Part E - Allocating institutional units to sectors

2.57.

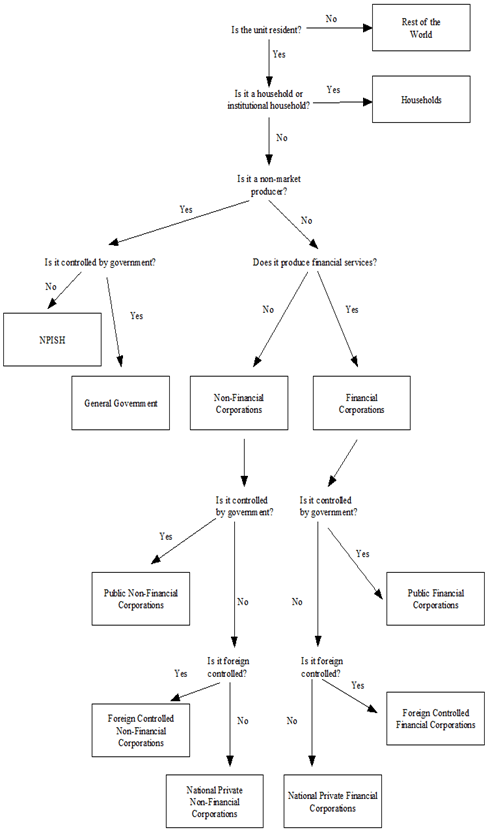

Using the concepts covered in this chapter of residence and institutional units, the following decision tree in Diagram 2.1 assists compilers of GFS to apply the appropriate sector classification to entities. The concepts of government control and market versus non-market production, which are used to allocate units to sectors, are also discussed in this section. The decision tree should be followed from the top and should answer the sequential questions asked to indicate whether the unit should be classified to the Rest of the World (ROW), Households, Non-profit Institutions Serving Households (NPISH), the General Government, Public Non-Financial Corporation or Public Financial Corporation sectors.

Diagram 2.1 - Decision tree for sector classification of public entities

Image

Description

Market and non-market producers

2.58.

To determine if a public sector unit is a public corporation or general government unit, it is necessary to classify it as a market producer (public corporation) or non-market producer (general government). The following indicators are useful when determining whether a government entity is a market or non-market producer. Note that macro-economic statistics are compiled using a principles based framework in Australia. Therefore these indicators are not ranked or weighted as they would be under a rules based approach. Usually two or three of the indicators are used collectively to classify units, although in some cases a single indicator could be sufficient to determine the type of producer. These indicators are designed to consider both the producer's and consumer's point of view to assess whether economically significant prices are being charged:

- What proportion of total production costs (including subsidies) are covered by total sales?

- What government interventions are in place to influence the supply of goods / services?

- Does the producer compete with other providers and/or is the consumer's choice of provider influenced by government interventions?

Market producer

2.59.

A market producer is defined in paragraph 2.65 of the IMF GFSM 2014 as an institutional unit that provides all or most of its output to others at prices that are economically significant. Paragraph 2.66 of the IMF GFSM 2014 defines economically significant prices as prices that have a significant effect on the amounts that producers are willing to supply and on the amounts purchasers wish to buy. These prices normally result when:

- The producer has an incentive to adjust supply either with the goal of making a profit in the long run or, at a minimum, covering capital and other costs; and

- Consumers have the freedom to purchase or not purchase and make the choice on the basis of the prices charged.

2.60.

A comparison between the receipts from sales and the costs of production of goods and / or services sold of an institutional unit over a number of years is recommended in paragraph 2.73 of the IMF GFSM 2014 to determine whether prices charged for the production of goods and / or services can be considered to be economically significant. This will assist to determine whether the institutional unit should be classified as a market or a non-market producer. In this context, the proportion of production costs covered by sales is a strong indicator of whether the unit is a market or non-market producer. It is generally expected that market producers will cover their production costs through sales. Therefore, the lower the ratio the more likely it is that the unit is a non-market producer, conversely the higher the ratio the higher the likelihood that the unit is a market producer. Further to the production costs to sales ratio, prices are considered economically significant if consumers are free to choose whether to buy, and how much to buy, on the basis of the prices charged.

