- 2008 SNA, 4.4; ANSA, 1. 4.7

- 2008 SNA, 4.6; ASNA, 4.10

- 2008 SNA, 4.16-17

- The same categories are followed in the ASNA, with the exception of the NPISH sector, which is instead combined with the household sector.

- 2008 SNA 6.99

- 2008 SNA 6.128

- Fixed assets are defined in the SNA as produced assets that are used repeatedly, or continuously, in processes of production for more than one year (2008 SNA, 10.11)

- 2008 SNA 6.114

- 2008 SNA 1.42

- For more detail, see 2008 SNA 1.41-2, 6.29-31

- 2008 SNA, 1.42, 6.31

- 2008 SNA 6.34 - 6.35

- 2008 SNA, 19.37-39

- 2008 SNA, 19.40

- ASNA 4.38

- 2008 SNA 26.4

- BPM6 4.114

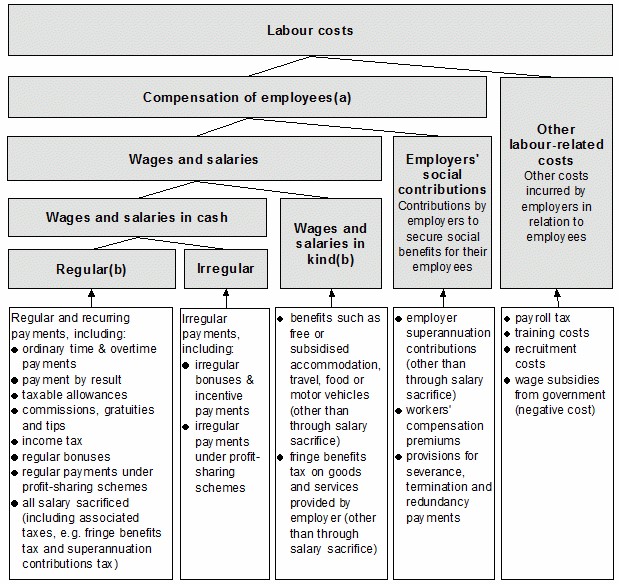

Concepts and sources

This section discusses the fundamental underlying statistical concepts, and classifications, that are important to measuring and understanding the labour market. This includes:

- Institutional units and the economically active population

- The labour force framework

- Employment

- Employment arrangements

- Jobs

- Hours of work

- Unemployment

- Underutilised labour

- Not in the labour force

- Job vacancies

- Earnings

- Workplace relations

- Labour productivity

- Occupational injuries and diseases

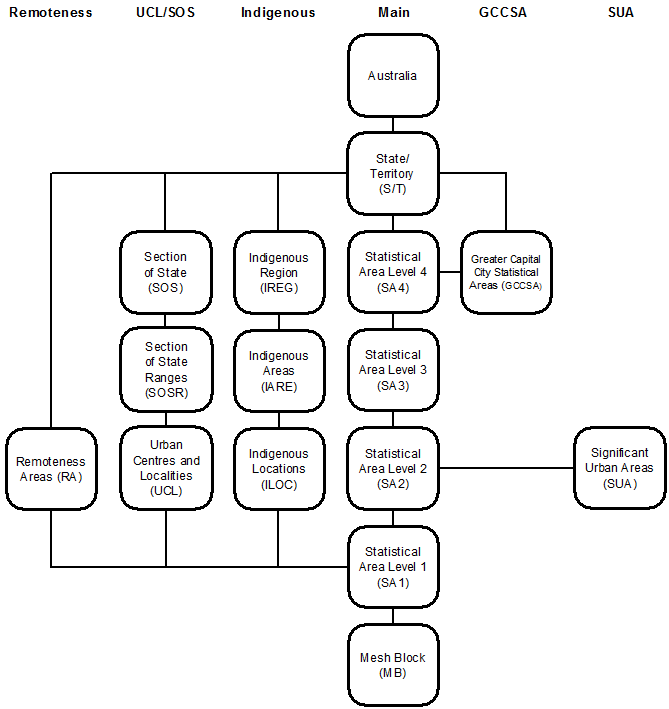

- Classifications used in labour statistics

Institutional units and the economically active population

‘Institutional units’ and the ‘economically active population’ form the basis of many labour statistics. A clear understanding of the ‘institution’ and of ‘economic activity’ is fundamental to the correct definition of these groups.

This chapter discusses the institutional units from which data are collected by the ABS in its business and household surveys. It also explains the concepts underlying measures of the economically active population produced by the ABS. These include the scope of economic activity and the United Nations System of National Accounts (SNA) production boundary, the scope of the economically active population, and the differentiation between current and usual economic activity.

The definition and measurement of institutions, which create jobs and therefore generate demand for labour services of the economically active population, and economic activity, by which the economically active population produce goods and services, are both governed by international standards and guidelines. The fundamental definitions of both are laid out in the 2008 SNA.

Standards and guidelines for measuring the economically active population are set out by the International Labour Organisation (ILO), and were first presented in the ‘Resolution concerning statistics of the economically active population, employment, unemployment and underemployment, 1982’ (No. 170), which was adopted by the Thirteenth International Conference of Labour Statisticians (ICLS). These standards and guidelines were subsequently incorporated into the ILO's Labour Statistics Convention, 1985 (No. 160).

In its manual Surveys of Economically Active Population, Employment, Unemployment and Underemployment (1990), the ILO discusses the concepts and definitions underlying these standards and provides technical guidelines for how to apply them to the collection of data through household surveys. The ILO article ‘Measurement of employment, unemployment and underemployment – Current international standards and issues in their application (2007)’ provides a summary update of changes in the concepts and definitions.

Institutional units

An institutional unit is defined as:

“4.2 …an economic entity that is capable, in its own right, of owning assets, incurring liabilities and engaging in economic activities and in transactions with other entities."

2008 United Nations System of National Accounts

Institutional units can take a variety of forms, each of which operates with different objectives and behaviours. The SNA describes two types of institutional unit, being ‘households’ and ‘legal or social entities.’ It also describes the ‘enterprise’, being a view of an institutional unit as a productive unit.

The enterprise is the primary unit of the ASNA.

For more detail on the definition of institutions, see chapter 4 of Australian System of National Accounts, Concepts, Sources and Methods.

Households

Households, which are providers of labour services, are defined as groups of persons who share the same living accommodation, who pool some, or all of their income and wealth, and who consume certain types of goods and services collectively, mainly housing and food¹. Households are primarily consumer units, although they may also engage in production and accumulation.

Legal or social entities

Legal or social entities, which create jobs and therefore generate demand for labour services, are defined as institutional units whose existence is, either legally or by society, recognised independently of the persons or entities that may own or control them².

Legal or social entities include several forms of institutional units, such as ‘corporations’, ‘non-profit institutions’, and ‘government units’.

Corporations

Corporations produce goods and services for sale on the market, usually as a source of profit for their owners. They may not, however, undertake final consumption.

Non-profit institutions

Non-profit institutions (NPIs) produce or distribute goods and services, but not for the purpose of generating income or profits. They are diverse in nature, with some behaving like corporations, some effectively part of general government, and some undertaking activities similar to general government but independent of it.

