This page is designed to assist providers in the completion of the Survey of Foreign Currency Exposure – Form 1FCE. This survey collects information on foreign currency denominated financial assets and liabilities and future estimated/forecasted foreign currency denominated receipts and payments. It details the extent to which they are hedged and the hedging policy used.

This survey is used in the compilation of aggregated data on Australian resident enterprises’ foreign currency exposure and the risk management practices associated with that exposure.

The Survey of Foreign Currency Exposure was previously conducted in March 2017 and published as Foreign Currency Exposure, Australia, March Quarter 2017.

Queries regarding the Survey of Foreign Currency Exposure may be directed to the following number: 1800 206 696

Explanatory notes

1. Reporting arrangements

1.1

The Survey of Foreign Currency Exposure (Form 1FCE) is completed by the top Australian entity within an enterprise on behalf of the enterprise group. For definitions of an enterprise and an enterprise group see Note 2.1.

1.2

A separate Form 1FCE is sent to the appropriate entities within your Australian enterprise group (see Note 2.1 on page 4) that have been selected for the survey. A separate Form 1FCE should still be completed for each different Standard Institutional Sector Classification of Australia (SISCA) sub-sector.

The institutional sub-sectors generally applying to Form 1FCE are:

- Financial Corporations

- Banks

- Other depository corporations

- Reserve Bank of Australia

- Central borrowing authorities

- Other financial corporations

- Non-financial corporations

- General government

Further information on SISCA subsectors can be found here or by searching for the release ‘Standard Economic Sector Classifications of Australia’ on the ABS website.

1.3

The 1FCE has several key distinctions from the Survey of International Investment (SII, Form 90) and Survey of International Trade in Services (SITS) collections. Some differences are:

- Form 1FCE seeks to obtain data on activities with resident counterparties as well as non-resident counterparties only when the transaction is denominated in a foreign currency.

Form 1FCE also includes:

- Forecasted foreign-currency-denominated receipts and payments from trade in goods and services;

- The notional value of outstanding derivative contracts with a foreign currency component; and

- The policies enterprises adopted on hedging foreign currency exposure.

This may mean that certain enterprises within your group which were not involved in the quarterly SITS/SII may be required to report for this collection. This would be the case for example if an enterprise has foreign currency dealings with resident counterparties only. The similarities between Form 1FCE and Form 90 are discussed in Note 3.5.

If you have any queries regarding the reporting arrangements for this collection, please contact the Australian Bureau of Statistics on the number listed on the front page of the Form 1FCE.

2. General notes on questions

2.1 Australian enterprise

An Australian enterprise consists of all the entities within an Australian enterprise group that are in the same SISCA subsector. An Australian enterprise group consists of an Australian parent enterprise (the top Australian enterprise), its Australian branches and its Australian subsidiaries as defined by the Corporations Act 2001.

If you are unsure of the entities that make up your enterprise group, the ABS can provide a list of ABNs that are included in your enterprise group. This list was also included in the induction letter sent to your company.

2.2 All values should be reported in thousands of Australian dollars.

All values should be reported in thousands of Australian dollars. Positions denominated in foreign currency should be converted to Australian dollars at the midpoint of the appropriate buy and sell rates applicable on 31 March 2022.

2.3 Residents and non-residents

A resident is any individual, enterprise or other organisation ordinarily domiciled in Australia.

- Australian registered branches and incorporated subsidiaries of foreign enterprises are regarded as Australian residents.

A non-resident is any individual, enterprise or other organisation ordinarily domiciled in a country other than Australia.

- Foreign branches and foreign subsidiaries of Australian enterprises are regarded as non-residents; and

- Residents of Norfolk Island and other external territories of Australia are regarded as non-residents.

2.4 Institutional sector of resident counterparties

Throughout this form you are asked to record details of activities with resident counterparties by the institutional sector of these counterparties. The institutional sectors of resident counterparties applying to this collection are as follows:

- Banks (as licensed by APRA);

- Other depository corporations (see Note 2.5);

- Reserve Bank of Australia;

- Central borrowing authorities (see Note 2.6 on page 5);

- Other financial corporations (see Note 2.7 on page 5);

- Non-financial corporations (see Note 2.8 on page 5); and

- General government (see Note 2.9 on page 5).

It should be noted that the sector of resident counterparty detail sought throughout the form is the sector of the entity that your enterprise is physically dealing with, not the sector of that entity’s parent enterprise.

If data by sector of resident counterparty are not readily available, please contact the ABS on the number listed on the front page of 1FCE.

2.5 Other depository corporations

Other depository corporations are those non-bank financial intermediaries with liabilities included in The Reserve Bank of Australia’s definition of broad money. This includes non-bank Authorised Deposit Taking Institutions (ADIs) such as building societies, credit unions and cash management trusts. Financial corporations registered under the Financial Sector (Collection of Data) Act 2001 Registered Financial Corporations (RFCs), which include money market corporations and Other Category RFCs, also fall into this sector.

2.6 Central borrowing authorities

Central borrowing authorities refer to corporations established by state and territory governments to provide finance for government authorities and to manage their surplus funds.

