Four additional monthly data series have been included under the Food and non-alcoholic beverages group:

- Bread and cereal products

- Dairy and related products

- Food products n.e.c.

- Non-alcoholic beverages

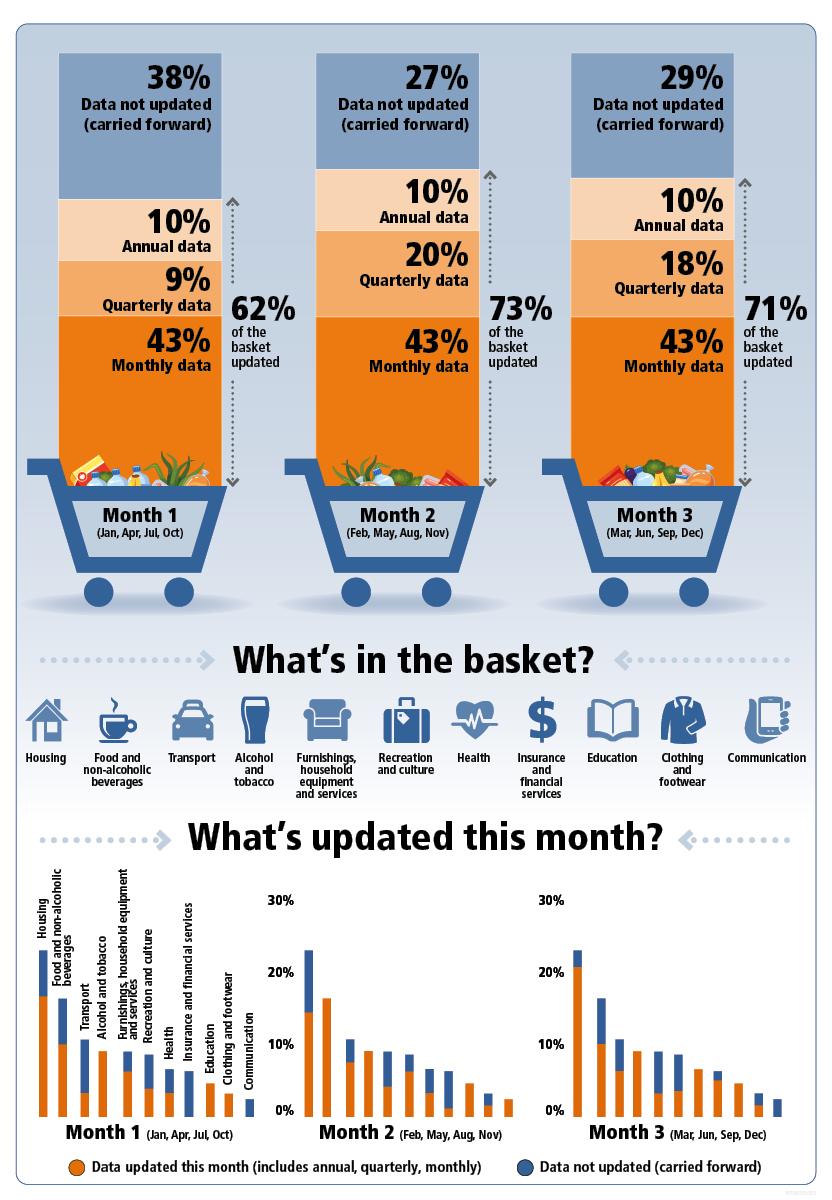

The monthly CPI indicator is a measure of inflation and includes statistics about prices for categories of households expenditure.

Four additional monthly data series have been included under the Food and non-alcoholic beverages group:

| Annual change (%) | |

|---|---|

| Nov-18 | 1.6 |

| Dec-18 | 1.5 |

| Jan-19 | 1.2 |

| Feb-19 | 1.5 |

| Mar-19 | 1.6 |

| Apr-19 | 1.8 |

| May-19 | 1.5 |

| Jun-19 | 1.4 |

| Jul-19 | 1.6 |

| Aug-19 | 1.6 |

| Sep-19 | 1.7 |

| Oct-19 | 1.8 |

| Nov-19 | 1.8 |

| Dec-19 | 2.2 |

| Jan-20 | 2.7 |

| Feb-20 | 2 |

| Mar-20 | 2.1 |

| Apr-20 | 0.1 |

| May-20 | -0.2 |

| Jun-20 | -0.1 |

| Jul-20 | 0.8 |

| Aug-20 | 1.1 |

| Sep-20 | 0.4 |

| Oct-20 | 0.5 |

| Nov-20 | 1.1 |

| Dec-20 | 0.3 |

| Jan-21 | 0.4 |

| Feb-21 | 1.1 |

| Mar-21 | 0.8 |

| Apr-21 | 2.5 |

| May-21 | 3.3 |

| Jun-21 | 3.5 |

| Jul-21 | 2.1 |

| Aug-21 | 2.5 |

| Sep-21 | 3.1 |

| Oct-21 | 3 |

| Nov-21 | 3.1 |

| Dec-21 | 3.4 |

| Jan-22 | 3.9 |

| Feb-22 | 4.8 |

| Mar-22 | 5.7 |

| Apr-22 | 5.5 |

| May-22 | 6.1 |

| Jun-22 | 6.7 |

| Jul-22 | 7 |

| Aug-22 | 6.9 |

| Sep-22 | 7.3 |

| Oct-22 | 6.9 |

| Nov-22 | 7.3 |

All groups monthly CPI indicator, Australia, annual movement (%)

["","Annual change"]

[["Nov-18","Dec-18","Jan-19","Feb-19","Mar-19","Apr-19","May-19","Jun-19","Jul-19","Aug-19","Sep-19","Oct-19","Nov-19","Dec-19","Jan-20","Feb-20","Mar-20","Apr-20","May-20","Jun-20","Jul-20","Aug-20","Sep-20","Oct-20","Nov-20","Dec-20","Jan-21","Feb-21","Mar-21","Apr-21","May-21","Jun-21","Jul-21","Aug-21","Sep-21","Oct-21","Nov-21","Dec-21","Jan-22","Feb-22","Mar-22","Apr-22","May-22","Jun-22","Jul-22","Aug-22","Sep-22","Oct-22","Nov-22"],[[1.6],[1.5],[1.2],[1.5],[1.6],[1.8],[1.5],[1.4],[1.6],[1.6],[1.7],[1.8],[1.8],[2.2],[2.7],[2],[2.1],[0.1],[-0.2],[-0.1],[0.8],[1.1],[0.4],[0.5],[1.1],[0.3],[0.4],[1.1],[0.8],[2.5],[3.3],[3.5],[2.1],[2.5],[3.1],[3],[3.1],[3.4],[3.9],[4.8],[5.7],[5.5],[6.1],[6.7],[7],[6.9],[7.3],[6.9],[7.3]]]

[]

[{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]Sept 21 to Sept 22 % change | Oct 21 to Oct 22 % change | Nov 21 to Nov 22 % change | |

|---|---|---|---|

| All groups CPI | 7.3 | 6.9 | 7.3 |

| Food and non-alcoholic beverages | 9.6 | 8.9 | 9.4 |

| Bread and cereal products | 11.8 | 12.0 | 12.0 |

| Meat & seafood | 7.6 | 7.9 | 8.1 |

| Dairy and related products | 13.6 | 14.4 | 15.3 |

| Fruit & vegetables | 17.4 | 9.4 | 9.5 |

| Food products n.e.c. | 10.6 | 10.9 | 10.9 |

| Non-alcoholic beverages | 10.4 | 11.2 | 11.0 |

| Alcohol and tobacco | 4.6 | 4.3 | 4.3 |

| Alcohol | 3.9 | 3.6 | 4.2 |

| Tobacco | 5.6 | 5.4 | 4.6 |

| Clothing and footwear | 7.1 | 5.7 | 4.1 |

| Housing | 10.3 | 10.5 | 9.6 |

| Rents | 2.9 | 3.5 | 3.6 |

| New dwelling purchases by owner-occupiers | 20.0 | 20.4 | 17.9 |

| Furnishings, household equipment and services | 7.7 | 7.8 | 8.4 |

| Health | 2.8 | 2.6 | 3.6 |

| Transport | 6.8 | 7.4 | 9.0 |

| Automotive fuel | 10.1 | 11.8 | 16.6 |

| Communications | 2.0 | 1.9 | 0.7 |

| Recreation and culture | 5.3 | 2.3 | 5.8 |

| Holiday travel and accommodation | 12.6 | 3.7 | 12.8 |

| Education | 4.5 | 4.5 | 4.6 |

| Insurance and financial services | 4.2 | 4.2 | 4.8 |

| CPI analytical series | |||

| Seasonally adjusted | 7.2 | 6.9 | 7.4 |

| Trimmed mean | 5.5 | 5.4 | 5.6 |

| All groups CPI excluding volatile items* | 6.8 | 6.4 | 6.7 |

*Volatile items are Fruit and vegetables and Automotive fuel

| Sep-22 (%) | Oct-22 (%) | Nov-22 (%) | |

|---|---|---|---|

| All groups | 7.3 | 6.9 | 7.3 |

| Food & non-alcoholic beverages | 9.6 | 8.9 | 9.4 |

| Alcohol & tobacco | 4.6 | 4.3 | 4.3 |

| Clothing & footwear | 7.1 | 5.7 | 4.1 |

| Housing | 10.3 | 10.5 | 9.6 |

| Furnishings, household equipment & services | 7.7 | 7.8 | 8.4 |

| Health | 2.8 | 2.6 | 3.6 |

| Transport | 6.8 | 7.4 | 9 |

| Communications | 2 | 1.9 | 0.7 |

| Recreation & culture | 5.3 | 2.3 | 5.8 |

| Education | 4.5 | 4.5 | 4.6 |

| Insurance & financial services | 4.2 | 4.2 | 4.8 |

Groups and All groups monthly CPI indicator, Australia, annual movement (%)

["","Sep-22","Oct-22","Nov-22"]

[["All groups","Food & non-alcoholic beverages","Alcohol & tobacco","Clothing & footwear","Housing","Furnishings, household equipment & services","Health","Transport","Communications","Recreation & culture","Education","Insurance & financial services"],[[7.3],[9.6],[4.6],[7.1],[10.3],[7.7],[2.8],[6.8],[2],[5.3],[4.5],[4.2]],[[6.9],[8.9],[4.3],[5.7],[10.5],[7.8],[2.6],[7.4],[1.9],[2.3],[4.5],[4.2]],[[7.3],[9.4],[4.3],[4.1],[9.6],[8.4],[3.6],[9],[0.7],[5.8],[4.6],[4.8]]]

[]

[{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]New dwelling prices rose 17.9% in the year to November as builders passed through higher costs for labour and materials. The rate of price growth eased in November compared to the 20.4% annual rise in October. Fewer payments of government construction grants compared to November 2021 also contributed to the rise in new dwelling prices.

