Card 1

1. Never married

2. Widowed

3. Divorced

4. Separated

5. Married (in a registered marriage)

6. De facto

7. Single or not married

Card 2

Real estate, government, or community:

1. Real estate agent

2. State or territory housing authority

3. Community housing provider

Person not in the same household:

4. Parent or other relative

5. Other unrelated person

Residential park:

6. Owner or manager of a residential park (including caravan parks and manufactured home estates)

Employer:

7. Government (including Defence Housing Australia)

8. Other employer

Other:

9. Other (please specify)

Card 3

1. Water and sewerage rates

2. General council rates

3. Combined water and general council rates (on the same bill)

5. None of these

Card 4

Include for water rates

- Any charges if part of the rates notice

- Payments for permit (e.g. for access to river water)

- Water rates and sewerage, drainage charges, sewerage pedestal charges

- Any other water use charges

Include for general rates

- Charges for services such as sanitary or rubbish collection, wheelie bin services and council rates

- Fire levy, charges for road construction and other local council charges and fees

Card 5

1. Water and sewerage rates

2. General council rates

3. Combined water and general council rates

4. Body Corporate

5. Land tax

6. None of the above

Card 6

Government, community, or real estate:

11. Real estate agent

12. State or territory housing authority

13. Community housing provider

Person living in the same household:

14. Parent or other relative

15. Other unrelated person

Person not in the same household:

16. Parent or other relative

17. Other unrelated person

Residential park:

18. Owner or manager of a residential park (including caravan parks and manufactured home estates)

Employer:

19. Government (including Defence Housing Australia)

20. Other employer

Other:

21. Other (please specify)

Card 7

1. Mains electricity

2. Mains gas

3. Bottled gas (excluding outdoor use only)

4. Wood

5. Solar (solar electricity or solar hot water)

6. Oil

7. Other (please specify)

Card 8

1. Loans or mortgages to buy, build, or make alterations or additions to this property, or other properties (excluding rental properties)

2. Personal loans

3. Hire purchase

4. Loans for holidays

5. Motor vehicle loans

6. Any other loans or mortgages (excluding business or investment loans, credit cards or store account loans)

7. No / None

Card 9

Include:

- Pay Day Loans

- Revolving Credit

- Loans from finance companies or stores with an interest free period

- Lease agreements where the goods are being (or intended to be) purchased

- Loans from friends and relatives (with or without interest)

- Loans held overseas

Exclude:

- Credit cards

- Buy Now Pay Later accounts

- Business loans

- Investment loans

- Rental or leasing loans

- Rental or leasing arrangements (e.g. cars under salary sacrifice)

- Store account loans

- Advance payments e.g. from Centrelink

- Loans from friends and relatives with no repayments and no commitment

- Loans from persons in the same household

Card 10

Exclude:

- Advance payments, e.g. from Centrelink

- Business and investment loans

- Rental property loans

- Credit cards

- Buy now, pay later

Note: Refer to your financial records to help you answer (e.g. loan statements)

Card 11

This property:

1. To buy or build this property

2. For alterations and additions to this property

Other property:

3. To buy or build other property

4. For alterations and additions to other property

Other:

5. To buy motor vehicles

6. For a holiday

7. For another purpose (Please specify)

Note: Exclude loans originally taken out to buy or build the home you are living in, that have since been extended so that most of the value of the loan is now for another purpose.

Card 12

10. Spend more money than I/we get

11. Just break even most weeks

12. Able to save money most weeks

13. Cannot be compared to 12 months ago

Card 13

1. Better than 2 years ago

2. The same as 2 years ago

3. Worse than 2 years ago

4. Cannot be compared to 2 years ago

Card 14

Please select all that apply:

1. Have a holiday away from home for at least one week a year

2. Have a night out once a fortnight

3. Have friends or family over for a meal once a month

4. Have a special meal once a week

5. Buy new and not second hand clothes, most of the time

6. Spend time on leisure or hobby activities

7. No / None of these

Card 15

Please select all that apply:

1. Pawned or sold something

2. Went without meals

3. Went without dental treatment when needed

4. Were unable to heat or cool at least one room of the home

5. Sought financial assistance from friends or family

6. Sought assistance from welfare or community organisations

7. None of the above

Card 16

Please select all that apply:

1. Electricity, gas, telephone or internet bills

2. Mortgage or rent payments

3. Car registration or insurance

4. Home and/or contents insurance

5. Minimum payment on credit card

6. None of the above

Card 17

Please select all that apply:

1. Followed a budget

2. Saved regularly

3. Paid more than the minimum payment required by credit card company or loan provider

4. Made more than the minimum home loan repayments

5. Made voluntary contributions towards superannuation

6. Received financial information, counselling or advice from a professional (including Centrelink, welfare and community organisations and financial planners)