Government units

Government units organise and finance the provision of goods and services to individual households and the community at large, mainly financed from taxation revenue. They are also concerned with the distribution and redistribution of income and wealth, in accordance with government policies. They undertake production and final consumption on behalf of the population.

Enterprise

An enterprise is a view of an institutional unit as a producer of goods and services. Most enterprises consist of individual legal or social entities, or in some instances, combinations of unincorporated legal or social entities. A household can constitute an unincorporated enterprise with respect to its production of goods and services.

In the ASNA, the primary unit is the enterprise, which is part of the ABS Economic Units Model. Within the Economic Units Model, enterprises are grouped into institutional sectors and subsectors based upon their economic objectives, functions and behaviour. An enterprise can be a single legal entity, or a group of related legal entities which belong to the same institutional subsector. The Economic Units Model structures the often complex and unique relationships between businesses and parts of businesses into a framework that facilitates the compilation of meaningful statistics.

Institutional sectors

Corporations, non-profit institutions, government units and households are intrinsically different from each other in their economic objectives, functions and behaviour. The institutional sectors of the SNA group together similar kinds of institutional units according to the nature of the economic role they perform³. SNA defines the following institutional sectors⁴:

- Financial Corporations;

- Non-financial Corporations;

- General government;

- Non-profit institutions serving households;

- Households; and

- Rest of the World.

The Standard Economic Sector Classifications of Australia (SESCA) (cat. no. 1218.0) is based upon international standards and contains a variety of classifications, including institutional sectors as laid out in the SNA. Within SESCA, the Standard Institutional Sector Classification of Australia (SISCA) describes these sectors. Within SISCA, sectors can be further divided into a range of subsectors, which more accurately describe the activities of the institutional units within them.

Sectors can also be divided more simply into public and private, where the former includes all government units and units controlled by government, and the latter includes all other units. This breakdown is often used in the classification and dissemination of statistics from ABS business surveys.

The ASNA utilises a combination of SISCA subsectors and public/private distinctions to assign institutions to ASNA institutional subsectors. These ASNA subsectors are the level at which legal entities may be grouped into enterprises in the ABS Economic Units Model.

ABS Economic Units Model

For the compilation of statistics, the ABS has developed an Economic Units Model to further describe and categorise enterprises and their components. The Units Model is a tiered structure, containing four levels, namely the enterprise group, the legal entity, the type of activity unit, and the location unit. Most businesses are simple in structure and are considered to have only a single level (at all four levels, the business is identical), while some businesses are complex in structure and may be classified by all four levels of the Units Model.

Enterprise Groups

The Enterprise Group (EG) is an institutional unit which contains one or more legal entities under common control and covers all of their collective activities in Australia. An EG can contain one or many legal entities and be divided into one or multiple Type of Activity Units or location units.

Legal Entities

The Legal Entity (LE) is an institutional unit which covers all activities in Australia of a single entity which possesses some or all of the rights and obligations of individual persons or corporations, or which behaves as such in respect of those matters of concern for economic statistics. In most cases the LE is equivalent to a single Australian Business Number (ABN) registration. LEs approximate the SNA concept of legal or social entities, but the concept is extended to include households engaged in productive economic activity.

Type of Activity Units

The Type of Activity Unit (TAU) is a producing unit comprised of one or more LEs, sub-entities or branches of a LE that can report productive and employment activities, and are homogeneous in their activity. TAUs operate within a single EG, and within a single industry subdivision in the Australian and New Zealand Standard Industrial Classification (ANZSIC).

Location Units

The Location Unit is comprised of a single, unbroken physical area from which an organisation is engaged in productive activity on a relatively permanent basis, or at which the organisation is undertaking capital expenditure with the intention of commencing productive activity on a relatively permanent basis at some time in the future.

The diagram below illustrates the nature of the relationships between the different units within the model.

ABS Economic Units Model

Economically active population

The economically active population comprises all persons who, during a specific period, furnished the supply of labour for the production of economic goods and services.

International Labour Organization, 13th ICLS, 1982

Understanding the economically active population is critical to interpreting statistics on labour supply and demand. The following section discusses the concept of economic activity, and defines the scope of the economically active population.

Scope of economic activity and the SNA production boundary

The concept of economic activity underlies measurement of the economically active population. The basis of this concept is found in the SNA concepts of 'production' and ‘economic activity’. Production is broadly defined as all activities within the SNA 'general production boundary'.

Within this boundary are all physical processes, under the control and responsibility of institutional units, by which labour and assets are used to transform inputs of goods and services into outputs of other goods and services. Within the SNA, a more restrictive production boundary also exists, known as the 'SNA production boundary', which separates economic activity from other production.

The SNA production boundary is a subset of the SNA general production boundary, allowing a distinction between economic activity and other production activities. Activities falling within the constraints of the SNA production boundary are considered to be economic activity, while those outside of it are not economic activity (regardless of whether they are within the SNA general production boundary or not). Activities within the SNA production boundary include all market and non-market production, and certain types of production for own final use.

Market production

Market production is considered in scope of the production boundary. Market production is the production of goods and services for sale on the market, at prices which are economically significant. Prices are said to be economically significant when they have a significant influence on the amounts the producers are willing to supply, and on the amounts purchasers wish to buy. Market production also extends to goods and services bartered; those used as payments in kind; those transferred within the same enterprise to be used as intermediate inputs into production over which the original producer has no responsibility; or changes in inventories of finished or in-progress goods, intended for one of the above purposes.

The activities of workers employed in factories, business enterprises, farms, shops, service undertakings, household enterprises and other economic units engaged in the production of goods and services intended for sale on the market are considered to be part of market production⁵.

Non-market production

Non-market production is considered in scope of the production boundary. Non-market production is the production of goods and individual or collective services produced either by non-profit institutions serving households or government entities that are supplied free or at prices which are not economically significant. Prices are said to be not economically significant when they have little or no influence on how much the producer is prepared to supply, and are expected to have only a marginal influence on the quantities demanded.

Among the most prevalent forms of non-market production are the provision of education and health care to the general public. The activities of employees of government and other social and cultural institutions producing these goods and services are considered to be non-market production⁶.

Production for own final use

Production for own final use can be subdivided into two groups based, roughly, on the divide between goods and services. The production of goods for own final use is included within the SNA production boundary, while the production of domestic and personal services for own final use is mostly excluded.

Production of goods for own final use

The production of goods for own final use is considered in scope of the production boundary. Production of goods for own final use includes the production and processing of primary produce by households for their own final consumption, the construction of dwellings and structures for own use, and the production of fixed assets⁷ for own use.

The production of goods is included as, although the output is intended for own use, the producer theoretically has the option of selling the goods on the market after they have been produced (e.g. if a household constructs a dwelling, the dwelling can then either be lived in or sold on the market). This production closely resembles market production, and could become market production if the choice was made to sell rather than consume the output⁸.

Production of domestic and personal services for own final use

The production of domestic and personal services for own final use is typically not considered in scope of the production boundary, however several exceptions exist.

The production of domestic and personal services is the production of services for consumption within the same household, such as the cleaning and repair of dwellings and household durables, goods and vehicles; the preparing of meals; caring for children or the sick; and the transportation of household members.