2.61.

The value of sales from sales of goods and services should be measured before any taxes applicable to the products are added (i.e. ETF 1121 to ETF 1124), less all payments received from government (i.e. revenue from current grants and subsidies (ETF 1141)) unless they would be granted to any producer undertaking the same activity (see paragraphs 2.73 and 2.74 of the IMF GFSM 2014). Own-account production is not considered to be part of sales in this context because this activity does not generate receipts from sales.

2.62.

The costs of production include superannuation expenses (ETF 1211 to ETF 1213), other employee expenses (ETF 1221 to ETF 1229), production tax expenses (ETF 1231), use of goods and services (ETF 1233), depreciation (ETF 1241 or ETF 1242). Like for sales, the calculation of the costs of production exclude all costs associated with own-account capital formation (classified to the appropriate category within ETF 76). Subsidies receivable on production are not deducted from the costs of production.

2.63.

Once it is determined that the institutional unit is indeed a market producer, then it can be further classified as either a non-financial corporation or a financial corporation based on the nature of its activity.

Non-market producer

2.64.

A non-market producer is an institutional unit that provides all or most of its output to others for free or at prices that are not economically significant (see paragraph 2.59 of this manual for the definition). A comparison between the receipts from sales and the production costs of goods and / or services sold over a multi-year period needs to be undertaken to assist in identifying whether the unit in question should be classified as a non-market producer.

2.65.

Paragraph 2.71 of the IMF GFSM 2014 states that corporations in receipt of substantial government financial support or other risk-reducing factors such as substantial government guarantees, respond to changes in the economic conditions differently from corporations without such advantages. This is because their budget constraints are softer, and so these types of entities are more likely to be classified as nonmarket producers.

2.66.

Government owned entities supplying goods and services to government are treated as non-market producers if the entity is a dedicated provider of ancillary services. Paragraph 2.45 of the IMF GFSM 2014 defines an ancillary activity as a supporting activity providing services within an enterprise in order to create the conditions within which the principal or secondary activities can be carried out. Ancillary services include keeping records, managing and paying employees, cleaning, maintenance, transportation, and security. Ancillary activities produce mainly services, but in exceptional cases they may sometimes produce goods that do not become a physical part of the marketable products produced by an an enterprise. Entities providing ancillary services generally do not satisfy the criteria to be an institutional unit.

2.67.

It can often be assumed that the producer is not a market producer if the unit provides the goods and services in the absence of competition with private producers, and when the choice of supplier to government is not based on price. This is true regardless of whether the supplier is the only supplier, and whether the government is the only customer of the supplier.

Government control of corporations

2.68.

A corporation is considered to be a public corporation if a government unit, another public corporation, or some combination of government units and public corporations controls the entity. Paragraph 2.107 of the IMF GFSM 2014 states that control of a corporation is defined as the ability to determine the general corporate policy of the corporation. The expression 'general corporate policy' in this context is taken to mean the key financial and operating policies relating to the corporation’s strategic objectives as a market producer, but does not necessarily include the direct control of the day-to-day activities or operations of a particular corporation.

2.69.

In some cases, the existence of government control may not be clear. In Australia, such is the case with some superannuation funds that governments have established for the benefit of their employees. Legislation places responsibility for the day-to-day operation of the superannuation funds with a board of trustees that is created as a separate legal entity. The establishing governments generally receive no monetary benefits from the funds. Although the establishing government has the power, under the legislation, to appoint and dismiss some or all of the trustees, the boards of trustees are typically not under the direction of government, and are required to act in the beneficiaries’ interests and not those of the government. Accordingly, the funds are not considered to be under government control. Although the circumstances of individual funds may vary, in the interest of uniformity, all superannuation funds with arrangements broadly similar to those described are included in the private sector.

2.70.

