- For a detailed discussion of price index theory and internationally recommended practices, see Consumer Price Index Manual, Theory and Practice, 2004 (International Labour Office).

- 2 This is the terminology used by Pollak (1971).

- In this example, the price relative shows the change in price between two times. If, instead of two different periods we looked at the price between two different markets in the same period, the price relative would show the difference between the prices in the two markets in the same period.

- The use of the geometric mean of the Laspeyres and Paasche indexes was first proposed by Pigou in 1920, and given the title "ideal" by Fisher (1922).

- For further discussion of forward and backward Laspeyres and Paasche price and quantity indexes, refer to Chapter 2 of Allen (1975).

- Economists measure the change in the quantity of an item in response to a change in price (or income) by elasticities, which are measured as the ratio of the percentage change in the quantity to the percentage change in price (or income). An item is price inelastic if the percentage change in the quantity is less than the percentage change in price. It has unit elasticity if the percentage changes are the same, and is price elastic if the percentage change in the quantity is greater than the percentage change in price. If an item is price inelastic, the change in expenditure will be in the same direction as the change in price (i.e. if price increases, then expenditure also increases). If the item has unit elasticity, then expenditure is unchanged. If the item is price elastic, the change in expenditure will be in the opposite direction to the price change (i.e. if price increases, then expenditure decreases).

- The relationship between the Laspeyres and Paasche indexes holds while there is a normal relationship (negative correlation) between prices and quantities; that is, quantity declines if price increases between the two periods, and vice versa.

- The implicit weights applied by the three formulas are equal base–period quantities (RAP), equal base–period expenditures (quantities inversely proportional to base–period prices) (APR) and equal expenditure shares in both periods (GM).

- The geometric mean of n numbers is the nth root of the product of the numbers. For example, the geometric mean of 4 and 9 is 6 (= ), but the arithmetic mean is 6.5 ( = (4+9)/2 ).

- For a mathematical proof of this see Diewert (1995). The unweighted indexes will all produce the same result if all prices move in the same proportion (have the same relative). In addition, the RAP and APR will produce the same index number if all base–period prices are equal. Diewert also refers to other studies that compare real world results for elementary aggregate formulas.

- For example, Woolford (1994) calculated these indexes for twenty three fresh fruit and vegetable elementary aggregates of the Australian CPI over the period June 1993 to June 1994. He found that the GM produced the lowest increase in sixteen of the twenty three elementary aggregates, and the APR produced the highest increase for nineteen of the elementary aggregates. The RAP formula produced the middle estimate for thirteen of the elementary aggregates. Combining the elementary aggregates to produce the fresh fruit and vegetables index, the index compiled using the APR estimates was 4.7 per cent higher than the index based on GM estimates, and the RAP was 1.7 per cent higher than the index based on GM.

- See Diewert (1995) for further discussion of unit values.

- In a volume index, prices are held constant between the two periods, and the actual quantities from each period are used in the calculation. The change in the index is then measuring the weighted change in the volume of purchases, expenditure etc.

- The characteristics approach to goods is the basis of the so–called household production theory. The development of this theory is generally attributed to Lancaster (1966), Muth (1966) and Becker (1965). Bresnahan and Gordon (1998) also provide a good example using household lighting, tracing the development from whale–oil lamps through to the electric light–bulb, pointing out how the additional inputs required on the part of households (such as trimming wicks etc.) were an important part of the production of light.

- This point, and the use of characteristics in compiling consumer and producer price indexes, are explained in Triplett (1983).

- Pollak (1983) identifies two characteristics approaches, that of Lancaster (1966) and Houthakker (1952). The Lancaster approach assumes that characteristics are additive across items (e.g. protein from meat can be added to protein from bread) whereas the Houthakker approach assumes characteristics are commodity specific.

- There are many examples in literature of the application of the hedonic technique; for example, Ohta and Griliches (1975). For an overview of household production theory and the hedonic technique, see Muellbauer (1974). Pollak (1983) provides an exposition on the treatment of quality in a cost–of–living index.

- For example, the hedonic technique is now used for estimating pure price change for personal computers and television sets in the United States CPI, and personal computers in Australia.

- It is a moot point whether the increased speed and power of computers is reflected in corresponding increases in consumer utility, which raises questions as to whether the hedonic approach adequately captures quality change from a consumer perspective. However, studies have shown remarkable similarities in price indexes based on a hedonics approach and those for computers based on a comprehensive matched models approach.

- Current thinking as presented in Koskimaki and Vartia (2001) for example is that hedonic equations should have log price as the dependent variable and should be estimated for each period. The use of weighted regressions is also supported by researchers such as Diewert. <back

- This is often referred to as the Boskin Report, see Boskin (1996). Boskin estimated that the United States CPI was biased upwards by about 1.1 percentage points a year. There were many submissions and views expressed about bias in the US CPI. For a semi–official perspective on the issue see Moulton (1996).

- As noted earlier, the issue of frequency of re–weighting or chaining is not straightforward. In a situation of price bouncing, chaining can introduce substantial bias into indexes (see for example Szulc (1983)). In general, chaining more frequently than annually, even if feasible in practice, is not recommended because it could introduce bias.

Consumer Price Index: Concepts, Sources and Methods

This release provides updated information relating to the data sources and methods used to compile the CPI

Aim of this publication

1.1 The Australian Consumer Price Index (CPI) is an important economic indicator. It measures price changes experienced by households. It is compiled according to international standards, and is based on robust data collection and compilation methodologies. This publication provides a comprehensive description of price index theory and methodology, focusing on the Australian CPI and the concepts, sources and methods behind its compilation. It also provides some insight into the kinds of conceptual and practical difficulties that the Australian Bureau of Statistics (ABS) encounters in compiling the CPI, and how it deals with these challenges.

1.2 The ABS currently publishes a set of Frequently Asked Questions (FAQs) and a brief description of the CPI in A Guide to the Consumer Price Index: 17th Series, 2017 (cat. no. 6440.0). The Guide is for those interested in a straightforward and brief account of the main features of the CPI. This Concepts, Sources and Methods publication, on the other hand, is for those users who require a deeper understanding of the CPI, and of the methods and techniques used to deal with the complex situations that arise in constructing price indexes across the spectrum of household consumer expenditure.

Other sources of information about the Consumer Price Index

1.3 The CPI is compiled quarterly by the ABS for quarters ending on 31 March, 30 June, 30 September, and 31 December each year. The CPI is released each quarter on the last Wednesday of the month following the end of the reference quarter, depending on public holidays, in the publication Consumer Price Index, Australia (cat. no. 6401.0).

1.4 From December quarter 2017, the CPI is re-weighted annually. The Household Expenditure Survey (HES) is used to update the weights in the years that it is available. For the inter-HES years, Household Final Consumption Expenditure (HFCE) data from the National Accounts is used as the principal data source for re-weighting the CPI. Prior to this, the CPI was reviewed and re-weighted every six years. The ABS described the change to annual re-weighting in the following information papers:

- Information Paper: Increasing the Frequency of CPI Expenditure Class Weight Updates, July 2016 (cat. no. 6401.0.60.002); and

- Information Paper: An Implementation Plan to Annually Re-weight the Australian CPI, 2017 (cat. no. 6401.0.60.005).

1.5 The 17th series used data from the Household Expenditure Survey, Australia: Summary of Results, 2015-16 (cat. no. 6530.0) to represent household expenditure patterns. It was introduced in the December quarter 2017 following a minor review. As well as updating the weights in the CPI basket, the review included a simple examination of structures and methodologies. As part of the 17th series review, the ABS published an Information Paper:

- Information Paper: Introduction of the 17th Series Australian Consumer Price Index, 2017 (cat. no. 6470.0.55.001).

1.6 The 16th Series CPI introduced in the September quarter 2011 was a major review. The item weights were revised in line with expenditure patterns identified in the 2009-10 Household Expenditure Survey (HES). As well as updating the weights in the CPI basket, the review looked at the uses, concepts and purpose of the CPI and confirmed the principal purpose of the CPI is to measure inflation faced by households to support macroeconomic policy decision making. As part of the 16th series review, the ABS published a number of Information Papers:

- Issues to be considered during the 16th Series Australian Consumer Price Index Review, Dec 2009 (cat. no. 6468.0);

- Outcome of the 16th Series Australian Consumer Price Index Review, Dec 2010 (cat. no. 6469.0); and

- Information Paper: Introduction of the 16th Series Australian Consumer Price Index, 2011 (cat. no. 6470.0).

