- Of participating Wave 1 products with sodium composition data available for baseline (June 2020) and the four-year endpoint (June 2024), 30% recorded a decrease in sodium content between periods and 12% recorded an increase in sodium. The average sodium content across all participating Wave 1 products fell by 4.1% over the four-year period.

- The population impact of the sodium reduction was estimated to be 14.8 mg per person per day in 2023–24, equivalent to a 0.5% reduction from the total sodium intake of 2,995 mg per person per day from baseline composition.

- Of eligible Wave 1 products with saturated fat composition data available for both periods, the proportion which recorded an increase in saturated fat content (25%) exceeded the proportion recording a decrease (23%). The average saturated fat content across all eligible Wave 1 products increased by 5.1% over the four-year period.

- The change in saturated fat composition had a negligible impact on consumption of saturated fat which was estimated to be 36.1g per capita per day under both the baseline and the June 2024 compositions.

Healthy Food Partnership Reformulation Program: Wave 1, four-year progress

Estimates consumption impact of sodium and saturated fat reformulation from the Partnership Reformulation Program, June 2020 and June 2024

Key statistics

Introduction

In 2015, the Australian Government established the Healthy Food Partnership (HFP) as a voluntary collaboration between the food industry, the public health sector and government. Its goal is to enhance health by improving the food environment and influencing Australian's ability to make healthier food choices. A key initiative of the HFP is the Partnership Reformulation Program (PRP) which aims to reduce the Australian population’s consumption of sodium, saturated fat and sugar from processed food products.

The reformulation phase of the PRP is being conducted from 2020 to 2026 with eligible food categories being divided into waves. Each wave specifies targets for the maximum levels of sodium, saturated fat and total sugars content within specified food categories that Australian companies can voluntarily work towards over a four-year period.

The four-year implementation period for Wave 1 of the PRP commenced on 1 July 2020 following the introduction of voluntary reformulation targets for:

- Sodium (across 12 food categories and 28 sub-categories)

- Saturated fat (across 4 food categories and 5 sub-categories).

This article reports on the final progress towards the reformulation targets at the four-year mark (from June 2020 to June 2024) based on reporting by participating manufacturers. The analysis includes the number of participating products that met the sodium/saturated fat targets at each period, the change in average sodium/saturated fat content (per 100g) and the impact of reformulation on consumption. For details on the methods and assumptions used in this analysis see the Methodology section.

Sodium

Summary of industry supplied product data

Sodium composition data was available for a total of 1,853 unique products including 1,293 (70%) where the sodium data was available for both June 2020 (baseline) and June 2024 (four-year endpoint).

The leading food categories by total number of products were:

- Bread with 442 products, the majority (88%) of which were leavened breads

- Savoury snacks (278 products), around half (49%) of which were potato snacks

- Sweet bakery products (cakes, muffins and slices) with 255 items

- Gravies and sauces (193 products), half (50%) of which were in the sub-category ‘other savoury sauces’ (e.g. simmer sauces and pasta sauces)

- Soups (169 products)

- Savoury biscuits (128 products).

- Count of products that had sodium composition data provided for both June 2020 and June 2024 and had retail sales recorded in 2023–24.

- Count of products that had sodium composition data provided for either June 2020 or June 2024 and had retail sales recorded in 2023–24.

How much dietary sodium was accounted for by the participating products?

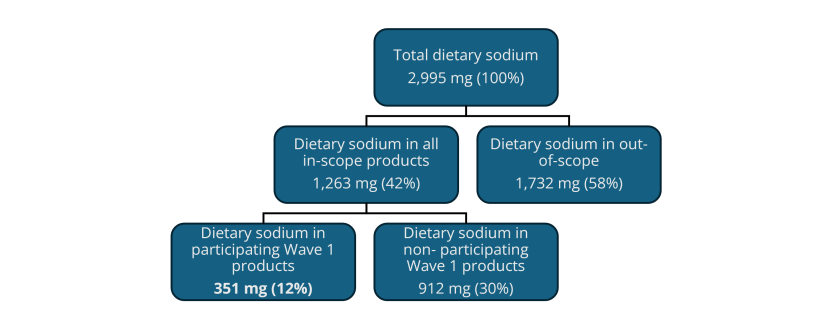

To estimate sodium consumption, participating products were integrated with 2023–24 scanner sales data to quantify units sold. Using baseline sodium composition data (June 2020), these products contributed an estimated 351 mg of sodium per capita per day, representing 12% of total dietary sodium intake at baseline (2,995 mg per capita per day).

