By Leigh Merrington, Economic Research Section

Towards an Australian Monthly CPI

Summary

The Consumer Price Index (CPI) provides a general measure of change in the prices of goods and services acquired by Australian households. It is a key indicator for informing monetary policy, with the Reserve Bank of Australia (RBA) having an explicit inflation target to "keep consumer price inflation in the economy to 2-3 per cent, on average, over the medium term" (RBA 2018). The CPI is also used extensively by government, academics and economists for macro-economic analysis, as well as by businesses and the general community in setting wages and the prices of goods and services.

Over the past few years the Australian Bureau of Statistics (ABS) has undertaken a range of activities to enhance the Australian CPI. These activities include: (a) the annual re-weighting of the CPI (ABS 2017a); and (b) the use of new data sources to compile the CPI, namely transactions data and web-scraped data (ABS 2017b). These strategic enhancements to the CPI have addressed most of the significant topics raised by stakeholders during the 2010 review of the CPI and has positioned the ABS to produce a monthly CPI.

While these activities have enhanced the quality of the CPI, they have also lowered the costs, in particular the data collections costs, required to produce the quarterly CPI. As part of the 2010 review of the CPI, the ABS estimated it would cost an additional $15 million per annum to produce a monthly CPI (ABS 2010). The cost to produce a monthly CPI has significantly reduced as a result of the investment made by the ABS to lower the CPI data collection costs over the past three or four years.

The ABS has begun development work on the feasibility of a monthly CPI. This paper outlines the challenges being investigated in the development phase of the project and proposes an implementation plan. User and stakeholder input is being sought to determine the requirements for a monthly CPI and as a basis for broad community consultation.

Feedback and comments can be directed to:

Leigh Merrington

Director

Economic Research Section

P: (02) 6252 6833

E: price.statistics@abs.gov.au

The ABS Privacy Policy outlines how the ABS will handle any personal information that you provide to us.

Background

The Australian CPI is published once every three months for the March, June, September and December quarters, approximately four weeks following the end of the quarter. Australia is one of only two OECD¹ economies (the other is New Zealand), and the only G-20 (Group of Twenty Finance Ministers and Central Bank Governors) country, that does not produce a monthly CPI.

Australia is also a subscriber to the International Monetary Fund's (IMF) Special Data Dissemination Standards (SDDS), which sets guidelines for the compilation of statistics for those countries which wish to access international capital markets. The standards recommend that the CPI should be produced monthly. Australia has committed to meeting these standards; however, a monthly CPI is one of the few guidelines Australia does not currently meet (IMF 2016).

A major review of the CPI conducted by the ABS in 2010 found that:

There was significant demand for a monthly CPI. The ABS is persuaded there would be a significant benefit from more timely and responsive economic management if a CPI of equivalent quality to the current quarterly index were available monthly. Additional funding will be required to meet the costs involved in compiling a monthly index (ABS 2010).

Since the 2010 review there have been significant enhancements to the CPI that have reduced the costs of producing the CPI. In particular, the use of transactions data and web-scraping data collection techniques² provides high frequency data at a significantly reduced cost to the ABS. These data sources and collection techniques were not available back in 2010.

A monthly CPI would deliver benefits to informing monetary policy, as well as for macro-economic analysis and forecasting, by providing an earlier indication of the trend of inflation and for identifying turning points. In the RBA's submission to the 2010 review it was stated that:

One benefit for the RBA would be the ability to adjust the official cash rate target in response to a more timely indicator of inflationary trends available one month after the reference period rather than the current delay of up to three months. An adjustment of 25 basis points on the cash rate target results in changes of the order of several hundreds of millions of dollars in interest payments by Australian households (ABS 2010).

This view remains current today, noting recent RBA statements:

At the moment, we need to wait three more months to gain a better understanding as to whether any particular read on inflation is signalling a possible change in trend or is just noise. That is one of the reasons why the RBA has long advocated a shift to monthly calculation of the CPI (RBA 2017).

Another benefit of a monthly CPI is the ability to produce monthly volume measures of retail trade. This will provide an earlier and more frequent indicator of the strength or weakness of the retail industry and household consumption in general.