Rent prices increased further this month from an annual rise of 3.5% in October to 3.6% in November, reflecting a tight rental market.

| monthly change (%) | annual change (%) | |

|---|---|---|

| Nov-19 | 0 | -0.1 |

| Dec-19 | 0.2 | -0.1 |

| Jan-20 | 0.1 | 0.4 |

| Feb-20 | 0.4 | 0.8 |

| Mar-20 | -0.1 | 0.5 |

| Apr-20 | 0 | 0.7 |

| May-20 | -0.3 | 0.6 |

| Jun-20 | 0.5 | 1 |

| Jul-20 | 0.2 | 1.2 |

| Aug-20 | 0.2 | 1.8 |

| Sep-20 | 0 | 1.3 |

| Oct-20 | 0.2 | 1.4 |

| Nov-20 | 0.4 | 1.8 |

| Dec-20 | 0 | 1.6 |

| Jan-21 | 0.8 | 2.3 |

| Feb-21 | -1 | 0.9 |

| Mar-21 | -0.1 | 0.9 |

| Apr-21 | -0.9 | 0 |

| May-21 | 1.3 | 1.6 |

| Jun-21 | 0.8 | 1.9 |

| Jul-21 | 0.5 | 2.1 |

| Aug-21 | 2.1 | 4.1 |

| Sep-21 | 0.9 | 5 |

| Oct-21 | 0.2 | 5 |

| Nov-21 | 2.2 | 6.9 |

| Dec-21 | 2.5 | 9.6 |

| Jan-22 | 1.6 | 10.5 |

| Feb-22 | 1.6 | 13.4 |

| Mar-22 | 2 | 15.8 |

| Apr-22 | 2.2 | 19.3 |

| May-22 | 1.3 | 19.4 |

| Jun-22 | 1.9 | 20.7 |

| Jul-22 | 1.3 | 21.7 |

| Aug-22 | 1.1 | 20.5 |

| Sep-22 | 0.5 | 20 |

| Oct-22 | 0.5 | 20.4 |

| Nov-22 | 0.1 | 17.9 |

New dwelling purchase by owner occupiers, Australia, monthly and annual movement (%)

["","monthly change","annual change"]

[["Nov-19","Dec-19","Jan-20","Feb-20","Mar-20","Apr-20","May-20","Jun-20","Jul-20","Aug-20","Sep-20","Oct-20","Nov-20","Dec-20","Jan-21","Feb-21","Mar-21","Apr-21","May-21","Jun-21","Jul-21","Aug-21","Sep-21","Oct-21","Nov-21","Dec-21","Jan-22","Feb-22","Mar-22","Apr-22","May-22","Jun-22","Jul-22","Aug-22","Sep-22","Oct-22","Nov-22"],[[0],[0.2],[0.1],[0.4],[-0.1],[0],[-0.3],[0.5],[0.2],[0.2],[0],[0.2],[0.4],[0],[0.8],[-1],[-0.1],[-0.9],[1.3],[0.8],[0.5],[2.1],[0.9],[0.2],[2.2],[2.5],[1.6],[1.6],[2],[2.2],[1.3],[1.9],[1.3],[1.1],[0.5],[0.5],[0.1]],[[-0.1],[-0.1],[0.4],[0.8],[0.5],[0.7],[0.6],[1],[1.2],[1.8],[1.3],[1.4],[1.8],[1.6],[2.3],[0.9],[0.9],[0],[1.6],[1.9],[2.1],[4.1],[5],[5],[6.9],[9.6],[10.5],[13.4],[15.8],[19.3],[19.4],[20.7],[21.7],[20.5],[20],[20.4],[17.9]]]

[]

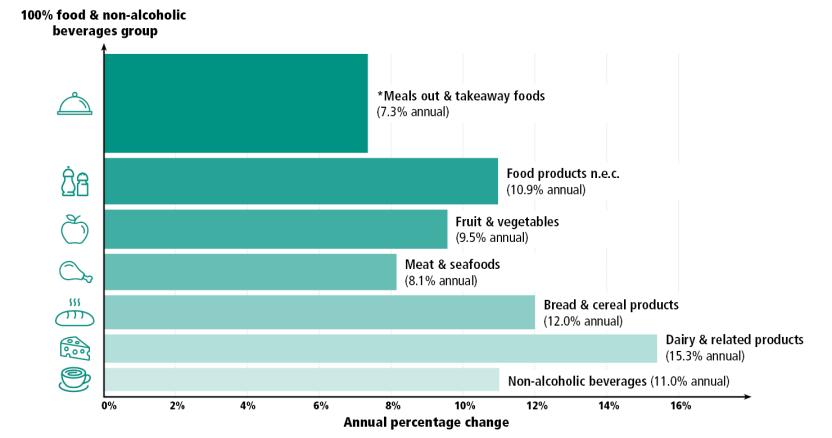

[{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]Over the twelve months to November price rises were seen across all food categories. These rises reflect a range of price pressures including supply chain issues and increased input costs.

The main contributor to the annual rise was Meals out and take away foods, which rose 7.3% due to rising input costs, fresh food supply issues and labour shortages.

Fruit and vegetables rose 9.5% in the year to November. This subgroup continues to be impacted by flooding, heavy rainfall and hail in key growing areas, alongside high transport and fertiliser costs.

Food and non alcoholic beverages subgroups, Annual percentage change (%), ordered by percentage contribution to the Food and non alcoholic beverages group:

*Quarterly index, price updated in Nov (month2) – more information

Automotive fuel prices increased 16.6% in the twelve months to November, up from 11.8% in October.

The restoration of the Australian Government’s fuel excise on 29 September contributed to higher prices for automotive fuel in October and early November as the increase in fuel excise started to filter through as petrol stations used up their existing fuel reserves. Average prices for unleaded petrol peaked at $2.01 in early November before falling approximately 22 cents by the end of November.