Based on scanner data, the total sodium available from all eligible Wave 1 products (i.e. with 100% participation) would account for 42% of total dietary sodium consumption in 2023–24.

Overall, the participating products accounted for 28% (351 mg) of the total sodium available from all in-scope products (1,263 mg). By category, sodium representation ranged from 13% for savoury pastries (i.e. the participating savoury pastries accounted for 13% of sodium in all savoury pastries) to 62% for soups.

Estimated coverage of dietary sodium by participating products, 2023–24

Image

Description

The top box shows the total dietary sodium intake of 2,995 mg (in per capita per day) at baseline. Of this, 42% (1,263 mg) comes from products in-scope for Wave 1, which is further divided into participating products (351 mg, 12%) and non-participating products (912 mg, 30%). The remaining 58% (1,732 mg) is from products out of scope.

- The numerator is the total sodium available from the participating products at baseline, the denominator is the total sodium available from participating products + non-participating products at baseline.

Accounting for the volume of consumption by product category shows the greatest contribution to sodium (from all participating products) was from bread which made up one-third (33%) of the sodium. This was followed by:

- Savoury snacks (with 13% of the sodium from all participating products)

- Cheese (11%)

- Gravies and sauces (9.3%)

- Processed meat (7.9%)

- Sausages (7.6%).

- The numerator is the sodium available from participating products in each category, the denominator is the total sodium available from all categories of participating products at baseline (i.e. components sum to 100%).

Changes in sodium content

Almost one in three (31% or 394) of the participating products that had sodium data available for both June 2020 and June 2024 recorded a decrease in sodium content over the period. In contrast, 12% (156 products) recorded an increase in sodium content over the period.

The food categories with the greatest proportion recording a decrease in sodium content between June 2020 and June 2024 were:

- Sausages (65% of products)

- Processed meat (50%)

- Gravies and sauces (46% of products)

- Pizza (41%)

- Crumbed and battered proteins (32%)

- Bread (32%).

- From products which had composition data available for both periods and had sales in 2023–24.

Across all food categories, the average sodium content of all the participating products was found to be 4.3% lower for the June 2024 composition than for June 2020. The greatest relative reductions in average sodium levels were seen among:

- Gravies and sauces with sodium levels down 8.9% – led by Asian style cooking sauces and gravies and finishing sauces having average decreases of 20% and 10% respectively

- Crumbed and battered proteins (down 8.7%) – led by crumbed and battered fish products with an average 17% sodium reduction

- Sweet bakery products (down 7.9%)

- Processed meat (down 7.8%) – led by frankfurts and saveloys which had an average 19% reduction in sodium

- Sausages (down 6.8%)

- Savoury snacks (down 5.5%).

- Relative change in mean sodium values within categories values of all products with June 2024 composition data from all products with June 2020 composition data.

Progress against sodium targets

Around four out of five (81%) of all participating products with June 2024 composition data met their respective sodium target, up from 68% at baseline. Based on the June 2024 sodium content data, the participating product categories with the highest proportion of products meeting sodium targets were:

- Cheese (96%)

- Sweet bakery goods (92%)

- Crumbed and battered proteins (90%)

- Savoury pastries (88%)

- Soups (87%).

The greatest improvements against the sodium target were for processed meat and sausages where the proportions meeting the target went from 43% to 77% for the processed meat and from 50% to 80% for sausage products between the June 2020 and June 2024 formulations.

- Based on all products which had composition data available for June 2020 and had sales in 2023–24.

- Based on all products which had composition data available for June 2024 and had sales in 2023–24.

Several food sub-categories had relatively higher proportions of products meeting the sodium target than their parent food category. These included:

- Asian style cooking sauces (100% met target, compared to 77% of all gravies and sauces)

- Salt and vinegar snacks (100% met target, compared to 63% of all savoury snacks)

- Frankfurts (100% met target ) and bacon (95% met target), compared to 77% for all processed meat.