2.7 Other financial corporations

Other financial corporations include:

- Life insurance and pension funds;

- Other insurance corporations;

- Financial auxiliaries (for example: fund managers, security brokers and loan brokers); and

- Other financial institutions (which includes securitisers and mortgage brokers, fixed interest and equity unit trusts)

2.8 Non-financial corporations

Non-financial corporations include both public and private corporations and cover all resident corporations engaged in the production of market goods and/or nonfinancial services and holding companies with mainly non-financial corporations as subsidiaries.

2.9 General government

General government includes federal, state and local general government agencies. It excludes non-financial corporations (both public and private) and public marketing authorities as these are included in the ‘Other resident sectors’ grouping.

2.10 Institutional sector grouping of non-resident counterparties

Throughout this form you are asked to record details of activities with non-resident counterparties by the institutional sector of these counterparties. The institutional sectors of non-resident counterparties applying to this collection are as follows:

- Banks;

- Other;

If data by sector of non-resident counterparty are not readily available, please contact the ABS on the number listed on the front page of 1FCE.

2.11 All values should be reported in thousands of Australian dollars.

All values should be reported in thousands of Australian dollars. This requirement is consistent with the Survey of International Investment and Survey of International Trade in Services collections.

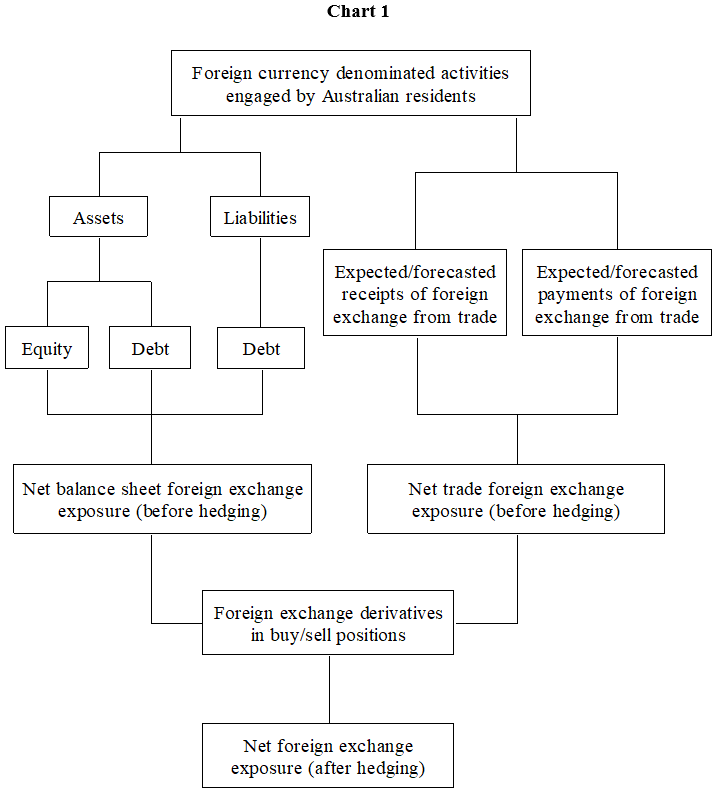

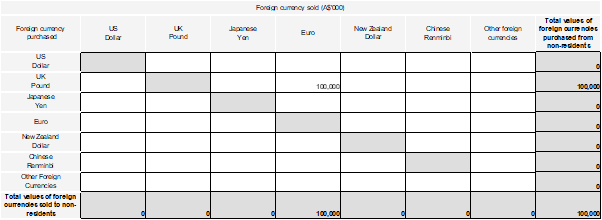

2.12 Chart 1

Chart 1 provides a schematic diagram describing the foreign currency denominated activities undertaken by Australian residents and the potential for foreign currency derivatives to impact net foreign currency exposures.

Chart 1

3. Notes on Parts A, B, C, D

3.1 Equity

Equity for the purposes of this survey is defined as all classes of shares or units on issue.

Including:

- Net equity held in joint ventures and other unincorporated enterprises.

Excluding:

- Non-participating preference shares.

3.2 Debt assets and debt liabilities

Debt assets and debt liabilities should include all non-equity balance sheet assets and liabilities, such as, but not limited to:

- Cash and deposits;

- Short term instruments, i.e. certificates of deposit, convertible and non-convertible securities, promissory notes, bills of exchange, other short-term commercial and financial paper;

- Long term instruments, i.e. non-participating preference shares, bonds, asset backed securities, bearer depository receipts, loans, debentures;

- Trade credits payables and receivables, which are accounts payable or receivable by your Australian enterprise group for the import or export of goods and services; and:

- Prepayments made for future imports or exports of goods and services.

3.3

Parts A, B, C & D collect information about financial claims on and liabilities to residents and non-residents that are denominated in foreign currencies.

Including:

- All foreign denominated financial claims and liabilities that are shown in your books and which you have either acquired yourself or have arranged through a financial intermediary.

- All foreign currency denominated financial claims and liabilities acquired using funds managed by your enterprise group on behalf of other Australian enterprise groups, governments or individuals.