| Daily average price of ULP (%) | Monthly average price of ULP (%) | |

|---|---|---|

| Mar20 | 126.5 | 127.1 |

| Apr-20 | 120.1 | 105.5 |

| Apr-20 | 119.8 | 105.5 |

| Apr-20 | 119.3 | 105.5 |

| Apr-20 | 116.3 | 105.5 |

| Apr-20 | 114.3 | 105.5 |

| Apr-20 | 112.7 | 105.5 |

| Apr-20 | 112.1 | 105.5 |

| Apr-20 | 115.4 | 105.5 |

| Apr-20 | 113.4 | 105.5 |

| Apr-20 | 109.8 | 105.5 |

| Apr-20 | 107.7 | 105.5 |

| Apr-20 | 104.8 | 105.5 |

| Apr-20 | 102.6 | 105.5 |

| Apr-20 | 102.5 | 105.5 |

| Apr-20 | 106.2 | 105.5 |

| Apr-20 | 106.2 | 105.5 |

| Apr-20 | 105.4 | 105.5 |

| Apr-20 | 103.2 | 105.5 |

| Apr-20 | 101.3 | 105.5 |

| Apr-20 | 99.8 | 105.5 |

| Apr-20 | 97.9 | 105.5 |

| Apr-20 | 102.5 | 105.5 |

| Apr-20 | 100.5 | 105.5 |

| Apr-20 | 97.4 | 105.5 |

| Apr-20 | 95.2 | 105.5 |

| Apr-20 | 93.6 | 105.5 |

| Apr-20 | 92.5 | 105.5 |

| Apr-20 | 92.3 | 105.5 |

| Apr-20 | 99.8 | 105.5 |

| Apr-20 | 100.1 | 105.5 |

| May-20 | 100.9 | 107.2 |

| May-20 | 99.4 | 107.2 |

| May-20 | 97.8 | 107.2 |

| May-20 | 96.2 | 107.2 |

| May-20 | 96.8 | 107.2 |

| May-20 | 104.1 | 107.2 |

| May-20 | 105.2 | 107.2 |

| May-20 | 104.7 | 107.2 |

| May-20 | 103.9 | 107.2 |

| May-20 | 106.3 | 107.2 |

| May-20 | 107.4 | 107.2 |

| May-20 | 108.5 | 107.2 |

| May-20 | 115.2 | 107.2 |

| May-20 | 115.3 | 107.2 |

| May-20 | 113.4 | 107.2 |

| May-20 | 111.1 | 107.2 |

| May-20 | 109.4 | 107.2 |

| May-20 | 108.7 | 107.2 |

| May-20 | 107.4 | 107.2 |

| May-20 | 112.3 | 107.2 |

| May-20 | 110.9 | 107.2 |

| May-20 | 108.9 | 107.2 |

| May-20 | 108.2 | 107.2 |

| May-20 | 109.1 | 107.2 |

| May-20 | 108.4 | 107.2 |

| May-20 | 107.4 | 107.2 |

| May-20 | 112.5 | 107.2 |

| May-20 | 110.9 | 107.2 |

| May-20 | 109.1 | 107.2 |

| May-20 | 108.1 | 107.2 |

| May-20 | 106.6 | 107.2 |

| Jun-20 | 106.2 | 118.9 |

| Jun-20 | 105.4 | 118.9 |

| Jun-20 | 111.6 | 118.9 |

| Jun-20 | 112.5 | 118.9 |

| Jun-20 | 112.5 | 118.9 |

| Jun-20 | 112.6 | 118.9 |

| Jun-20 | 116.4 | 118.9 |

| Jun-20 | 117.9 | 118.9 |

| Jun-20 | 119.1 | 118.9 |

| Jun-20 | 127.8 | 118.9 |

| Jun-20 | 127.5 | 118.9 |

| Jun-20 | 126.3 | 118.9 |

| Jun-20 | 124.2 | 118.9 |

| Jun-20 | 122.1 | 118.9 |

| Jun-20 | 120.5 | 118.9 |

| Jun-20 | 119.2 | 118.9 |

| Jun-20 | 124.3 | 118.9 |

| Jun-20 | 122.8 | 118.9 |

| Jun-20 | 120.7 | 118.9 |

| Jun-20 | 121.7 | 118.9 |

| Jun-20 | 121.0 | 118.9 |

| Jun-20 | 119.3 | 118.9 |

| Jun-20 | 118.2 | 118.9 |

| Jun-20 | 123.7 | 118.9 |

| Jun-20 | 122.6 | 118.9 |

| Jun-20 | 120.7 | 118.9 |

| Jun-20 | 119.0 | 118.9 |

| Jun-20 | 117.7 | 118.9 |

| Jun-20 | 116.8 | 118.9 |

| Jun-20 | 115.9 | 118.9 |

| Jul-20 | 123.5 | 124.3 |

| Jul-20 | 123.9 | 124.3 |

| Jul-20 | 122.9 | 124.3 |

| Jul-20 | 122.4 | 124.3 |

| Jul-20 | 122.5 | 124.3 |

| Jul-20 | 122.7 | 124.3 |

| Jul-20 | 121.9 | 124.3 |

| Jul-20 | 126.3 | 124.3 |

| Jul-20 | 126.6 | 124.3 |

| Jul-20 | 123.9 | 124.3 |

| Jul-20 | 121.5 | 124.3 |

| Jul-20 | 120.3 | 124.3 |

| Jul-20 | 119.6 | 124.3 |

| Jul-20 | 118.9 | 124.3 |

| Jul-20 | 125.3 | 124.3 |

| Jul-20 | 124.4 | 124.3 |

| Jul-20 | 125.6 | 124.3 |

| Jul-20 | 125.7 | 124.3 |

| Jul-20 | 126.4 | 124.3 |

| Jul-20 | 126.1 | 124.3 |

| Jul-20 | 124.9 | 124.3 |

| Jul-20 | 129.7 | 124.3 |

| Jul-20 | 127.7 | 124.3 |

| Jul-20 | 125.2 | 124.3 |

| Jul-20 | 123.3 | 124.3 |

| Jul-20 | 121.8 | 124.3 |

| Jul-20 | 120.0 | 124.3 |

| Jul-20 | 120.0 | 124.3 |

| Jul-20 | 128.7 | 124.3 |

| Jul-20 | 130.6 | 124.3 |

| Jul-20 | 129.6 | 124.3 |

| Aug-20 | 128.8 | 123.0 |

| Aug-20 | 128.3 | 123.0 |

| Aug-20 | 128.0 | 123.0 |

| Aug-20 | 126.3 | 123.0 |

| Aug-20 | 132.1 | 123.0 |

| Aug-20 | 129.8 | 123.0 |

| Aug-20 | 126.1 | 123.0 |

| Aug-20 | 122.2 | 123.0 |

| Aug-20 | 120.3 | 123.0 |

| Aug-20 | 119.3 | 123.0 |

| Aug-20 | 117.3 | 123.0 |

| Aug-20 | 123.5 | 123.0 |

| Aug-20 | 123.4 | 123.0 |

| Aug-20 | 120.7 | 123.0 |

| Aug-20 | 119.0 | 123.0 |

| Aug-20 | 118.7 | 123.0 |

| Aug-20 | 117.3 | 123.0 |

| Aug-20 | 115.3 | 123.0 |

| Aug-20 | 121.2 | 123.0 |

| Aug-20 | 120.2 | 123.0 |

| Aug-20 | 118.0 | 123.0 |

| Aug-20 | 116.8 | 123.0 |

| Aug-20 | 115.2 | 123.0 |

| Aug-20 | 115.4 | 123.0 |

| Aug-20 | 116.0 | 123.0 |

| Aug-20 | 125.5 | 123.0 |

| Aug-20 | 126.8 | 123.0 |

| Aug-20 | 127.2 | 123.0 |

| Aug-20 | 129.7 | 123.0 |

| Aug-20 | 132.0 | 123.0 |

| Aug-20 | 133.8 | 123.0 |

| Sep-20 | 132.6 | 122.7 |

| Sep-20 | 139.0 | 122.7 |

| Sep-20 | 136.7 | 122.7 |

| Sep-20 | 132.7 | 122.7 |

| Sep-20 | 129.3 | 122.7 |

| Sep-20 | 127.2 | 122.7 |

| Sep-20 | 125.5 | 122.7 |

| Sep-20 | 124.0 | 122.7 |

| Sep-20 | 129.7 | 122.7 |

| Sep-20 | 127.5 | 122.7 |

| Sep-20 | 124.4 | 122.7 |

| Sep-20 | 122.9 | 122.7 |

| Sep-20 | 122.1 | 122.7 |

| Sep-20 | 122.5 | 122.7 |

| Sep-20 | 121.9 | 122.7 |

| Sep-20 | 127.7 | 122.7 |

| Sep-20 | 125.1 | 122.7 |

| Sep-20 | 121.7 | 122.7 |

| Sep-20 | 118.4 | 122.7 |

| Sep-20 | 116.0 | 122.7 |

| Sep-20 | 113.9 | 122.7 |

| Sep-20 | 112.5 | 122.7 |

| Sep-20 | 119.0 | 122.7 |

| Sep-20 | 117.1 | 122.7 |

| Sep-20 | 114.7 | 122.7 |

| Sep-20 | 113.6 | 122.7 |

| Sep-20 | 114.8 | 122.7 |

| Sep-20 | 114.3 | 122.7 |

| Sep-20 | 113.9 | 122.7 |

| Sep-20 | 120.6 | 122.7 |

| Oct-20 | 121.9 | 121.8 |

| Oct-20 | 120.0 | 121.8 |

| Oct-20 | 117.6 | 121.8 |

| Oct-20 | 116.0 | 121.8 |

| Oct-20 | 114.2 | 121.8 |

| Oct-20 | 115.3 | 121.8 |

| Oct-20 | 122.6 | 121.8 |

| Oct-20 | 122.5 | 121.8 |

| Oct-20 | 120.7 | 121.8 |

| Oct-20 | 117.8 | 121.8 |

| Oct-20 | 117.5 | 121.8 |

| Oct-20 | 118.9 | 121.8 |

| Oct-20 | 118.4 | 121.8 |

| Oct-20 | 126.2 | 121.8 |

| Oct-20 | 124.9 | 121.8 |

| Oct-20 | 123.0 | 121.8 |

| Oct-20 | 120.1 | 121.8 |

| Oct-20 | 121.9 | 121.8 |

| Oct-20 | 123.3 | 121.8 |

| Oct-20 | 123.0 | 121.8 |

| Oct-20 | 131.6 | 121.8 |

| Oct-20 | 131.4 | 121.8 |

| Oct-20 | 127.4 | 121.8 |

| Oct-20 | 124.8 | 121.8 |

| Oct-20 | 123.1 | 121.8 |

| Oct-20 | 121.8 | 121.8 |

| Oct-20 | 119.2 | 121.8 |

| Oct-20 | 125.9 | 121.8 |

| Oct-20 | 124.0 | 121.8 |

| Oct-20 | 121.0 | 121.8 |

| Oct-20 | 119.6 | 121.8 |

| Nov-20 | 116.6 | 120.6 |

| Nov-20 | 114.7 | 120.6 |

| Nov-20 | 112.2 | 120.6 |

| Nov-20 | 120.4 | 120.6 |

| Nov-20 | 118.9 | 120.6 |

| Nov-20 | 117.1 | 120.6 |

| Nov-20 | 115.6 | 120.6 |

| Nov-20 | 114.9 | 120.6 |

| Nov-20 | 115.0 | 120.6 |

| Nov-20 | 116.5 | 120.6 |

| Nov-20 | 125.2 | 120.6 |

| Nov-20 | 126.1 | 120.6 |

| Nov-20 | 124.3 | 120.6 |

| Nov-20 | 121.6 | 120.6 |

| Nov-20 | 120.7 | 120.6 |

| Nov-20 | 120.6 | 120.6 |

| Nov-20 | 121.6 | 120.6 |

| Nov-20 | 129.1 | 120.6 |

| Nov-20 | 129.2 | 120.6 |

| Nov-20 | 127.5 | 120.6 |

| Nov-20 | 123.7 | 120.6 |

| Nov-20 | 122.1 | 120.6 |

| Nov-20 | 121.2 | 120.6 |

| Nov-20 | 119.7 | 120.6 |

| Nov-20 | 124.8 | 120.6 |

| Nov-20 | 122.6 | 120.6 |

| Nov-20 | 120.0 | 120.6 |

| Nov-20 | 117.0 | 120.6 |

