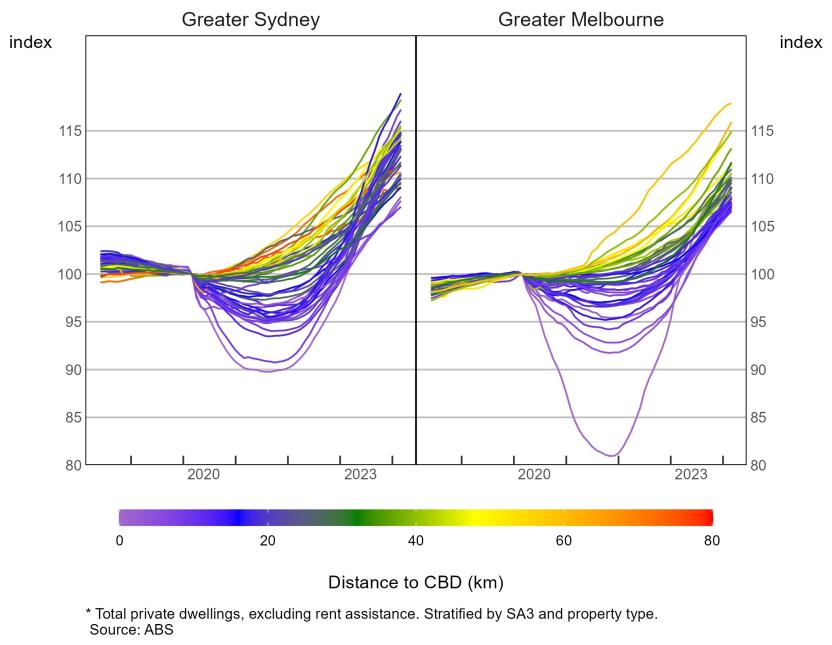

Annual rent inflation, by SA3 distance to CBD *

[["Jun-19","Jul-19","Aug-19","Sep-19","Oct-19","Nov-19","Dec-19","Jan-20","Feb-20","Mar-20","Apr-20","May-20","Jun-20","Jul-20","Aug-20","Sep-20","Oct-20","Nov-20","Dec-20","Jan-21","Feb-21","Mar-21","Apr-21","May-21","Jun-21","Jul-21","Aug-21","Sep-21","Oct-21","Nov-21","Dec-21","Jan-22","Feb-22","Mar-22","Apr-22","May-22","Jun-22","Jul-22","Aug-22","Sep-22","Oct-22","Nov-22","Dec-22","Jan-23","Feb-23","Mar-23","Apr-23","May-23","Jun-23","Jul-23","Aug-23","Sep-23","Oct-23","Nov-23","Dec-23","Jan-24","Feb-24","Mar-24"],[[0.2],[0.1],[0.1],[0.1],[0.1],[0],[0],[0.1],[0.1],[-0.1],[-1.1],[-1.7],[-1.9],[-2],[-2.3],[-2.7],[-2.9],[-3.1],[-3.3],[-3.5],[-3.8],[-3.7],[-2.7],[-2.2],[-1.9],[-1.7],[-1.3],[-0.9],[-0.6],[-0.2],[0.1],[0.5],[1],[1.4],[1.8],[2.2],[2.6],[3.1],[3.6],[4.1],[4.5],[5],[5.4],[6],[6.6],[7.1],[7.6],[8.1],[8.5],[8.9],[9.1],[9.3],[9.4],[9.4],[9.4],[9.4],[9.3],[9.1]],[[0.1],[0.1],[0],[0],[0],[-0.1],[-0.1],[0],[0],[-0.1],[-0.6],[-0.8],[-0.8],[-0.8],[-0.9],[-0.9],[-1],[-1],[-1],[-1],[-1.1],[-1],[-0.4],[-0.1],[0],[0.1],[0.2],[0.5],[0.7],[0.9],[1.1],[1.3],[1.5],[1.7],[1.9],[2.2],[2.4],[2.8],[3.1],[3.5],[3.8],[4.1],[4.4],[4.8],[5.1],[5.5],[5.9],[6.3],[6.7],[7],[7.3],[7.5],[7.7],[8],[8.1],[8.2],[8.3],[8.4]],[[0.3],[0.3],[0.2],[0.2],[0.2],[0.2],[0.2],[0.2],[0.2],[0.1],[-0.1],[-0.2],[-0.2],[-0.2],[-0.2],[-0.2],[-0.1],[-0.1],[0],[0],[0.1],[0.2],[0.6],[0.8],[1],[1.1],[1.3],[1.5],[1.7],[1.9],[2],[2.2],[2.4],[2.5],[2.7],[3],[3.1],[3.4],[3.7],[4.1],[4.4],[4.7],[4.9],[5.2],[5.5],[5.7],[6],[6.2],[6.5],[6.8],[6.9],[7.1],[7.2],[7.4],[7.5],[7.6],[7.7],[7.8]],[[1],[1],[0.9],[0.9],[0.9],[0.8],[0.8],[0.8],[0.8],[0.6],[0.2],[0.1],[0.1],[0.2],[0.2],[0.2],[0.3],[0.3],[0.4],[0.5],[0.6],[0.9],[1.4],[1.7],[1.9],[2.1],[2.3],[2.6],[2.8],[3],[3.2],[3.4],[3.6],[3.8],[4],[4.3],[4.4],[4.6],[4.8],[5],[5.2],[5.4],[5.6],[5.8],[5.9],[6],[6.1],[6],[6.2],[6.1],[6.1],[6.1],[6],[5.9],[5.8],[5.8],[5.7],[5.6]],[[0.8],[0.8],[0.7],[0.7],[0.7],[0.7],[0.7],[0.7],[0.7],[0.6],[0.1],[0],[0],[0.