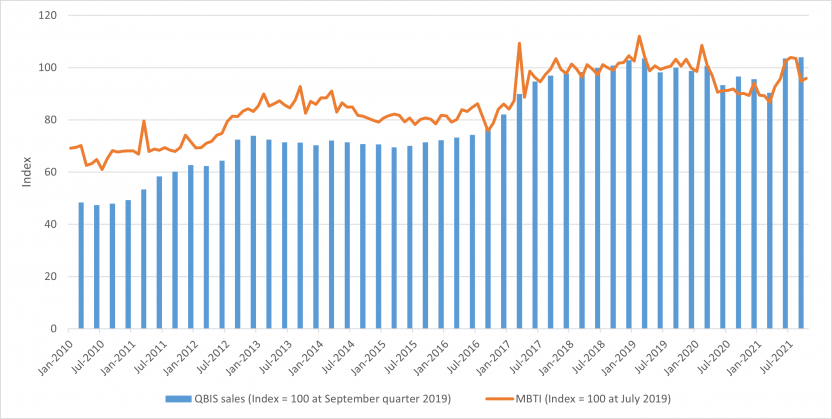

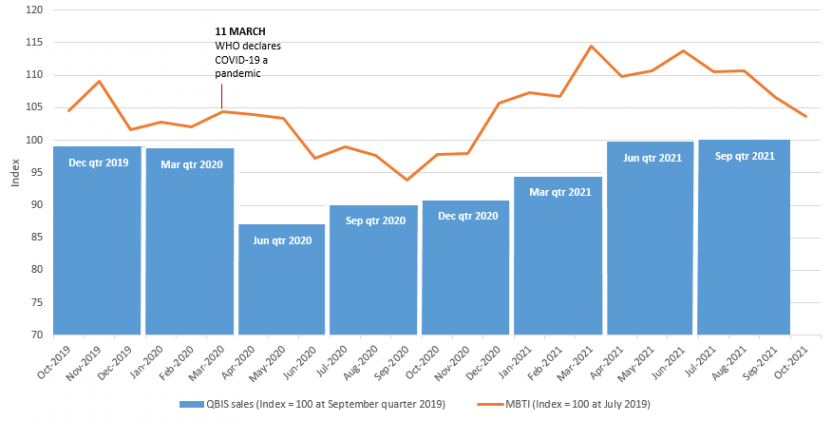

The ABS recently released the Monthly Business Turnover Indicator (MBTI), which uses Australian Taxation Office (ATO) Business Activity Statement (BAS) data to provide timely and more frequent insights into changes in economic activity.

The MBTI is one measure of changes in sales or business turnover produced by the ABS. Another measure currently produced is ‘Sales of goods and services’ from the quarterly Business Indicators survey (QBIS). The outputs from QBIS include a range of statistics relating to private sector businesses including company profits, the book value of inventories, and wages and salaries. Sales data from QBIS is used as an indicator of output for most industries in the quarterly National Accounts.

This article compares the MBTI with QBIS sales across three dimensions (scope and coverage, conceptual alignment, and timeliness) to provide users with some of the key advantages and differences between the two series.

| MBTI | QBIS sales | |

|---|---|---|

| Frequency | Monthly | Quarterly |

| Timeliness | Released approximately six weeks after the end of the reference month | Released approximately 8 weeks after the end of the reference quarter |

| Inclusion of public corporations | Yes | No – private sector only in scope |

| Coverage | Monthly BAS remitters | Excludes micro non-employing businesses |

| Alignment with concept of output from the Australian System of National Accounts | Less aligned as the source data is not created for statistical purposes | Better - The survey allows data collected to be aligned with ASNA concepts |

| Industry data | 13 of the 18 ANZSIC industry divisions | 15 of the 18 ANZSIC industry divisions |

| State dimension | No | Yes |

| Range of measures available | MBTI index and monthly movement only | Range of measures including sales, wages, profits and inventories |

| Publication | Monthly Business Turnover Indicator | Business Indicators, Australia |