The decision to consume these services within the household is made even before the service is provided and, in contrast to the production of goods for own final use, the household cannot theoretically choose to sell the service after it has been produced (e.g. if a member of the household cleans a room or repairs a car, the cleaning or repair service cannot then be sold to another after it has been performed)⁹.

Although the production of household domestic and personal services is productive in an economic sense, they are excluded from the national accounts for practical reasons. From an SNA perspective, household services have little relevance for the analysis of inflation or deflation or other fluctuations within the economy, as they can't be sold and wouldn't have a price. Without substantial changes to the measurement of production, their inclusion could obscure what is happening on markets and reduce the analytic usefulness of national accounts data.

The SNA provides a number of justifications for this exclusion¹⁰, summarised as follows:

"6.30…the relative isolation and independence of these activities from markets, the extreme difficulty of making economically meaningful estimates of their values, and the adverse effects it would have on the usefulness of the accounts for policy purposes and the analysis of markets and market disequilibria."

2008 United Nations System of National Accounts

Domestic and personal services are also excluded from labour statistics because, without substantial revision to the way labour statistics are compiled, their inclusion would adversely affect the compilation of labour statistics that are relevant and useful in economic analysis. Using the current framework for labour statistics, which is linked to the SNA production boundary, the extension of the boundary to include the production of personal and domestic services by members of households for their own final consumption would result in all persons engaged in such activities becoming both economically active and self-employed. This would result in virtually the whole adult population being defined as 'economically active' and make unemployment virtually impossible by definition¹¹.

The production of housing services for own consumption by owner-occupiers is included in the SNA production boundary to account for large differences in rates of home ownership across countries. The production of own-account housing services has always been included in the SNA production boundary, and its exclusion would limit the comparability of the data both internationally and inter-temporally.

The paid employment of external staff to produce domestic and personal services for final consumption in the household is included in the SNA production boundary. The production of domestic and personal services by employing paid staff is considered market activity¹².

With the exception of own-account housing services and the paid employment of domestic staff, the production of domestic and personal services for own final use is not within the SNA production boundary, and therefore is not considered to be economic activity.

Unpaid work and volunteer services

Volunteers are people who willingly give unpaid help, in the form of time, service or skills, to an organisation our group. Included in this category are the volunteer component of boards of management, fundraising committee members and auxiliary members.

Australian National Accounts: Non-Profit Institutions Satellite Account (cat. no. 5256.0)

Unpaid work and volunteer services are generally in scope of the SNA production boundary, however they are generally not considered in scope of the Australian production boundary in the ASNA and labour household surveys.

A distinction can be made between those who have an agreement to provide labour for token remuneration or only income in kind, those for whom there is explicitly no remuneration, and those where there is apparently no remuneration but the workers benefit directly from the output to which they contribute. In ILO statistics, all three types of worker may be included in the economically active population as employees.

In the SNA, persons working for token amounts or only income in kind are considered to be economically active if the unit employing these staff is responsible for whatever little remuneration is received. For example, if doctors or teachers work for only food and lodging, the value of this as income in kind is the only remuneration imputed to them, and they are considered within the SNA production boundary. Such instances may arise in religious institutions or in the wake of natural disasters.

If staff are purely voluntary, with no remuneration at all, not even in kind, but are working in a recognised institutional unit (business, government agency, not-for-profit organisation) engaged in economic activity, then these individuals are still regarded as being economically active in the SNA. Individuals providing services to groups of other individuals, such as coaching a children’s sports team, without any associated infrastructure, are not regarded as being economically active but rather engaging in a leisure pursuit¹³.

Although unpaid volunteers and volunteer services may fall within scope of the SNA production boundary, they are excluded from the ASNA and therefore, with the exception of contributing family workers, from Australian labour statistics. Persons working for token amounts or payment in kind are included in the ASNA and therefore in Australian labour statistics.

Contributing family workers

If family members contribute to the output of an unincorporated enterprise, they are assumed to receive an element of remuneration in kind, and as such are treated as being in the economically active population¹⁴. As such, Australian labour statistics include estimates for contributing family workers, even though other unpaid work is excluded.

Illegal activities

The SNA states that illegal production should be included within the production boundary, providing a production process exists and the outputs have market demand.

The SNA classifies illegal production within two categories:

- The production of goods or services whose sale, distribution or possession is forbidden by law; and

- Production activities that are usually legal, but become illegal when carried out by unauthorised producers; for example, unlicensed medical practitioners.

The treatment of illegal activities within the SNA is based upon whether the action is considered to be a 'transaction' or an 'externality'. Transactions are actions (regardless of their legality) in which two units enter by mutual agreement, such as buying and selling goods or services. Externalities, however, are actions carried out by one unit which change the condition or circumstances of other units without their consent, such as theft, violence, pollution, or other unsolicited service or disservice.

Illegal actions that fit the characteristics of transactions are treated in the same way as legal actions within the SNA production boundary. Thus, a variety of illegal work is considered to be economic activity. This includes, but is not limited to:

- the production of illegal goods such as narcotics;

- the sale of stolen goods;

- working without authority (e.g. selling merchandise without a licence, working in the construction industry without a permit, or a foreign citizen working without an appropriate visa); or

- working off-the-book for tax evasion purposes or for fear of losing entitlements, or because the employer wants to avoid their obligations (e.g. superannuation payments, taxation, or other labour legislation requirements).

Illegal actions that fit the characteristics of externalities are not considered to be economic activity. Thus, thefts of goods from persons or households and other illegal activities which do not resemble transactions are not considered economic activity.

Illegal activity may involve both transactions and externalities. In such cases, these actions are considered separately, such that an action which is a transaction may be considered economic activity but one that is an externality is not. For example, theft is an externality and is not economic activity; however, the sale of those stolen goods is a transaction and may be considered economic activity.

Due to the difficulty in identifying and valuing illegal transactions, no explicit estimates for such activities are made in the Australian System of National Accounts and Australian labour statistics for the production of illegal goods, such as narcotics or for stolen goods. However, some illegal transactions are likely to be included if they are reported as part of legal activities or as income for taxation purposes, such as prostitution and illegal workers. As a result, their effects on employment and unemployment statistics are difficult to assess.

For more information refer to Information Paper: The Non-Observed Economy and Australia's GDP, 2012.

Determining the Production Boundaries in the SNA and the ASNA

The diagram below summarises the preceding information, and shows how the SNA general and production boundaries are constructed.

The Production Boundaries in the SNA

- Production of goods and services normally intended for sale on the market.

- Production of other goods and services, such as government activities.

- Production and processing of primary products, construction of dwellings, and production of fixed assets.

- Value gained from owning own home, and hiring a person external to the household to provide domestic and personal services to the household in exchange for remuneration.

- Cleaning and repair of dwellings and household items, preparation of food, care for children or the sick, and transportation of household members.

- Unpaid work within an institutional unit (e.g. working for an organised charity), work for token amounts or payment in kind received from an institutional unit (e.g. doctors or teachers working for food and lodging), and work of family members contributing to the output of an unincorporated family enterprise (e.g. children working in a family restaurant).