7. None of the above

Card 18

10. Unpaid voluntary work

11. Unpaid trainee work or work placement

12. Contractor or Subcontractor

13. Own business or Partnership

14. Commission only

15. Commission with retainer

16. In a family business without pay

17. Payment in kind

18. Paid by the piece or item produced

19. Wage or salary earner

20. Other

Card 19

11. Unpaid voluntary work

12. Unpaid trainee work

13. Contractor or Subcontractor

14. Own business or Partnership

15. Commission only

16. Commission with retainer

17. In a family business without pay

18. Payment in kind

19. Paid by the piece or item produced

20. Wage or salary earner

21. Other

Card 20

Please select all that apply:

1. Advertised or tendered for work

2. Contacted friends or relatives

3. Only looked in newspapers, on the internet or checked notice boards, and/or only registered with Centrelink as a jobseeker

4. Other

5. None of the above

Card 21

1. Less than 2 years ago

2. 2 years to less than 5 years ago

3. 5 years or more ago

Card 22

1. Less than 2 years ago

2. 2 years to less than 5 years ago

3. 5 years or more ago

4. Have never worked

Card 23

Please select all that apply:

1. Superannuation (above compulsory 11%)

2. Housing (rent or mortgage)

3. Meals or entertainment

4. Household or personal bills (e.g. health insurance, credit cards, gym memberships, school fees and living expenses)

5. Motor vehicle

6. Car parking

7. Computer and/or phone

8. Other (please specify)

9. No salary sacrifice arrangement

Card 24

Please select all that apply:

11. Superannuation from your employer (above the minimum 11%)

12. Motor vehicle or motor vehicle running costs

13. Computer (for personal use)

14. Childcare

15. Phone or contribution to personal phone costs

16. Housing (free or discounted)

17. Car park

18. Shares

19. Low interest loans

20. Other (please specify)

21. No non-cash items

Card 25

Include:

- Total gross pay

- All amounts that have been salary sacrificed

- Income from own incorporated business

- Total pay from wages / salary / leave and workers compensation

- In cases of new job / contract – what you expect to be paid

Exclude:

- Dividends

- Mileage or car allowance

Card 26

1. Service Pension from the Department of Veterans’ Affairs

2. Disability Pension from the Department of Veterans’ Affairs

3. War Widow(er)’s Pension from the Department of Veterans’ Affairs

5. No, none of these

Card 27

10. Age Pension

11. JobSeeker Payment

12. Centrelink Disability Support Pension

13. Carer Payment

14. Youth Allowance

15. Austudy / ABSTUDY

17. Special Benefit

20. No, none of these

Card 28

Please select all that apply:

10. Family Tax Benefit (FTB)

11. Parental Leave Pay (PLP)

12. Dad and Partner Pay (DAPP)

13. Parenting Payment

14. Carer Allowance

15. Carer Supplement

16. Pensioner Education Supplement

17. Mobility Allowance

18. Pension Supplement

19. Energy Supplement

20. Other Government payment (please specify)

21. No, none of these

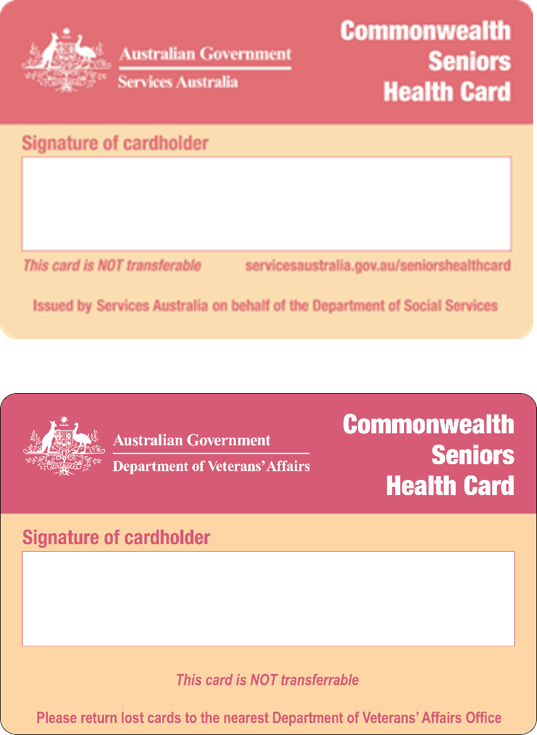

Card 29

1. DVA Commonwealth Seniors Health Card

2. Centrelink Commonwealth Seniors Health Card

3. Neither of these

Card 30

Include:

- Scholarships from government or private organisations.

- Scholarships received in the previous financial year but which still support current study.

- Scholarships from overseas.

Exclude:

- Austudy/Abstudy

- Youth Allowance

Card 31

Include:

- Accounts with retirement benefit schemes

- Self-managed superannuation funds

- DIY super schemes

- Self-managed super funds (SMSFs) and SMSFs set up as trusts

- Retirement schemes, provident funds, and pension schemes such as CSS

- Defence Force Retirement and Death Benefits (DFRDB) and subsequent military superannuation schemes.

