Trade system, valuation and time of recording

Introduction

3.1 The scope and coverage of Australia's international merchandise trade statistics are explained in the Scope, Coverage and Treatments chapter. This chapter on the Trade System, Valuation and Time of Recording, covers the remaining aspects of the conceptual framework: the trade system; valuation; and time of recording of imports and exports. Statistical users should use both chapters to gain a full appreciation of the basis upon which the statistics are compiled.

Trade systems

3.2 There are two internationally recognised systems for compiling international merchandise trade statistics: the general trade system; and the special trade system. The difference between them lies mainly in the way goods passing through the Department of Home Affairs warehouses (or 'customs free zones') are treated. The alternative systems give rise to differences in the timing of recording trade flows.

The general trade system

3.3 The general trade system used by the ABS records the movement of goods as they enter or leave the country. Under this system, imports comprise goods entered directly for home consumption, including re-imports, together with goods imported into Department of Home Affairs warehouses. Exports include all goods moving out of the country and comprise both domestic goods and re-exports of foreign goods.

3.4 Re-imports are goods originally exported, which are subsequently imported in either the same condition in which they were exported, or after undergoing repair or minor operation which leaves them essentially unchanged. Minor operations include blending, packaging, bottling, cleaning and sorting.

3.5 Re-exports are goods originally imported, which are exported in either the same condition in which they were imported, or after undergoing repair or minor alterations which leave them essentially unchanged. Re-exports are not considered the production or manufacture of the country which originally imported the goods. Minor operations include blending, packaging, bottling, cleaning and sorting.

3.6 In Australia's international merchandise trade statistics, re-imports are identified as the data item where Country of Origin is recorded as Australia and re-exports are identified with a State of Origin of Re-exports.

The special trade system

3.7 The special trade system records the clearance of goods by the Department of Home Affairs authorities. Imports are recorded at the point when the goods are cleared for home consumption. Under this system, imports comprise goods entered directly for home consumption, together with goods cleared from the Department of Home Affairs warehouses. Exports include all goods exported and comprise both domestic goods and re-exports of foreign goods.

3.8 The special trade system is used by the European Union and Indonesia. An Australian export to a warehouse in the European Union is not declared as an import until the imported goods are released for free circulation or consumption. Goods exported to Indonesia's Batam Island bonded processing zone are not recorded as Indonesian imports unless the goods are released for use in the rest of Indonesia. A number of other countries have established similar processing zones.

3.9 Australia's international merchandise import statistics are available on the special trade basis if statistics are required on imports entering the statistical territory for home consumption. These are called import clearances (see paragraph 10.22 of the Data Dissemination chapter). While there are some instances where a valid export declaration is required to be submitted before goods for export can be released from a Department of Home Affairs warehouse, Australia does not separately compile or publish statistics about these movements.

Valuation

3.10 The WTO Agreement on customs valuation defines the rules on customs value for imported goods. Broadly speaking the rules say that the customs value is the transaction value, which is the price actually paid or payable for the goods when sold for export to the country of importation, provided that certain conditions for a fair, uniform and neutral valuation are met. This is usually the market price (the basic valuation reference in the system of national accounts), or a very close approximation to it, which is recorded in the accounts of the transactors or in the administrative records used as data sources. The market price is the amount of money that a willing buyer pays to acquire something from a willing seller, when such an exchange is between independent parties and involves only commercial considerations.

3.11 For Australia's international merchandise trade statistics the transaction value is used. If the transaction value reported by the exporter/importer does not meet the conditions described in the preceding paragraph (see paragraph 3.10), the WTO Agreement prescribes a hierarchy of valuation methods (see paragraph 3.17 in the Customs Value section below).

Point of valuation

3.12 Delivery of goods by the exporter to the importer may occur at any time and place, from the point at which the goods are produced, to the point at which they are finally used. The UN guidelines recommend the use of a cost, insurance and freight (CIF) type valuation for imports (i.e. the value at the border of the importing country) and a free on board (FOB) type valuation for exports (i.e. the value at the border of the exporting country). The point of valuation is independent of the time payment is made or received, but may occur at the same time.

3.13 In Australia, import statistics are published using the customs value, (described below) which is a FOB type value, but imports on a CIF basis are also available (see paragraph 3.19 in the Other Import Values section below). Export statistics are published on a FOB type basis, and the transaction values reported are assessed to be the most practical approximation of market price.