- Unpaid work not within an institutional unit (e.g. charity work as an individual), work for token amounts of payment in kind not received from an institutional unit (e.g. a volunteer fed or housed by individuals), and the provision of services to groups of individuals (e.g. coaching children's sport) without any associated infrastructure.

- Sale of stolen goods, production of illegal goods such as narcotics, illegal or unauthorised work (e.g. visitors working without an appropriate visa, working without appropriate permits, and work that is 'off the book').

- Theft and violence.

The diagram below shows how the concept of economic activity is operationalised by the production boundary within the ASNA and Australian labour statistics.

The Production Boundaries in the ASNA

- Activities of all employees remunerated in cash or in kind, including domestic paid employment.

- Activities of employers, own account workers, members of producers' cooperatives and contributing family workers in units producing goods or services for the market. All activities in this category occur in household unincorporated market enterprises. Some goods or services produced may be consumed by the household. Includes the production of goods or services that are exchanged for other goods or services (barter). Includes self-employed workers rendering paid/remunerated domestic services to households.

- Self-employment work in own household or another household with family ties that produces goods mainly for own final use. Considered in employment if such production comprises an important contribution to the total consumption of the household. A household with family ties relates to a household of which at least one member belongs to the family of the worker.

- Illegal activities, despite a likelihood of being under-reported, are included in the scope of economic production in the ASNA if they are reported by businesses. These activities involve transactions between two parties, for example payments to employees below minimum rates or activities conducted without necessary permits or licenses.

- Unreported transactional illegal activities are outside the scope of production in the ASNA. These activities include, for example, supply and purchase of illegal goods.

- Volunteer work is performed without pay to advance a cause or produce a benefit that primarily helps someone other than one’s own household or family. Volunteer work may be carried out in units that produce goods or services. Such units may be market enterprises, non-market organisations or households with no family ties that produce for own final use.

- Unpaid work for another household with family ties that produces services for own final use. The output of these services is consumed by the household to which the services are rendered. Household services may be paid or unpaid. When paid, the worker may be in paid employment or self-employment and is a person engaged in economic activity. When unpaid, the worker may provide the service to his or her own household or to another household with family ties (i.e., as an unpaid household service) or to another household with no family ties (i.e., as volunteer work in the production of services by households).

Scope of the economically active population

The economically active population is defined as all persons, within the population, who contribute to economic activity or are available to contribute to economic activity. The economically active population can be defined using the notion of time, such that a usually economically active population and a currently economically active population can be constructed.

The definition of the ‘population’ is therefore fundamental to the scope of the economically active population and must be clearly defined.

The notion of a ‘population’, from which the economically active population can be surveyed, is contingent on a variety of criteria. The two key criteria are those defining the economic territory, within which the population exists; and those defining residence, which enable the inclusion or exclusion of individuals, households, and institutions from that economic territory.

There are also other criteria applied for practical reasons and, as such, the survey population is usually not identical to the total resident population of the economic territory. The ILO manual ‘Surveys of the Economically Active Population, Employment, Unemployment and Underemployment, 1990’ highlights the need for these additional criteria:

"2.2 Surveys of the economically active population should, in principle, cover the entire population irrespective of activity status, sex, marital status, ethnic group, etc. In practice, however, certain restrictions may be necessary."

International Labour Organisation

Additional criteria which define the economically active population are age limitations, which restrict measures of the economically active population to certain age ranges; and membership of the armed forces, which typically restrict measures of the economically active population to the civilian population.

The following section discusses these four key population criteria, as they apply to Australian labour statistics, as well as the definitions of current and usual economic activity and the relationship between economic activity and the labour force.

Economic territory

The production of meaningful statistics about the economically active population requires that the economic territory to which the population relates is accurately defined.

The concept of economic territory in the SNA is not identical to the concept of country. The most commonly used definition is a territory under the effective economic control of a single government, and as such usually approximates the geographic borders of a country.

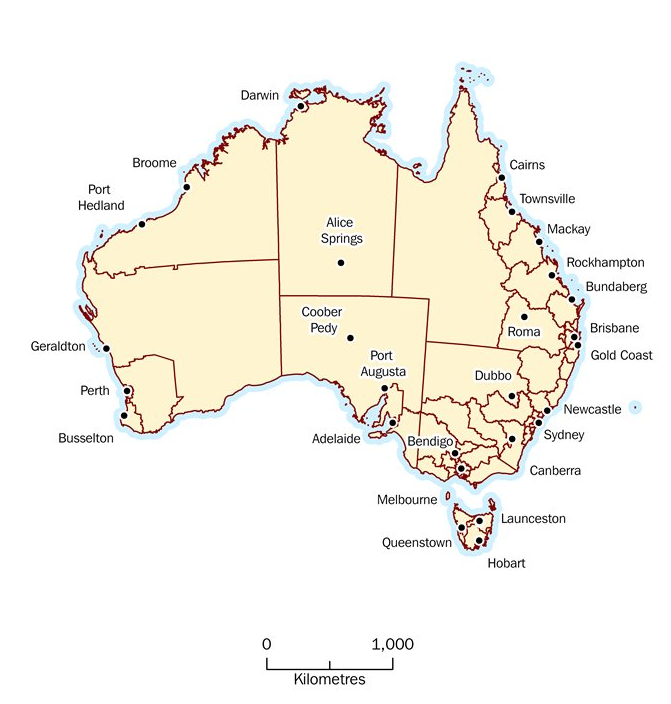

In principal, the economic territory of Australia as defined in the ASNA¹⁵ includes the geographic territory under the effective control of the Australian government, including:

- any islands belonging to Australia which are subject to the same fiscal and monetary authorities as the mainland;

- the land area, airspace, territorial waters, and continental shelf lying in international waters over which Australia enjoys exclusive rights or over which it has, or claims to have, jurisdiction in respect of the right to fish or to exploit fuels or minerals below the sea bed; and

- territorial enclaves in the rest of the world (that is, geographic territories situated in the rest of the world and used, under international treaties or agreements, by general government agencies of the country). Territorial enclaves include embassies or consulates, military bases, scientific stations, etc. It follows that the economic territory of Australia does not include the territorial enclaves used by foreign governments which are physically located within Australia’s geographical boundaries.

Specifically, the economic territory of Australia consists of geographic Australia including Cocos (Keeling) Islands, Christmas Island, Norfolk Island, Jarvis Bay, Australian Antarctic Territory, Heard Island and McDonald Islands, Territory of Ashmore Reef and Cartier Island, and the Coral Sea Islands.

The Joint Petroleum Development Area (JPDA) is considered joint territory between Australia and East Timor.

Within the Australian labour household surveys context, a distinction must be made between: the territories which determine the estimated resident population of Australia; those which are covered by household survey collection procedures; and those used to benchmark or ‘weight’ household survey estimates (i.e., the population benchmarks).

- The “other territories” of Australia, namely Jervis Bay, Christmas Island, Cocos (Keeling) Island, and Norfolk Island after the 2016 Census, are included in the estimated resident population of Australia, but excluded from household survey collection procedures and population benchmarks.