Exclude:

- Centrelink and DVA social security payments.

- Foreign social security payments

Card 32

1. Allocated pension

2. Lifetime guaranteed pension

3. Term annuity

4. Transition to retirement pension (TTR)

5. Other pension

Card 33

Please select all that apply:

1. Bank accounts (including savings, cheque and term deposit accounts, etc.)

2. Offset accounts

3. Debentures, bonds and/or securities

4. Shares and stocks

5. Public unit trusts (such as cash management, property, equity trusts, managed funds etc.)

6. Loans to persons not in this household

7. Any other financial investments (excluding superannuation and rental properties) (please specify)

8. No / None of these

Card 34

Please select all that apply:

1. Child support or maintenance

2. Workers’ compensation

3. Accident or sickness insurance

4. No / None of these

Card 35

Include:

- Rent

- Education

- Childcare

- Food

- Clothing

- Car registration and running costs

- Bills (e.g. electricity, gas, phone)

Exclude:

- Loans and mortgages or home loans

- Inheritances

- Help paying off debt

- Help to buy property or cars

Card 36

Include:

- Third job

- Army Reserve pay

- Additional scholarship(s)

- Student allowance received regularly from

- family overseas

Exclude:

- Lottery or gambling wins, inheritance,

- sale of assets and other windfall gains

- Lump sum retirement benefits

- Income received from other household members

- Income reported elsewhere

- Non-life insurance claims

- Withdrawals from savings and loans obtained

- Repayment of loans

- Capital gains or losses resulting from changes in the value of financial and non-financial assets and liabilities.

Card 37

Include:

- Rent

- Education

- Childcare

- Food

- Clothing

- Car registration and running costs

- Bills (e.g. electricity, gas, phone)

Exclude:

- Loans and mortgages or home loans

- Inheritances

- Help paying off debt

- Help to buy property or cars

Card 38

Examples of credit cards and charge accounts

- VISA credit cards

- MasterCard credit cards

- American Express

- Diners Club

- Store account cards (e.g. Myer or BP)

Exclude:

- Debit cards (e.g. Visa Debit, MasterCard Debit)

- ‘Buy Now Pay Later’ accounts (e.g. Afterpay, Zip, Klarna)

Card 39

Examples of ‘Buy Now Pay Later’ accounts

- Afterpay

- Zip Pay/Zip Money

- OpenPay

- Humm

- Klarna

- Splitit

- Sezzle

Exclude:

- Credit cards

- Debit cards

- Store account cards

- Hire purchase agreements

- Loans from finance companies or stores with an interest free period

- PayPal

- Google/Apple Pay

Card 40

School

1. Year 1, Grade 1 or higher

2. Kindergarten, Preparatory, Reception, Pre-primary, Transition

Non-School

3. Preschool or Kindergarten

Other year or grade

4. Other (please specify)

Card 41

Please select all that apply:

1. Outside school hours care (OSHC)

2. Long day care

3. Family day care

4. Occasional care

5. Vacation care

6. Registered in-home care or qualified nanny

7. Other formal care (please specify)

8. None of these

Card 42

‘Formal care’ refers to any care eligible for the Child Care Subsidy to reduce the cost of care for the child’s parent or guardian.

- Outside school hours care (OSHC) is generally available for primary school-aged children but some younger children are also eligible.

- Long day care is a centre-based form of child care service providing all-day or part-time care for children.

- Family day care is a network of caregivers who provide care in their own homes.

- An occasional care centre provides short periods of care for children under school age. Care is usually provided at a centre on an hourly or sessional basis for short periods or at irregular intervals.

- A vacation care service provides care to school aged children during school holidays.

- A registered in-home care / qualified nanny provided by a qualified childhood education and care provider registered with an agency and is subsidised by the government.

Card 43

Please select all that apply:

1. Outside school hours care (OSHC)

2. Long day care

3. Family day care

4. Occasional care

5. Vacation care

6. Registered in-home care or qualified nanny

7. Other formal care

8. None of these

Card 44

Please select all that apply:

1. Shortness of breath

2. Chronic or recurring pain

3. A nervous or emotional condition

4. Memory problems or periods of confusion

5. Social or behavioural difficulties

6. Long term effects as a result of a head injury, stroke or other brain damage

7. Receiving treatment or medication for any other long-term condition

8. Any other long-term condition (such as arthritis, asthma, heart disease etc.)

9. None of the above

Card 45

Please select all that apply:

11. Sight problems not corrected by glasses or contact lenses

12. Hearing problems

13. Speech problems

14. Blackouts, seizures or loss of consciousness

15. Difficulty learning or understanding things

16. Limited use of arms or fingers

17. Difficulty gripping things

18. Limited use of legs or feet

19. Any condition that restricts physical activity or physical work (e.g. back problems, migraines)

20. Any disfigurement or deformity

21. Any mental illness for which help or supervision is required

22. None of the above