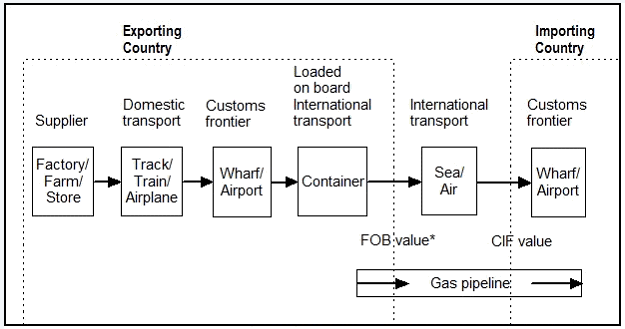

3.14 A FOB price at the customs frontier includes the transaction value of the goods, the value of outside packaging (other than international containers used for containerised cargo), and related distributive services used, up to and including loading the goods onto the carrier at the customs frontier of the exporting country. A FOB type point of valuation applies whether the goods are transported by sea, air or pipeline. The CIF price is equal to the FOB transaction value, plus the cost of freight and merchandise insurance involved in transporting the goods beyond the place of export to the customs frontier of the importing country. The movement of goods across customs frontiers and the appropriate points of valuation are shown in Diagram 3.1.

Diagram 3.1 Physical movement of goods

Image

Description

* The Fob valuation point for gas being transported via pipeline is as it enters the pipeline although this may depend on contractual agreements.

3.15 The point of valuation for goods transported via pipeline can also be considered in terms of the FOB or CIF type valuation. These goods while not loaded onto a ship or aircraft for international transportation can still be valued at the time they enter the pipeline (approximation for valuation point at the frontier of the exporting country (FOB type)) and their arrival at the frontier of the importing country (CIF type).

Customs value

3.16 The conceptual basis for the Australian customs value is defined by the Department of Home Affairs. The starting point for establishing the customs value is the price actually paid or payable to the supplier (transaction value), provided a number of conditions are met. The most important of these is that the buyer and seller are not related, or where they are related that the relationship has not affected the price of the imported goods.

3.17 If the Department of Home Affairs determines that the reported transactions value does not meet the requirement for a fair, uniform and neutral valuation they will use one of the following methods to replace the value. These methods are consistent with the rules in the WTO Agreement on customs valuation.

- identical goods value - the value of identical goods sold for export to Australia

- similar goods value - the value of similar goods sold for export to Australia

- deductive value - the price of identical or similar goods placed for sale in Australia. To determine the deductive value the price must be reduced by the value of costs incurred between the place of export and the time of sale in Australia

- computed value - a method to calculate the value of producing the goods, plus any costs relating to importation including profits

- fall-back value - if in the event that there is no suitable method for valuing the goods, the Department of Home Affairs will decide on the value by taking into account the above methods and any other related information.

3.18 The customs value (which in Australia's case is a FOB valuation) does not include the international freight and international insurance costs involved in transporting the goods from the place of export (see the Department of Home Affairs publication, Valuation of Imported Goods). However, any inland freight and inland insurance costs incurred by the purchaser before the goods leave the place of export are included in the customs value.

Other import values

3.19 Importers who import goods with values above the customs thresholds described in the Scope, Coverage and Treatments chapter (paragraph 2.7) are required to complete a full imports declaration. Included on all import declarations are the customs value for each commodity as well as the total customs, FOB and CIF values for the consignment. The ABS processing system models the CIF and FOB per line item (commodity) using the ratio between customs, FOB and CIF values for the entire consignment. All three imports values are available in international merchandise trade statistics, however only customs value is available on Imports Clearances, see Table 10.1 in the Data Dissemination chapter.

Currency conversion

3.20 The compilation of international merchandise trade statistics can be complicated by the fact that transaction values may initially be expressed in a variety of currencies. The conversion of these values into a single currency is a prerequisite for the compilation of consistent and meaningful statistics. In Australia's case, the data are presented in terms of Australian dollars, though for international comparisons it is customary to convert to US dollars. For countries where the exchange rate is volatile it may be more meaningful to present the time series in US dollars.

3.21 In Australia, import values are reported to the Department of Home Affairs in the invoice currency of the transaction. The Integrated Cargo System (ICS) automatically converts the values to Australian dollars, using exchange rates applicable on the date of export. The rates used are the daily average selling rates of currencies against the Australian dollar, as advised by the Reserve Bank of Australia (RBA). The ABS receives details of the reported invoice currency, together with the value of the import transaction in Australian dollars.

3.22 From October 2004, for export transactions, the FOB value must be reported to the Department of Home Affairs in the currency used on the invoice for the goods, provided it is one of twenty-eight allowable foreign currencies or Australian dollars. Appendix 4 (in the Downloads tab) shows the twenty-eight foreign currencies that the Department of Home Affairs allows export reporters to report in. Goods invoiced in all other currencies need to be converted to Australian dollars by the exporter or their agent.

3.23 The ABS receives export data as reported to the Department of Home and converts any values reported in one of the accepted foreign currencies to Australian dollars. This conversion uses an indicative reference rate supplied daily by the RBA that applied on the date of departure of the goods from Australia. The invoice currency in which the transaction was negotiated and sold is also reported to the Department of Home Affairs.

Time of recording

3.24 Australia's exported goods are generally recorded at the time of shipment. Imports are recorded when the Department of Home Affairs first finalises the processing of the relevant import declarations. The time of recording of exports and imports is explained more fully in Table 3.2 below.

| Exports | |

|---|---|

| |

| |

| |

| Imports | |

| |

| |

| |

| |