Appendix 1 Australian units model

Overview

The Units Model was reviewed in 2012. The previous version was introduced in 2000 in response to major taxation reforms.

ABS Units Model

The Units Model used by the ABS in determining the structure of businesses is consistent with Australia's Corporations Law and with the definition of institutional units outlined in 2008 System of National Accounts (SNA). The model consists of:

- The Enterprise Group (EG)

- one or more Legal Entities (LEs)

- one or more Type of Activity Units (TAUs)

- one or more Locations.

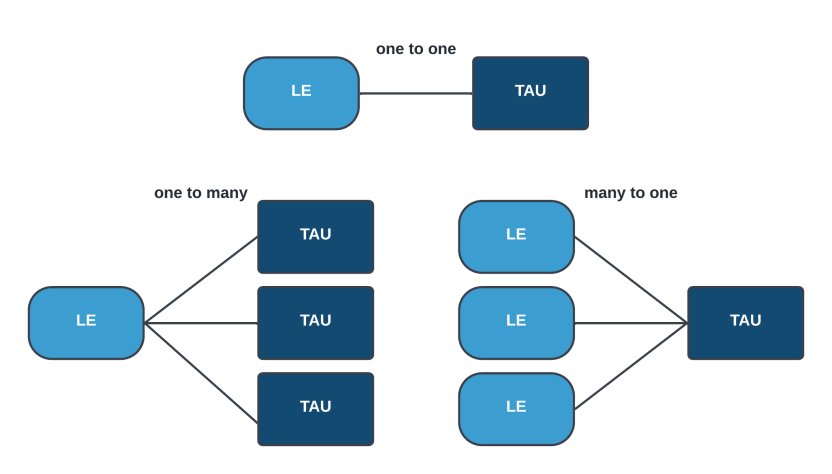

The EG and LE are institutional units and the TAU and Location are producing units. The LE and the TAU are the main institutional and producing units used by the ABS to produce statistical outputs. They do not have a universal relationship with each other, e.g. one to one, one to many, many to one. A variety of relationships exist in some of the larger and more complex Australian enterprise groups.

Diagram 1: Legal Entity (LE) to Type of Activity Unit (TAU) relationship

Image

Description

This is a limited departure from the 2008 SNA, which states that there is a hierarchical relationship between institutional and producing units. In the 2008 SNA the enterprise (the producing view of an individual institutional unit) can be partitioned into one or more establishments. The 2008 SNA statement is true at the EG level, but not necessarily at the LE level.

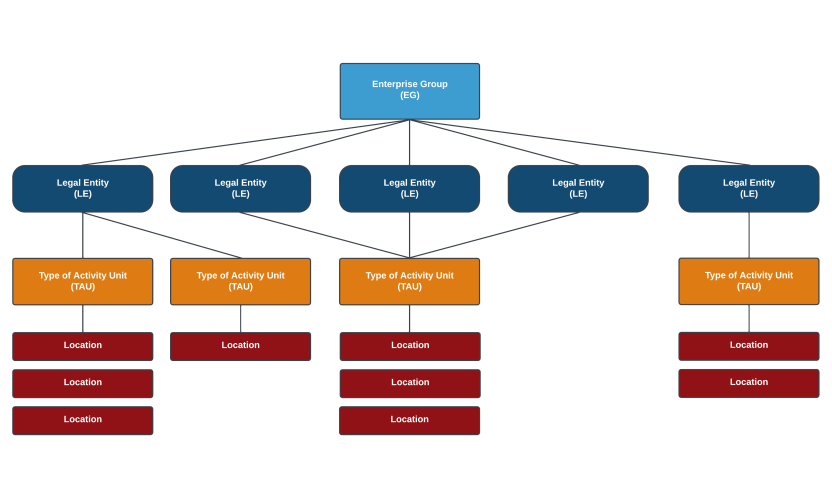

Diagram 2 illustrates the nature of the relationships between the unit types in the model. The LE is represented by the ABN in the diagram, as they are usually the same.

Diagram 2: ABS Units Model

Image

Description

Unit definitions

The Legal Entity (LE) statistical unit is defined as a unit covering all the operations in Australia of an entity which possesses some or all of the rights and obligations of individual persons or corporations, or which behaves as such in respect of those matters of concern for economic statistics. Examples of legal entities include companies, partnerships, trusts, sole (business) proprietorships, government departments and statutory authorities. Legal entities are institutional units.

The Enterprise Group (EG) is an institutional unit covering all the operations within Australia's economic territory of legal entities under common control. Control is defined in Corporations legislation. Majority ownership is not required for control to be exercised.

The Type of Activity Unit (TAU) is a producing unit comprising one or more legal entities, sub-entities or branches of a legal entity that can report productive and employment activities via a minimum set of data items. Only a small number of data items are required to be available on a quarterly basis. The data items are:

- Total capital expenditure;

- Income from the sale of goods and services;

- Wages and salaries;

- Total inventories; and,

- Total purchases and selected expenses.

A TAU can also be formed in situations where only some data items are available directly from accounts and good quality estimates can be provided. The activity of the unit should be as homogeneous as possible. If accounts sufficient to approximate Industry Value Added (IVA) are available at the ANZSIC Subdivision level, a TAU will be formed.

Ideally, all TAUs are constructed so that two-digit ANZSIC (Subdivision) homogeneity is observed. This ensures that good quality industry estimates can be calculated by the ABS at that level. However, not all businesses are able to supply a complete set of accounts for every ANZSIC Subdivision in which they have activity. Where a business cannot supply adequate data to form a TAU for an individual ANZSIC Subdivision, a TAU will be formed which contains activity in two or more ANZSIC Subdivisions.

A Location is a single, unbroken physical area, occupied by an organisation, at which or from which, the organisation is engaged in productive activity on a relatively permanent basis, or at which the organisation is undertaking capital expenditure with the intention of commencing productive activity on a relatively permanent basis at some time in the future. The exception is the agricultural location unit (farm unit) where land parcels are operated as a single property and are treated as a single location.

The TAU may be subdivided into TAU-state units which cover production in each state of operation. TAU-state units are synthesised for the Labour Statistics collections. They are derived statistical units and inherit the attributes of the TAU statistical units.

Ancillary units

A business unit's productive activity is described as ‘ancillary’ when its sole function is to provide common types of services for intermediate consumption within the same enterprise group. These are typically services likely to be needed in most enterprise groups, whatever their principal activities. Examples are: transportation, purchasing, sales and marketing, various financial or business services, personnel, computing and communications, security, maintenance and cleaning.

Classification of units

Various classifications are applied to the units in the ABS Units Model. The main classifications applied are:

- ANZSIC for industry

- Type of Legal Organisation (TOLO)

- Type of Business Entity (TOBE) for the type of entity

- Standard Institutional Sector Classification of Australia (SISCA) for institutional sector and the public / private flag.

ANZSIC is used to classify the industry in which the TAU has productive activity. Each unit is assigned a four digit (class level) ANZSIC code which reflects the predominant industry of the TAU's economic activity. ANZSIC can be found at ABS catalogue number 1292.0.

SISCA provides a framework for dividing the Australian economy into institutional sectors. These sectors group Legal Entities which have similar economic functions and share similar structural characteristics.

Statistical collections

The ABS uses the TAU unit as the statistical unit for industry and some other economic statistics collections. For some activity and labour collections, the ABS uses sub-TAU units e.g. farm units, TAU State units.