Excluding:

- All financial assets and liabilities that your Australian enterprise has negotiated on behalf of others and which are not shown in your books (unless you are a fund manager).

- All investments that are being managed on behalf of your Australian enterprise by an independent fund manager in Australia (Such investments will be reported separately by the relevant fund manager/s).

- The market values of derivative instruments held by your Australian enterprise.

For example, an Australian company issuing a bond denominated in USD would be issuing a foreign currency denominated debt liability. Similarly, if the company was purchasing the issue of the bond denominated in USD from a foreign entity, this would increase the company’s holdings of their foreign currency denominated debt assets.

3.4

Parts A, B, C & D use market valuations only. If this is not available, estimate using one of the following methods:

Market value of equity for unlisted enterprises: use

- A recent transaction price;

- Director’s valuation; or

- Net asset value: where net asset value is equal to total assets, including intangibles, less liabilities, including the paid value of ordinary shares. Assets and liabilities should be recorded at book value as reported on your balance sheet.

Market value for net equity of head office in branch: report the total assets of the branch at book value less liabilities. Liabilities include retained earnings revaluation and other reserves as well as capital invested by the head office.

Market value of securities/debt instruments: use the traded price as of 31 March 2022. If this is not available, estimate using (in order of preference) the following methods:

- Yield to maturity method;

- Discounted net present value;

- Face value less written down value;

- Issue price plus amortisation of discount on the bond; or

- Another mark to market method.

Market value of loans, trade credits, deposits and other instruments: use nominal (face) value as an approximation for market value unless book values have been revalued. If further clarification is required, please contact the ABS on the numbers listed on the front page of 1FCE.

3.5

If the enterprise group also currently receives the Survey of International Investment (SII) as of 31 March 2022:

- Foreign currency denominated financial debt liabilities to non-residents should be identical to the foreign currency data reported collectively in Parts D and E of questions 6-13 in SII Form 90 for the quarter ended 31 March 2022, or questions 1b and 2b of Part A of Forms 52 and 53.

- Foreign equity assets should be identical to the foreign currency data reported collectively in questions 14 and 15 (Part F) in the SII Form 90 for the quarter ended 31 March 2022.

- Foreign currency denominated financial debt assets with non-residents should be identical to the foreign currency data reported collectively in Parts H and I of questions 17–24 in SII Form 90 for the quarter ended 31 March 2022.

All foreign currency denominated debt assets and liabilities refer to the currency (of the closing positions) in which the assets or liabilities are likely to be repaid.

3.6

In Question 2 (Part B) and Question 6 (Part D) the mutually exclusive hedging categories are:

- Value fully hedged by derivatives;

- Value partially hedged by derivatives;

- Value naturally hedged;

- Value hedged by overseas affiliate;

- Other values hedged; and

- Value of all unhedged

The examples below illustrate how the different approaches to hedging should be reported in this section. Note that these are illustrative examples only. If further assistance is required for this section, please contact the ABS on the number listed on the front page of 1FCE.

For all examples in this section suppose that at acquisition date t = 0, the exchange rate is 1 AUD = 0.9 USD. At reporting date t = 1, suppose that the exchange rate has appreciated to 1 AUD = 1 USD.

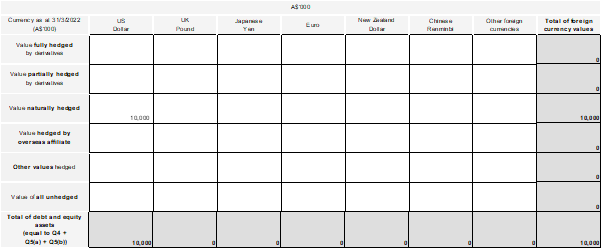

Example 1: Fully hedged by derivatives

A resident enterprise purchases equities in a US resident company worth US$18 million (A$20 million) at time t = 0. They then enter into a currency futures position worth US$18 million to remove the risk associated with currency volatility.

At t = 1, the AUD appreciation means that the $US18 million equity asset is now worth A$18 million. The entire A$18 million is reported as ‘fully hedged’.

Amounts hedged by an overseas affiliate should be reported in the category ‘Value hedged by overseas affiliate’; see example 4.

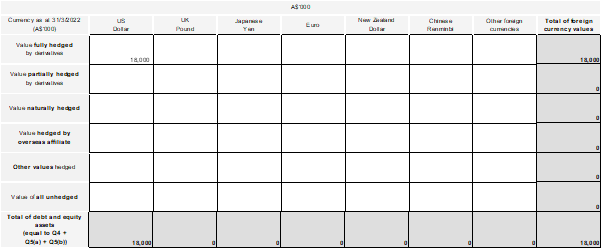

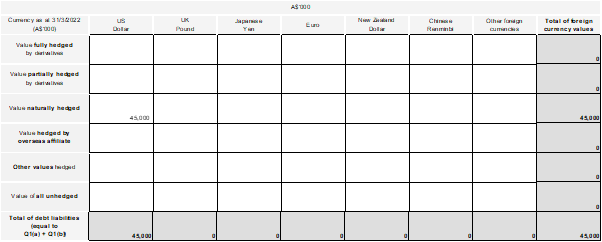

This would be reported in Question 6 (Part D) as follows:

Question 6 (Part D)

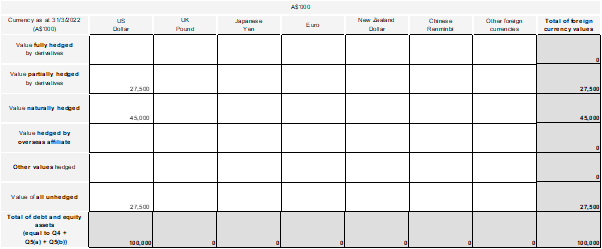

Example 2: Partially hedged by derivatives

A resident enterprise issues a US$100 million bond at t = 0. They enter into a cross currency basis swap with a notional value of US$80 million to partially hedge the US$100 million bond (A$111 million).

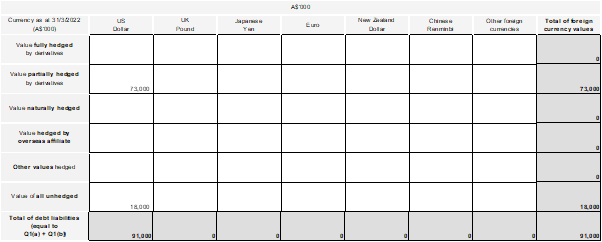

At t = 1, the US$100 million liabilities exposure is now worth A$91 million and is 80% hedged. The 80% hedged amount (A$73 million) is reported in the ‘partially hedged’ category and the remaining 20% (A$18 million) is categorised as ‘all unhedged’. These would be reported in Question 2 (Part B) as follows:

Question 2 (Part B)

Amounts hedged by an overseas affiliate should be reported in the category ‘Value hedged by overseas affiliate’; see example 4.

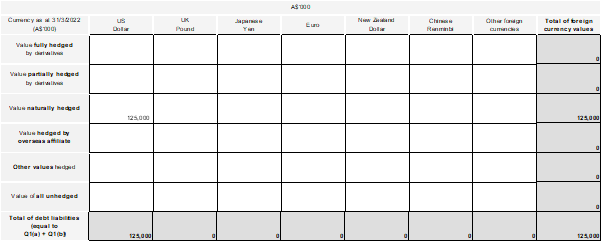

Example 3: Naturally hedged

Natural hedging refers to carrying out two different types of transactions that have opposite movements in order to reduce the underlying risk in one or both transactions. Any portfolio of assets and liabilities that has both assets and liabilities denominated in the same foreign currency in order to offset their respective movements is covered under natural hedging; when positions are naturally hedged this way, the asset and liability positions move by similar proportions. The destination counterparty with which natural hedging is conducted with does not matter. This is in contrast to any hedging that uses financial derivatives which is referred in 1FCE as derivatives hedging.

Amounts that are fully hedged, partially hedged or hedged by an overseas affiliate should be reported in their respective categories; see examples 1, 2 and 4.

For example, an Australian company may borrow USD $10m to fund the purchase of equipment in the US. In this case the loan (liability) offsets the equipment (asset) purchased.

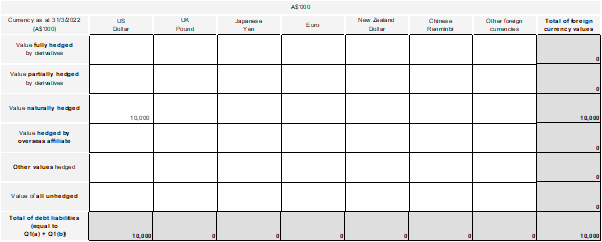

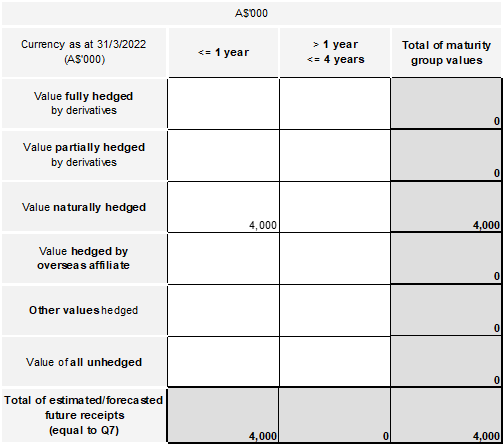

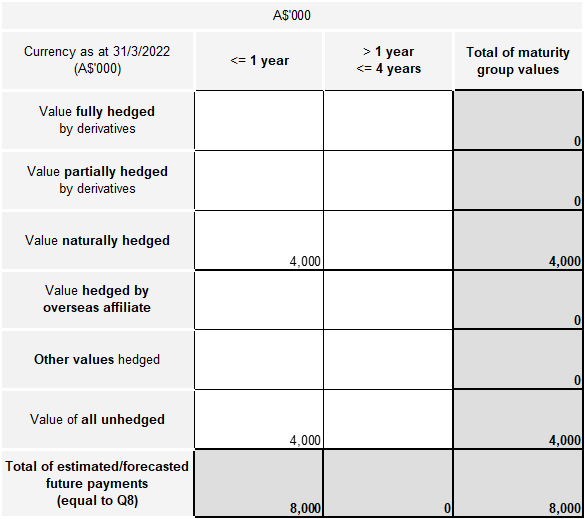

This would be reported in Question 2 (Part B) and Question 6 (Part D) respectively as follows:

Question 2 (Part B):

Question 6 (Part D):

Please see note 5.3 below for the further breakdown required for hedging foreign currency receipts and payments for this example.