| Nov-20 | 120.3 | 120.6 |

| Nov-20 | 120.3 | 120.6 |

| Dec-20 | 119.2 | 127.0 |

| Dec-20 | 125.0 | 127.0 |

| Dec-20 | 123.5 | 127.0 |

| Dec-20 | 122.1 | 127.0 |

| Dec-20 | 120.4 | 127.0 |

| Dec-20 | 119.4 | 127.0 |

| Dec-20 | 119.6 | 127.0 |

| Dec-20 | 119.6 | 127.0 |

| Dec-20 | 127.1 | 127.0 |

| Dec-20 | 125.9 | 127.0 |

| Dec-20 | 126.7 | 127.0 |

| Dec-20 | 125.6 | 127.0 |

| Dec-20 | 127.9 | 127.0 |

| Dec-20 | 127.8 | 127.0 |

| Dec-20 | 127.7 | 127.0 |

| Dec-20 | 136.2 | 127.0 |

| Dec-20 | 134.8 | 127.0 |

| Dec-20 | 133.4 | 127.0 |

| Dec-20 | 131.2 | 127.0 |

| Dec-20 | 130.6 | 127.0 |

| Dec-20 | 131.1 | 127.0 |

| Dec-20 | 129.1 | 127.0 |

| Dec-20 | 135.8 | 127.0 |

| Dec-20 | 133.3 | 127.0 |

| Dec-20 | 129.6 | 127.0 |

| Dec-20 | 126.5 | 127.0 |

| Dec-20 | 125.0 | 127.0 |

| Dec-20 | 124.3 | 127.0 |

| Dec-20 | 122.6 | 127.0 |

| Dec-20 | 128.7 | 127.0 |

| Dec-20 | 126.9 | 127.0 |

| Jan-21 | 124.0 | 128.7 |

| Jan-21 | 122.0 | 128.7 |

| Jan-21 | 121.9 | 128.7 |

| Jan-21 | 121.0 | 128.7 |

| Jan-21 | 119.8 | 128.7 |

| Jan-21 | 126.3 | 128.7 |

| Jan-21 | 124.6 | 128.7 |

| Jan-21 | 121.8 | 128.7 |

| Jan-21 | 118.9 | 128.7 |

| Jan-21 | 116.9 | 128.7 |

| Jan-21 | 115.3 | 128.7 |

| Jan-21 | 114.7 | 128.7 |

| Jan-21 | 123.0 | 128.7 |

| Jan-21 | 123.2 | 128.7 |

| Jan-21 | 122.8 | 128.7 |

| Jan-21 | 121.9 | 128.7 |

| Jan-21 | 124.1 | 128.7 |

| Jan-21 | 126.9 | 128.7 |

| Jan-21 | 130.3 | 128.7 |

| Jan-21 | 143.8 | 128.7 |

| Jan-21 | 145.9 | 128.7 |

| Jan-21 | 144.1 | 128.7 |

| Jan-21 | 140.2 | 128.7 |

| Jan-21 | 138.6 | 128.7 |

| Jan-21 | 138.4 | 128.7 |

| Jan-21 | 134.7 | 128.7 |

| Jan-21 | 143.0 | 128.7 |

| Jan-21 | 140.2 | 128.7 |

| Jan-21 | 136.3 | 128.7 |

| Jan-21 | 133.5 | 128.7 |

| Jan-21 | 133.1 | 128.7 |

| Feb-21 | 134.8 | 133.1 |

| Feb-21 | 133.3 | 133.1 |

| Feb-21 | 138.6 | 133.1 |

| Feb-21 | 136.3 | 133.1 |

| Feb-21 | 133.8 | 133.1 |

| Feb-21 | 130.7 | 133.1 |

| Feb-21 | 128.6 | 133.1 |

| Feb-21 | 126.2 | 133.1 |

| Feb-21 | 124.9 | 133.1 |

| Feb-21 | 131.2 | 133.1 |

| Feb-21 | 131.0 | 133.1 |

| Feb-21 | 129.7 | 133.1 |

| Feb-21 | 128.0 | 133.1 |

| Feb-21 | 129.0 | 133.1 |

| Feb-21 | 129.2 | 133.1 |

| Feb-21 | 128.8 | 133.1 |

| Feb-21 | 140.0 | 133.1 |

| Feb-21 | 137.7 | 133.1 |

| Feb-21 | 136.1 | 133.1 |

| Feb-21 | 133.2 | 133.1 |

| Feb-21 | 132.1 | 133.1 |

| Feb-21 | 133.4 | 133.1 |

| Feb-21 | 133.3 | 133.1 |

| Feb-21 | 140.4 | 133.1 |

| Feb-21 | 139.3 | 133.1 |

| Feb-21 | 137.1 | 133.1 |

| Feb-21 | 134.7 | 133.1 |

| Feb-21 | 134.4 | 133.1 |

| Mar-21 | 138.3 | 142.0 |

| Mar-21 | 139.9 | 142.0 |

| Mar-21 | 152.0 | 142.0 |

| Mar-21 | 150.2 | 142.0 |

| Mar-21 | 147.9 | 142.0 |

| Mar-21 | 145.2 | 142.0 |

| Mar-21 | 143.4 | 142.0 |

| Mar-21 | 140.3 | 142.0 |

| Mar-21 | 139.5 | 142.0 |

| Mar-21 | 147.1 | 142.0 |

| Mar-21 | 144.3 | 142.0 |

| Mar-21 | 141.4 | 142.0 |

| Mar-21 | 139.0 | 142.0 |

| Mar-21 | 139.7 | 142.0 |

| Mar-21 | 138.2 | 142.0 |

| Mar-21 | 137.6 | 142.0 |

| Mar-21 | 146.6 | 142.0 |

| Mar-21 | 144.6 | 142.0 |

| Mar-21 | 142.1 | 142.0 |

| Mar-21 | 139.0 | 142.0 |

| Mar-21 | 137.1 | 142.0 |

| Mar-21 | 135.9 | 142.0 |

| Mar-21 | 135.0 | 142.0 |

| Mar-21 | 143.2 | 142.0 |

| Mar-21 | 142.5 | 142.0 |

| Mar-21 | 140.6 | 142.0 |

| Mar-21 | 138.5 | 142.0 |

| Mar-21 | 138.9 | 142.0 |

| Mar-21 | 140.5 | 142.0 |

| Mar-21 | 140.5 | 142.0 |

| Mar-21 | 152.7 | 142.0 |

| Apr-21 | 152.8 | 144.2 |

| Apr-21 | 152.1 | 144.2 |

| Apr-21 | 150.3 | 144.2 |

| Apr-21 | 148.1 | 144.2 |

| Apr-21 | 146.9 | 144.2 |

| Apr-21 | 145.6 | 144.2 |

| Apr-21 | 152.9 | 144.2 |

| Apr-21 | 151.6 | 144.2 |

| Apr-21 | 149.7 | 144.2 |

| Apr-21 | 147.5 | 144.2 |

| Apr-21 | 146.0 | 144.2 |

| Apr-21 | 145.2 | 144.2 |

| Apr-21 | 143.0 | 144.2 |

| Apr-21 | 149.2 | 144.2 |

| Apr-21 | 145.9 | 144.2 |

| Apr-21 | 143.4 | 144.2 |

| Apr-21 | 140.6 | 144.2 |

| Apr-21 | 139.8 | 144.2 |

| Apr-21 | 138.6 | 144.2 |

| Apr-21 | 136.7 | 144.2 |

| Apr-21 | 143.3 | 144.2 |

| Apr-21 | 141.4 | 144.2 |

| Apr-21 | 139.8 | 144.2 |

| Apr-21 | 137.9 | 144.2 |

| Apr-21 | 138.2 | 144.2 |

| Apr-21 | 136.8 | 144.2 |

| Apr-21 | 136.3 | 144.2 |

| Apr-21 | 143.0 | 144.2 |

| Apr-21 | 141.7 | 144.2 |

| Apr-21 | 140.7 | 144.2 |

| May-21 | 138.0 | 143.2 |

| May-21 | 137.7 | 143.2 |

| May-21 | 139.1 | 143.2 |

| May-21 | 140.9 | 143.2 |

| May-21 | 147.9 | 143.2 |

| May-21 | 149.0 | 143.2 |

| May-21 | 147.3 | 143.2 |

| May-21 | 143.1 | 143.2 |

| May-21 | 142.2 | 143.2 |

| May-21 | 142.5 | 143.2 |

| May-21 | 144.6 | 143.2 |

| May-21 | 150.5 | 143.2 |

| May-21 | 148.8 | 143.2 |

| May-21 | 146.6 | 143.2 |

| May-21 | 144.0 | 143.2 |

| May-21 | 145.3 | 143.2 |

| May-21 | 144.4 | 143.2 |

| May-21 | 143.6 | 143.2 |

| May-21 | 149.8 | 143.2 |

| May-21 | 148.1 | 143.2 |

| May-21 | 144.8 | 143.2 |

| May-21 | 141.6 | 143.2 |

| May-21 | 140.3 | 143.2 |

| May-21 | 138.7 | 143.2 |

| May-21 | 137.5 | 143.2 |

| May-21 | 144.6 | 143.2 |

| May-21 | 142.9 | 143.2 |

| May-21 | 140.9 | 143.2 |

| May-21 | 138.3 | 143.2 |

| May-21 | 138.5 | 143.2 |

| May-21 | 139.1 | 143.2 |

| Jun-21 | 138.6 | 143.4 |

| Jun-21 | 148.3 | 143.4 |

| Jun-21 | 146.9 | 143.4 |

| Jun-21 | 145.1 | 143.4 |

| Jun-21 | 141.9 | 143.4 |

| Jun-21 | 141.4 | 143.4 |

| Jun-21 | 141.8 | 143.4 |

| Jun-21 | 141.2 | 143.4 |

| Jun-21 | 149.8 | 143.4 |

| Jun-21 | 147.8 | 143.4 |

| Jun-21 | 144.0 | 143.4 |

| Jun-21 | 140.2 | 143.4 |

| Jun-21 | 138.7 | 143.4 |

| Jun-21 | 138.9 | 143.4 |

| Jun-21 | 137.5 | 143.4 |

| Jun-21 | 145.3 | 143.4 |

| Jun-21 | 142.8 | 143.4 |

| Jun-21 | 140.5 | 143.4 |

| Jun-21 | 137.4 | 143.4 |

| Jun-21 | 136.5 | 143.4 |

| Jun-21 | 137.0 | 143.4 |

| Jun-21 | 137.7 | 143.4 |

| Jun-21 | 145.9 | 143.4 |

| Jun-21 | 146.6 | 143.4 |

| Jun-21 | 145.4 | 143.4 |

| Jun-21 | 144.0 | 143.4 |

| Jun-21 | 144.8 | 143.4 |

| Jun-21 | 147.2 | 143.4 |

| Jun-21 | 149.5 | 143.4 |

| Jun-21 | 159.0 | 143.4 |

| Jul-21 | 162.5 | 153.2 |

| Jul-21 | 160.6 | 153.2 |

| Jul-21 | 157.4 | 153.2 |

| Jul-21 | 157.1 | 153.2 |

| Jul-21 | 157.0 | 153.2 |

| Jul-21 | 157.0 | 153.2 |

| Jul-21 | 162.8 | 153.2 |

| Jul-21 | 159.8 | 153.2 |

| Jul-21 | 156.4 | 153.2 |

| Jul-21 | 153.2 | 153.2 |

| Jul-21 | 153.2 | 153.2 |

| Jul-21 | 152.7 | 153.2 |

| Jul-21 | 151.0 | 153.2 |

| Jul-21 | 155.6 | 153.2 |

| Jul-21 | 153.1 | 153.2 |

| Jul-21 | 150.6 | 153.2 |

| Jul-21 | 147.4 | 153.2 |

| Jul-21 | 145.6 | 153.2 |

| Jul-21 | 144.5 | 153.2 |

| Jul-21 | 143.8 | 153.2 |

| Jul-21 | 152.4 | 153.2 |

| Jul-21 | 150.9 | 153.2 |

| Jul-21 | 148.9 | 153.2 |

| Jul-21 | 146.4 | 153.2 |

| Jul-21 | 147.6 | 153.2 |

| Jul-21 | 147.8 | 153.2 |

| Jul-21 | 148.0 | 153.2 |

| Jul-21 | 159.1 | 153.2 |

| Jul-21 | 157.8 | 153.2 |

| Jul-21 | 155.2 | 153.2 |

| Jul-21 | 152.9 | 153.2 |