1.7 These papers describe the review process, the issues considered, the review outcomes, the re-weighting process and outline the changes from the previous series.

1.8 The 15th Series CPI introduced in the September quarter 2005 was a minor review. The item weights were revised in line with expenditure patterns identified in the 2003-04 Household Expenditure Survey (HES) and a new sub-group called Financial services was introduced into the CPI. The ABS published an Information Paper describing the changes:

- Information Paper: Introduction of the 15th Series Australian Consumer Price Index, 2005 (Reissue) (cat. no. 6462.0).

1.9 The 14th Series CPI was introduced in the September quarter 2000, after a minor review completed early in 2000. The changes introduced in the 14th series were considered necessary to address issues arising from the introduction of The New Tax System (TNTS) on 1 July 2000. As part of the review process the ABS published two Information Papers describing the changes:

- Information Paper: Price Indexes and The New Tax System, 2000 (cat. no. 6425.0); and

- Information Paper: Introduction of the 14th Series Australian Consumer Price Index, 2000 (cat. no. 6456.0).

1.10 The 13th Series CPI, which followed a major review of the index, was introduced in the September quarter 1998. Several important changes were made to the index at that time. Prior to the September quarter 1998, the CPI was compiled primarily to be used for income adjustment through wage indexation. This had implications for the coverage and design of the index. It was limited to the expenditures made by households whose principal source of income was wages. It measured out-of-pocket living expenses, including mortgage interest payments.

1.11 Since the September quarter 1998, the principal purpose of the CPI has been to measure inflation faced by households to support the operation of macroeconomic policy decision making. The CPI covers the expenditures of all households (not just those whose principal source of income is wages, as was the case before 1998) and measures the changes in the prices of a basket of goods and services acquired each period. The cost of housing is measured as the price of a new home (excluding land). Mortgage interest payments are excluded.

1.12 As part of the 13th Series review, the ABS published three Information Papers:

- Information Paper: Issues to be Considered During the 13th Series Australian Consumer Price Index Review, Apr 1997 (cat. no. 6451.0);

- Information Paper: Outcome of the 13th Series Australian Consumer Price Index Review, 1997 (cat. no. 6453.0); and

- Information Paper: Introduction of the 13th Series Australian Consumer Price Index, 1998 (cat. no. 6454.0).

1.13 In recognition of the interest in the extent to which the impact of price change varies across different groups in the community, in addition to the CPI, the ABS compiles the Selected Living Cost Indexes, Australia (cat. no. 6467.0).

Contact details

1.14 The ABS intends to update this manual periodically. Therefore, the ABS would welcome comments from the users of statistics covered in this publication. You may direct your comments or questions to:

Consumer Price Index Section

Australian Bureau of Statistics

Locked Bag 10

Belconnen, ACT, 2616

Telephone: 02 6252 6654

Email: prices.statistics@abs.gov.au

Purposes and uses of consumer price indexes

Introduction

2.1 A consumer price index measures the change in the prices paid by households for goods and services consumed. All expenditure by businesses, and expenditure by households for investment purposes, are out of scope of a consumer price index. In this regard, expenditure on housing presents particular difficulties as it can be considered as part investment and part purchase of shelter-related services.

2.2 There is currently no single, universally accepted definition of a consumer price index. The often quoted description of a CPI is the following statement from the Resolution concerning consumer price indexes released in 2003 by the Seventeenth International Conference of Labour Statisticians convened by the International Labour Organization (ILO) (the Resolution is reproduced in Appendix 4):

"The CPI is a current social and economic indicator that is constructed to measure changes over time in the general level of prices of consumer goods and services that households acquire, use or pay for consumption. The index aims to measure the change in consumer prices over time. This may be done by measuring the cost of purchasing a fixed basket of consumer goods and services of constant quality and similar characteristics, with the products in the basket being selected to be representative of households’ expenditure during a year or other specified period."

Principal purposes of a Consumer Price Index

2.3 A consumer price index may serve several purposes. However, three principal purposes are generally recognised, namely to measure:

- changes in the purchasing power of money incomes;

- changes in living standards; and

- price inflation experienced by households.

Purchasing power of money incomes

2.4 A CPI designed to measure the purchasing power of money incomes is concerned with answering questions such as how much income is required today to purchase the same basket of goods and services that was purchased in the base period. The appropriate domain of the basket in this case is all those outlays on consumer goods and services actually made by households in the base period.

2.5 For this purpose the correct measure of income to use is net income (i.e. after income tax), not gross income. Application of the index to gross income is only valid if income tax is proportional to income, and the treatment of property income is identical to that of wage and salary income. A progressive income tax regime, such as that applying in Australia, emphasises the need to use net income. In addition, as the significance of different sources of income and expenditure varies considerably between household types, changes in purchasing power are best assessed by type of household rather than in total.

Assessing changes in living standards

2.6 In assessing changes in living standards, the CPI is used in conjunction with data on expenditures by households to measure changes in their volume of consumption of all goods and services.

2.7 For this purpose, the first thing to do is to define standard of living. A narrow definition of standard of living is the volume of goods and services consumed by households in the base period. For many consumer items, the acquisition of, the payment for, and the consumption of, an item all occur at about the same time. However, for some items the volume of the item consumed in a period may have little relationship to the payments made in the period. A good example of this is a consumer durable such as a private motor vehicle where the vehicle may have been purchased several years earlier. For other items, the price is substantially below the economic cost of providing the good or service, so that the expenditure is not a true reflection of the quantity of the item consumed. Typical examples of this are services provided by the public sector such as education and medical care. Estimates must be made of the economic value of these items actually consumed in the base period.

2.8 Estimates of the market value of the consumption of consumer durables can be made by reference to the market prices of similar items (thus private rents can be used as an indicator of the value of owner-occupied housing, and leasing charges for households' fleet of motor vehicles). For insurance services, estimates of the service component (essentially operating costs plus profit) are derived from the published accounts of insurance companies. For publicly supplied goods and services, the ABS compares their prices with those of private suppliers of similar services or makes estimates based on the cost of providing the service (e.g. teachers’ salaries plus building and running costs for educational services).

2.9 Of course, a broader definition of living standards is possible. It might include environmental conditions such as the quality of air and water, or the area of national parks. Although these are important in their own right, the measurement of these factors, the value placed on them by households, and the means of including them in an index of living standards, are as yet insoluble problems (see Pollak (1998)). So for practical reasons, the narrow definition is used.

2.10 Against this background, the domain for an index designed to assess changes in living standards would include:

- residential rent payments;

- imputed rent of owner-occupied dwellings;

- consumer durables;

- the value of insurance and banking service charges;

- other private-sector goods and services; and

- government-provided goods and services valued at cost or at their estimated market prices.

2.11 This measure accords with the concept of Household Final Consumption Expenditure (HFCE) in the Australian National Accounts.

Measuring household inflation

2.12 Another possible purpose of the CPI is to measure household inflation. This measure is primarily for use in macroeconomic management, and also has some possible uses in contracts where an index of prices for household consumption items is appropriate. Of course, as the CPI measures only households' price experience, it is not a measure of economy-wide inflation.

2.13 As there is no generally agreed definition of inflation, the issue of how it should be measured is complicated. Nevertheless, it seems clear that an index of household inflation should attempt to measure the contemporary rate of change in prices of consumer goods and services.

2.14 An important aspect of a measure of inflation is that it should only include market-determined prices. Thus, an inflation measure would not include imputed rent of owner-occupied dwellings (which, however, would be included in a cost-of-use approach as discussed below). A measure of house prices would be more appropriate, if housing is not considered an investment. Financial assets would not be considered a good or service, thus prices of shares and the like would be out of scope. However, such a measure would need to capture changes in the service charges of intermediaries involved in financial and asset-transaction services, such as banks, insurance companies, and real estate agents

2.15 It could be argued that an inflation measure should also exclude goods and services provided to households at subsidised prices. The reason is that the inflation rate has implications for government policy, and as such it should be determined by market forces unhindered by the actions of governments themselves. The argument goes that subsidies are distortions of pure market forces, and subsidised prices do not reflect the true market price (or economic value) of the goods and services. However, the treatment of taxes, and subsidies which are regarded as negative taxes, should be symmetrical. Excluding subsidised goods would lead to some significant goods and services (e.g. education) being omitted that would otherwise be considered essential for complete coverage in a CPI. Consequently, the most common practice is to include subsidised goods and services.