- The “external territories” of Australia, namely Territory of Ashmore and Cartier Islands, Coral Sea Islands Territory, Australian Antarctic Territory, and Territory of Heard and McDonald Islands, are not included in the estimated resident population, household survey collection procedures or the population benchmarks.

Within the Australian labour business surveys context, no further geographical restrictions are imposed. Samples for business surveys are typically selected from the ABS Business Register, and therefore all businesses within the economic territory of Australia may be included, providing they meet other relevant scope restrictions.

This is further detailed within the relevant entry for each collection.

Residency

Within the SNA, residency is defined as the economic territory with which an institutional unit or individual has the strongest connection - in other words, its centre of predominant economic interest. Each institutional unit or individual is a resident of one and only one economic territory.

Actual or intended residence for one year or more is used as an operational definition in many countries (including Australia) to facilitate international comparability.

Residence of individuals and households

Persons are considered to have the strongest connection with the economic territory in which they physically reside. In the broadest sense, the total population consists of either all usual residents of the country (the usually resident or de jure population) or all persons present in the country (the de facto population) at a particular time.

Household surveys use the first population category, the usually resident population. All persons who are usually resident in Australia are considered part of the usually resident population, regardless of nationality, citizenship or legal status.

To determine whether a person is usually resident, Australia has adopted a 12 in 16 month rule. This rule specifies that, to be considered a usual resident, a person must have been (or expect to be) residing in Australia for 12 months or more in a 16 month period. This 12 month period does not need to be consecutive.

The application of the 12 in 16 month rule in the labour household survey context cannot be so precise. A screening question asks if the respondent is a short term resident and, if so, they are excluded from the survey. Labour household surveys also include residents who are temporarily overseas for less than six weeks. However, the 12 in 16 month rule is explicitly applied in the estimated resident population, and the population benchmarks used to weight the LFS.

For more information regarding the 12 in 16 month rule, refer to Information Paper: Improved Methods for Estimating Net Overseas Migration, 2006.

Residence of students

The residence of students is described as:

"26.83a ... People who go abroad for full-time study generally continue to be resident in the territory in which they were resident prior to studying abroad. This treatment is adopted even though their course of study may exceed a year. However, students become residents of the territory in which they are studying when they develop an intention to continue their presence in the territory of study after the completion of the studies."

2008 United Nations System of National Accounts

Within the Australian labour household survey context, there is no special treatment for students and they are treated using the same 12 in 16 month rule. Within the Australian business survey context, there is no distinction made between students and other persons, such that they are included if they are an employee, irrespective of their length of stay in the country.

Residence of enterprises

Within the labour business survey context, the de facto population is used, that is, all employees are included irrespective of their length of stay in the country. This is consistent with the SNA production boundary.

As a general principle, an enterprise is resident in an economic territory when it is engaged in a significant amount of production of goods or services from a location in the territory¹⁶.

An enterprise is resident in an economic territory when there exists, within the economic territory, some location, dwelling, place of production, or other premises on which or from which the unit engages and intends to continue engaging, either indefinitely or over a finite but long period of time, in economic activities and transactions on a significant scale. The location need not be fixed, so long as it remains within the economic territory¹⁷.

Corporations and non-profit institutions normally may be expected to have a centre of economic interest in the economy in which they are legally constituted and registered. Corporations may be resident in economies different from their shareholders, and subsidiaries may be resident in different economies from their parent corporations.

When a corporation, or unincorporated enterprise, maintains a branch, office, or production site in another territory to engage in a significant amount of production over a long period of time (usually one year or more) but without creating a corporation for the purpose, the branch, office, or site is considered to be a quasi-corporation (i.e., a separate institutional unit) resident in the territory in which it is located.

Within the Australian business survey context, residency is determined by deriving the sample selection of business frames from the Australian Business Register, which is an administrative data source maintained by the Australian Taxation Office (ATO). The registration of a business by the ATO is deemed to be a demonstration that the business has a centre of economic interest within Australia.

Age limits

The international standards and guidelines recognise the need to exclude persons below a certain age from measures of the economically population, without specifying a particular age limit. The responsibility for setting such limits lies with individual countries.

Examples of factors influencing the age limit are:

- legislation governing the minimum school leaving age;

- labour laws setting the minimum age for entering paid employment;

- the extent of the contribution to economic activity by young people; and

- the cost and feasibility of accurately measuring this contribution in household surveys.

Australian labour and compulsory schooling legislation have resulted in low numbers of young people being involved in economic activity. While such legislation varies from state to state, the net result is that age 15 is the lowest practical limit at which it is feasible, useful and cost-effective to measure the participation of young persons in economic activity with acceptable accuracy through household surveys. It should also be noted that this limit applies to all workers, including contributing family workers who perform unpaid work in a family business or farm.

As such, Australia has adopted a minimum age limit of 15 years and over in labour household surveys. While many household surveys do not use this age limit, estimates of economic activity are often made only for persons 15 years and over. Consistent with international guidelines, Australia does not apply a maximum age limit.

For more information regarding the significance of employment of those less than 15 years of age, refer to Child Employment, Australia, Jun 2006.

Labour business surveys collect information irrespective of the age of the employee, consistent with the SNA.

Members of the armed forces

The international standards require that members of the armed forces be classified as employed, and recommend that, for analytical purposes, the economically active population be divided into two parts: the armed forces and the economically active civilian population. The guidelines recognise that there may be difficulties in obtaining measures of the armed forces from labour household surveys due to scope restrictions, and that separate administrative counts may be necessary to supplement survey results to obtain statistics on total employment.

Within the Australian labour household surveys context, permanent members of the Australian Defence Force and members of non-Australian armed forces (and their dependants) are excluded.

The labour household surveys exclude permanent members of the Australian Defence Force because of practical collection difficulties. Where an estimate is required of the total economically active population, for example in international comparisons collated by the ILO, survey estimates are supplemented by administrative counts of the defence forces.

Non-permanent members of the Australian Defence Forces (i.e. Australian Army Reserve, Airforce Reserve or Navy Reserve) are included in the labour household surveys. Their work within the defence force is considered as economic activity in the same way as any other work.

Current and usual economic activity

The international standards identify two measures of the economically active population:

- The currently active population, measured in relation to a short reference period such as one week or one day; and

- The usually active population, measured in relation to a long reference period such as one year.

The currently active population provides a snapshot of the economically active population at a particular point in time. This current stock measure of the labour supply, collected at sufficiently frequent intervals, can contribute to the formation of national accounts data (particularly relating to compensation of employees), and can also be used to monitor labour market trends in general (and employment and unemployment levels in particular).

The usually active framework was introduced as an international standard in 1982. It provides a framework for the collection of data reflecting the dominant pattern of activities over a lengthy period. The use of a long reference period can provide more representative estimates of the economically active population, particularly where economic activity has significant seasonal variation. Further, as it permits collection of information on not only the main activity of individuals over the year but also their other activities (e.g. spells of employment and unemployment), it is useful for analysis of employment and income.

As Australia publishes frequent measures with short reference periods, in most cases it is the currently active concept which is measured.

The economically active population and the labour force

The currently economically active population is conceptually equivalent to the labour force.