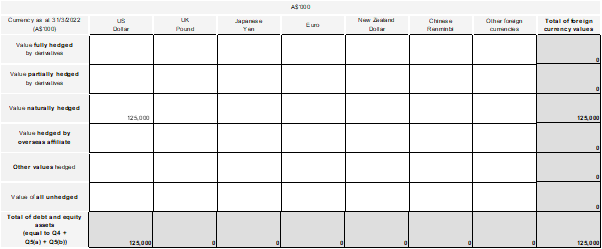

A natural hedge may also be created via formal hedging activity. For example, a resident company has US$125 million in assets and £100 million in liabilities. Assuming an exchange rate of 1 USD = 0.8 GBP, the company may choose to take out a futures contract to buy US$125 million for £100 million. The futures contact effectively pegs the US asset to the UK liability in US Dollars. These amounts form a natural hedge against each other back to the Australian dollar. This would be recorded in Question 2 (Part B) and Question 6 (Part D) respectively as follows.

Question 2 (Part B):

Question 6 (Part D):

Other examples of natural hedging may include the following:

- An Australian company buying raw materials from a foreign supplier (e.g. China) can also sell its product in China, generating receivables denominated in Chinese yuan. Any gains in the AUD against the yuan will decrease the value of the accounts receivable along with the value of the accounts payable.

- An Australian trader purchases stock on the London Stock Exchange. They fund the purchase with a loan denominated in pounds. The asset (stock purchased on the London Stock Exchange) and the liability (loan in pounds) are again kept in the same currency.

This list is not exhaustive; if further assistance is required on this section, please contact the number on the front page of the form.

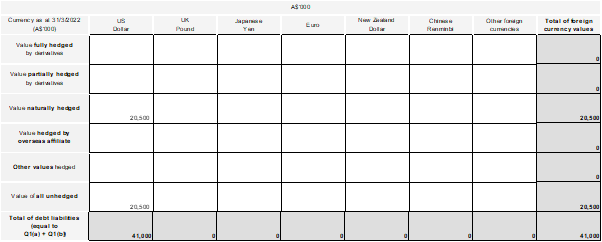

Example 4: Hedged by overseas affiliate

A resident company borrows US$45 (A$50 million) at time t = 0. The US head office of the resident company enters into a currency futures position worth US$22.5 million to partially hedge the US$45 million loan on the resident company’s behalf.

At t = 1, the AUD appreciation means that the $US45 million debt liability is now worth A$41 million and is 50% hedged. The 50% hedged amount (A$20.5 million) is reported in the ‘hedged by overseas affiliate’ category and the remaining 50% (A$20.5 million) is categorised as ‘all unhedged’.

This would be reported in Question 2 (Part B) as follows:

Question 2 (Part B)

In addition to this example, please report hedging undertaken by overseas affiliates on behalf of the resident enterprise group as per examples 1, 2 or 3, under formalised hedging (i.e. hedging using derivatives), natural hedging, or a combination of the above.

Example 5: Hedged as part of a portfolio containing assets and liabilities

At t = 0 a company has a portfolio of US$ denominated bonds, equities (assets) and debt liabilities, worth US$55 million (US$100 million of assets less US$45 million debt). The company hedges 50% of this portfolio back to A$ using derivatives.

At t = 1 the portfolio’s net exposure is now A$55 million (A$100 million of assets less A$45 million debt). In Question 2 (Part B), A$45 million of the liability exposure is ‘naturally hedged’. In Question 6 (Part D), A$45 million of the asset position is ‘naturally hedged’, A$27.5 million is hedged using derivatives and included in ‘partially hedged’. The remaining A$27.5 million is unhedged and included in ‘all unhedged’.

This would be reported in both Question 2 (Part B) and Question 6 (Part D) respectively as follows:

Question 2 (Part B)

Question 6 (Part D)

3.7 Maturity matching

Maturity matching occurs when financial instruments are purchased with the intention of offsetting the foreign currency risk of an asset or liability over a set time period or a particular point in time. If an enterprise group has internal policies for recognising maturity matching then they should apply. However, if they do not have internal policies then the below guidelines may be applied:

- For assets/liabilities with an original maturity less than or equal to 1 year, maturity matching would involve maturities that are matched to less than 90 days.

- For assets/liabilities with an original maturity more than 1 year but less than or equal to 5 years, maturity matching would be within a few months.

- For assets/liabilities with an original maturity more than 5 years, maturity matching would be within a six month period.