2.16 The domain for a measure of household inflation would thus include:

- residential rent payments;

- net purchase of owner-occupied dwellings;

- net purchase of consumer durables;

- the value of intermediary services for transactions in real and financial assets (e.g. banking and stockbroking services); and

- other consumer goods and services provided at market prices.

2.17 As it presently stands, the Australian CPI is specifically designed to provide a general measure of price inflation for households residing in the capital cities.

Conceptual approaches to constructing a Consumer Price Index

2.18 Once the purpose of a CPI is decided, a method of construction can be worked out to satisfy that purpose. Consistent with the three purposes outlined above, there are three possible conceptual approaches for constructing a CPI. These approaches are consistent with the ILO Resolution which says that "...a reference population acquires, uses or pays for consumer goods and services".

These are the three methods.

(i) The Acquisitions method: in the base period, all goods and services acquired (i.e. actually received) by the reference population are included in the CPI regardless of the period in which payment or use occurs.

(ii) The Cost-of-Use method: in the base period, all goods and services used (i.e. consumed) by the reference population are included in the CPI regardless of when they are paid for or acquired. In particular, the cost of using the good or service is measured by its true economic cost.

(iii) The Outlays method: in the base period, all goods or services for which payments were made are included in the CPI without regard to the source of the funds.

2.19 The acquisitions and outlays approaches are similar. The acquisitions approach leads to a CPI basket that can be viewed as a subset of the basket resulting from an outlays approach. Both conceptual approaches include goods and services acquired during the base period, but the outlays approach also effectively includes any inescapable costs associated with the acquisition of a good or service, such as interest charges. The cost-of-use approach can result in a basket that differs from both the acquisitions and outlays approaches.

2.20 The choice of conceptual approach for construction of the index depends on the purpose. The approach that is most appropriate for each of the three possible CPI purposes is outlined below.

(i) Purchasing power of money incomes. In order to determine changes in the purchasing power of money, an outlays approach is most appropriate. The outlays approach provides a proxy for household income through measurement of consumer outlays.

(ii) Assessing changes in living standards. The cost-of-use approach provides the best indication of changes in living standards as it relates to goods and services actually consumed in the base period.

(iii) Measuring household inflation. The acquisitions method is the most appropriate for this purpose. A measure of household inflation should relate to the contemporary rate of change in the prices of goods and services. The acquisitions approach captures this by measuring changes in the prices of goods and services actually acquired in the base period.

Comparison of the conceptual approaches

2.21 In practice, for most goods and services purchased by the reference population, outlay, acquisition, and use all occur within a short period, and the price paid by the reference population is a true economic value, effectively making the distinction between the approaches academic. However, in some cases there can be significant lags between outlay, acquisition, and use; or the price paid may differ significantly from what is considered the true value.

2.22 There are three areas of household expenditure in which these conceptual approaches provide significantly different results. These are:

(i) the purchase of housing;

(ii) the purchase of durable goods; and

(iii) financial services, including the use of credit.

2.23 To illustrate the differences among the three approaches, the way in which these three special cases are treated under each approach is outlined below.

Expenditure on housing

2.24 Under the acquisitions approach, the required measure is the change in prices for both the net purchase of housing, and the increase in the volume of housing because of renovations and extensions, plus other costs incurred in ensuring the continued supply of services provided by owner-occupied dwellings (e.g. maintenance costs and council rates). Changes in rents are measured for that part of the reference population that resides in rented dwellings. Costs such as maintenance of rental dwellings are paid by investors who are out of scope of a CPI.

2.25 Under the outlays approach, the required measure includes changes in the amount of interest paid on mortgages, and the costs incurred in ensuring the continued supply of services provided by the dwellings (e.g. maintenance costs and council rates). Also included are changes in rents which are measured for that part of the reference population that resides in rented dwellings.

2.26 Under the cost-of-use approach, the required measure is the change in the economic value of the services provided by dwellings. The price of these services is usually measured as the rental value of the dwellings. For owner-occupied dwellings, the rental values are imputed. Costs such as maintenance costs are not included as they are part of the cost of maintaining an investment, and so are outside the scope of a CPI.

Durable goods

2.27 For durable goods, the three approaches result in the following treatments

(i) Acquisitions - the basket includes those durable goods acquired in the base period, and their price measure is the transaction (purchase) price.

(ii) Outlays - the basket includes those durable goods paid for in the base period, and their price measure is the transaction price.

(iii) Cost-of-use - the basket includes the services of durable goods consumed in the base period, regardless of the period in which they were purchased, and the price measure is the market value of the services provided by those goods (measured in business accounts as depreciation plus the return on investment).

Financial services and the use of credit

2.28 Under the acquisitions approach, interest paid is not a charge that is within scope of the CPI basket of goods and services. The service for which prices are required is that of providing banking services (including the provision of loans).

2.29 Under the outlays approach, the product being priced is the cost of servicing loans taken out to purchase products that are part of the CPI basket. Thus the change in the level of interest paid on this debt is the required price measure.

2.30 The cost-of-use approach requires that the cost of the financial services used is measured in a similar manner to the acquisitions approach.

Concluding remarks

2.31 The alternate approaches to the construction of the CPI reflect conceptual differences; and their use is determined by the purpose of the CPI.

The Australian Consumer Price Index

1997 Review and the adoption of an acquisitions basis for the CPI

2.32 In 1997 a major review of the CPI was conducted, involving consultation with a wide range of organisations and individuals representing government, social, business and community interests. This review concluded that the ABS should change from an outlays index for wage and salary earner households and adopt an acquisitions approach as a general measure of household inflation for all private households. Since the introduction of the 13th series CPI in the September quarter 1998, the CPI has been compiled on an acquisitions basis. Another major review of the CPI was conducted in 2010 which concluded that, with the introduction of the 16th series CPI, the acquisitions approach continue to be used in the compilation of the CPI. For more detail on the 1997 and 2010 Reviews, see:

- Information Paper: Issues to be Considered During the 13th Series Australian Consumer Price Index Review, Apr 1997 (cat. no. 6451.0);

- Information Paper: Outcome of The 13th Series Australian Consumer Price Index Review, 1997 (cat. no. 6453.0);

- Information Paper: Introduction of the 13th Series Australian Consumer Price Index, 1998 (cat. no. 6454.0);

- Information Paper: Issues to be considered during the 16th Series Australian Consumer Price Index Review, Dec 2009 (cat. no. 6468.0);

- Information Paper: Outcome of the 16th Series Australian Consumer Price Index Review, Australia, December 2010 (cat. no. 6469.0); and

- Information Paper: Introduction of the 16th Series Australian Consumer Price Index, 2011 (cat. no. 6470.0).

Uses of the CPI

2.33 A major use of the CPI is to assist government economists in conducting general economic policy, especially monetary policy. Since 1993, Australian monetary policy has been conducted with the aim of meeting a medium-term inflationary target. Since the introduction of the 13th series CPI in the September quarter 1998, that target has been the inflation rate as measured by the CPI. Additional analytical series including the international trade exposure and underlying trend estimates are also used to assist in understanding inflationary trends.

2.34 The CPI, or one of its components, is also widely used in indexation arrangements in both the private and public sectors. These include indexing pension and superannuation payments, taxes and charges, some governmental bonds, and business contracts.

2.35 In Australia, the use of the CPI in wage determination has diminished with the trend towards decentralised, enterprise-based wage and salary setting arrangements with outcomes focused on the commercial circumstances of each business.

Historical background

Introduction

3.1 Before the introduction of the Consumer Price Index (CPI) in 1960, there were five series of retail-price indexes compiled by the then Commonwealth Bureau of Census and Statistics. Those indexes were as follows:

(i) The A Series Index, covering only food, groceries and housing rents (for all houses), which was first compiled in 1912 with index numbers going back to 1901, was discontinued in 1938. Its main use was for adjusting wages between 1913 and 1933.

(ii) The B Series Index, covering only food, groceries and housing rents (for four and five-roomed houses), which was first compiled in 1925, was discontinued in 1953. It was introduced to replace the A Series Index for general statistical purposes, but was never used for adjusting wages.