Because the concept of the economically active population includes both persons who contribute to economic activity and those who are available to contribute to economic activity, the current economically active population includes both employed persons and unemployed persons.

As most labour statistics reference a short reference period, the labour force is equivalent to the currently, rather than the usually, economically active population.

Footnotes

The labour force framework

Concepts and international guidelines

The currently economically active population is also referred to as the labour force. The labour force is conceptually equivalent to the labour supply available for the production of economic goods and services in a given short reference period. The labour force is the most widely used measure of the economically active population. The term 'labour force', as defined by the International Labour Organisation (ILO) in the international standards, is associated with a particular approach to the measurement of employment and unemployment. Essentially, this approach is the categorisation of persons according to their activities during a short reference period, using a specific set of priority rules.

The ABS labour force framework classifies a population, at a given point in time, into three mutually exclusive categories:

- Employed;

- Unemployed; and

- Not in the Labour Force (NILF).

Those persons contributing to economic activity are also known as employed persons, while those seeking to contribute to economic activity are also known as unemployed persons. The employed and unemployed categories together make up the labour force, which gives a measure of the number of persons contributing to, or actively looking and immediately available for, the supply of labour at that time. The third category (not in the labour force) represents the currently economically inactive population.

The Labour Force Framework

The labour force framework includes detailed rules for sorting the population into its categories. These rules are applied in population surveys through three steps. The first involves identifying the in-scope population. The second involves identifying, within the in-scope population, those persons who were engaged in economic activity and who were either at work or temporarily absent from work. The third step involves identifying, among the remaining persons, those persons who were actively seeking and available for work, or who were not seeking work because they were waiting to commence a job that they had already found. The labour force framework classifies persons identified in the second step as employed, and those identified in the third step as unemployed. The residual in-scope population is classified as 'not in the labour force'.

The labour force framework rules have the following features:

- the activity principle, which is used to classify the population into one of the three basic categories in the labour force framework;

- a set of priority rules, which ensure that each person is classified into only one of the three basic categories; and

- a short reference period, to reflect the labour supply situation at a specified point in time.

The rationale for the treatment of people temporarily absent from work, and of people waiting to start a job they have already found, stems directly from the labour supply perspective, and is discussed further below (and in the Unemployment chapter).

Activity principle

The activity principle of the labour force framework requires that a person's labour force status is determined by what they were actually doing in the reference period, in terms of their engagement in, or capacity to engage in, economic activity. Commonly, surveys seek responses to a series of activity-based questions, which reflect both the reference period and the priority rules. The purpose of the activity principle is to provide an objective measure of the labour force.

Priority rules

Under the priority rules, precedence is given to employment over unemployment and to unemployment over economic inactivity. To ensure that all economic activity is covered, a practical minimum quantity of work is required (one hour or more in the short reference period); this also ensures that only those completely without work can be classified as unemployed. Of those completely without work, the unemployed must have taken active steps to obtain work and be currently available for work. The employed, the unemployed and the inactive are thus mutually exclusive and exhaustive components of the population.

Together, the priority rules and the activity principle provide unambiguous labour force measures, regardless of other activities that may be undertaken at the same time. For example, a person at work may also be actively seeking other employment; they are currently contributing to economic production and are therefore classed as employed, despite their job search. Similarly, a person working part-time while undertaking full-time study will be classed as employed. Likewise, a full-time student who is not working and is actively seeking and available for work will be classed as unemployed.

Reference period

The concepts of employed and unemployed need to relate to short time periods to allow meaningful measures of current levels and changes in employment and unemployment. Two short reference periods are presented in the international standards as suitable for the purpose: one week; and one day. Since employment and unemployment are stock concepts, the statistical measures would ideally be of a precise point in time. However, the closest practical time-span that could represent a single point in time is one day or one week. The choice between a one week and a one day reference period is not a recent problem, but one that has been the subject of much consideration and debate by labour statisticians for over 50 years.

As a result of the application of the priority rule (under which economic activity, however little, has precedence over other non-economic activities), the labour force measured using a one week reference period must always be equal to or greater than the labour force measured using a single day of that reference week. The difference between the two measures depends on the relative number of persons who change their activity status during a week. The differences are likely to be fairly small, because, in the course of a week, the movement of persons from unemployed to employed, and from employed to unemployed, is more likely than persons changing their status from inside the labour force to outside the labour force.

The solution adopted in the international standards aims to satisfy different conditions which exist among countries. In countries such as Australia, where regular full-time employment is dominant, similar average results will arise from the use of a reference period of a week or a single day; however, the one week reference period is likely to provide results of lower variance and is therefore preferred. Conversely, where persons employed in casual, part-time, or temporary jobs constitute a significant proportion of total employment, the use of a one day reference period will provide a more precise measure of employment and unemployment than using a reference period of a week.

Application of the framework

In household surveys, labour force status is derived by asking a series of questions about a person's work-related activities and availability for work in the reference period.

The criteria for determining a person's labour force status are (broadly) as follows:

- whether a person has work (i.e. economic work, including production and processing of primary products for own consumption, own-account construction and other production of fixed assets for own use, but excluding activities such as unpaid domestic work and volunteer community services); and

- whether those who do not have work are:

- actively looking for work; and

- available to start work.

The determination of labour force status from these criteria is as follows:

- a person who meets the first criterion is classified as employed, and hence in the labour force (currently economically active);

- a person who meets all of the subsequent criteria (i.e. without work, actively looking for work, and available to start work) is classified as unemployed, and hence in the labour force (currently economically active); and

- a person not classified as employed or unemployed is classified as not in the labour force (not currently economically active).

Employed

Employed persons are defined as all persons aged 15 years and over who, during the reference week:

- worked for one hour or more for pay, profit, commission or payment in kind, in a job or business or on a farm (comprising employees and owner managers of incorporated or unincorporated enterprises); or

- worked for one hour or more without pay in a family business or on a farm (i.e. contributing family workers); or

- were employees who had a job but were not at work and were:

- away from work for less than four weeks up to the end of the reference week, or

- away from work for more than four weeks up to the end of the reference week and received pay for some or all of the four week period to the end of the reference week, or

- away from work as a standard work or shift arrangement, or

- on strike or locked out, or

- on workers' compensation and expected to be returning to their job; or

- were owner managers, who had a job, business or farm, but were not at work.

Unemployed

Unemployed persons are defined as persons aged 15 years and over who were not employed during the reference week, and:

- had actively looked for full-time or part-time work at any time in the four weeks up to the end of the reference week and were available for work in the reference week; or

- were waiting to start a new job within four weeks from the end of the reference week and could have started in the reference week if the job had been available then.

Persons Not In the Labour Force (NILF)

Persons not in the labour force are defined as persons aged 15 years and over who were neither employed nor unemployed. They include persons who are:

- retired or voluntarily economically inactive;

- performing home duties or caring for children;

- attending an educational institution;

- experiencing a long-term health condition or disability;

- experiencing a short-term illness or injury;

- looking after an ill or disabled person;

- undertaking travel or a leisure activity;

- working in an unpaid voluntary job;

- in institutions (hospitals, gaols, sanatoriums, etc.);

- permanently unable to work; and

- members of contemplative religious orders.