| Aug-21 | 152.0 | 152.6 |

| Aug-21 | 150.0 | 152.6 |

| Aug-21 | 148.8 | 152.6 |

| Aug-21 | 157.9 | 152.6 |

| Aug-21 | 155.9 | 152.6 |

| Aug-21 | 153.8 | 152.6 |

| Aug-21 | 151.2 | 152.6 |

| Aug-21 | 152.4 | 152.6 |

| Aug-21 | 154.6 | 152.6 |

| Aug-21 | 155.1 | 152.6 |

| Aug-21 | 163.6 | 152.6 |

| Aug-21 | 161.0 | 152.6 |

| Aug-21 | 156.9 | 152.6 |

| Aug-21 | 153.2 | 152.6 |

| Aug-21 | 151.3 | 152.6 |

| Aug-21 | 151.7 | 152.6 |

| Aug-21 | 150.5 | 152.6 |

| Aug-21 | 158.1 | 152.6 |

| Aug-21 | 155.7 | 152.6 |

| Aug-21 | 153.0 | 152.6 |

| Aug-21 | 149.5 | 152.6 |

| Aug-21 | 149.0 | 152.6 |

| Aug-21 | 150.5 | 152.6 |

| Aug-21 | 149.2 | 152.6 |

| Aug-21 | 157.1 | 152.6 |

| Aug-21 | 153.8 | 152.6 |

| Aug-21 | 150.7 | 152.6 |

| Aug-21 | 147.4 | 152.6 |

| Aug-21 | 146.2 | 152.6 |

| Aug-21 | 144.9 | 152.6 |

| Sep-21 | 145.7 | 152.6 |

| Sep-21 | 152.3 | 155.8 |

| Sep-21 | 150.2 | 155.8 |

| Sep-21 | 148.7 | 155.8 |

| Sep-21 | 146.7 | 155.8 |

| Sep-21 | 147.7 | 155.8 |

| Sep-21 | 148.5 | 155.8 |

| Sep-21 | 149.0 | 155.8 |

| Sep-21 | 159.2 | 155.8 |

| Sep-21 | 158.8 | 155.8 |

| Sep-21 | 157.6 | 155.8 |

| Sep-21 | 155.8 | 155.8 |

| Sep-21 | 155.9 | 155.8 |

| Sep-21 | 157.6 | 155.8 |

| Sep-21 | 157.3 | 155.8 |

| Sep-21 | 164.8 | 155.8 |

| Sep-21 | 162.3 | 155.8 |

| Sep-21 | 160.7 | 155.8 |

| Sep-21 | 157.9 | 155.8 |

| Sep-21 | 156.5 | 155.8 |

| Sep-21 | 157.7 | 155.8 |

| Sep-21 | 155.0 | 155.8 |

| Sep-21 | 164.3 | 155.8 |

| Sep-21 | 162.9 | 155.8 |

| Sep-21 | 159.8 | 155.8 |

| Sep-21 | 156.4 | 155.8 |

| Sep-21 | 155.0 | 155.8 |

| Sep-21 | 154.1 | 155.8 |

| Sep-21 | 152.3 | 155.8 |

| Sep-21 | 155.8 | 155.8 |

| Sep-21 | 154.1 | 155.8 |

| Oct-21 | 152.3 | 164.4 |

| Oct-21 | 150.8 | 164.4 |

| Oct-21 | 150.6 | 164.4 |

| Oct-21 | 149.5 | 164.4 |

| Oct-21 | 148.9 | 164.4 |

| Oct-21 | 158.4 | 164.4 |

| Oct-21 | 159.2 | 164.4 |

| Oct-21 | 160.4 | 164.4 |

| Oct-21 | 161.9 | 164.4 |

| Oct-21 | 161.2 | 164.4 |

| Oct-21 | 160.7 | 164.4 |

| Oct-21 | 161.0 | 164.4 |

| Oct-21 | 162.5 | 164.4 |

| Oct-21 | 164.1 | 164.4 |

| Oct-21 | 165.4 | 164.4 |

| Oct-21 | 165.0 | 164.4 |

| Oct-21 | 166.1 | 164.4 |

| Oct-21 | 167.9 | 164.4 |

| Oct-21 | 167.3 | 164.4 |

| Oct-21 | 174.4 | 164.4 |

| Oct-21 | 174.9 | 164.4 |

| Oct-21 | 174.8 | 164.4 |

| Oct-21 | 174.1 | 164.4 |

| Oct-21 | 174.1 | 164.4 |

| Oct-21 | 173.8 | 164.4 |

| Oct-21 | 172.5 | 164.4 |

| Oct-21 | 171.1 | 164.4 |

| Oct-21 | 169.9 | 164.4 |

| Oct-21 | 168.6 | 164.4 |

| Oct-21 | 167.4 | 164.4 |

| Oct-21 | 166.6 | 164.4 |

| Nov-21 | 165.8 | 168.6 |

| Nov-21 | 164.5 | 168.6 |

| Nov-21 | 170.4 | 168.6 |

| Nov-21 | 168.8 | 168.6 |

| Nov-21 | 167.9 | 168.6 |

| Nov-21 | 167.4 | 168.6 |

| Nov-21 | 167.6 | 168.6 |

| Nov-21 | 166.5 | 168.6 |

| Nov-21 | 166.7 | 168.6 |

| Nov-21 | 166.3 | 168.6 |

| Nov-21 | 165.1 | 168.6 |

| Nov-21 | 164.4 | 168.6 |

| Nov-21 | 163.2 | 168.6 |

| Nov-21 | 162.4 | 168.6 |

| Nov-21 | 162.0 | 168.6 |

| Nov-21 | 161.8 | 168.6 |

| Nov-21 | 170.9 | 168.6 |

| Nov-21 | 170.7 | 168.6 |

| Nov-21 | 169.9 | 168.6 |

| Nov-21 | 169.9 | 168.6 |

| Nov-21 | 171.7 | 168.6 |

| Nov-21 | 172.8 | 168.6 |

| Nov-21 | 174.0 | 168.6 |

| Nov-21 | 176.8 | 168.6 |

| Nov-21 | 176.2 | 168.6 |

| Nov-21 | 174.3 | 168.6 |

| Nov-21 | 171.9 | 168.6 |

| Nov-21 | 170.4 | 168.6 |

| Nov-21 | 169.7 | 168.6 |

| Nov-21 | 166.8 | 168.6 |

| Dec-21 | 172.8 | 159.8 |

| Dec-21 | 171.0 | 159.8 |

| Dec-21 | 168.3 | 159.8 |

| Dec-21 | 166.5 | 159.8 |

| Dec-21 | 165.8 | 159.8 |

| Dec-21 | 164.5 | 159.8 |

| Dec-21 | 162.6 | 159.8 |

| Dec-21 | 161.7 | 159.8 |

| Dec-21 | 158.9 | 159.8 |

| Dec-21 | 157.1 | 159.8 |

| Dec-21 | 155.4 | 159.8 |

| Dec-21 | 156.7 | 159.8 |

| Dec-21 | 157.2 | 159.8 |

| Dec-21 | 156.2 | 159.8 |

| Dec-21 | 162.8 | 159.8 |

| Dec-21 | 161.8 | 159.8 |

| Dec-21 | 160.6 | 159.8 |

| Dec-21 | 159.8 | 159.8 |

| Dec-21 | 158.9 | 159.8 |

| Dec-21 | 159.1 | 159.8 |

| Dec-21 | 159.1 | 159.8 |

| Dec-21 | 157.8 | 159.8 |

| Dec-21 | 156.0 | 159.8 |

| Dec-21 | 155.8 | 159.8 |

| Dec-21 | 154.0 | 159.8 |

| Dec-21 | 153.7 | 159.8 |

| Dec-21 | 151.9 | 159.8 |

| Dec-21 | 151.2 | 159.8 |

| Dec-21 | 157.9 | 159.8 |

| Dec-21 | 159.8 | 159.8 |

| Dec-21 | 160.1 | 159.8 |

| Jan-22 | 163.2 | 167.9 |

| Jan-22 | 164.0 | 167.9 |

| Jan-22 | 163.9 | 167.9 |

| Jan-22 | 163.2 | 167.9 |

| Jan-22 | 162.0 | 167.9 |

| Jan-22 | 161.5 | 167.9 |

| Jan-22 | 162.6 | 167.9 |

| Jan-22 | 162.3 | 167.9 |

| Jan-22 | 163.4 | 167.9 |

| Jan-22 | 164.5 | 167.9 |

| Jan-22 | 164.7 | 167.9 |

| Jan-22 | 173.2 | 167.9 |

| Jan-22 | 173.9 | 167.9 |

| Jan-22 | 173.8 | 167.9 |

| Jan-22 | 171.8 | 167.9 |

| Jan-22 | 171.7 | 167.9 |

| Jan-22 | 172.1 | 167.9 |

| Jan-22 | 172.0 | 167.9 |

| Jan-22 | 172.2 | 167.9 |

| Jan-22 | 171.9 | 167.9 |

| Jan-22 | 170.7 | 167.9 |

| Jan-22 | 167.8 | 167.9 |

| Jan-22 | 167.5 | 167.9 |

| Jan-22 | 167.4 | 167.9 |

| Jan-22 | 166.9 | 167.9 |

| Jan-22 | 172.0 | 167.9 |

| Jan-22 | 171.4 | 167.9 |

| Jan-22 | 170.1 | 167.9 |

| Jan-22 | 168.6 | 167.9 |

| Jan-22 | 168.4 | 167.9 |

| Jan-22 | 167.1 | 167.9 |

| Feb-22 | 170.2 | 180.0 |

| Feb-22 | 170.7 | 180.0 |

| Feb-22 | 173.7 | 180.0 |

| Feb-22 | 175.2 | 180.0 |

| Feb-22 | 175.3 | 180.0 |

| Feb-22 | 175.5 | 180.0 |

| Feb-22 | 175.9 | 180.0 |

| Feb-22 | 176.7 | 180.0 |

| Feb-22 | 182.5 | 180.0 |

| Feb-22 | 183.8 | 180.0 |

| Feb-22 | 183.4 | 180.0 |

| Feb-22 | 182.9 | 180.0 |

| Feb-22 | 183.3 | 180.0 |

| Feb-22 | 183.3 | 180.0 |

| Feb-22 | 182.8 | 180.0 |

| Feb-22 | 182.1 | 180.0 |

| Feb-22 | 181.6 | 180.0 |

| Feb-22 | 180.6 | 180.0 |

| Feb-22 | 179.2 | 180.0 |

| Feb-22 | 178.6 | 180.0 |

| Feb-22 | 179.2 | 180.0 |

| Feb-22 | 178.0 | 180.0 |

| Feb-22 | 182.3 | 180.0 |

| Feb-22 | 183.0 | 180.0 |

| Feb-22 | 184.4 | 180.0 |

| Feb-22 | 184.4 | 180.0 |

| Feb-22 | 184.4 | 180.0 |

| Feb-22 | 185.5 | 180.0 |

| Mar-22 | 184.7 | 201.8 |

| Mar-22 | 186.2 | 201.8 |

| Mar-22 | 186.2 | 201.8 |

| Mar-22 | 185.2 | 201.8 |

| Mar-22 | 184.9 | 201.8 |

| Mar-22 | 185.3 | 201.8 |

| Mar-22 | 185.8 | 201.8 |

| Mar-22 | 187.3 | 201.8 |

| Mar-22 | 196.9 | 201.8 |

| Mar-22 | 204.4 | 201.8 |

| Mar-22 | 210.4 | 201.8 |

| Mar-22 | 212.6 | 201.8 |

| Mar-22 | 213.8 | 201.8 |

| Mar-22 | 215.9 | 201.8 |

| Mar-22 | 216.9 | 201.8 |

| Mar-22 | 216.2 | 201.8 |

| Mar-22 | 215.0 | 201.8 |

| Mar-22 | 213.2 | 201.8 |

| Mar-22 | 211.3 | 201.8 |

| Mar-22 | 210.0 | 201.8 |

| Mar-22 | 209.4 | 201.8 |

| Mar-22 | 206.6 | 201.8 |

| Mar-22 | 209.8 | 201.8 |

| Mar-22 | 207.9 | 201.8 |

| Mar-22 | 206.1 | 201.8 |

| Mar-22 | 204.1 | 201.8 |

| Mar-22 | 203.0 | 201.8 |

| Mar-22 | 201.5 | 201.8 |

| Mar-22 | 199.9 | 201.8 |

| Mar-22 | 194.6 | 201.8 |

| Mar-22 | 189.0 | 201.8 |

| Apr-22 | 184.7 | 170.7 |

| Apr-22 | 181.4 | 170.7 |

| Apr-22 | 179.1 | 170.7 |

