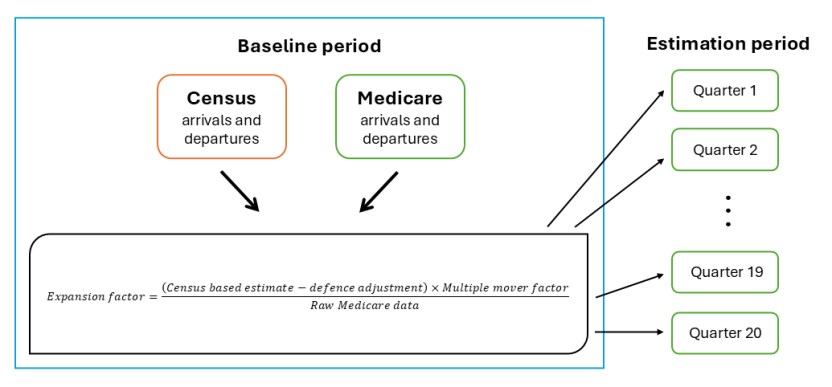

Expansion factors have historically only been applied to ages where there was significant under-reporting of moves in the Medicare data compared to the Census. Following the 2021 Census and prior to this review, expansion factors were applied to ages 16 to 35 for males and 16 to 32 for females. All ages outside this range were not expanded.

While used to expand the Medicare data, these factors have also historically been restricted (capped) to a maximum of 2.0 to limit the influence of any particular age/sex cell, whose behaviour may change over time. Capping at 2.0 means that moves cannot be more than double what Medicare indicates. The number of cells capped at 2.0 in the 2021 expansion factors was much higher than previous years, reducing the factors’ ability to reflect the overall relationship between Medicare and Census.

For all ages, interstate moves were not allowed to be less than what Medicare indicated (i.e. factors could not be below 1.0), regardless of the relationship between Medicare- and Census-based migration data. However, historical data over several Censuses reveals that Medicare overestimates the number of moves for some ages.

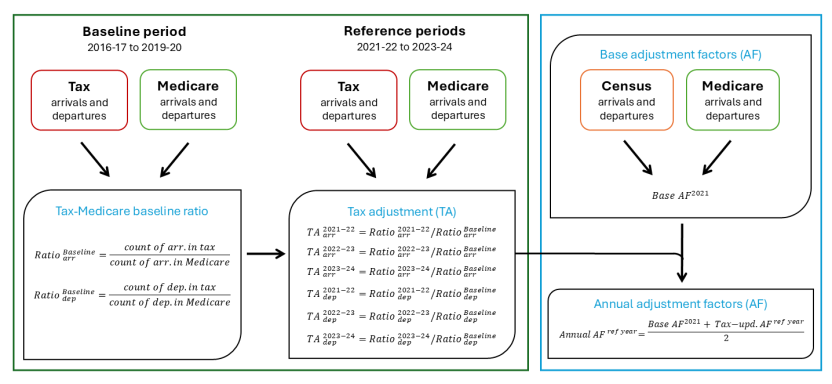

While there are minor scope differences, comparing the number of interstate moves recorded by Medicare and the Census in 2020–21 showed undercoverage of young adults (which is accounted for by expansion factors) and overcoverage of people aged under 18. Data from previous periods shows a similar pattern.

- Medicare data is treated for the COVID-19 vaccination effect.

Applying both caps and age range restrictions erodes the overall relationship between Medicare- and Census-based migration. The review concluded that:

- these factors should be allowed to have values below 1.0, which allows age/sex cells to be reduced where Medicare overestimates Census-based moves, and above 2.0 where Medicare significantly underestimates Census-based moves

- the ages where these factors are applied be increased from the previous ranges of 16 to 35 for males and 16 to 32 for females, to enable the overall relationship between Medicare- and Census-based moves to be better maintained.

The age range where these factors are applied has been increased to 0 to 59 years. To reduce some volatility and considering the previous age restrictions, the new factors for males aged 36 to 59 and females aged 33 to 59 are restrained by taking an average of their unrestrained factors and 1.0. This allows state relativities in the Medicare/Census relationship to be maintained. Factors for ages 60 and over are set to 1.0 (i.e. no adjustment to the Medicare-based data) due to small numbers causing unrealistic volatility.

As a result of these changes, the new factors can increase or decrease Medicare counts of interstate movers aged 0 to 59 years. To reflect this, the previously used terminology of expansion factors has been changed to adjustment factors.