(iii) The C Series Index, covering food and groceries, housing rents (for four and five-roomed houses), clothing, household drapery, household utensils, fuel, lighting, urban-transport fares, smoking and some miscellaneous items, which was introduced in 1921, was discontinued in 1961. The food and rent component of the C Series Index was the same as that for the B Series Index. The C Series Index was used to adjust wages from 1934 until it was discontinued.

(iv) The D Series Index, which was derived by combining the A Series and C Series Indexes, and was compiled especially for wage adjustment purposes for a short period in 1933-34.

(v) The Interim Retail Price Index, covering food and groceries, housing rents (for four and five-roomed houses), clothing, household drapery, household utensils, fuel, lighting, urban-transport fares, smoking, and some services and miscellaneous items which was first compiled in 1954 and was discontinued in 1960. As the name implies, the Interim Index was intended to serve as a transitional index, but to some extent it replaced the C Series Index for general statistical purposes for a few years before 1960. It was never used for wage adjustment purposes.

C Series Index

3.2 By far the most important of these old price indexes was the C Series Index which was the principal retail price index in Australia for almost forty years. It was first compiled in 1921 with index numbers compiled back to 1914. C Series Index numbers were compiled for:

(i) the capital city in each of the six states;

(ii) four of the larger towns in each of the six states;

(iii) weighted average of five towns (including the capital city) in each of the six states;

(iv) weighted average of the six state capital cities;

(v) weighted average of thirty towns (including the capital cities); and

(vi) three additional towns - Whyalla, Port Augusta, and Canberra.

3.3 The C Series Index was reviewed in 1936 and a slightly revised selection of goods and services was introduced, which then remained unchanged until the C Series Index was discontinued.

3.4 The main reason for the long interval without any review or change in composition of the C Series Index after 1936 was the recurrent changes in consumption patterns which occurred during and after World War II. It was considered impossible at the time to devise a revised weighting pattern which would be any more representative of post-war consumption than the existing weighting pattern of the C Series Index. The Commonwealth Statistician of the time, in successive editions of the Labour Report during the 1950s and 1960s, explained the absence of any re-weighting of the C Series Index in the following words.

"From the outbreak of war in 1939 to late in 1948, periodic policy changes in various wartime controls (including rationing) caused recurrent changes in consumption and in the pattern of expenditure. This rendered changes desirable but made it impracticable either to produce a new index, or to revise the old one, on any basis that would render the index more representative than it already was of the changing pattern of household expenditure in those years. When commodity rationing had virtually ceased in the latter part of 1948 action was taken by the Statistician to collect price data of about 100 additional items and to gather information as to current consumption and expenditure patterns. This was done to facilitate review of the component items and weighting system of the C Series Retail Price Index in the light of the new pattern of wage earner expenditure and consumption that appeared to be then emerging. But there supervened, in the next few years, conditions which caused wide price dispersion, coupled with a very rapid rise in prices and a new sequence of changes in consumption and in the pattern of wage earner expenditure. Under these conditions it was not possible to devise any new weighting pattern likely to be more continuously representative of conditions then current, than was the existing C Series Index on the 1936 revision."

3.5 In 1953, the decision was made to continue compiling the C Series Index on its pre-war basis, but also to compile an interim retail price index based as nearly as possible on the post-war pattern of consumer usage and expenditure. Nevertheless, the C Series Index continued to be regarded by the majority of users as the principal official index, and was the one used in most indexation and escalation arrangements throughout the 1950s.

Interim Retail Price Index

3.6 The Interim Retail Price Index was based on post-war consumption weights. Compared with the C Series Index, the Interim Index covered an expanded range of items, including additional foods (such as packaged breakfast foods, soft drinks, ice cream, and confectionery) and services (such as dry-cleaning and shoe repairs). Throughout the period of its compilation, no attempt was made to revise its weights to take account of major changes in expenditure patterns and lifestyles that were occurring during the 1950s. During that decade, house renting was substantially replaced by home ownership, the use of motor cars partially replaced the use of public transport, and a variety of electrical appliances, and subsequently television, became widely used by households. During the same period, widely disparate movements occurred in the prices of different items routinely purchased by households. It was considered that the combined effect of these factors made it impracticable to introduce a comprehensive new retail price index during the period to 1960.

Consumer Price Index

3.7 In 1960, a new approach was tried. Instead of the former emphasis on long-term fixed-weighted indexes, the aim was to compile a series of shorter term indexes that would be chain linked to form long-term series. The Consumer Price Index, commonly referred to as the CPI, was the first price index of this kind constructed in Australia.

3.8 The CPI was first compiled in 1960 with index numbers compiled back to mid-1948. Like the old indexes, the CPI was designed to measure quarterly changes in the retail prices of goods and services purchased by metropolitan wage-earning households.

3.9 At its inception in 1960, the CPI consisted of three original series linked together with changes in weights in 1952 and 1956. Weights were changed in 1960 and subsequently in 1963, 1968, 1973, 1974, 1976, 1982, 1987, 1992, 1998, 2000, 2005, 2011 and 2017. From 2017, the CPI is re-weighted annually each December quarter. The Household Expenditure Survey (HES) is used to update the weights in the years that it is available. For the inter-HES years, Household Final Consumption Expenditure (HFCE) data from the National Accounts is used as the principal data source for re-weighting the CPI.

Long-term linked series

3.10 To provide an approximate long-term aggregate measure of consumer price change for the period since the first Australian retail price index was compiled, the ABS has constructed a single series of index numbers by linking together selected retail and consumer price index series from amongst those described above (see Table 3.1). The index numbers are expressed with an index reference base of 1945 equals 100.0 which was the end of a period of price stability during World War II. The successive series linked together to produce this long-term series of index numbers are:

- from 1901 to 1914, the A Series Retail Price Index;

- from 1914 to 1946-47, the C Series Retail Price Index;

- from 1946-47 to 1948-49, a combination of the C Series Index, excluding the housing group of the CPI; and

- from 1948-49 onwards, the CPI.

3.11 This long-term series of index numbers is updated each year. A graph of the series taken from Table 3.1 is presented in Figure 3.1.

| Year | Index | Year | Index | Year | Index | Year | Index |

|---|---|---|---|---|---|---|---|

| 1901 | 47 | 1931 | 78 | 1961 | 252 | 1991 | 1,898 |

| 1902 | 50 | 1932 | 74 | 1962 | 251 | 1992 | 1,917 |

| 1903 | 49 | 1933 | 71 | 1963 | 252 | 1993 | 1,952 |

| 1904 | 46 | 1934 | 73 | 1964 | 258 | 1994 | 1,989 |

| 1905 | 48 | 1935 | 74 | 1965 | 268 | 1995 | 2,082 |

| 1906 | 48 | 1936 | 75 | 1966 | 276 | 1996 | 2,136 |

| 1907 | 48 | 1937 | 78 | 1967 | 286 | 1997 | 2,141 |

| 1908 | 51 | 1938 | 80 | 1968 | 293 | 1998 | 2,159 |

| 1909 | 51 | 1939 | 82 | 1969 | 302 | 1999 | 2,191 |

| 1910 | 52 | 1940 | 85 | 1970 | 313 | 2000 | 2,289 |

| 1911 | 53 | 1941 | 89 | 1971 | 332 | 2001 | 2,389 |

| 1912 | 59 | 1942 | 97 | 1972 | 352 | 2002 | 2,462 |

| 1913 | 59 | 1943 | 101 | 1973 | 385 | 2003 | 2,530 |

| 1914 | 61 | 1944 | 100 | 1974 | 443 | 2004 | 2,588 |

| 1915 | 70 | 1945 | 100 | 1975 | 510 | 2005 | 2,658 |

| 1916 | 71 | 1946 | 102 | 1976 | 579 | 2006 | 2,753 |

| 1917 | 75 | 1947 | 106 | 1977 | 650 | 2007 | 2,817 |

| 1918 | 80 | 1948 | 117 | 1978 | 702 | 2008 | 2,940 |

| 1919 | 91 | 1949 | 128 | 1979 | 766 | 2009 | 2,994 |

| 1920 | 103 | 1950 | 140 | 1980 | 844 | 2010 | 3,079 |

| 1921 | 90 | 1951 | 167 | 1981 | 926 | 2011 | 3,181 |

| 1922 | 87 | 1952 | 196 | 1982 | 1,028 | 2012 | 3,237 |

| 1923 | 89 | 1953 | 205 | 1983 | 1,132 | 2013 | 3,316 |

| 1924 | 88 | 1954 | 206 | 1984 | 1,177 | 2014 | 3,399 |

| 1925 | 88 | 1955 | 211 | 1985 | 1,257 | 2015 | 3,450 |

| 1926 | 90 | 1956 | 224 | 1986 | 1,370 | 2016 | 3,494 |

| 1927 | 89 | 1957 | 229 | 1987 | 1,487 | 2017 | 3,562 |

| 1928 | 89 | 1958 | 233 | 1988 | 1,594 | 2018 | 3,630 |

| 1929 | 91 | 1959 | 237 | 1989 | 1,714 | ||

| 1930 | 87 | 1960 | 245 | 1990 | 1,839 |

- Base: Calendar Year 1945 = 100.0.