Instances can arise in which the public and private sectors share ownership of a corporation. In such cases, the corporation is allocated to the sector that has effective control over the determination of the activities and policy of the corporation.

2.71.

Because the arrangements for the control of corporations can vary considerably, the IMF GFSM 2014 has provided guidance to assist in determining whether government control exists over a corporation. Box 2.2 of the IMF GFSM 2014 identifies eight indicators of government control of a corporation. These indicators are not a definitive list of factors, but show the most important and likely factors to consider. Although a single indicator could be sufficient to establish control, in other cases, a number of separate indicators may collectively indicate control. Box 2.1 below reproduces the eight indicators of control which may be used in GFS to determine if a corporation is controlled by government.

Box 2.1 Government control of corporations

In GFS, control is defined as the ability to determine the general corporate policy of the corporation. To determine if a corporation is controlled by the government, the following eight indicators of control should be considered:

- Ownership of the majority of the voting interest - owning a majority of shares will normally constitute control when decisions are made on a one-share one-vote basis. The shares may be held directly or indirectly, and the shares owned by all other public entities should be aggregated. If decisions are not made on a one-share one-vote basis, the classification should be based on whether the shares owned by other public entities provide a majority voice.

- Control of the board or other governing body - the ability to appoint or remove a majority of the board or other governing body as a result of existing legislation, regulation, contractual, or other arrangements will likely constitute control. Even the right to veto proposed appointments can be seen as a form of control if it influences the choices that can be made. If another body is responsible for appointing the directors, it is necessary to examine its composition for public influence. If a government appoints the first set of directors but does not control the appointment of replacement directors, the body would then be part of the public sector until the initial appointments had expired.

- Control of the appointment and removal of key personnel - if control of the board or other governing body is weak, the appointment of key executives, such as the chief executive, chairperson and finance director, may be decisive. Nonexecutive directors may also be relevant if they sit on key committees such as the remuneration committee determining the pay of senior staff.

- Control of key committees of the entity - subcommittees of the board or other governing body could determine the key operating and financial policies of the entity. Majority public sector membership on these subcommittees could constitute control. Such membership can be established under the constitution or other enabling instrument of the corporation.

- Golden shares and options - a government may own a “golden share,” particularly in a corporation that has been privatised. In some cases, this share gives the government some residual rights to protect the interests of the public by, for example, preventing the company selling off some categories of assets or appointing a special director who has strong powers in certain circumstances. A golden share is not of itself indicative of control. If, however, the powers covered by the golden share do confer on the government the ability to determine the general corporate policy of the entity in particular circumstances and those circumstances currently existed, then the entity should be in the public sector from the date in question. The existence of a share purchase option available to a government unit or a public corporation in certain circumstances may also be similar in concept to the golden share arrangement discussed above. It is necessary to consider whether, if the circumstance in which the option may be exercised exists, the volume of shares that may be purchased under the option and the consequences of such exercise means that the government has “the ability to determine the general corporate policy of the entity” by exercising that option. An entity’s status in general should be based on the government’s existing ability to determine corporate policy exercised under normal conditions rather than in exceptional economic or other circumstances such as wars, civil disorders, or natural disasters.

- Regulation and control - the borderline between regulation that applies to all entities within a class or industry group and the control of an individual corporation can be difficult to judge. There are many examples of government involvement through regulation, particularly in areas such as monopolies and privatised utilities. It is possible for regulatory involvement to exist in important areas, such as in price setting, without the entity ceding control of its general corporate policy. Choosing to enter into or continue to operate in a highly regulated environment suggests that the entity is not subject to control. When regulation is so tight as to effectively dictate how the entity performs its business, then it could be a form of control. If an entity retains unilateral discretion as to whether it will take funding from, interact commercially with, or otherwise deal with a public sector entity, the entity has the ultimate ability to determine its own corporate policy and is not controlled by the public sector entity.