Consumption impact of sodium reformulation

In this analysis, the product sales volumes were used to estimate and compare sodium consumption for each formulation. From 2023–24 sales, this comparison demonstrated that the June 2024 formulations relative to the June 2020 formulations reduced total annual sodium consumption by 145 tonnes (or around 369 tonnes of table salt). This translates to a per capita reduction of 14.8 mg per day, which was 0.5% of the estimated total consumption of 2,995 mg of sodium per person per day.

The food categories with reformulations contributing most to the sodium reduction were:

- Processed meat (-3.4 mg per capita per day, or 23% of the overall decline)

- Sausages (-3.2 mg per capita per day or 22% of the decline)

- Sweet bakery products (-2.4 mg per capita per day or 16% of the decline)

- Savoury snacks (-1.9 mg per capita per day or 13% of the decline)

- Bread (-1.9 mg per capita per day or 13% of the decline).

- Consumption per capita, per day.

Although -14.8 mg of sodium per person per day is a relatively modest reduction of the total dietary sodium available for consumption, this is the average based on all foods being consumed by the total population. Because these products would be consumed by only a subset of the whole population, the sodium reduction among those consumers may be expected to be significantly greater than suggested by the per capita amount.

Saturated Fat

Summary of industry supplied product data

Saturated fat composition data was available for a total of 165 unique products across 5 categories of processed foods. The total included 95 products (58%) where the saturated fat data was available for both June 2020 and June 2024.

The categories represented by number of products were:

- Sausages (53 products)

- Pizza (49 products)

- Dry savoury pastries (e.g. sausage rolls, pasties) (34)

- Wet savoury pastries (e.g. meat pies) (26)

- Processed meat: Frankfurts and saveloys (3).

- Count of products that had saturated fat composition data provided for both June 2020 and June 2024 and had retail sales recorded in 2023–24.

- Count of products that had saturated fat composition data provided for either June 2020 or June 2024 and had retail sales recorded in 2023–24.

How much dietary saturated fat was accounted for by the participating products?

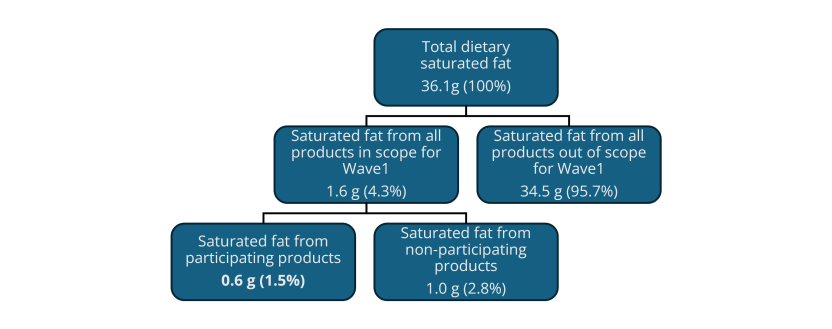

When the manufacturers saturated fat composition data was integrated with 2023–24 scanner data sales to measure consumption, it was estimated that the participating products in scope for Wave 1 accounted for 0.6g (1.5%) of the total 36.1g of dietary saturated fat (per capita, per day). Of the total 1.6g of saturated fat available from all eligible Wave 1 products (i.e. including non-participating), the participating products accounted for 36%.

Estimated coverage of dietary saturated fat by participating products, 2023–24

Image

Description

The top box in the flowchart shows the total dietary saturated fat intake was 36.1g (per capita, per day) at baseline. Of that, a small portion (4.3%, or 1.6g) comes from products in-scope for Wave 1, which is further divided into participating products (0.6g, 1.5%) and non-participating products (1.0g, 2.8%). The remaining majority (95.7%, or 34.5g) comes from products out of scope.

Sausage products had the greatest representation of saturated fat among the Wave 1 food categories with participating sausage products accounting for 51% of the saturated fat from all sausage products. This was followed by:

- Pizza (47% of the saturated fat from all pizza)

- Dry pastries (17% of the saturated fat from all dry pastry products)

- Wet pastries (15% of the saturated fat from all wet pastry products).