If the asset/liability has an option imbedded in its structure then the matching should occur to the first put/call date instead of the legal maturity date.

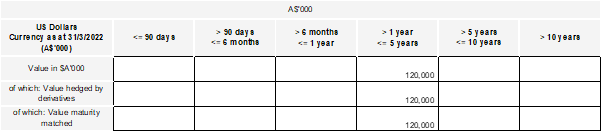

Example 6: Maturity matching

At t=0, a resident enterprise borrows US$200 million with an original maturity of 10 years. US$3 million repayments on the loan are due every month.

At t=1, the residual maturity of the loan is 5 years and the market value of the loan is $US120 million. The company has a policy of hedging 100% of all liabilities and takes out a cross-currency swap to buy US$9 million every 90 days for five years. Since the company does not have a specific policy of maturity matching, the guidelines listed above were used. The loan is deemed to be maturity matched as the derivative matches the repayments to within a few months over the 5 year period.

This question would be completed in Question 3(a) (Part B) as follows:

Question 3(a) (Part B)

3.8

Question 3 (Part B) seeks further information on the short and long term hedging practices associated with wholesale debt funding. In particular, it asks for information on the value of foreign currency exposures that are hedged back to AUD using derivatives. It also seeks information on the extent to which these exposures are currency and/or maturity matched (see note 3.9 below).

3.9

Maturity groups in this form are based on the residual maturity of the foreign currency debt liabilities and not the original maturity of the foreign currency debt liabilities. The maturity groups listed on the form are as follows:

| Maturity Groups | |

|---|---|

| <= 90 days | Less than or equal to 90 days to maturity |

| > 90 days <= 6 months | Greater than 90 days or less than or equal to 6 months to maturity |

| > 6 months <= 1 year | Greater than 6 months or less than or equal to 1 year to maturity |

| > 1 year <= 5 years | Greater than 1 year or less than or equal to 5 years to maturity |

| > 5 years <= 10 years | Greater than 5 year or less than or equal to 10 years to maturity |

| > 10 years | Greater than 10 years to maturity |

4. Notes on Part E

4.1

Part E collects information about estimated/forecasted future foreign currency denominated receipts and payments arising from trade in goods and services for the period following 31 March 2022. Please include all estimated/forecasted receipts and payments denominated in foreign currencies, not just those which you have already hedged, or expect to hedge through financial derivative contracts.

Please do not include any receipts and payments already reported in Parts A, B, C or D, or those arising from the following:

- Estimated/forecasted future interest & dividends resulting in increases and/or decrease in the levels of financial assets and liabilities;

- Future settlements of outstanding derivative contracts; or

- Future investment income flows arising from existing financial assets and liabilities.

Accurate estimates of future receipts and payments may be difficult to evaluate; please provide estimates where possible. If further assistance is required for this section please contact the ABS on the number listed on the front page of 1FCE.

4.2

Examples of estimated/forecasted foreign currency denominated receipts and payments that should be incorporated into estimates include:

- Fees for services:

- Agricultural, mining and on-site processing services (including project management);

- Computer and information services;

- Construction services;

- Engineering services;

- Transport services;

- Financial services;

- Personal, cultural and recreational services

- Financial services includes:

- Financial, intermediary and auxiliary services denominated in foreign currency.

- Letters of credit

- Bankers’ acceptances

- Lines of credit

- Financial leasing

- Foreign exchange transactions

- Commissions and other fees related to transactions in securities

- Commissions of commodity futures traders

- Services related to asset management

- Financial market operational and regulatory services

- Security custody services.

- Financial services excludes:

- Interest and dividends

- Items included in trade debtors and trade creditors reported in Parts A and C of the form.

4.3

Future receipts and payment groups in this form are broken down into the two following categories:

| Time Horizon Groups | |

|---|---|

| <= 1 year | Receipts or payments estimated/forecasted less than or equal to 1 year in the future. |

| > 1 year <= 4 years | Receipts or payments estimated/forecasted more than 1 year or less than or equal to 4 years in the future. |

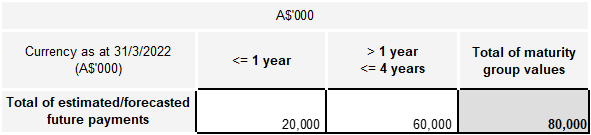

Example 7: Future foreign currency denominated payments

An enterprise paying for a 4 year contract for services worth US$20 million a year will be broken down as follows, assuming the exchange rate at time t = 1 is 1 AUD = 1 USD and the contract is paid in annual instalments:

Example 7: Future foreign currency denominated payments

5. Notes on Part F

5.1

Part F collects information about hedging of estimated/forecasted future foreign currency denominated receipts and payments arising from the trade in goods and services in the period following 31 March 2022. Please include all estimated/forecasted receipts and payments and not just existing receipts and payments currently hedged through financial derivative contracts.

5.2

The different time horizon groups in which future foreign currency receipts and payments are to be estimated/forecasted are listed in note 4.3.