1],[0.2],[0.2],[0.3],[0.4],[0.5],[0.7],[0.9],[1.2],[2],[2.4],[2.7],[2.9],[3.2],[3.5],[3.7],[4],[4.2],[4.5],[4.9],[5.1],[5.3],[5.5],[5.6],[5.9],[6.1],[6.4],[6.6],[6.9],[7],[7.1],[7.1],[7],[7],[7],[6.9],[6.7],[6.6],[6.4],[6.2],[6],[5.7],[5.6],[5.4],[5.4]],[[1.2],[1.3],[1.3],[1.3],[1.3],[1.3],[1.3],[1.2],[1.2],[1.2],[1],[0.8],[0.9],[0.8],[0.8],[0.8],[0.9],[0.9],[1],[1.1],[1.2],[1.4],[1.8],[2.1],[2.4],[2.7],[2.9],[3.2],[3.4],[3.7],[3.8],[4.1],[4.3],[4.4],[4.6],[4.8],[4.8],[4.9],[5.2],[5.3],[5.3],[5.4],[5.4],[5.5],[5.4],[5.5],[5.4],[5.4],[5.4],[5.3],[5.2],[5.1],[5],[4.9],[4.8],[4.7],[4.6],[4.6]],[[1.8],[1.9],[1.9],[1.7],[1.6],[1.6],[1.6],[1.6],[1.6],[1.6],[1.4],[1.4],[1.3],[1.3],[1.3],[1.3],[1.4],[1.5],[1.5],[1.7],[1.8],[2],[2.4],[2.7],[3],[3.3],[3.5],[3.8],[3.9],[4.1],[4.3],[4.5],[4.7],[4.8],[5],[5.1],[5.2],[5.3],[5.4],[5.4],[5.6],[5.6],[5.7],[5.6],[5.5],[5.5],[5.3],[5.2],[5.2],[5.1],[5],[4.9],[4.8],[4.7],[4.7],[4.7],[4.6],[4.6]],[[2.5],[2.5],[2.4],[2.3],[2.3],[2.3],[2.4],[2.5],[2.5],[2.3],[1.8],[1.6],[1.7],[1.8],[1.8],[1.7],[1.9],[2],[2.2],[2.5],[2.8],[3.3],[4.2],[4.6],[4.9],[5.1],[5.5],[5.8],[6],[6.1],[6.1],[6.1],[6.1],[6],[5.9],[6],[5.9],[6],[5.9],[6],[6],[6.1],[6.1],[6.1],[6],[6],[6],[5.9],[5.9],[5.9],[5.7],[5.7],[5.6],[5.5],[5.5],[5.6],[5.6],[5.7]],[[1.3],[1.4],[1.6],[1.8],[1.8],[1.9],[2.1],[2.2],[2.3],[2.3],[1.9],[1.8],[2.7],[2.8],[2.6],[2.6],[2.6],[2.6],[2.6],[2.7],[2.7],[3.3],[4],[4.5],[3.9],[4],[4.4],[4.6],[4.9],[5.2],[5.4],[5.5],[5.7],[5.6],[5.5],[5.5],[5.6],[5.6],[5.7],[5.9],[5.9],[6],[6.2],[6.5],[6.6],[6.7],[6.7],[6.9],[7],[7.2],[7.2],[7.2],[7.2],[7.2],[7.1],[7.1],[7.1],[7]]]

[]

[{"value":"0","axis_id":"0","axis_title":"","axis_units":"","tooltip_units":"","table_units":"","axis_min":null,"axis_max":null,"tick_interval":"12","precision":"-1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}][{"value":"0","axis_id":"0","axis_title":"%","axis_units":"","tooltip_units":"(%)","table_units":"(%)","axis_min":"-5","axis_max":"10","tick_interval":"2.5","precision":"1","data_unit_prefix":"","data_unit_suffix":"","reverse_axis":false}]