Author area: Macroeconomic Statistics Division¹

1.1 Measuring the continuing economic impacts of COVID-19

Global uncertainty associated with the rise in COVID-19 infections and deaths around the world dominated the June quarter of 2020 (Figure 1). The COVID-19 pandemic had an unprecedented impact on the global economy and Australia was not immune to its effects.

To meet the demand from government, business and the Australian community for near ‘real-time’ data on the impacts of COVID-19, the ABS continued to produce a range of new ‘rapid response’ surveys. These new statistical products complemented the regular ABS economic statistical publications, which continued to provide benchmark measurements of the Australian economy.

This article brings together data from the regular key economic statistical releases including the National and International Accounts, the Labour Force Survey, Weekly Payroll Jobs and Wages statistics, price indexes and government finance statistics. It builds on the March quarter analysis of the pandemic's impact to create a comprehensive record of the Australian economy’s response to the unfolding events of the June quarter.

Source: COVID-19 Data Repository by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University, https://github.com/CSSEGISandData/COVID-19.

1.2 Overview of June quarter 2020 events in Australia

In late March Australia started to see falls in new daily COVID-19 cases (Figure 2). From mid-April onwards, NSW and Victoria were the only states with new COVID-19 case figures higher than 10 per day. New cases in NSW fell below this level at the end of April.

The fall in COVID-19 cases saw the gradual easing of restrictions on local travel and social gatherings in most parts of Australia. Students began progressively returning to face-to-face teaching in May.

Sources: https://www.covid19data.com.au/states-and-territories

and https://infogram.com/1p0lp9vmnqd3n9te63x3q090ketnx57evn5?live

The key events in the June quarter 2020 are:

- March 23 - Social distancing restrictions Stage 1

- March 26 - Social distancing restrictions Stage 2

- March 30 - JobKeeper package

- May 8 - Three-step plan to ease restrictions

- July 8 - Melbourne stay at home restrictions

In June Victoria's case statistics took a different trajectory. While the number of new daily cases fell in April and May, they began to rise again from mid-June, with nearly 200 new daily cases recorded shortly after the end of the quarter.

Immediately after the end of the June quarter (on 1 July), Victoria introduced ‘Stay at Home’ restrictions for selected Melbourne postcodes, expanding these to include metropolitan Melbourne and Mitchell Shire on 8 July.

While business trading restrictions gradually eased in most states across the June quarter, business of all sizes continued to be affected by the remaining restrictions and altered consumer behaviour.

1.3 The unprecedented economic movements of the June quarter

The combined effects of the pandemic and community and government responses to it led to movements of unprecedented size in the economic statistics aggregates of the June quarter 2020.

Labour market

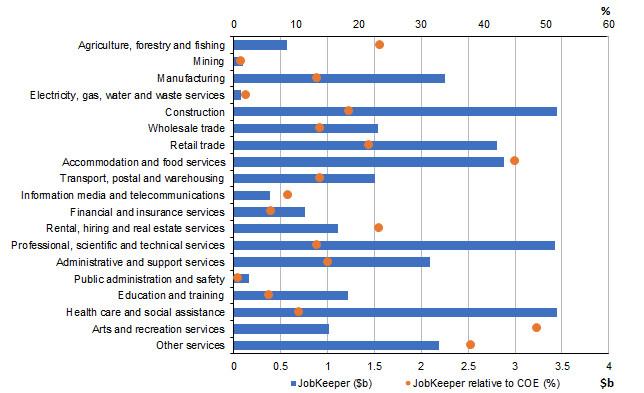

Hours worked fell 9.8%, with April and May seeing many people having their hours reduced or being stood down. There was a smaller fall in compensation of employees (-2.5%) as the JobKeeper program delivered $31.0 billion in payments to eligible businesses.

Employment fell 5.4%, between March and June. April and May saw large numbers of people leaving the labour force (around 900,000 between March and April and over 700,000 between April and May in original terms). Between March and June, the industries with the highest proportion of payroll job losses were: Accommodation and food services (20.3%) and Arts and recreation services (18.6%). These two industries also had sharp decreases in job vacancies (65.9% and 95.2%).

Government

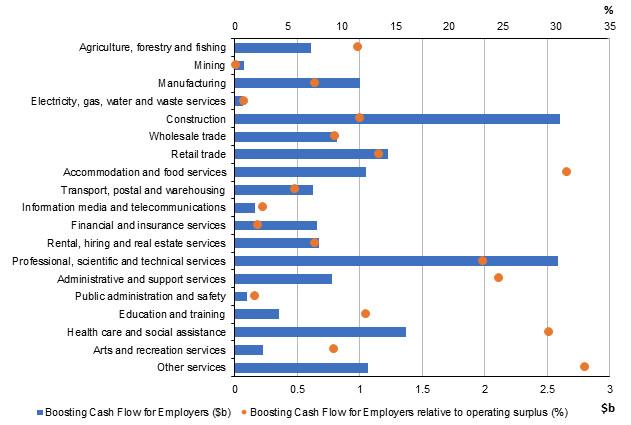

Government subsidies such as JobKeeper and Boosting Cash Flow for Employers increased Other subsidies on production to a record level of $52.0 billion. Social assistance benefits in cash increased $14.4 billion, reflecting additional COVID-19 support payments. As a result of increased support, General Government net saving was -$82.6 billion, the largest negative outcome on record.²