5.3

For the various types of hedging to be included in this question see the examples in part 3.6, as well as the one below for natural hedging:

Example 8: Hedging of future foreign currency denominated receipts

A resident company intends to purchase input materials from a US supplier worth US$9 million (A$10 million). It also expects to sell US$4.5 million (A$5 million) of its products back into US dollars within a year. An appreciation of the AUD against the USD at t=1 simultaneously decreases the cost of the input materials from the supplier to A$8 million and the price of the final product sold to A$4 million.

For natural hedging on receipts (Question 9) A$4 million is reported in the ‘naturally hedged’ category:

Question 9

For natural hedging on payments (Question 10) A$4 million is reported in the ‘naturally hedged’ category and the remaining A$4 million is reported in the ‘all unhedged’ category, as follows:

Question 10

6. Notes on Part G

6.1

Part G collects information about financial derivative currency contracts that could be used to hedge (or create) a foreign currency exposure. Other derivatives (e.g. commodities) are not to be included in Part G.

6.2 Forward foreign exchange

Forward foreign exchange denotes future commitments to buy or sell $A in exchange for foreign currency at a pre-agreed exchange rate and includes forward contracts, spot transactions that have not yet settled and outstanding commitments under foreign exchange swaps.

- Forward contracts are contracts to buy or sell $A in exchange for foreign currency at a pre-agreed exchange rate at a specified future date.

- Foreign exchange swaps combine a spot exchange of two currencies with a forward transaction that reverses the initial exchange (though generally at a different exchange rate).

6.3 Futures

Futures are contracts to buy or sell $A in exchange for foreign currency at a preagreed exchange rate at a specified future date. The principal difference between futures and forward contracts is that futures are traded on organised exchanges and settlement is with a central counterparty.

6.4 Cross-currency interest rate swaps

Cross-currency interest rate swaps involve the exchange of streams of interest payments in different currencies for an agreed period of time and the exchange of principal amounts in different currencies at a pre-agreed exchange rate at maturity.

6.5 Currency options

Currency options grant the holder the right, but not the obligation, to exchange $A for a foreign currency at a specified exchange rate at a future date.

- Call options on the Australian dollar give the holder the right to buy $A in exchange for a foreign currency (and are equivalent to a put on the foreign currency).

- Put options on the Australian dollar give the holder the right to sell $A in exchange for a foreign currency (and are equivalent to a call on the foreign currency).

6.6 Repurchase agreements (currency repos)

Repurchase agreements (currency repos) is a contractual agreement between two parties to sell $A at an agreed price on a specified date, then the other party to repurchase the $A at an agreed future date. This should be included in the ‘all other’ total.

6.7 The notional principal (notional or effective exposure)

The notional principal (notional or effective exposure) of a derivative contract is the underlying nominal amount upon which the transaction is based. The notional principal should be expressed in thousands of Australian dollars. Where it is necessary to convert from a foreign currency, this should be done at the spot rate for 31 March 2022 (and not the contractual exchange rate).

6.8 In Part G Question 11

In Part G Question 11, report the notional principal of outstanding derivatives where foreign currency will be purchased in exchange for $A when the derivative is exercised. For options, this will include calls purchased on foreign currency (i.e. puts purchased on Australian dollars) and puts sold (or written) on foreign currency (i.e. calls sold on Australian dollars).

6.9 In Part G Question 12

In Part G Question 12, report the notional principal of outstanding derivatives where foreign currency will be sold in exchange for $A when the derivative is exercised. For options, this will include puts purchased on foreign currency (i.e. calls purchased on Australian dollars) and calls sold (or written) on foreign currency (i.e. puts sold on Australian dollars).

6.10 In Part G Question 13

In Part G Question 13, report the notional principal of outstanding derivatives where foreign currency will be sold in exchange for foreign currency when the derivative is exercised. This will include both puts purchased and calls sold on (or written) on foreign currency.

6.11 In Part G Question 14

In Part G Question 14, report the total market value of outstanding derivatives where foreign currency will be sold in exchange for $A when the derivative is exercised. If a market value is not currently available, see note 3.4 for guidance.

Derivative contracts in an asset position with non-residents are those contracts where the mark to market value of the closing position is positive at the reporting date.

Derivative contracts in a liability position with non-residents are those contracts where the mark to market value of the closing position is negative at the reporting date.

The following examples go into further detail which transactions are in scope for Part G Questions 11 to 14:

Example 9: Derivative contracts

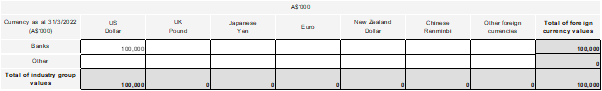

An Australian enterprise issues a derivative contract to a foreign bank for the purchase of US$100 million for A$100 million. Assuming the exchange rate remains at 1 USD = 1 AUD, the notional principal reported will be A$100 million. This amount should be reported under Part G Question 11(a) as follows:

Part G Question 11(a)

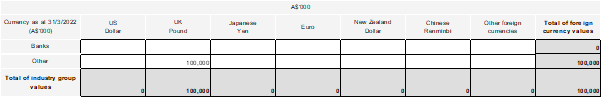

A foreign non-bank enterprise issues a derivative contract to an Australian enterprise for the purchase of A$100 million for £100 million. Assuming the exchange rate remains at 1 AUD = 1 GBP, the notional principal reported will be A$100 million. This amount should be reported under Part G Question 12(a) as follows:

Part G Question 12(a)

An Australian enterprise issues a derivative contract to a non-resident bank for the purchase of £100 million for €100 million. This amount should be reported under Part G Question 13(a) as follows:

Part G Question 13(a)

7. Notes on Part H

7.1

Part H provides a representation of the major factors which you may consider when determining the extent to which your enterprise is exposed to foreign currency risk. The data summarised here will, at best, provide a broad indication of the extent to which your enterprise is exposed currently.