- The index numbers relate to the weighted average of six state capital cities from 1901 to 1980 and to the weighted average of eight capital cities from 1981. Index numbers are for calendar years.

- Any discrepancies with movements published in ABS cat. no. 6401.0 are due to different index reference periods and rounding.

Price index theory

Overview

4.1 Price indexes in one form or another have been constructed for several centuries, and are commonly used in everyday life. However, the complexities of price indexes are not always fully appreciated or understood. Price index theory provides an overview of the theory and practices that underpin the construction of price indexes.¹

4.2 Price index theory commences by describing the concept of a price index as a single-number representation of information about many prices before discussing the relationship between indexes of prices, quantities and expenditures.

4.3 Two levels of construction of price indexes are described. At the lowest level is the construction of an index for a narrowly defined commodity from price observations. The other is the aggregation of these basic or elementary aggregate indexes across a range of commodities. Various mathematical formulas for constructing these indexes are discussed including problems for prices statisticians in selecting the most appropriate methodology. The advantages and disadvantages of the various formulas are discussed, along with criteria to guide decisions on the most appropriate formula.

4.4 Price index theory concludes with a discussion of issues that arise in price index construction, including changes in observation numbers, quality adjustments, the inclusion of new products and index number bias.

4.5 Price index theory focuses on traditional price index methods, however in the past ten years there have been significant developments in new price index construction methods involving transactions (scanner) data. These methods are discussed in more detail in Use of transactions data in the Australian CPI of this manual.

The concept of a price index

Comparing prices

4.6 There are many situations where there is a need to compare two (or more) sets of price observations. For example, a household might want to compare prices today with some earlier period; a manufacturer would be interested in comparing prices between markets to determine where to sell its output, or to compare price movements between two time periods with movements in its production costs; and economists and market analysts need to be able to compare prices between countries and over time to assess and forecast a country’s economic performance.

4.7 In some situations, the price comparisons might only involve a single commodity. Here it is simply a matter of directly comparing the two price observations. For example, a household might want to assess how the price of shampoo today compares with the price at some previous time for the same item.

4.8 In other circumstances, the required comparison is of prices across a range of commodities. For example, a comparison of clothing prices might be required. There is a wide range of clothing types and thus prices to be considered (e.g. toddlers’ jump suits, women’s fashion skirts, boys’ shorts, men’s suits). Although comparisons can readily be made for individual or identical clothing items, this is unlikely to enable a satisfactory result for all clothing in aggregate. A method is required for combining the prices across this diverse range of items allowing for the fact that they have many different units or quantities of measurement. This is where price indexes play an extremely useful role.

The basic concept

4.9 A price index allows the comparison of two sets of prices either over time (temporal indexes) or regions (spatial indexes) for a common item or group of items. In order to compare the sets of prices, it is necessary to designate one set the reference set and the other the comparison set.² The reference price set is used as the base (or first) period for constructing the index, and by convention in Australia is always given an index value of 100. For example, suppose for a single item the average of prices in the first set was $15 and for the second set was $30. Then, designating the first set as the reference set gives an index of 200.0 (30/15x100) for the comparison second set. Designating the second set as the reference set gives an index of 50.0 (15/30×100) for the comparison first set.

4.10 The most common price index is a comparison between sets of prices at two times (temporal indexes). The times can be adjacent (this month and previous month) or many periods apart (this year and ten years earlier). Typically the method is to nominate one set of prices as the reference prices and to revalue the quantities (or basket) of items purchased in the base period by prices in the second (or comparison) period. The ratio of the revalued comparison period basket to the value of the reference period basket provides a measure of the price change between the two periods. This simple revaluation, however, does not take account of any changes or substitutions that may be made in quantities consumed in response to changes in relative prices between the two periods. Nor does it allow for any change in tastes between the two periods. These changes to the preferences of consumers are significant in the choice of index methodology.

4.11 Handling quantity changes that occur in response to changes in relative prices is fundamental to price index construction. Changes in the relative importance of items in the basket of goods and services can have a significant effect on index movements.

4.12 Another objective of price indexes is to determine levels of household expenditure that are equivalent between two cities, say Darwin and Hobart. To do this, a spatial price index is required which allows the price levels in the two cities to be compared. This can be done by specifying a basket (i.e. quantities) of goods and services, and pricing this basket in both cities. The ratio of the total price of the basket in each city gives a measure of price relatives.

4.13 The composition of the basket would depend on the comparison required. For example, suppose the household was considering relocating from Darwin to Hobart and desired to be no worse off in terms of the overall basket of goods and services it could purchase. The reference basket should then comprise the quantities of each item currently purchased by the household in Darwin. Alternatively, if the household were in Hobart and considered relocating to Darwin, then it would specify the reference basket as the quantities of goods and services being purchased in Hobart.

4.14 The composition of the basket reflects the consumption preferences of the subject, in this case the household. It will reflect the household’s preferences under the prices and income prevailing in its current situation. Ideally, what would be required is some indication of how the household’s tastes or preferences might change between locations. Clearly the household could choose a different mix of items in Hobart than in Darwin, reflecting differences in relative prices between the cities, climate and other factors. The objective, though, is the same: to measure the relative expenditures in the two cities for which the household is equally satisfied (or indifferent).

Refining the concept

4.15 The remainder of Price index theory focuses on the comparison of prices over time (temporal indexes). Expenditure on an individual item is the product of price and quantity, that is:

\(e_t = p_tq_t \space \space \space \space \space \space (4.1)\)

where \(e\) is expenditure, \(p\) is price, \(q\) is quantity and the subscript \(t\) refers to the time periods at which the observations are made.

4.16 Consider the expenditures on the same commodity in two different times periods. Changes in these expenditures can reflect changes in the price, changes in the quantity, or a combination of both price and quantity changes. For example, suppose the price of Granny Smith apples at a particular market is $2.00 per kg in period one, and it rises to $2.50 per kg in period two. The change in the price of apples between these two periods is obtained from the ratio of the price in the second period to the price in the first period; that is, $2.50/$2.00 = 1.25 or an increase of 25% in the price. If a consumer bought exactly the same quantity of apples in the two periods, the expenditure on Granny Smith apples would rise by 25%. However, if the amount purchased in the first period was 10 kg, and the amount purchased in the second period was 12 kg, the quantity would also have risen by a factor of 12/10 = 1.20 or 20%. In these circumstances, the total expenditure on apples increases from $20 in the first period (10 kg at $2.00 per kg), to $30 in the second period (12 at $2.50 per kg), an increase in expenditure of $10 or 50%. The ratio of the current expenditure to the previous expenditure is the product of the change in price and the change in quantity (1.25 x 1.20 = 1.50).

4.17 The ratio between the price in the current period and the price in the reference period is called a price relative. A price relative shows the change in price for one item only (e.g. the pricing of Granny Smith apples at one particular fruit market).

In terms of the formula in equation 4.1:

\(e_1\) (expenditure in period 1) = \(p_1\) ($2.00) x \(q_1\) (10kg) = $20, and

\(e_2\) (expenditure in period 2) = \(p_2\) ($2.50) x \(q_2\) (12kg) = $30

where: \(p_1\) is the price per kg in period 1; \(q_1\) is the quantity in period 1;

\(p_2\) is the price per kg in period 2 and \(q_2\) is the quantity in period 2.