| Apr-22 | 175.6 | 170.7 |

| Apr-22 | 170.4 | 170.7 |

| Apr-22 | 171.9 | 170.7 |

| Apr-22 | 170.1 | 170.7 |

| Apr-22 | 168.3 | 170.7 |

| Apr-22 | 166.7 | 170.7 |

| Apr-22 | 165.8 | 170.7 |

| Apr-22 | 164.7 | 170.7 |

| Apr-22 | 163.3 | 170.7 |

| Apr-22 | 162.0 | 170.7 |

| Apr-22 | 160.7 | 170.7 |

| Apr-22 | 159.5 | 170.7 |

| Apr-22 | 158.9 | 170.7 |

| Apr-22 | 158.6 | 170.7 |

| Apr-22 | 158.2 | 170.7 |

| Apr-22 | 158.2 | 170.7 |

| Apr-22 | 165.8 | 170.7 |

| Apr-22 | 172.2 | 170.7 |

| Apr-22 | 176.0 | 170.7 |

| Apr-22 | 176.8 | 170.7 |

| Apr-22 | 178.0 | 170.7 |

| Apr-22 | 179.1 | 170.7 |

| Apr-22 | 179.8 | 170.7 |

| Apr-22 | 179.7 | 170.7 |

| Apr-22 | 179.4 | 170.7 |

| Apr-22 | 178.3 | 170.7 |

| Apr-22 | 177.6 | 170.7 |

| May-22 | 178.5 | 191.7 |

| May-22 | 178.4 | 191.7 |

| May-22 | 179.2 | 191.7 |

| May-22 | 182.8 | 191.7 |

| May-22 | 180.2 | 191.7 |

| May-22 | 179.6 | 191.7 |

| May-22 | 181.4 | 191.7 |

| May-22 | 182.8 | 191.7 |

| May-22 | 183.6 | 191.7 |

| May-22 | 183.7 | 191.7 |

| May-22 | 184.3 | 191.7 |

| May-22 | 184.7 | 191.7 |

| May-22 | 186.1 | 191.7 |

| May-22 | 188.1 | 191.7 |

| May-22 | 190.9 | 191.7 |

| May-22 | 193.6 | 191.7 |

| May-22 | 195.7 | 191.7 |

| May-22 | 202.3 | 191.7 |

| May-22 | 204.1 | 191.7 |

| May-22 | 204.9 | 191.7 |

| May-22 | 205.8 | 191.7 |

| May-22 | 206.6 | 191.7 |

| May-22 | 205.6 | 191.7 |

| May-22 | 202.9 | 191.7 |

| May-22 | 200.4 | 191.7 |

| May-22 | 198.9 | 191.7 |

| May-22 | 197.3 | 191.7 |

| May-22 | 195.8 | 191.7 |

| May-22 | 195.3 | 191.7 |

| May-22 | 195.1 | 191.7 |

| May-22 | 195.0 | 191.7 |

| Jun-22 | 197.6 | 205.5 |

| Jun-22 | 197.4 | 205.5 |

| Jun-22 | 196.6 | 205.5 |

| Jun-22 | 198.1 | 205.5 |

| Jun-22 | 201.0 | 205.5 |

| Jun-22 | 201.9 | 205.5 |

| Jun-22 | 202.1 | 205.5 |

| Jun-22 | 201.1 | 205.5 |

| Jun-22 | 200.5 | 205.5 |

| Jun-22 | 199.7 | 205.5 |

| Jun-22 | 199.2 | 205.5 |

| Jun-22 | 199.6 | 205.5 |

| Jun-22 | 200.0 | 205.5 |

| Jun-22 | 200.5 | 205.5 |

| Jun-22 | 205.7 | 205.5 |

| Jun-22 | 208.5 | 205.5 |

| Jun-22 | 210.9 | 205.5 |

| Jun-22 | 214.0 | 205.5 |

| Jun-22 | 215.6 | 205.5 |

| Jun-22 | 216.1 | 205.5 |

| Jun-22 | 214.1 | 205.5 |

| Jun-22 | 212.4 | 205.5 |

| Jun-22 | 211.0 | 205.5 |

| Jun-22 | 209.7 | 205.5 |

| Jun-22 | 208.7 | 205.5 |

| Jun-22 | 207.8 | 205.5 |

| Jun-22 | 207.4 | 205.5 |

| Jun-22 | 206.2 | 205.5 |

| Jun-22 | 211.2 | 205.5 |

| Jun-22 | 211.2 | 205.5 |

| Jul-22 | 211.4 | 195.7 |

| Jul-22 | 211.7 | 195.7 |

| Jul-22 | 213.9 | 195.7 |

| Jul-22 | 215.2 | 195.7 |

| Jul-22 | 215.2 | 195.7 |

| Jul-22 | 216.1 | 195.7 |

| Jul-22 | 213.7 | 195.7 |

| Jul-22 | 210.3 | 195.7 |

| Jul-22 | 207.0 | 195.7 |

| Jul-22 | 205.5 | 195.7 |

| Jul-22 | 204.3 | 195.7 |

| Jul-22 | 202.0 | 195.7 |

| Jul-22 | 204.2 | 195.7 |

| Jul-22 | 202.1 | 195.7 |

| Jul-22 | 199.3 | 195.7 |

| Jul-22 | 196.7 | 195.7 |

| Jul-22 | 194.2 | 195.7 |

| Jul-22 | 191.7 | 195.7 |

| Jul-22 | 189.0 | 195.7 |

| Jul-22 | 189.3 | 195.7 |

| Jul-22 | 188.0 | 195.7 |

| Jul-22 | 187.5 | 195.7 |

| Jul-22 | 185.1 | 195.7 |

| Jul-22 | 183.4 | 195.7 |

| Jul-22 | 180.4 | 195.7 |

| Jul-22 | 176.7 | 195.7 |

| Jul-22 | 179.3 | 195.7 |

| Jul-22 | 177.0 | 195.7 |

| Jul-22 | 174.6 | 195.7 |

| Jul-22 | 171.9 | 195.7 |

| Jul-22 | 169.6 | 195.7 |

| Aug-22 | 170.7 | 171.9 |

| Aug-22 | 169.0 | 171.9 |

| Aug-22 | 173.2 | 171.9 |

| Aug-22 | 171.9 | 171.9 |

| Aug-22 | 169.7 | 171.9 |

| Aug-22 | 167.4 | 171.9 |

| Aug-22 | 166.6 | 171.9 |

| Aug-22 | 165.6 | 171.9 |

| Aug-22 | 163.7 | 171.9 |

| Aug-22 | 169.2 | 171.9 |

| Aug-22 | 167.8 | 171.9 |

| Aug-22 | 166.1 | 171.9 |

| Aug-22 | 165.3 | 171.9 |

| Aug-22 | 166.4 | 171.9 |

| Aug-22 | 167.9 | 171.9 |

| Aug-22 | 168.5 | 171.9 |

| Aug-22 | 173.2 | 171.9 |

| Aug-22 | 173.8 | 171.9 |

| Aug-22 | 172.8 | 171.9 |

| Aug-22 | 173.0 | 171.9 |

| Aug-22 | 173.5 | 171.9 |

| Aug-22 | 175.5 | 171.9 |

| Aug-22 | 174.8 | 171.9 |

| Aug-22 | 182.0 | 171.9 |

| Aug-22 | 180.6 | 171.9 |

| Aug-22 | 178.8 | 171.9 |

| Aug-22 | 176.6 | 171.9 |

| Aug-22 | 176.5 | 171.9 |

| Aug-22 | 178.3 | 171.9 |

| Aug-22 | 175.9 | 171.9 |

| Aug-22 | 173.8 | 171.9 |

| Sep-22 | 171.3 | 169.5 |

| Sep-22 | 168.2 | 169.5 |

| Sep-22 | 166.0 | 169.5 |

| Sep-22 | 164.8 | 169.5 |

| Sep-22 | 163.1 | 169.5 |

| Sep-22 | 160.4 | 169.5 |

| Sep-22 | 163.9 | 169.5 |

| Sep-22 | 162.3 | 169.5 |

| Sep-22 | 161.0 | 169.5 |

| Sep-22 | 160.1 | 169.5 |

| Sep-22 | 160.1 | 169.5 |

| Sep-22 | 160.1 | 169.5 |

| Sep-22 | 161.0 | 169.5 |

| Sep-22 | 164.1 | 169.5 |

| Sep-22 | 164.4 | 169.5 |

| Sep-22 | 163.5 | 169.5 |

| Sep-22 | 163.3 | 169.5 |

| Sep-22 | 164.1 | 169.5 |

| Sep-22 | 166.4 | 169.5 |

| Sep-22 | 166.8 | 169.5 |

| Sep-22 | 175.0 | 169.5 |

| Sep-22 | 176.9 | 169.5 |

| Sep-22 | 177.6 | 169.5 |

| Sep-22 | 178.7 | 169.5 |

| Sep-22 | 183.0 | 169.5 |

| Sep-22 | 184.4 | 169.5 |

| Sep-22 | 182.7 | 169.5 |

| Sep-22 | 184.1 | 169.5 |

| Sep-22 | 184.5 | 169.5 |

| Sep-22 | 184.5 | 169.5 |

| Oct-22 | 183.1 | 182.0 |

| Oct-22 | 182.8 | 182.0 |

| Oct-22 | 182.8 | 182.0 |

| Oct-22 | 182.2 | 182.0 |

| Oct-22 | 186.1 | 182.0 |

| Oct-22 | 184.7 | 182.0 |

| Oct-22 | 183.5 | 182.0 |

| Oct-22 | 182.2 | 182.0 |

| Oct-22 | 180.6 | 182.0 |

| Oct-22 | 178.7 | 182.0 |

| Oct-22 | 176.1 | 182.0 |

| Oct-22 | 176.4 | 182.0 |

| Oct-22 | 176.4 | 182.0 |

| Oct-22 | 176.5 | 182.0 |

| Oct-22 | 178.3 | 182.0 |

| Oct-22 | 179.6 | 182.0 |

| Oct-22 | 179.5 | 182.0 |

| Oct-22 | 178.9 | 182.0 |

| Oct-22 | 182.9 | 182.0 |

| Oct-22 | 181.5 | 182.0 |

| Oct-22 | 181.2 | 182.0 |

| Oct-22 | 180.7 | 182.0 |

| Oct-22 | 180.0 | 182.0 |

| Oct-22 | 181.2 | 182.0 |

| Oct-22 | 184.7 | 182.0 |

| Oct-22 | 189.0 | 182.0 |

| Oct-22 | 187.2 | 182.0 |

| Oct-22 | 186.4 | 182.0 |

| Oct-22 | 186.0 | 182.0 |

| Oct-22 | 186.5 | 182.0 |

| Oct-22 | 186.5 | 182.0 |

| Nov-22 | 188.3 | 191.1 |

| Nov-22 | 197.1 | 191.1 |

| Nov-22 | 197.3 | 191.1 |

| Nov-22 | 197.2 | 191.1 |

| Nov-22 | 197.5 | 191.1 |

| Nov-22 | 195.7 | 191.1 |

| Nov-22 | 196.5 | 191.1 |

| Nov-22 | 197.2 | 191.1 |

| Nov-22 | 201.8 | 191.1 |

| Nov-22 | 200.9 | 191.1 |

| Nov-22 | 198.2 | 191.1 |

| Nov-22 | 195.5 | 191.1 |

| Nov-22 | 194.5 | 191.1 |

| Nov-22 | 193.7 | 191.1 |

| Nov-22 | 192.2 | 191.1 |

| Nov-22 | 195.3 | 191.1 |

| Nov-22 | 193.0 | 191.1 |

| Nov-22 | 190.2 | 191.1 |

| Nov-22 | 187.3 | 191.1 |

| Nov-22 | 185.6 | 191.1 |

| Nov-22 | 185.0 | 191.1 |

| Nov-22 | 183.9 | 191.1 |

| Nov-22 | 187.2 | 191.1 |

| Nov-22 | 186.4 | 191.1 |

| Nov-22 | 185.4 | 191.1 |

| Nov-22 | 184.4 | 191.1 |

| Nov-22 | 184.0 | 191.1 |

| Nov-22 | 182.4 | 191.1 |

| Nov-22 | 179.2 | 191.1 |

| Nov-22 | 179.9 | 191.1 |

Average price of unleaded petrol (91 octane), cents per litre

["","Daily average price of ULP","Monthly average price of ULP"]