- Control by a dominant public sector customer or group of public sector customers - if all of the sales of a corporation are to a single public sector customer or a group of public sector customers, there is clear scope for dominant influence. The presence of a minority private sector customer and/or open competition from private producers to supply goods and services to the public sector usually implies an element of independent decision-making by the corporation so that the entity would not be considered controlled. In general, if there is clear evidence that the corporation could not choose to deal with non-public sector clients because of the public sector influence, then public control is implied.

- Control attached to borrowing from the government - lenders often impose controls as conditions of making loans. If the government imposed controls through lending or issuing guarantees that are more than would be typical when a healthy private sector entity borrows from a bank, control may be indicated. Similarly, control may be implied if only the government was prepared to lend to the corporation.

Although a single indicator could be sufficient to establish control, in other cases, a number of separate indicators may collectively indicate control.

Source: Based on Box 2.2, International Monetary Fund Government Finance Statistics Manual, 2014.

Government control of non-profit institutions

2.72.

Non-profit institutions (NPIs) are defined in the SESCA as legal or social entities created for the purpose of producing goods and services and whose status does not permit them to be a source of income, profit or other financial gain for the units that establish, control, or finance them. NPIs must have an enabling instrument which includes a clause that prohibits the NPI from distributing income, profit or other financial gain to its establishing, controlling or financing unit. Paragraph 2.61 of the IMF GFSM 2014 defines non-profit institutions serving households (NPISH) as resident non-market non-profit institutions (NPIs) that are not controlled by government. These types of units provide goods and services to households for free or at prices that are not economically significant (see paragraph 2.59 of this manual for the definition of economically significant prices). It is important to note that NPISH are out of scope for GFS.

2.73.

Examples of NPISH include political parties, trade unions, consumers’ associations, churches or religious institutions, aid agencies, charities, and environmental groups. Excluded from NPISH are bodies serving similar functions that are controlled by government units. These types of entity are classified as part of the general government sector. Further excluded from NPISH are non-profit institutions engaged in market production (see paragraphs 2.58 to 2.67 of this manual for definitions of market and non-market producers). These types of entities are classified as financial or non-financial corporations depending on the nature of the business activity. Paragraph 2.61 of the IMF GFSM 2014 states that non-market NPIs controlled by foreign governments are classified as NPISHs in the host economy.

2.74.

NPIs may engage in market or non-market production (see paragraphs 2.58 to 2.67 of this manual for the definition of market and non-market producers). Paragraph 2.37 of the IMF GFSM 2014 contains the following guidance on NPIs that are involved in market or non-market activities:

- NPIs engaged in market production charge economically significant prices for their services. Schools, colleges, universities, clinics, hospitals, etc. constituted as NPIs are market producers when they charge fees that are based on their production costs and that are sufficiently high to have a significant influence on the demand for their services. Government payments to these NPIs are treated not as transfers but as payments for services rendered. There are no shareholders with a claim on the profits or equity of the NPI. Because of their status as NPIs, they are also able to raise significant additional funds through donations from persons, corporations, or governments. Nevertheless, NPIs that are engaged in market production and are controlled by government units must be treated as public corporations so long as they produce goods and services for the market at economically significant prices.

- Some market NPIs restrict their activities to serving a particular subset of other market producers. These consist of chambers of commerce, agricultural, manufacturing or trade associations, employers’ organisations, research or testing laboratories, or other organisations or institutions that engage in activities that are of common interest or benefit to the group of enterprises that control and finance them. These NPIs are usually financed by contributions or subscriptions from the group of enterprises concerned. Such subscriptions are treated not as transfers but as payments for services rendered and these NPIs are classified as market producers. These market NPIs are, like corporations and quasi-corporations, members of either the non-financial corporations sector or the financial corporations sector.

- NPIs that are engaged in non-market production, and are controlled by government. Schools, colleges, universities, clinics, hospitals, etc. constituted as NPIs are non-market producers only when they charge fees at prices that are not economically significant. These units are treated as general government units.

- The remaining NPIs, those that produce goods and services which are not sold at economically significant prices and are not controlled by government, are classified as a special group of units called NPIs serving households (NPISHs). These fall outside of the scope of the GFS system.