With these benefits for policy makers and the Australian community in mind, along with the recent reduction in collection costs, the ABS has begun development work towards producing a monthly CPI. Additional funding will be needed by the ABS to cover the ongoing compilation, analysis and dissemination costs of producing a monthly CPI.

How could a monthly CPI provide a more timely indication of the inflation trend?

A recent example of when a monthly CPI would have proved valuable for users was the March quarter 2016, where the headline CPI recorded a fall of -0.2 per cent, as shown in figure 1. This was the first negative movement for over eight years and was unexpected for many users. It was unclear at the time whether the quarterly movement was the beginning of a trend of falling inflation, or even deflation, or a one-off. What transpired was a period of lower inflation for a period of six months, before rising again. A monthly CPI would have given users an earlier insight into the trend of inflation leading up to and following the March quarter 2016 result.

Purpose of the CPI

The CPI has many uses; however, its principal purpose is as a macro-economic indicator of household inflation (ABS 2010). The CPI plays a central role in informing monetary policy and the setting of interest rates.³ Figure 2 shows how the RBA's cash rate is strongly correlated with the headline CPI.

Changes in the cash rate have a direct impact on interest rates. Interest rates play a key role in the Australian economy: from what households receive in the amount of interest on savings or the interest paid on loans; to the amount that businesses and government invest.

While inflation has been relatively low and stable over the past two decades, a monthly CPI would provide an earlier indication of the trend of inflation and possible turning points, such as what occurred during the global financial crisis of 2008-09.

Monthly outputs

As part of the development phase of the project, the ABS has the opportunity to determine the level of detail for the published monthly outputs, noting that these may be different from the indexes produced quarterly. The level of detail published needs to be balanced against the requirements of users of the CPI and the resources necessary to compile, analyse and disseminate the outputs each month. The ABS is committed to meeting the needs of users, while making efficient use of its resources.

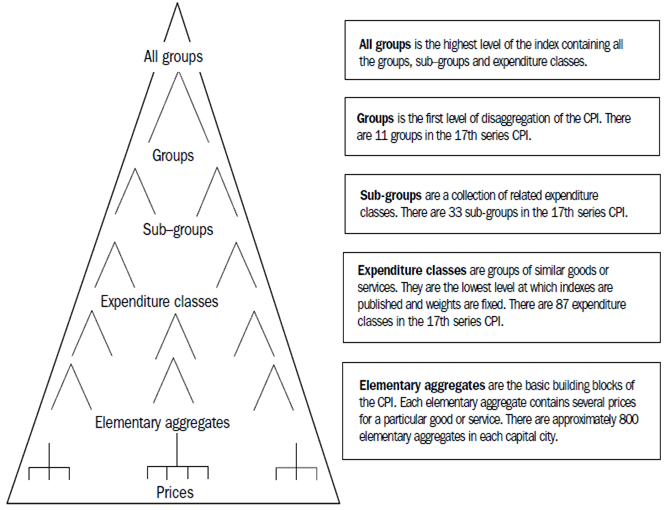

The ABS will continue to publish quarterly outputs to the same level of detail and timing. The structure of the CPI is shown in Figure 3. Along with the headline CPI, the currently published quarterly series is comprised of: 11 Groups; 33 sub-Groups; and 87 Expenditure Classes (ECs), for each capital city, approximately four weeks after the reference period. Maintaining the same quarterly series is important for continuity, particularly for existing indexation arrangements where the CPI is widely used. It is proposed that these quarterly outputs will be published alongside the monthly outputs each March, June, September and December.

Figure 3 Structure of the CPI

Image

Description

On a monthly basis, the ABS plans to publish All groups, Group, sub-Group and EC levels for the weighted average of the eight capital cities only. Analytical series including the seasonally adjusted CPI, Trimmed mean, Weighted median and the Tradables and Non-tradables series will also be published each month. Capital city measures will continue to be published on a quarterly basis.

The ABS will consult with users to determine their requirements for a monthly CPI for informing monetary and fiscal policy, macro-economic forecasting, indexation and deflation purposes in the National Accounts. As part of this consultation process, the ABS is seeking feedback from users on whether this level of detail meets your needs for a monthly CPI.