Commonwealth Government tax revenue fell 7.5% ($9.6 billion) through the year, mainly from falls in company income tax ($5.6 billion) and personal income tax ($1.4 billion). State and local government taxation revenue fell 10.9% ($2.8 billion) through the year, mainly from falls in payroll taxes ($1.7 billion) and taxes on the provision of goods and services including reductions in stamp duty on conveyancing and gambling taxes ($1.3 billion).³

Household income

Household income (gross disposable income) rose 2.2% ($7.1 billion, in current price terms) during the June quarter, mainly from investment income, earnings from unincorporated businesses and social assistance benefits. The JobKeeper and Boosting Cash Flow for Employers programs contributed to the rise in unincorporated business earnings.

Household spending

Household spending fell by a record 12.1% in the June quarter, in volume, seasonally adjusted terms, resulting in a current price fall of $1.2 billion in Goods and Services Tax (GST). The consumption of services fell by the greatest amount (17.6%).⁴

In volume terms, Household spending fell in all but six categories (including Alcoholic beverages and Furnishings and household equipment). The greatest falls in household spending were in Transport services (85.9%) as restrictions on day to day mobility and holiday travel led to falls across all modes of passenger transport, most notably in air transport; and Hotels, cafes and restaurants (56.1%) as businesses were closed or customer numbers restricted. As people worked and schooled from home expenditure on electricity, gas and other fuels rose by 4.8%.

Consumer prices

The Consumer Price Index (CPI) fell 1.9%, which was the largest fall in the 72-year history of the CPI. The fall was mainly the result of the Early Childhood Education and Care Relief Package, which provided fee-free child care for households. There were also significant falls in: the price of automotive fuel (-19.3%); and pre-school and primary education prices (-16.2%). Lockdown conditions resulted in weaker rental market conditions and rents recorded the first quarterly fall since the series began in 1972.

Household saving to income ratio

Quarter on quarter, the combination of a rise in household income ($7.1 billion) and a fall in household spending ($35.2 billion) resulted in household net saving rising $42 billion to $59.5 billion, in current price, seasonally adjusted terms. The household saving to income ratio rose to 19.8%, its highest level since June 1974.

Household borrowing

COVID-19 restrictions and uncertainty drove a sharp decline in housing market activity that led to large falls in the value of new housing loan commitments in April and May, with the May fall (11.6%) being the largest in the history of the series. June saw some recovery with a rise of 6.2% in housing loan commitments.

Businesses

The June quarter saw the largest fall in seasonally adjusted retail volumes since the introduction of the GST in the September quarter 2000. Online sales peaked as a percentage of total sales in April (11.1%), and although a reduction followed, the percentage of online sales remained above pre-pandemic levels at 9.7% in June.

International travel, trade and investment

Both imports and exports of travel services were severely impacted by travel restrictions, as short-term visitor arrivals dropped by close to 100% quarter-on-quarter and Australian international travel restrictions led to a 99% fall in travel service imports.

The June quarter saw the 10th consecutive surplus in the balance on goods and services (the trade surplus) supporting a fifth successive current account surplus. Despite the trade surplus, the level of imports and exports fell strongly as the result of COVID-19 impacts.

Australia’s net International Investment Position (IIP) increased in the June quarter 2020, with the current account surplus and valuation effects in the quarter reducing the magnitude of Australia’s net liability position with the rest of the world.

The IIP to Gross Domestic Product (GDP) ratio decreased to a 30-year low of 42% in the March quarter with an uptick to 45% in the June quarter, the second lowest figure over the same 30-year period.⁵ This was driven by the falling net Foreign Equity to GDP ratio as the net Foreign Debt to GDP ratio remained roughly steady.⁶

Gross Domestic Product

As a result of the outcomes noted above, GDP fell 7.0% quarter on quarter. This was, by a wide margin, the largest fall in quarterly GDP since records began in 1959 (Figure 3). As shown in Figure 4 there were only three positive contributions to growth: General Government consumption, public investment and net exports.

Gross value added fell 6.5% in the quarter with falls in 15 of the 19 industries. Record falls were observed in hospitality and tourism related industries due to COVID-19 restrictions. Section 5.1 provides more industry-level detail.

Source: 5206.0 - Australian National Accounts: National Income, Expenditure and Product, Jun 2020 - Economic downturn in an historical context

Source: 5206.0 - Australian National Accounts: National Income, Expenditure and Product, Jun 2020

A selection of the economic statistics of the June quarter are discussed in further detail in the remaining sections of this article.