Statistical measures

The ABS produces a number of statistics to summarise the state of the labour market in relation to the number of people in Australia who are either:

- employed,

- unemployed, or

- not in the labour force.

The diagram below depicts how the labour force framework is applied to all persons in Australia.

How the Labour Force Framework Applies to All People in Australia

Basic labour force formulae

The labour force can be described and examined using a range of simple formulae. These provide both total numbers for various categories, as well as rates and ratios which serve as analytical tools for interpreting the data.

The Labour Force Survey publishes labour force participation rates and other population ratios on a regular basis. For more information on the contents and methodology of this survey, refer to the Labour Force Survey section of this publication.

Labour force categories

The labour force (lf) is made up of all employed and unemployed persons.

\( labour \ force (l f)= employed \ persons \ (e) + unemployed \ persons \ (u)\)

The usually resident, adult civilian population (p), often simply referred to as ‘the population’ or ‘the civilian population’, is made up of the labour force and all persons not in the labour force.

\(civilian \ population \ (p)=l f+ persons \ not \ in \ the \ labour \ force \ (n)\)

The underutilised population is made up all persons who are unemployed and all employed persons who want to and are available to work more hours, known as the underemployed.

\(underutilised \ persons = u + underemployed \ persons \ (ude)\)

Rates and ratios

Various rates and ratios are used extensively in analyses of labour statistics, in particular to monitor changes in the size and composition of the supply of labour. These include the unemployment rate, the labour force participation rate, the underemployment rate and ratio, the underutilisation rate, and several population ratios. Although the names of these relative measures often include ‘rate’ or ‘ratio’, they are typically published by the ABS as a percentage.

The unemployment rate shows the percentage of the labour force which is unemployed, relative to those in the labour force.

\(unemployment \ rate=\frac{u}{l f} \times 100\)

The labour force participation rate shows the proportion of the in-scope population which is in the labour force, relative to those who are not in the labour force.

\(\begin{array}{c}labour \ force \\ participation \ rate \end{array}=\frac{lf}{p} \times 100\)

The underemployment rate and ratio are supplementary measures of underutilised labour capacity. Underemployed persons can be expressed either as a percentage of employed persons (underemployment ratio) or as a percentage of the total labour force (the underemployment rate).

\(underemployment \ ratio=\frac{u d e}{e} \times 100\)

\(underemployment \ rate=\frac{u d e}{l f} \times 100\)

The labour force underutilisation rate combines the unemployment and underemployment rates to show the proportion of the population who are looking for work, either as unemployed or as underemployed, expressed as a percentage of the total labour force.

\(underutilisation \ rate=\frac{u+u d e}{l f} \times 100\)

Population ratios provide information on the percentage of persons in a population with certain characteristics. The employment to population ratio shows the proportion of the total population who are employed, relative to those who are unemployed or not in the labour force.

\(\begin{array}{c} employment \ to \\ population \ ratio \end{array}=\frac{e}{p} \times 100\)

Relative frequencies can also be calculated for specific subgroups within the population with specific characteristics, such as a certain age group. These frequencies are typically calculated by applying the characteristics to both the numerator and denominator, such that they represent the frequency of a smaller group with specific characteristics relative to a larger group with those same characteristics. Examples are the employment to working age population ratio, and the youth unemployment rate.

The employment to working age population ratio is derived from the employment to population ratio, but restricted to include only persons below the retirement age, currently 65. It shows the ratio of employed persons aged 15-64 years \((e^{15-64})\), relative to all persons aged 15-64 years \((p^{15-64})\). The rationale is that this measure is less impacted over time by changing demographic structures than the employment to population ratio. It is, however, important to note that, since people do continue to work past the official retirement age or return to work after retirement, this measure does not capture the full scope of employment.

\(\begin{array}{c} employment \ to \ working \\ age \ population \ ratio \end{array}=\frac{e^{15-64}}{p^{15-64}} \times 100\)

The youth unemployment rate facilitates the specific analysis of youth unemployment. It shows the proportion of persons aged 15-24 years who are unemployed \((u^{15-24})\), relative to all persons aged 15-24 in the labour force \((lf^{15-24})\).

\(youth \ unemployment \ rate=\frac{u^{15-24}}{lf^{15-24}} \times 100\)

Example: solving the formulas

The following example details how some of these formulae are calculated using example data from the Labour Force Survey.

- Civilian population 15 years and over = 19,745,000

- Civilian population aged 15-64 years = 15,982,833

- Employed persons = 11,998,800

- Employed persons aged 15-64 years = 11,530,000

- Employed persons aged 15-24 years = 1,824,300

- Unemployed persons = 748,100

- Unemployed persons aged 15-24 years = 279,900

- Underemployed persons = 1,114,600

Solving the formulas

Using the data above, the employment to population ratio is calculated as:

\(\begin{aligned} \begin{array}{c} employment \ to \\ population \ ratio \end{array} &=\frac{e}{p} \times 100 \\ & = \frac{11,998,800}{19,745,000} \times 100 \\ & = 60.8\% \end{aligned}\)

One might then want to know how much of the total population is in the labour force (the labour force participation rate), or how much of the labour force is unemployed (the unemployment rate). To do this, however, one would need to first work out the size of the labour force, which is made up of the employed and the unemployed.

\(\begin{aligned} labour \ force &=e + u\\ & = 11,998,800 + 748,100 \\ & = 12,746,900 \end{aligned}\)

It is then possible to calculate the labour force participation rate and the unemployment rate.

\(\begin{aligned} \begin{array}{c} labour \ force \\ participation \ rate \end{array} &=\frac{lf}{p} \times 100 \\ & = \frac{12,746,900}{19,745,000} \times 100 \\ & = 64.6\% \end{aligned}\)

\(\begin{aligned} unemployment \ rate &=\frac{u}{lf} \times 100 \\ & = \frac{748,100}{12,746,900} \times 100 \\ & = 5.9\% \end{aligned}\)

One might then want to examine the prevalence of underemployment, both among employed people and within the entire labour force. For this, one would turn to the underemployment ratio and the underemployment rate.

\(\begin{aligned} u n d e r e m p l o y m e n t ~ r a t i o &=\frac{u d e}{e} \times 100 \\ &=\frac{1,114,600}{11,998,800} \times 100 \\ &=9.3 \% \end{aligned}\)

\(\begin{aligned} underemployment \ rate &=\frac{u d e}{l f} \times 100 \\ &=\frac{1,114,600}{12,746,900} \times 100 \\ &=8.7 \% \end{aligned}\)

Neither unemployment nor underemployment alone tells the whole picture of underutilised labour. As such, one would then want to know about the total amount of underutilisation in the labour force, and therefore would want to know the labour force underutilisation rate. Firstly, the number of underutilised persons, which is the sum of unemployed and underemployed, needs to be calculated.

\(\begin{aligned} underutilised\ persons &=u+u d e \\ &=748,100+1,114,600 \\ &=1,862,700 \end{aligned}\)

It is then possible to calculate the underutilisation rate.

