Articles

This quarter's Finance and Wealth includes the following articles:

Financing resources

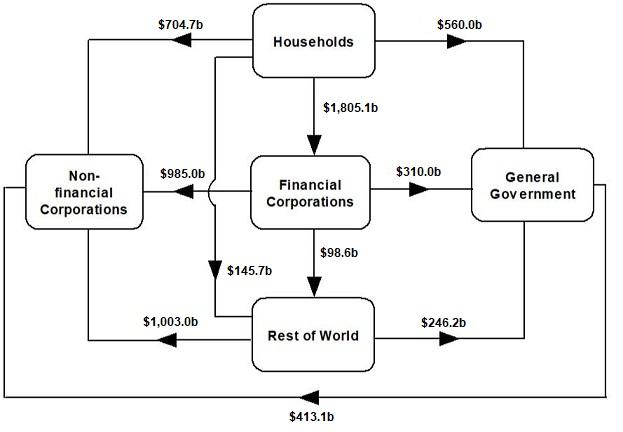

Total financing resources available to the Australian economy rose by $16.7b to $126.9b for the June quarter. Gross saving was the biggest driver with:

- $76.8b gross saving by households, an increase of $25.1b from the March quarter

- $77.8b gross saving by non financial corporations, an increase of $47.6b from the March quarter

Gross saving by general government was -$63.6b, a decrease of $77.7b from the March quarter. The large fall in saving reflects the government's economic response to the COVID-19 pandemic, which resulted in record high subsidy payments to households and businesses.

Financing resources table

Capital formation

Capital formation for the June quarter was $107.9b. This is 6.9% lower than the level in June 2019 and the lowest since 2011.

Total financing resources available exceeded the level of capital formation resulting in Australia being a net lender in the June quarter.

Capital formation and financial investment table

Financial investment

Australia was a net lender of $18.4b in the June quarter, the strongest on record. It was also Australia's fifth consecutive quarter of net lending. This was due to a $174.6b decrease in liabilities to rest of world (ROW) driven by:

- $50.6b in net maturites of debt securities (one name paper and bonds) held by ROW and issued by authorised deposit taking institutions (ADIs)

- $97.0b in settlements of derivative contracts with ROW

ADIs sourced alternative, lower cost forms of funding such as deposits and RBA's term funding facility, rather than issuing debt overseas.

Households' $62.5b net lending position was the result of a $76.0b acquisition of assets and a $13.4b incurrence of liabilities, driven by:

- $33.4b increase in deposits

- $13.3b increase in loan liabilities

The increase in deposits reflects increased household saving due to government income support packages combined with reduction in consumption due to COVID-19. The increase in loan liabilities was as a result of refinancing activity and deferred loan repayments relating to housing loans.

Non-financial corporations' $39.8b net lending position was due to a $37.9b acquisition of assets and a $1.9b decrease in liabilities, driven by:

- $32.0b increase in deposits

- $33.2b repayment of loan liabilities

- partly offset by $26.2b in equity raisings

General government's $62.5b net borrowing position was due to a $146.7b increase in liabilities, driven by:

- A record $106.6b issuance of debt securities (one name paper and bonds)

- $29.4b increase in loan liabilities

Increases in both debt security issuance and loan liabilities were used to mainly fund COVID-19 related economic support policies. For further analysis, see - Financing COVID-19 government policies