The ratio between the prices in the two periods, \(p_2\) and \(p_1\) ($2.50/$2.00 = 1.25) is the price relative.³

4.18 It is only necessary to have observations on two of the three components of equation 4.1 to analyse contributions to change in the expenditure. Using the apple example, suppose observations were only available on expenditure and price. The expenditure could be divided by the price to estimate the quantity (or the movements in expenditure and price could be used). Alternatively, if only expenditure and quantity data were available, expenditure could be divided by quantity to derive what's known as the 'unit (price) value'.

4.19 Now consider the case of price and quantity (and expenditure) observations on many commodities. The quantity measurements can have many dimensions, such as kilograms, tonnes, or even units (e.g. number of motor cars), and the quantities and prices of items are likely to show different movements between periods. Answers are required to questions such as these: what is the change over time in the quantity of commodities, and what is the contribution of price changes to changes in the expenditure on the bundle of commodities over time? Answering these questions is the task of index numbers: to summarise the information on sets of prices and quantities into single measures to assist in understanding and analysing changes.

4.20 In essence, an index number is an average of either prices or quantities compared with the corresponding average in a base period. The problem is how to calculate the average.

4.21 More formally, the price index problem is how to derive an index of price \((I^P)\) and an index of quantity \((I^Q)\) such that the product of the two is the change in the total value of the items between the base period \((0)\) and any other period \((t)\), that is

\({I{^P_t}I{^Q_t}={V_t/V_0}} \space \space \space \space \space (4.2)\)

where \(V_t\) is the value of all items in period \(t\) and \(V_0\) is their value in period \(0\) (base period). Based on equation (4.1), can be represented as:

\({V_t} = {\sum {v_{it}}} = {\sum {p_{it}{q_{it}}}} \space \space \space \space \space (4.3)\)

that is, the sum of the product of prices and quantities of each item denoted by subscript \(i\). The summation range \((i =1..N)\) is not shown in order to make the formula more readable.

Major index formulas

4.22 In presenting index number formulas, a simple starting point is to compare two sets of prices (sometimes called bilateral indexes). Consider price movements between two periods, where the first period is denoted as period \(0\) and the second period as period \(t\) (period \(0\) occurs before period \(t\)). To calculate the price index, the quantities need to be fixed at the same period in time. The initial question is what period should be used to determine the basket (or quantities). There are several possibilities.

(i) The quantities of the first (or earlier) period.

This approach answers the question how much would it cost in the second period, relative to the first period, to purchase the same basket of goods and services that was purchased in the first period. Estimating the cost of the basket in the second period's prices simply requires multiplying the quantities of items purchased in the first period by the prices that prevailed in the second period. A price index is obtained from the ratio of the revalued basket to the total price of the basket in the first period. This approach was proposed by Laspeyres in 1871, and is referred to as a Laspeyres price index \(I_{Lt}\). It may be represented, with a base of 100.0, as:

\({I_{Lt}}=\frac{\sum p_{it}q_{i0}}{\sum p_{i0}q_{i0}} \times 100 \space \space \space \space \space (4.4)\)

(ii) The quantities of the second (or more recent) period.

This approach answers the question how much would it have cost in the first period, relative to the second period, to purchase the same basket that was purchased in the second period. Estimating the cost of purchasing the second period's basket in the first period simply requires multiplying the quantities of items purchased in the second period by the prices prevailing in the first period. A price index is obtained from the ratio of the total price of the basket in the second period compared to the total price of the basket valued at the first period's prices. This approach was proposed by Paasche in 1874, and is referred to as a Paasche price index \(I_{Pt}\). It may be represented, with a base of 100.0, as:

\({I_{Pt}}=\frac{\sum p_{it}q_{it}}{\sum p_{i0}q_{it}} \times 100 \space \space \space \space \space (4.5)\)

(iii) A combination (or average) of quantities in both periods.

This approach tries to overcome some of the inherent difficulties of using a basket fixed at either time period. In the absence of any firm indication that either period is the better to use as the base or reference, then a combination of the two is a sensible compromise. In practice this approach is most frequent in:

a) the Fisher Ideal price index,⁴ which is the geometric mean of the Laspeyres and Paasche indexes:

\(I_{Ft} = {(I_{Lt}I_{Pt}) ^ \frac {1}{2}} \space \space \space \space \space (4.6)\)

b) the Törnqvist price index, which is a weighted geometric mean of the price relatives where the weights are the average expenditure shares in the two periods, that is:

\(I_{Tt} = \prod \limits_i (\frac {p_{it}}{p_{i0}})^{s_{i}} \space \space \space \space \space (4.7)\)

where \(s_i = \frac {1}{2} (e_{i0} / \sum e_{i0}+e_{i1} / \sum e_{i1})\) is the average of the expenditure shares for the \(i\)ᵗʰ item in the two periods.

The Fisher Ideal and Törnqvist indexes are often described as symmetrically weighted indexes because they treat the weights from the two periods equally.

4.23 The Laspeyres and Paasche formulas are expressed above in terms of quantities and prices. However, in practice, quantities might not be observable or meaningful (e.g. consider the quantity dimension of legal services, public transport, and education). Thus in practice, the Laspeyres formula is typically estimated using expenditure shares to weight price relatives - this is numerically equivalent to the formula (4.4) above.

4.24 To derive the price relatives form of the Laspeyres index, multiply the numerator of equation 4.4 by \(\frac {p_{i0}}{p_{i0}}\)and rearrange to obtain:

\({I_{t}}= \sum \frac {p_{it}}{P_{i0}} (\frac{p_{i0}q_{i0}}{\sum p_{i0}q_{i0}}) \times 100 \space \space \space \space \space (4.8)\)

where the term in parentheses represents the expenditure share of item \(i\) in the reference (or, more commonly labelled, base) period. Let:

\(w_{i0} = \frac{p_{i0}q_{i0}}{\sum p_{i0}q_{i0}} = \frac{e_{i0}}{\sum {e_{i0}}} \space \space \space \space \space (4.9)\)

then the Laspeyres formula may be expressed as:

\({I_{it}}= \sum w_{i0} (\frac{p_{it}}{p_{i0}}) \times 100 \space \space \space \space \space (4.10)\)

where \(\frac {P_{it}}{P_{i0}}\) is the price relative for the \(i\)ᵗʰ item.

4.25 In a similar manner, the Paasche index may be constructed using expenditure weights. In equation 4.5, multiply the denominator by \(\frac {P_{it}}{P_{it}}\)and rearrange terms to obtain:

\(I_{Pt} = \frac{\sum p_{it}q_{it}}{\sum p_{it}q_{it} \frac{p_{i0}}{p_{it}}} = \frac{1}{\sum \frac{p_{i0}}{p_{it}}} (\frac {\sum p_{it}q_{it}}{p_{it}q{_{it}}}) \times 100 \space \space \space \space \space (4.11)\)

which may be expressed as:

\(I_{Pt} = \frac{1}{\sum w_{it} \frac{p_{i0}}{p_{it}}} \times 100 \space \space \space \space \space (4.12)\)

which is the inverse of a ‘backward’ Laspeyres index (i.e. a Laspeyres index going from period t to period \(0\) using period \(t\) expenditure weights).⁵

4.26 The important point to note here is that if price relatives are used, then value (or expenditure) weights must also be used. On the other hand, if prices are used directly rather than in their relative form, then the weights must be quantities.

4.27 An example of creating index numbers using the above formulas is presented in Table 4.1. For the purposes of this exercise, a limited range of the types of commodities households might purchase is used. The quantities that these items would typically be measured in may vary. There are likely to be differences in price behaviour of the commodities over time. Further, the quantities of these items households purchase may vary over time in response to changes in prices (of both the item and other items) and household incomes.

4.28 Differences that might arise in price changes (and, by implication expenditure patterns) are illustrated by the following:

- prices of high labour content items, such as services like a haircut, will tend to show steady trends over time relative to other items;

- prices of high technology goods, such as tablets, tend to decline over time, either absolutely or relative to other items, reflecting productivity and technological advances;

- prices of some items, such as fresh fruit, are affected by climatic and seasonal influences and so have volatile price movements; and

- prices of some items might at times be influenced by changes in taxation rates (e.g. tobacco).