[["Mar20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","Apr-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","May-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jun-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Jul-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Aug-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Sep-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Oct-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Nov-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Dec-20","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Jan-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Feb-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Mar-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","Apr-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","May-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jun-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Jul-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Aug-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Sep-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Oct-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Nov-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Dec-21","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Jan-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Feb-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Mar-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","Apr-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","May-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jun-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Jul-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Aug-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Sep-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Oct-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22","Nov-22"],[[126.5213105],[120.0922993],[119.7834101],[119.3166533],[116.250958],[114.2548632],[112.6774861],[112.0919095],[115.438406],[113.4467131],[109.8146817],[107.6768017],[104.8312757],[102.6036641],[102.4925369],[106.209175],[106.2013732],[105.3540392],[103.1504624],[101.2585589],[99.80697796],[97.92224646],[102.4558316],[100.475579],[97.40185093],[95.19679931],[93.59698432],[92.46006476],[92.29546952],[99.76053046],[100.1422727],[100.9154213],[99.41251529],[97.79294211],[96.19563827],[96.84254038],[104.1339386],[105.2367509],[104.6967814],[103.8681229],[106.2812733],[107.4459569],[108.5296379],[115.184347],[115.284834],[113.4400321],[111.1122524],[109.3778071],[108.7192197],[107.3626609],[112.2858977],[110.9230803],[108.9096882],[108.1771373],[109.0546187],[108.4279637],[107.3794731],[112.4941058],[110.9441871],[109.0633479],[108.0537818],[106.6427752],[106.2178072],[105.3921116],[111.6067209],[112.4829285],[112.470158],[112.6036389],[116.4093902],[117.8716997],[119.1154213],[127.7799068],[127.4632708],[126.3322214],[124.1829867],[122.1187957],[120.4855663],[119.2070416],[124.3067366],[122.8032353],[120.6997289],[121.7129636],[120.9871822],[119.2651102],[118.151487],[123.7091992],[122.6428733],[120.7081172],[119.0374871],[117.6936383],[116.7744098],[115.913979],[123.4805823],[123.932989],[122.8717203],[122.3615561],[122.5086367],[122.6619553],[121.9395445],[126.2571051],[126.5844674],[123.8718913],[121.520013],[120.3153203],[119.6238329],[118.9202496],[125.2804537],[124.4179736],[125.5931328],[125.7280109],[126.3961281],[126.0990339],[124.8585532],[129.7319288],[127.6916441],[125.1865199],[123.3127503],[121.7547559],[119.9739917],[119.9517644],[128.7263824],[130.5828967],[129.5549844],[128.8073214],[128.3077437],[127.9626845],[126.3414386],[132.1062869],[129.7740222],[126.0643824],[122.2124354],[120.3146375],[119.2801037],[117.275373],[123.5023917],[123.3536999],[120.6987627],[119.0134862],[118.7335542],[117.2808404],[115.345463],[121.2210895],[120.1909337],[118.0285976],[116.8274362],[115.2450382],[115.3564347],[115.9782262],[125.5142713],[126.809911],[127.1648402],[129.7300384],[131.9625],[133.8192843],[132.6071112],[138.9805414],[136.6714506],[132.7001401],[129.339123],[127.1558463],[125.5378251],[123.9938624],[129.7047501],[127.5344051],[124.4149767],[122.9038191],[122.1095734],[122.4527727],[121.8980173],[127.6955293],[125.137744],[121.7323053],[118.4460388],[116.0332774],[113.8932227],[112.4640964],[118.9865344],[117.1288993],[114.7078929],[113.6107263],[114.8390419],[114.3301023],[113.8615479],[120.6057987],[121.9351546],[119.9854936],[117.63462],[116.0163158],[114.1666448],[115.263166],[122.5742827],[122.4804359],[120.7086297],[117.8389561],[117.5025141],[118.8545143],[118.3650148],[126.1671314],[124.9184766],[123.0354525],[120.1402929],[121.8708567],[123.2997971],[122.9673222],[131.6491704],[131.4349303],[127.3688429],[124.7762673],[123.1147464],[121.7512545],[119.1753108],[125.8637978],[124.0082762],[120.9829173],[119.5708145],[116.6207656],[114.7047239],[112.1800396],[120.3899671],[118.8865647],[117.0628978],[115.6451488],[114.8984718],[115.0071788],[116.4659271],[125.1698361],[126.1179959],[124.3179718],[121.5604439],[120.6949779],[120.5690584],[121.6386806],[129.0657519],[129.1722475],[127.5107937],[123.6751022],[122.1446041],[121.2019366],[119.6948052],[124.7535998],[122.6172825],[119.9664413],[116.9528703],[120.3349412],[120.2899042],[119.1991261],[125.0175153],[123.4801802],[122.0918582],[120.3941104],[119.439069],[119.5867454],[119.5730548],[127.077797],[125.922],[126.7036253],[125.5893547],[127.9029402],[127.781935],[127.6578711],[136.2029324],[134.8166555],[133.3870046],[131.1817429],[130.6116529],[131.1367931],[129.1209724],[135.8084288],[133.3235987],[129.5736391],[126.4850414],[125.0336566],[124.326262],[122.6160705],[128.6682156],[126.9286506],[124.049284],[121.9921189],[121.9089217],[121.0169706],[119.7695559],[126.2716833],[124.6227952],[121.8068691],[118.926919],[116.9345617],[115.327254],[114.6536949],[122.9807022],[123.2142329],[122.8049803],[121.9241332],[124.0778],[126.9139317],[130.3058289],[143.7810288],[145.9265047],[144.053763],[140.1525534],[138.553256],[138.3787253],[134.6669241],[142.9704065],[140.1908529],[136.3498924],[133.4584811],[133.0841131],[134.8140091],[133.3014621],[138.6254734],[136.3339906],[133.7593216],[130.6900939],[128.6400188],[126.1909362],[124.8643411],[131.1866817],[130.9816004],[129.6729978],[128.0469183],[128.9893519],[129.178547],[128.7922759],[140.0336825],[137.7410706],[136.0958108],[133.2286184],[132.0609876],[133.4368409],[133.2829279],[140.3655806],[139.2561082],[137.109574],[134.6653236],[134.3670267],[138.3018309],[139.8807193],[152.0145865],[150.2068805],[147.8604726],[145.238526],[143.431069],[140.2750284],[139.4697834],[147.0527141],[144.2832739],[141.3758536],[139.0375809],[139.7286809],[138.2374841],[137.5613188],[146.5810574],[144.6107831],[142.0732187],[138.9839931],[137.0818583],[135.8624732],[134.9667548],[143.2272535],[142.4683216],[140.5880905],[138.4628334],[138.9168611],[140.504525],[140.4856653],[152.7363184],[152.7679652],[152.0882373],[150.2803324],[148.086323],[146.8756825],[145.6370292],[152.8860571],[151.6415602],[149.68255],[147.5165463],[146.0239124],[145.2333482],[143.0073821],[149.2016766],[145.8763364],[143.4414812],[140.6122583],[139.765886],[138.6490178],[136.7284816],[143.3100688],[141.3791764],[139.8286145],[137.8717297],[138.181032],[136.7676507],[136.2538829],[142.9878545],[141.7458961],[140.663251],[138.00573],[137.6668936],[139.1052617],[140.8564303],[147.9304185],[148.9744377],[147.3115776],[143.1438226],[142.2267077],[142.4743451],[144.5604171],[150.5120523],[148.7913672],[146.5644108],[144.0401198],[145.2842782],[144.3624398],[143.5837415],[149.8270438],[148.1270996],[144.782819],[141.6214928],[140.2803587],[138.6701573],[137.4724474],[144.5598754],[142.9278689],[140.857535],[138.3398753],[138.476486],[139.0724853],[138.6316258],[148.2795938],[146.8805312],[145.1160246],[141.8687303],[141.3693687],[141.8024225],[141.2327967],[149.7603302],[147.8344134],[144.0117431],[140.1513504],[138.7027372],[138.8625691],[137.501773],[145.3271702],[142.8061728],[140.4955472],[137.413447],[136.477084],[136.9789433],[137.7288039],[145.9110818],[146.5526854],[145.4175787],[144.0376962],[144.7868882],[147.1964256],[149.5094395],[159.0236127],[162.4515389],[160.6132283],[157.3521821],[157.1246679],[157.0117428],[156.9649462],[162.8209276],[159.8260766],[156.446103],[153.2296098],[153.1938261],[152.7304636],[151.0153635],[155.6356072],[153.1245465],[150.6429218],[147.3747836],[145.6179478],[144.4816857],[143.8237238],[152.4376943],[150.9435039],[148.8775498],[146.3747882],[147.6015631],[147.7627221],[147.9746878],[159.0917048],[157.7516449],[155.2002995],[152.9253807],[151.9639264],[149.9913717],[148.7904937],[157.8678391],[155.9421721],[153.7849558],[151.1830236],[152.4123348],[154.6135784],[155.0665716],[163.5883467],[160.9585286],[156.8851998],[153.2426384],[151.3293946],[151.7400704],[150.5213074],[158.1283881],[155.7416136],[153.0459194],[149.4916156],[149.0001121],[150.5041338],[149.2405003],[157.1148382],[153.7740306],[150.682411],[147.4048808],[146.2284374],[144.9160835],[145.6778056],[152.2878416],[150.2445124],[148.663361],[146.6816],[147.6625899],[148.5077775],[148.9599331],[159.1516222],[158.8371009],[157.5865854],[155.7795981],[155.9082213],[157.5568553],[157.338914],[164.7680556],[162.2859462],[160.7228144],[157.9226958],[156.5275961],[157.7087529],[154.9946865],[164.2642579],[162.8918242],[159.762395],[156.4383054],[154.9836922],[154.1160859],[152.2827414],[155.7747659],[154.1385482],[152.2505961],[150.8498808],[150.6149248],[149.4535739],[148.8705162],[158.3797974],[159.2216113],[160.4366935],[161.9499824],[161.2114062],[160.7328531],[161.0232715],[162.4770807],[164.0586515],[165.4379398],[165.0298324],[166.0853292],[167.868792],[167.3348963],[174.4067337],[174.8915992],[174.7862615],[174.0710452],[174.1245751],[173.8152788],[172.5397948],[171.1226606],[169.8752271],[168.5949938],[167.4288256],[166.5976299],[165.7830636],[164.4971048],[170.4366924],[168.7708571],[167.9193583],[167.4167445],[167.562889],[166.4966883],[166.7051889],[166.2617904],[165.1161511],[164.3501401],[163.1846277],[162.362759],[162.0085842],[161.7555378],[170.8780798],[170.6849931],[169.9400049],[169.9307985],[171.6528746],[172.7768985],[174.0300048],[176.8256292],[176.1912617],[174.3422305],[171.8659554],[170.4351369],[169.7479339],[166.7616067],[172.838934],[170.9521551],[168.2986596],[166.5075674],[165.8196222],[164.4569476],[162.5843591],[161.6648799],[158.8558752],[157.1123172],[155.4448246],[156.7266552],[157.1937346],[156.1732336],[162.7583836],[161.7975636],[160.5924686],[159.817415],[158.8787719],[159.0594506],[159.1298079],[157.8208626],[155.9921063],[155.797085],[154.0152711],[153.7286721],[151.9462193],[151.1588415],[157.9086911],[159.7645141],[160.0517784],[163.1990488],[163.9704698],[163.9186579],[163.205032],[162.0097288],[161.5094617],[162.6125916],[162.2696269],[163.3776269],[164.5193742],[164.7316976],[173.1753076],[173.8639258],[173.8081616],[171.8040581],[171.7021099],[172.0826506],[172.0393505],[172.240462],[171.8548722],[170.7263889],[167.7992663],[167.4705802],[167.3884602],[166.905447],[171.9608696],[171.4444361],[170.0773571],[168.625199],[168.4255006],[167.1223639],[170.2167449],[170.7032813],[173.6576808],[175.1635914],[175.3077263],[175.518166],[175.9275729],[176.6581908],[182.5475],[183.7524646],[183.440327],[182.8990831],[183.2753203],[183.2941051],[182.8463056],[182.1476474],[181.5706352],[180.5945287],[179.1649402],[178.6363503],[179.17124],[177.9565325],[182.3319427],[183.0281736],[184.3527154],[184.385296],[184.4182648],[185.519143],[184.720323],[186.2035841],[186.1797031],[185.2189663],[184.917746],[185.3185151],[185.8427103],[187.2755569],[196.9260754],[204.3535518],[210.3892162],[212.5819909],[213.7870561],[215.8759849],[216.9140065],[216.235486],[215.009749],[213.2176662],[211.3375138],[210.0456365],[209.4137426],[206.6262783],[209.796551],[207.8578343],[206.1093672],[204.08911],[202.9963982],[201.4631384],[199.9483607],[194.5920756],[188.9752817],[184.7213672],[181.4463394],[179.1268534],[175.5544658],[170.4060173],[171.8895079],[170.1164622],[168.2626611],[166.7192529],[165.7744847],[164.7193645],[163.3417185],[161.9957132],[160.6572105],[159.5274769],[158.9456881],[158.5698459],[158.2180071],[158.19095],[165.7782946],[172.1877015],[175.956701],[176.7878645],[177.9902059],[179.1449717],[179.8106746],[179.6851962],[179.4346597],[178.2722022],[177.5816631],[178.4752632],[178.3555608],[179.2116387],[182.8031759],[180.1905695],[179.6147842],[181.3569024],[182.7545055],[183.5633257],[183.7034938],[184.3091384],[184.7015195],[186.065937],[188.08587],[190.9436837],[193.5535173],[195.6910348],[202.2841161],[204.1008605],[204.8790412],[205.8333485],[206.5731369],[205.5651017],[202.9235446],[200.3912206],[198.863038],[197.3394094],[195.8159847],[195.3364523],[195.1172118],[195.0178571],[197.5615202],[197.3584992],[196.6205873],[198.1360488],[200.9510447],[201.9381257],[202.1269814],[201.1371997],[200.5199365],[199.7163338],[199.2293814],[199.6133591],[199.9879343],[200.5314886],[205.7180647],[208.5126536],[210.9077123],[214.0157936],[215.6014459],[216.075462],[214.0589609],[212.378943],[211.0447972],[209.6708646],[208.6817119],[207.7684049],[207.433649],[206.2464799],[211.1994218],[211.2449189],[211.397],[211.694],[213.913],[215.153],[215.214],[216.14],[213.667],[210.311],[207.021],[205.517],[204.297],[202.014],[204.24],[202.109],[199.339],[196.691],[194.171],[191.676],[188.996],[189.339],[188.03],[187.463],[185.11],[183.429],[180.388],[176.651],[179.325],[177.035],[174.556],[171.896],[169.608],[170.687],[168.955],[173.171],[171.895],[169.735],[167.416],[166.627],[165.611],[163.746],[169.176],[167.775],[166.125],[165.316],[166.431],[167.859],[168.509],[173.247],[173.836],[172.813],[173.009],[173.52],[175.489],[174.81],[181.971],[180.637],[178.792],[176.554],[176.474],[178.296],[175.867],[173.824],[171.274],[168.222],[166.007],[164.829],[163.1],[160.418],[163.877],[162.279],[161.006],[160.14],[160.074],[160.134],[160.955],[164.145],[164.376],[163.499],[163.334],[164.063],[166.362],[166.813],[174.962],[176.867],[177.613],[178.71],[182.981],[184.438],[182.703],[184.117],[184.467],[184.48],[183.148],[182.797],[182.809],[182.175],[186.144],[184.692],[183.518],[182.217],[180.561],[178.712],[176.074],[176.392],[176.364],[176.457],[178.265],[179.648],[179.5],[178.897],[182.863],[181.532],[181.233],[180.674],[179.989],[181.224],[184.705],[188.991],[187.239],[186.433],[186.013],[186.468],[186.518],[188.254],[197.071],[197.321],[197.236],[197.529],[195.688],[196.531],[197.179],[201.761],[200.885],[198.221],[195.498],[194.504],[193.679],[192.192],[195.327],[192.969],[190.207],[187.255],[185.592],[185.047],[183.924],[187.243],[186.362],[185.438],[184.374],[184.046],[182.351],[179.181],[179.924]],[[127.1],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[105.48],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[107.23],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[118.87],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[124.25],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[123.04],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[122.72],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[121.79],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[120.64],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[126.99],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[128.74],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[133.06],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[141.98],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[144.17],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.24],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[143.39],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[153.17],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[152.61],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[155.82],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[164.37],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[168.56],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[159.83],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[167.93],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[179.95],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[201.75],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[170.69],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[191.72],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[205.53],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[195.69],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[171.88],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[169.54],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[182.01],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093],[191.093]]]