It should be noted that even if your enterprise has an overall policy of ensuring that the enterprise is 100 per cent hedged against foreign exchange exposure; it is still unlikely that you would record a zero at the bottom of the table in this section. There are a number of reasons why this may be the case. For example:

- You may not consider all of the factors shown in the table (for example, foreign equity assets) during your calculations;

- The time horizon for future receipts and payments may not be appropriate to your enterprise;

- Balance sheet assets and liabilities are recorded at their market value (or approximation thereof). A balance sheet position hedged with forward foreign exchange derivatives will be based on the estimated/forecasted value of the assets and liabilities at the time the derivative is exercised. Therefore, it is likely that the sum of the present value of the balance sheet with the principal of the offsetting hedge may not be zero.

7.2

When reporting the net balance sheet foreign currency exposures item in Question 15 please report the total balance sheet foreign current exposure if the net amount is not available.

8. Notes of Part I

8.1

This section asks for information on your institution’s hedging policy, which may differ from the actual hedging reported in parts A to H in the Survey.

8.2

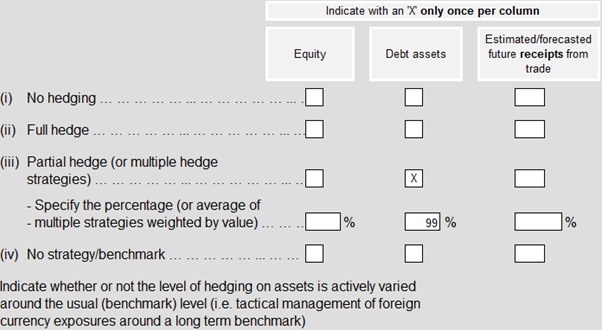

When reporting the percentage of a partial hedge your enterprise may not have a comprehensive portion of your portfolio hedged. To provide a best estimate take a weighted average of your hedging strategies. An example which shows how to calculate this weighted average is shown below; use it as a guide if necessary to help consider your institution’s overall hedging strategies.

Example 10: Hedging Strategy Calculation

Assume your enterprise has two major foreign currency investment strategies:

Strategy A

Fully hedged investment in foreign currency assets worth A$100 million.

Strategy B

Non-hedged trading on the FX market with a portfolio of A$10 million of which $1 million is exposed to foreign currency movements.

The weighted average of these two strategies (assuming equal weighting between both) would be:

\({(𝑀𝑎𝑟𝑘𝑒𝑡\space𝑉𝑎𝑙𝑢𝑒\space𝑜𝑓\space𝐴\space∗\space𝑃𝑜𝑟𝑡𝑖𝑜𝑛\space𝐻𝑒𝑑𝑔𝑒𝑑)\space+\space(𝑀𝑎𝑟𝑘𝑒𝑡\space𝑉𝑎𝑙𝑢𝑒\space𝑜𝑓\space𝐵\space∗\space𝑃𝑜𝑟𝑡𝑖𝑜𝑛\space𝐻𝑒𝑑𝑔𝑒𝑑) \over Market\space Value\space of\space A\space +\space Market\space Value\space of\space B}\)

\(=((A$100\space million*100 \%) + (A$10\space million * 90\%)) / (A$100\space million + A$10\space million) \)

\(≅99\%\)

This would be reported in Question 17(a) (Part I) as follows:

Question 17(a) (Part I)

If further clarification is required, please contact the ABS on the numbers listed on the front page of 1FCE.

8.3

If your enterprise targets a monetary level of exposure and not a percentage level of exposure, convert your monetary level of exposure by dividing the total monetary level of exposure in AUD as of 31 March 2022 by total assets or liabilities as of 31 March 2022, depending on the type of exposure.

Example:

- Assume your enterprise’s target exposure levels in foreign currencies are US$100 million, £50 million, and €50 million.

- Assume the exchange rates are 0.7 USD = 1 AUD, 0.6 GBP = 1 AUD, and 0.7 EUR = 1 AUD as of 31 March 2022.

If this enterprise’s total foreign denominated liabilities exposure is A$500 million, the enterprise’s foreign currency exposure in percentage terms would be:

\(=((\frac{100}{0.7})+(\frac {50}{0.6}) + (\frac {50}{0.7}) /500 ) \% \)

\(≅60\%\)

8.4

In part (e) of questions 16 and 17, natural hedging is defined as in Example 3 in part 3.6.