4.29 Price changes influence, to varying degrees, the quantities of items households purchase. For some items, such as basic food stuffs, the quantities purchased may show little change in response to price changes. For other items, the quantities households purchase may change by a smaller or greater proportionate amount than the price change.⁶

4.30 The examples in Table 4.1 reflect some of these possibilities.

4.31 In Table 4.1 the different index formulas produce different index numbers, and thus different estimates of the price movements. Typically the Laspeyres formula will produce a higher index number than the Paasche formula in periods after the base period, with the Fisher Ideal and the Törnqvist of similar magnitude falling between the index numbers produced by the other two formulas. In other words the Laspeyres index will generally produce a higher (lower) measure of price increase (decrease) than the other formulas and the Paasche index a lower (higher) measure of price increase (decrease) in periods after the base period.⁷

4.32 With the recent ability of National Statistical Offices to access transactions (scanner) data for use in their CPIs, new index construction methods have been developed to make use of the available price and quantity data in each period. These methods borrow heavily from existing methods in the production of spatial price indexes, in particular multilateral indexes. These multilateral index methods are being adapted for the purpose of producing temporal price indexes, which can be used in the production of the CPI. The use of transactions data and multilateral index methods in the Australian CPI are discussed further in Use of transactions data in the Australian CPI.

Generating index series over more than two periods

4.33 Most users of price indexes require a continuous series of index numbers at specific time intervals. There are two options for applying the above formulas when compiling a price index series.

(i) Select one period as the base and separately calculate the movement between that period and each required period. This is called a fixed base or direct index.

(ii) Calculate the period-to-period movements and chain these (i.e. calculate the movement from the first period to the second, the second to the third with the movement from the first period to the third obtained as the product of these two movements).

4.34 The calculation of direct and chained indexes over three periods (0, 1, and 2) using observations on three items, is shown in Table 4.2. The procedures can be extended to cover many periods.

| Item | Price ($) | Quantity | Expenditure ($) | Expenditure shares | Price relatives | |

|---|---|---|---|---|---|---|

| Period 0 | ||||||

| White fresh bread | loaves | 2.90 | 2 000 | 5 800 | 0.3932 | 1.0000 |

| Apples | kg | 5.50 | 500 | 2 750 | 0.1864 | 1.0000 |

| Beer | litres | 8.00 | 200 | 1 600 | 0.1085 | 1.0000 |

| LCD TV | units | 1 200.00 | 2 | 2 400 | 0.1627 | 1.0000 |

| Jeans | units | 55.00 | 40 | 2 200 | 0.1492 | 1.0000 |

| Total | 14 750 | 1.0000 | ||||

| Period t | ||||||

| White fresh bread | loaves | 3.00 | 2 000 | 6 000 | 0.4220 | 1.0345 |

| Apples | kg | 4.50 | 450 | 2 025 | 0.1424 | 0.8182 |

| Beer | litres | 8.40 | 130 | 1 092 | 0.0768 | 1.0500 |

| LCD TV | units | 1 100.00 | 3 | 3 300 | 0.2321 | 0.9167 |

| Jeans | units | 60.00 | 30 | 1 800 | 0.1266 | 1.0909 |

| Total | 14 217 | 1.0000 | ||||

| Index number | ||||||

| Index formula | Period 0 | Period t | ||||

| Laspeyres | no. | 100.0 | 98.5 | |||

| Paasche | no. | 100.0 | 97.6 | |||

| Fisher | no. | 100.0 | 98.1 | |||

| Törnqvist | no. | 100.0 | 98.0 | |||

Note: Any discrepancies between totals and sums of components are due to rounding.

4.35 The following illustrate the index number calculations:

Laspeyres

\(= [(0.3932 \times 1.0345) + (0.1864 \times 0.8182) + (0.1085 \times 1.0500) + (0.1627 \times 0.9167) + (0.1492 \times 1.0909)] \times 100 \\ = 98.51\)

Paasche

\(= 1 / [(0.4220 / 1.0345) + (0.1424 / 0.8182) + (0.0768 / 1.0500) + (0.2321 / 0.9167) + (0.1266 / 1.0909)] \times 100 \\ = 97.62\)

Fisher

\(= (98.51 \times 97.62)^{\frac{1}2} \\ = 98.06\)

Törnqvist is best calculated by first taking the logs of the index formula

\(= \frac{1}{2} \times (0.3932 + 0.4220) \times ln (1.0345) \\ + \frac{1}{2} \times (0.1864 + 0.1424) \times ln (0.8182) \\ + \frac{1}{2} \times (0.1085 + 0.0768) \times ln (1.0500) \\ + \frac{1}{2} \times (0.1627 + 0.2321) \times ln (0.9167) \\ + \frac{1}{2} \times (0.1492 + 0.1266) \times ln (1.0909) \\ = -0.0199\)

and then taking the exponent multiplied by 100

\(= e^{-0.0199} \times 100 \\ =98.04\)

| Item | Period 0 | Period 1 | Period 2 | |

|---|---|---|---|---|

| Price ($) | ||||

| 1 | 10 | 12 | 15 | |

| 2 | 12 | 13 | 14 | |

| 3 | 15 | 17 | 18 | |

| Quantity | ||||

| 1 | 20 | 17 | 12 | |

| 2 | 15 | 15 | 16 | |

| 3 | 10 | 12 | 8 | |

| Index number | ||||

| Index formula | ||||

| Laspeyres | ||||

| Period 0 to 1 | 100.0 | 114.2 | ||

| Period 1 to 2 | 100.0 | 112.9 | ||

| chain | 100.0 | 114.2 | 128.9 | |

| direct | 100.0 | 114.2 | 130.2 | |

| Paasche | ||||

| Period 0 to 1 | 100.0 | 113.8 | ||

| Period 1 to 2 | 100.0 | 112.3 | ||

| chain | 100.0 | 113.8 | 127.8 | |

| direct | 100.0 | 113.8 | 126.9 | |

| Fisher | ||||

| Period 0 to 1 | 100.0 | 114.0 | ||

| Period 1 to 2 | 100.0 | 112.6 | ||

| chain | 100.0 | 114.0 | 128.3 | |

| direct | 100.0 | 114.0 | 128.5 | |

4.36 In this example, the Laspeyres Chain Index for period 2 is calculated as follows:

\((114.2/100) \times (112.9/100) \times 100 \\ = 128.9\)

The Paasche Chain Index for period 2 is calculated as follows:

\((113.8/100) \times (112.3/100) \times 100 \\ = 127.8\)

And the Fisher Chain Index for period 2 is calculated as follows:

\((114/100) \times (112.6/100) \times 100 \\ = 128.3\)

OR

\((128.9 \times 127.8)^{\frac12} \\ = 128.3\)

4.37 An index formula is said to be 'transitive' if the index number derived directly is identical to the number derived by chaining. In general, no weighted index formula will be transitive because period-to-period calculation of the index involves changing the weights for each calculation. This can be seen in Table 4.2 where in period 2 the direct Laspeyres (130.2) is different to the chain Laspeyres (128.9) due to the different quantities. The index formulas in Table 4.2 will only result in transitivity if there is no change in the quantity of each item in each period or if all prices show the same movement. In both these unlikely cases, all the formulas (Laspeyres, Paasche and Fisher) will produce the same result.

4.38 The direct Laspeyres formula has the advantage that the index can be extended to include another period's price observations when available, as the weights are fixed at some earlier base period. On the other hand, the direct Paasche formula requires both current period price observations and current period weights before the index can be calculated.

Setting the CPI basket of goods and services in practice

4.39 The households’ expenditures on all consumer goods and services in the Consumer Price Index (CPI) basket is mainly sourced from information derived from the Household Expenditure Survey (HES). However, the results from the HES are not available until approximately 12 months after the end of the survey. The Laspeyres index requires either quantities or expenditure in the base period which would mean the CPI would be unable to be calculated on these expenditures until approximately 16 months after the HES is completed.

4.40 The CPI is a quarterly survey which means the ABS must continue to calculate the CPI on the old expenditures until the new expenditures are available. When the new expenditures are available, a statistical office can then recalculate the CPI based on the new weights. However, this will lead to revisions to previously published CPI estimates which is not desirable for any contract indexation. The alternative is to use a class of price indexes called a Lowe index which defines the index as the percentage change, between the periods compared, in the total cost of purchasing a fixed basket of quantities. Most statistical offices make use of some kind of Lowe index in practice.