[]

[{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]The Furniture, household equipment and services group rose 8.4% in the year to November. Higher freight and raw material costs recorded in mid 2022 contributed to price rises for furniture.

Non-durable household products contributed to the rise, driven by price increases for cleaning and maintenance products.

Holiday travel and accommodation prices rose 12.8% in the year to November, up from 3.7% in October. High jet fuel prices and strong travel demand throughout 2022, compared to COVID-19 affected 2021, have contributed to higher prices for airfares and accommodation.

In monthly terms, November’s increase of 4.3% varies from the falls usually seen in November, reflecting strong consumer demand for domestic accommodation and domestic and international airfares.

| monthly change (%)(1) | annual change (%) | |

|---|---|---|

| Nov-18 | -3.2 | 3.6 |

| Dec-18 | 13.3 | 5 |

| Jan-19 | -2.5 | 3.9 |

| Feb-19 | -9.7 | 1.9 |

| Mar-19 | -2.9 | 0 |

| Apr-19 | 10.5 | 4.9 |

| May-19 | -7.1 | 2.6 |

| Jun-19 | 2.8 | 3.6 |

| Jul-19 | 8.2 | 3.2 |

| Aug-19 | -6.8 | 4.8 |

| Sep-19 | 1.5 | 2.4 |

| Oct-19 | 2.9 | 4.4 |

| Nov-19 | -6.2(2) | 1.2 |

| Dec-19 | 14.6 | 2.3 |

| Jan-20 | -1.1 | 3.8 |

| Feb-20 | -13.4 | -0.5 |

| Mar-20 | 1.9 | 4.4 |

| Apr-20 | 2.7 | -3 |

| May-20 | -2 | 2.3 |

| Jun-20 | -0.4 | -0.9 |

| Jul-20 | 6 | -2.9 |

| Aug-20 | -0.5 | 3.7 |

| Sep-20 | -9.1 | -7.1 |

| Oct-20 | -1.1 | -10.7 |

| Nov-20 | -0.9(3) | -5.7 |

| Dec-20 | 11.6 | -8.2 |

| Jan-21 | -2.6 | -9.6 |

| Feb-21 | -7.9 | -3.9 |

| Mar-21 | -1.5 | -7.1 |

| Apr-21 | 5.8 | -4.2 |

| May-21 | -6.1 | -8.3 |

| Jun-21 | 4.3 | -4 |

| Jul-21 | -1.4 | -10.7 |

| Aug-21 | -0.3 | -10.5 |

| Sep-21 | 4.5 | 2.8 |

| Oct-21 | 1.7 | 5.7 |

| Nov-21 | -4.1(4) | 2.3 |

| Dec-21 | 10.8 | 1.5 |

| Jan-22 | 1.9 | 6.1 |

| Feb-22 | -12.4 | 1 |

| Mar-22 | 2.3 | 5 |

| Apr-22 | 9 | 8.2 |

| May-22 | -7.5 | 6.6 |

| Jun-22 | 5.4 | 7.8 |

| Jul-22 | 3.6 | 13.3 |

| Aug-22 | -5 | 7.9 |

| Sep-22 | 9.1 | 12.6 |

| Oct-22 | -6.4 | 3.7 |

| Nov-22 | 4.3(5) | 12.8 |

Holiday travel and accommodation, Australia, monthly and annual movement (%)

["","monthly change","annual change"]

[["Nov-18","Dec-18","Jan-19","Feb-19","Mar-19","Apr-19","May-19","Jun-19","Jul-19","Aug-19","Sep-19","Oct-19","Nov-19","Dec-19","Jan-20","Feb-20","Mar-20","Apr-20","May-20","Jun-20","Jul-20","Aug-20","Sep-20","Oct-20","Nov-20","Dec-20","Jan-21","Feb-21","Mar-21","Apr-21","May-21","Jun-21","Jul-21","Aug-21","Sep-21","Oct-21","Nov-21","Dec-21","Jan-22","Feb-22","Mar-22","Apr-22","May-22","Jun-22","Jul-22","Aug-22","Sep-22","Oct-22","Nov-22"],[[-3.2],[13.3],[-2.5],[-9.7],[-2.9],[10.5],[-7.1],[2.8],[8.2],[-6.8],[1.5],[2.9],[-6.2],[14.6],[-1.1],[-13.4],[1.9],[2.7],[-2],[-0.4],[6],[-0.5],[-9.1],[-1.1],[-0.9],[11.6],[-2.6],[-7.9],[-1.5],[5.8],[-6.1],[4.3],[-1.4],[-0.3],[4.5],[1.7],[-4.1],[10.8],[1.9],[-12.4],[2.3],[9],[-7.5],[5.4],[3.6],[-5],[9.1],[-6.4],[4.3]],[[3.6],[5],[3.9],[1.9],[0],[4.9],[2.6],[3.6],[3.2],[4.8],[2.4],[4.4],[1.2],[2.3],[3.8],[-0.5],[4.4],[-3],[2.3],[-0.9],[-2.9],[3.7],[-7.1],[-10.7],[-5.7],[-8.2],[-9.6],[-3.9],[-7.1],[-4.2],[-8.3],[-4],[-10.7],[-10.5],[2.8],[5.7],[2.3],[1.5],[6.1],[1],[5],[8.2],[6.6],[7.8],[13.3],[7.9],[12.6],[3.7],[12.8]]]

[{"value":"Nov 2018","annote_text":null,"x_value":"0","y_value":"-3.2","x_axis":"0","y_axis":"0","x_offset":"1","y_offset":"95","cell_row":"1","cell_column":"2"},{"value":"Nov 2019","annote_text":null,"x_value":"12","y_value":"-6.2","x_axis":"0","y_axis":"0","x_offset":"1","y_offset":"95","cell_row":"14","cell_column":"2"},{"value":"Nov 2020","annote_text":null,"x_value":"24","y_value":"-0.9","x_axis":"0","y_axis":"0","x_offset":"1","y_offset":"125","cell_row":"26","cell_column":"2"},{"value":"Nov 2021","annote_text":null,"x_value":"36","y_value":"-4.1","x_axis":"0","y_axis":"0","x_offset":"1","y_offset":"95","cell_row":"38","cell_column":"2"},{"value":"Nov 2022","annote_text":null,"x_value":"48","y_value":"4.3","x_axis":"0","y_axis":"0","x_offset":"1","y_offset":"-120","cell_row":"50","cell_column":"2"}][{"axis_id":"0","tick_interval":"","axis_min":"","axis_max":"","axis_title":"","precision":-1,"axis_units":"","tooltip_units":"","table_units":"","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"Percentage change (%)","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":null,"axis_max":null,"tick_interval":null,"precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]Analytical series Australia, Index Numbers and Percentage Change from Corresponding Month of Previous Year, Weighted Average of Eight Capital Cities

Analytical series, Australia, Percentage Change from previous period, Weighted Average of Eight Capital Cities

Caution: Data in Data Explorer is currently released after the 11:30am release on the ABS website. Please check the reference period when using Data Explorer.

Data explorer for the monthly CPI indicator.

For information on Data Explorer and how it works, see the Data Explorer user guide.

| Index | 2022 Weight (%) | 2021 weight (%) | Points Change |

|---|---|---|---|

| Food and non-alcoholic beverages group | 17.18 | 16.76 | 0.42 |

| Bread | 0.53 | 0.53 | 0.00 |

| Cakes and biscuits | 0.60 | 0.61 | -0.01 |

| Breakfast cereals | 0.11 | 0.12 | -0.01 |

| Other cereal products | 0.18 | 0.17 | 0.01 |

| Beef and veal | 0.53 | 0.54 | -0.01 |

| Pork | 0.29 | 0.32 | -0.03 |

| Lamb and goat | 0.29 | 0.31 | -0.02 |