Producing a monthly CPI

CPI price collection

The Australian CPI distinguishes 87 different Expenditure Classes (ECs). Of the 87 ECs:

- 28 use high frequency transaction data, representing a weight of 16 per cent of the CPI;

- a further 14 ECs are currently collected monthly, representing a weight of 27 per cent of the CPI; and

- 5 ECs only require an annual collection, representing a weight of 8 per cent of the CPI;

The remaining 40 ECs, representing a weight of 49 per cent of the CPI, use a mixture of administrative data, web-scraped data and manually collected data by phone, internet or in-store.

To minimise the collection costs of a monthly CPI, the development phase of this project will focus on replacing as much manual collection as possible with administrative data or high frequency web-scraped data.

Sample allocation

Where administrative data or web-scraped data is not feasible, the monthly CPI collection will continue to be conducted manually through in-store visits, and/or phone and internet collection. This is likely to be the case for some services where the market consists of predominantly small businesses (e.g. restaurant meals, dental services, hairdressing).

The current approach for these particular ECs is to collect all prices across one particular month of the quarter. For a monthly CPI the options are to: (i) replicate the current collection for each of the three months within the quarter; and (ii) spread the existing collection across the three months of the quarter.

The ABS will investigate the use of the second option and how to optimally allocate the manually collected samples. This may involve increasing the size of some of the smaller monthly samples and investigating whether those ECs with less frequent price change require a monthly collection at all.

Use of web-scraping

The use of high frequency web-scraped data presents some challenges in how best to incorporate this into the CPI. Two of these challenges are: (i) how to appropriately weight the products within the sample; and (ii) whether the current matched model approach⁴ is optimal where there is a significant amount of product churn (e.g. clothing).

The ABS will investigate methods to deal with these challenges.

Seasonally adjusted measures

Included in the suite of CPI outputs are seasonally adjusted measures of the All groups (headline) CPI, Group, sub-Group and EC level for the weighted average of eight capital cities. The Weighted median and Trimmed mean measures (often referred to as underlying inflation) are also produced using seasonally adjusted measures (see ABS 2011 for more information). The ABS will continue to publish these important analytical measures as part of a monthly CPI.

A sufficient time series of at least three years is usually required to develop reliable seasonal adjustment factors. While a monthly time series is available for around half of the ECs, for the other half there is only a quarterly time series currently available. In these cases, monthly seasonal adjustment factors may have to be modelled using a variety of data sources and methods.

The ABS will investigate how to produce monthly seasonally adjusted CPI measures with a limited time series. The intention will be to publish these measures alongside the CPI when it is first published on a monthly basis.⁵

ABS and international experience

As mentioned previously, Australia is one of the few countries that doesn’t currently produce a monthly CPI. Therefore, there are potentially some important lessons that could be learnt from other countries’ experience in the development and ongoing production of a monthly CPI.

In addition to this, there may also be some operational lessons from other macro-economic areas of the ABS that produce a monthly series including Labour Force, Retail Trade and International Trade. Central to this is how to utilise resources efficiently for a monthly statistical cycle.

Implementation of a monthly CPI

The development phase of the project is expected to take around 12 months. Following the planning and investigation of a monthly CPI, there will be an additional period of 12 months where the monthly price collection is implemented. This enables sufficient time to imbed the monthly collection and conduct a parallel run with the quarterly CPI. It will then ensure that when the monthly CPI is first published, an annual movement will also be available.

Conclusion

A monthly CPI would provide a more frequent and earlier insight of turning points in the Australian economy. This will assist in the formation of monetary policy.

With the availability of new data sources and web-scraping collection techniques, a monthly CPI is much more feasible now than when it was last investigated in 2010.

The ABS has committed to development work to produce a monthly CPI. Feedback is being sought as part of a consultation process with stakeholders and users to determine their requirements.

Footnotes

Show all

References

Show all

Frequently asked questions

The below Frequently Asked Questions are specific to the developmental work and feasibility, conducted by the ABS on a monthly CPI.