4.41 To calculate a price index, any set of quantities could be used. These do not have to be restricted to quantities or expenditures purchased in one period and could be arithmetic or geometric averages of the quantities of multiple periods. For the Australian CPI, the quarterly percentage change from the December quarter 2017 onwards is mainly based on the HES which was collected in respect of the financial year 2015-16. Prior to this, the CPI from the September quarter 2011 was based on the HES which was collected in respect of the financial year 2009-10. For a complete listing of the historical CPI weighting patterns see Consumer Price Index: Historical Weighting Patterns, 1948-2017 (cat. no. 6431.0).

4.42 The period whose quantities are actually used in a CPI is described as the weight reference period. In the 17th series this generally refers to the HES which is 2015-16 and it will be denoted as period \(b\). With the CPI being annually re-weighted, period \(b\) will be updated each year to the second most recent financial year (e.g. for 2018, period b is 2016-17). Period \(0\) is the price reference period which is the most recent September quarter. The Lowe index using the quantities of period \(b\) can be written as follows:

\(P_{L0} = \frac{\sum ^n _{i=1} p^t _iq^b_i}{\sum ^n_{i=1}p^0_i q^b_i} = {\sum^n_{i=1}} (\frac {p^t_i}{p^0_i})s^{0b}_i \)

where: \(s^{0b}_i = \frac{p^0 _iq^b_i}{\sum ^n_{i=1}p^0_i q^b_i} \space \space \space \space \space (4.13)\)

4.43 Similar to the Laspeyres index described earlier, the Lowe index can be calculated as either the ratio of prices and quantities, or as an arithmetic weighted average of the price relatives. The expenditures refer to quantities in period \(b\) (e.g. 2016-17) and prices in period \(0\) (e.g. September quarter 2018). Lowe indexes are widely used for CPI purposes.

4.44 The Laspeyres and Paasche indexes are two special cases of the Lowe price index. When the quantities are those of the price reference period, that is when \(b=0\), the Laspeyres index is obtained. When quantities are those of the other period, that is when \(b=t\), the Paasche index is obtained.

Unweighted, or equally weighted indexes

4.45 In some situations, it is not possible or meaningful to derive weights in either quantity or expenditure terms for each price observation. This is typically so for a narrowly defined commodity grouping in which there might be many sellers (or producers). Information might not be available on the total volume of sales of the item or for the individual sellers or producers from whom the sample of price observations is taken. In these cases, it seems appropriate not to weight, or more correctly to assign an equal weight, to each price observation. It is a common practice in the CPI in many countries that the price indexes at the lowest level (where prices enter the index) are calculated using an equally weighted formula, such as an arithmetic mean or a geometric mean.

4.46 Suppose there are price observations for \(N\) items in period \(0\) and period \(t\). Then three approaches⁸ for constructing an equally weighted index are as follows.

(i) Calculate the arithmetic mean of prices in both periods and obtain the relative of the current period’s average to the base period’s average (i.e. divide the current period’s average by the base period’s average). This is the relative of the arithmetic mean of prices (RAP) approach, also referred to as the Dutot formula:

\(I_D = \frac {\frac{1}{N} \sum p_{it}} {\frac{1}{N} \sum p_{i0}} \space \space \space \space \space (4.14)\)

(ii) For each item, calculate its price relative (i.e. divide the price in the current period by the price in the base period) and then take the arithmetic average of these relatives. This is the arithmetic mean of price relatives (APR) approach, also referred to as the Carli formula:

\(I_C = {\frac{1}{N} \sum} {\frac{p_{it}}{p_{i0}}} \space \space \space \space \space (4.15)\)

(iii) For each item, calculate its price relative, and then take the geometric mean⁹ of the relatives. This is the geometric mean (GM) approach, also referred to as the Jevons formula:

\(I_G = \prod ({\frac{p_{it}}{p_{i0}}})^{\frac{1}{N}} \space \space \space \space \space (4.16)\)

4.47 Although these formulas apply equal weights, the implicit basis of the weights differs. The geometric mean applies weights such that the expenditure shares of each observation are the same in each period. In other words, it is assumed that as an item becomes more (less) expensive relative to other items in the sample the quantity declines (increases) with the percentage change in the quantity offsetting the percentage change in the price. The RAP formula assumes equal quantities in both periods. That is, the RAP assumes there is no change in the quantity of an item purchased regardless of either its price movement or that of other items in the sample. The APR assumes equal expenditures in the base period with quantities being inversely proportional to base period prices.

4.48 The following are calculations of the equal weight indexes using the data in Table 4.2. Setting period \(0\) as the base with a value of 100.0, the following index numbers are obtained in period \(t\):

RAP formula: \(113.5 = \frac {\frac{1}{3} (12+13+17)} {\frac{1}{3} (10+12+15)} \times 100\)

ARP formula: \(113.9 = {\frac{1}{3} ({\frac {12}{10}}+{\frac {13}{12}}+{\frac {17}{15}})} \times 100\)

GM formula: \(113.9 = 3 {\sqrt {{\frac {12}{10}}\times {\frac {13}{12}}\times {\frac {17}{15}}}}\times 100\)

4.49 Theory suggests that the APR formula will produce the largest estimate of price change, the GM the least and the RAP a little larger but close to the GM.¹⁰ Empirical examples generally support this proposition,¹¹ although with a small sample as in the example above, substantially different rankings for the RAP formula are possible depending on the prices.

4.50 The behaviour of these formulas under chaining and direct estimation is shown in Table 4.3 using the price data from Table 4.2. The RAP and GM formulas are transitive, but not the APR.

| Formula | Period 0 | Period 1 | Period 2 |

|---|---|---|---|

| Relative of average prices (RAP) | |||

| period 0 to 1 | 100.0 | 113.5 | |

| period 1 to 2 | 100.0 | 111.9 | |

| chain | 100.0 | 113.5 | 127.0 |

| direct | 100.0 | 113.5 | 127.0 |

| Average of price relatives (APR) | |||

| period 0 to 1 | 100.0 | 113.9 | |

| period 1 to 2 | 100.0 | 112.9 | |

| chain | 100.0 | 113.9 | 128.6 |

| direct | 100.0 | 113.9 | 128.9 |

| Geometric mean (GM) | |||

| period 0 to 1 | 100.0 | 113.8 | |

| period 1 to 2 | 100.0 | 112.5 | |

| chain | 100.0 | 113.8 | (b)128.0 |

| direct | 100.0 | 113.8 | (b)128.1 |

- Uses the same price data as in Table 4.2.

- Difference in calculated index is due to rounding.

Unit values as prices

4.51 A common problem confronted by index compilers is how to measure the price of items in the index whose price may change several times during an index compilation period. For example, in Australia petrol prices change almost daily at many outlets, but the CPI is quarterly. Taking more frequent price readings and calculating an average is one approach to deriving an average quarterly price. A more desirable approach, data permitting, would be to calculate unit values and use these as price measures.¹² Unit values are obtained by dividing expenditure by a quantity (e.g. the total expenditure of petrol sold in a particular period divided by the number of litres sold will give a unit value per litre for the price of petrol over the period). Unit values can be used to measure price changes only for similar (homogeneous) products.

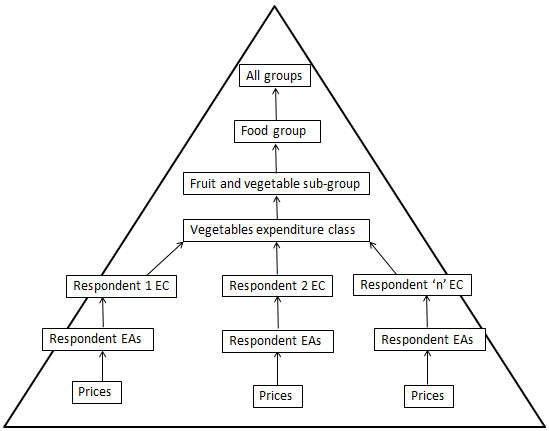

4.52 For example, suppose outlet X sells chocolate bars in weights of 50g, 80g and 100g. Further, suppose the outlet keeps records of the value of sales of these chocolate bars in aggregate and the number of each size of chocolate bar sold. It is then possible to calculate the total quantity of chocolate sold in grams. Dividing the expenditure on chocolate by the total quantity in grams produces a unit value that could be used as the price measure for chocolate.