- Representation from in-scope products: the denominator is the total saturated fat available from the respective food category (participating products + non-participating products) at baseline.

- Representation from participating products: the denominator is the total saturated fat available from all participating products at baseline (sums to 100%).

Although sausages and pizza represented relatively similar proportions of the saturated fat from their respective food categories, sausages accounted for the majority (72%) of the total saturated fat available from all participating Wave 1 products, indicating the greater contribution of sausages to dietary saturated fat.

Changes in saturated fat content

Just under one-quarter (23%, or 22) of participating products with available saturated fat data for both periods recorded a decrease in saturated fat levels. However, this reduction was more than offset by a saturated fat increase in 25% (or 24) products over the same period. Only two product categories had a greater proportion of products that reduced rather than increased saturated fat:

- Frankfurts and saveloys (100% decreased)

- Pizzas (24% decreased and 17% increased).

The categories where more products underwent an increase in saturated fat than a decrease were:

- Sausages (42% had an increase in saturated fat, while 38% had a decrease)

- Savoury pastries (22% increased, while 8% decreased).

- From products which had composition data available for both periods and had sales in 2023–24.

Across all food categories, the average saturated fat content of all the participating products was found to be 5.1% higher for the June 2024 composition than for June 2020. The greatest relative increases in average saturated fat levels were seen among:

- Sausages, up 10% (from 6.8g to 7.5g per 100g)

- Wet pastries, up 6% (from 5.3g to 5.6g per 100g).

In contrast, there were small reductions in the average saturated fat levels of:

- Pizzas, down 4.4% (from 4.3g to 4.1g per 100g)

- Dry pastries, down 1% (from 7.1g to 7.0g per 100g).

- Change in average saturated fat content from June 2020 composition to June 2024 composition (from products with composition data for both periods).

Progress against saturated fat targets

Fewer than half (48%) of all participating products with June 2024 composition data met their respective saturated fat target, down from 60% based on the participating products with June 2020 composition data. While this drop in the proportion of products meeting targets was in part due to a number of products increasing saturated fat levels above the target between 2020 and 2024, it was also a result of the new products (i.e. had composition data for 2024 but not for 2020) being less likely to meet the saturated fat target compared to products that had 2020 composition data (46% and 60% respectively).

Based on the June 2024 saturated fat content data, the proportion of participating products in each product categories meeting the saturated fat targets were:

- Wet pastries (83%)

- Dry pastries (46%)

- Pizza (43%)

- Sausages (33%).

- Based on all products which had composition data available for June 2020 and had sales in 2023–24.

- Based on all products which had composition data available for June 2024 and had sales in 2023–24.

Consumption impact of saturated fat reformulation

Despite the overall rise in average saturated fat levels between the June 2020 and June 2024 formulations, the consumption estimate from scanner data sales showed that on average, the 2024 formulations resulted in a reduction in saturated fat of 72 tonnes for 2023–24. The apparent paradox is largely explained by the sales distribution of sausages where a small number of products with relatively high sales volumes reduced saturated fat content between June 2020 and June 2024.

- Restricted to participating sausage products weighted by 2023–24 sales amounts.

Among the participating products, the relative and absolute change amounts of saturated fat by food categories showed that over the year to June 2024:

- Sausages contributed 73 fewer tonnes of saturated fat (-1.9%)

- Pizza contributed 35 fewer tonnes of saturated fat (-5.1%)

- Frankfurts and saveloys contributed 3.8 fewer tonnes of saturated fat (-4.7%)

- Dry pastries contributed an extra 16 tonnes of saturated fat (+4.2%)

- Wet pastries contributed an extra 24 tonnes of saturated fat (+6.7%).

- Percent change in saturated fat contribution.

- Annual change in tonnes of saturated fat.

On a per-capita basis, the reduction in saturated fat was less than 0.01g per day which was a 1.3% decrease from the 0.6 grams contributed by the participating products. Across all foods and beverages, the change was negligible with the estimated intake of saturated fat unchanged at 36.1g per capita per day.