- Without a reasonable expectation of a realistic rate of return; or

- To compensate for the impairment of assets or capital as a result of large operating deficits accumulated over two or more years, and exceptional losses due to factors outside the control of the enterprise.

13.65.

Under this arrangement, the unit providing the assistance records an expense in the form of a capital transfer / capital grant and a decrease in financial assets (e.g., currency and deposits) or an increase in liabilities, depending how this capital transfer is financed. Paragraph A3.51 of the IMF GFSM 2014 recommends that the recipient records revenue in the form of a capital transfer / capital grant and an increase in financial assets in the form of currency and deposits.

13.66.

If the government buys assets from a corporation being assisted through a capital injection, paragraph A3.52 of the IMF GFSM 2014 states that the amount paid may be more than the true market price of the assets. The purchase of assets should be recorded at the current market price, and a capital transfer / capital grant should be recorded for the difference between the market price and the actual amount paid. If government extends a guarantee as part of a bailout, the guarantees should be recorded according to whether this is a one-off guarantee or part of a standardised guarantee scheme. Diagram 13.3 below provides a decision tree for the statistical treatment of capital injections.

Diagram 13.3 - Decision tree for the statistical treatment of capital injections

Image

Description

¹An effective claim is understood to be a claim that is supported by a contract between the new debtor and the original debtor, or (especially in the case of governments) an agreement with a reasonable expectation to be honoured, that the original debtor will reimburse.

²A realistic rate of return on funds is indicated by the intention to earn a rate of return that is sufficient to generate dividends or holding gains at a later date, and includes a claim on the residual value of the corporation.

Source: Based on Figure A3.2, International Monetary Fund Government Finance Statistics Manual, 2014.

13.67.

Paragraph A3.53 of the IMF GFSM 2014 provides further guidance for borderline cases relating to capital injections:

- If the capital injection is covering large operating deficits accumulated over two or more years or exceptional losses due to factors outside the control of the enterprise, the capital injection is recorded as a capital transfer / capital grant;

- If capital injection is made to a quasi-corporation (for the definition, see Chapter 2 of this manual) that has negative equity, the capital injection is always recorded as a capital transfer / capital grant;

- If the capital injection is undertaken for specific purposes relating to public policy in order to compensate a bank in financial distress for anticipated defaults / bad assets / losses within its balance sheet, the capital injection is recorded as a capital transfer / capital grant; unless a realistic rate of return and / or a claim on the residual assets can be expected which results in an equity investment being recorded;

- If there are private shareholders providing a significant share (in proportion to their existing share holding) of equity during the capital injection, then the capital injection by the public entity is also recorded as an equity investment since the assumption is that private investors would be seeking a return on their investment.

Debt of special purpose entities

13.68.

Governments may establish artificial subsidiaries as Special Purpose Entities (SPEs) in the form of public corporations that sell goods or services exclusively to government, without tendering for a government contract in competition with the private sector. Paragraph A3.55 of the IMF GFSM 2014 recommends that such public corporations be classified as part of the general government sector (its parent unit).

13.69.

If a government conducts fiscal activities through an entity that is resident abroad, paragraph A3.56 of the IMF GFSM 2014 states that such entities are not treated in the same way as embassies and other territorial enclaves because they operate under the laws of the host economy. When an SPE resident in one economy borrows on behalf of the government of another economy and the borrowing is for fiscal purposes, paragraph A3.57 of the IMF GFSM 2014 recommends the following statistical treatment in the accounts of that government:

- At the time of borrowing, a transaction creating a debt liability of the government to the borrowing entity is imputed equal to the amount borrowed. The counterpart entry is an increase in the government’s equity in the borrowing entity.

- At the time funds (or assets acquired with the funds) are transferred to the government, a transaction for the flow of funds or assets is recorded, matched by a reduction of the government’s equity in the borrowing entity by the same amount.

- At the time expenses are incurred, or assets are transferred by the borrowing entity to a third party (i.e., are not transferred to the government), a current or capital transfer between the government and the entity is imputed, with the matching entry of a reduction in the value of the government’s equity.

Debt arising from securitisation

13.70.

Securitisation occurs when a unit (named the originator) conveys ownership rights over financial or nonfinancial assets, or the right to receive specific future flows to another unit (named the securitisation unit). Paragraph A3.59 of the IMF GFSM 2014 states that in return, the securitisation unit pays an amount to the originator from its own source of financing. The securitisation unit obtains its own financing by issuing debt securities using the assets or rights to future flows transferred by the originator as collateral. When asset-backed securities are issued by a public sector unit, they form part of public sector debt.

Debt arising from off-market swaps

13.71.

An off-market swap is defined as a swap contract that has a non-zero value at inception as a result of having a reference rate priced differently to current market values (that is, 'off-the-market'). Paragraph A3.68 of the IMF GFSM 20414 states that such a swap results in a lump sum being paid (usually at inception) by one party to the other. The economic nature of an off-market swap is a combination of borrowing (the lump sum) in the form of a loan, and an on-market swap (a financial derivative). Examples of swaps contracts that may involve off-market reference rates include interest rate and currency swaps.

13.72.

Because the economic nature of an off-market swap is equivalent to a combination of a loan and a financial derivative, paragraph A3.69 of the IMF GFSM 2014 recommends that two stock positions are recorded in the GFS balance sheet:

- A loan which is equal to the non-zero value of the swap at inception and with a maturity date equivalent to the expiration date of the swap (the loan position is a liability of the party that receives the lump sum); and

- A financial derivative (swap) component which has a market value of zero at inception (the derivative position may appear either on the financial asset or liability side, depending on market prices on the balance sheet date).

On-lending of borrowed funds

13.73.

Paragraph A3.72 of the IMF GFSM 2014 describes the on-lending of borrowed funds as occurring when a resident institutional unit (known in this case as 'A') borrowing from another institutional unit(s) (known in this case as 'B'), and then on-lending the proceeds from this borrowing to a third institutional unit(s) (known in this case as 'C'). The on-lending of borrowed funds is motivated by several factors, for example:

- Institutional unit A may be able to borrow from unit B at more favourable terms than unit C could borrow from unit B; or

- Institutional unit C’s borrowing powers are limited by factors such as foreign exchange regulations; only unit A can borrow from non-residents.

13.74.

The classification of the debt liability of institutional unit A to unit(s) B depends on the type of instrument(s) involved: typically, such borrowing is in the form of loans and / or debt securities. In such cases, paragraph A3.75 of the IMF GFSM 2014 recommends that institutional unit A’s debt liabilities in the form of loans and/or debt securities increase (credit) as a result of the borrowing from unit(s) B, with a corresponding increase (debit) in unit A’s financial assets in the form of currency and deposits. These events result in an increase in the gross debt position of unit A, but no change in its net debt position.