\(\begin{aligned} underutilisation \ rate &=\frac{u+u d e}{l f} \times 100 \\ &=\frac{1,862,700}{12,746,900} \times 100 \\ &=14.6 \% \end{aligned}\)

One might also be interested in looking specifically at unemployment among young people. To do this, one might decide to calculate a youth unemployment rate by restricting the labour force to only persons aged 15-24 years. The correct formula would divide unemployed persons aged 15-24 years \((u^{15-24})\) by all persons in the labour force aged 15-24 years. The first step is to calculate the labour force aged 15-24 years, which is the sum of employed persons aged 15-24 years \((e^{15-24})\) and unemployed persons aged 15-24 years.

\(\begin{aligned} \begin{array}{c}labour \ force \ aged \\ 15 \ to \ 24 \ years \end{array} &= e^{15-24} + u^{15-24} \\ & = 1,824,300 + 279,900 \\ & = 2,104,200 \end{aligned}\)

It is then possible to calculate the youth unemployment rate.

\(\begin{aligned} youth \ unemployment \ rate &=\frac{u^{15-24}}{l f^{15-24}} \times 100 \\ &=\frac{279,900}{2,104,200} \times 100 \\ &=13.3 \% \end{aligned}\)

One might further consider the implications of the age distribution of the population and realise that some of the previous frequencies, such as the employment to population ratio, might be impacted by an ageing population and greater numbers of retired persons not in the labour force. Therefore, one might decide to calculate an employment to population ratio only for persons aged between 15 and the retirement age, currently 65. The correct formula would divide employed persons aged between 15 and 64 years \((e^{15-64})\) by a civilian population restricted to those aged between 15 and 64 years \((p^{15-64})\).

\(\begin{aligned} \begin{array}{c} employment \ to \ working \\ age \ population \ ratio \end{array} &=\frac{e^{15-64}}{p^{15-64}} \times 100 \\ & = \frac{11,530,000}{15,982,833} \times 100 \\ & = 72.1\% \end{aligned}\)

Extensions to the framework

The basic framework, as outlined above, can be extended to identify various sub-groups within the labour force.

Employment types and arrangements

The arrangements of employment vary among employed persons. Persons may be employed as employees; however, they may also be an owner-manager of an enterprise, either incorporated or unincorporated, and either with or without employees. The ABS Status in Employment classification allows these groups to be separately identified within the labour force. Employees may also be broken down into groups based on the arrangements of their employment. Such breakdowns may be based on casual employment, contract work, labour hire employment, or even on job stability and flexibility measures.

Hours worked

Hours of work can be used to break down employment into smaller categories based upon either actual or usual hours worked, or the desired hours worked. Employed persons are classified as employed full-time if they worked 35 or more hours in the reference week, or worked less than 35 hours in the reference week but usually work 35 or more hours in a week. They are classified as part-time if they usually work less than 35 hours and did so in the reference week.

Labour participation potential: underemployment, marginal attachment, and discouraged jobseekers

Labour participation potential refers to potential labour which is not undertaken for a variety of reasons. It is a broader measure than unemployment, as potential labour can exist also within both of the other labour force categories of employment and not in the labour force.

The ABS produces both headcount (number of persons) and volume (number of hours) measures of underutilisation. Within employment, underemployment refers to a situation where the supply of labour is greater than the demand, and therefore employed persons are working fewer hours than they would like to. It is possible to identify employees who are underemployed by asking whether they want to work more hours than they currently do. Underemployment is a distinct measure of labour force underutilisation; however, it can also be combined with unemployment to form a broader measure of total underutilised labour in the economy.

The underutilised population can be further extended by the addition of select groups of persons not in the labour force, known as the marginally attached. Marginal attachment refers to persons who are not currently in the labour force, but who want to work. They are divided into two categories: those actively looking for work but not available to start work in the reference week, and those not actively looking for work but available to start work within four weeks. Within the second category are discouraged jobseekers, who are persons not looking for work because they believe that they are unlikely to find a job for a variety of reasons.

Long-term unemployed job seekers

Within unemployment, it is possible to identify persons who are in long-term unemployment, defined as having duration of unemployment of 12 months or more. The number of unemployed people is an important social and economic indicator. The length of time that unemployed people have been looking for work or since they last worked (previously referred to as duration of unemployment) is also important from both an economic and social perspective. Long-term unemployment (i.e. where duration of job search is 52 weeks or more) is of particular social concern due to the consequences of being out of work for long periods, such as financial hardship and the loss of relevant skills. From an economic perspective, the longer people are unemployed the less likely they are going to be able to contribute to the economy.

Since its inception in 1960, the ABS Labour Force Survey (LFS) has collected information about duration of unemployment for unemployed persons. The survey collects data each month about the length, in completed weeks, of current (incomplete) spells of looking for work and/or time since last job from those who are currently unemployed.

The definition used by the ABS aligns with international standards (19th ICLS resolution (2013) concerning statistics of work, employment and labour underutilisation).

Labour force framework examples

The section below discusses the treatment in the Labour Force Survey of particular groups of persons as employed, unemployed or not in the labour force. These groups include: participants in labour market programs (such as the 'Work for the Dole', 'Community Development Employment Projects (CDEP)' and 'Structured Training and Employment Project (STEP)' schemes); students; contributing family workers; and future starters.

Participants in labour market programs

A wide range of labour market programs are provided by governments. These programs aim to: assist the efficient functioning of the labour market; help individuals and industry to improve the productivity and skills of the labour force; and improve the skills and employment prospects of persons disadvantaged in the labour market. Programs implemented by governments take various forms including wage subsidies to employers, vocational training, paid and unpaid work experience, and assistance in finding employment.

The Labour Force Survey does not ask any questions directly related to participation in labour market programs. Such information is neither necessary nor sufficient to determine labour force status. Individual participants are counted as employed, unemployed or not in the labour force according to economic (work-related) activity undertaken in the survey reference period. The labour force measure, based on economic activity tests, is thus consistent over time and independent of administrative changes to labour market programs or their eligibility rules.

Persons working for pay in a job for which their employer receives a government subsidy are 'working in a job' (employed), regardless of the subsidy (about which the person may have no knowledge).

The treatment of participants in programs involving training but no subsidy (paid either to employers or participants) depends on the individual circumstances of the participant. If the participant worked for pay in a job (or was temporarily away from work) during the reference week, they should be classified as employed. If they did no paid work (and were not temporarily away from work), they are classified as either unemployed or not in the labour force depending on whether they actively looked for, and were available to commence work, in the survey reference period.

Below are some common labour market programs, and how the participants of these programs are treated in the Labour Force Survey.

Work for the Dole

Work for the Dole is a government program aimed at providing work experience to improve the skills, and future (paid) employment prospects, of persons registered for unemployment benefits. Under 'Work for the Dole' schemes, to maintain their eligibility for benefits, persons are required to undertake work-like activities at a host organisation (e.g. government agencies) or as part of a community-based project for a number of hours per week.

Superficially, such persons might be regarded as 'employed' as they are working for one hour or more and receive a payment. However, they are not paid for their work by the organisations undertaking the community projects. The participants are receiving only their unemployment benefit entitlement, paid directly by the administering government agency. As the community organisations do not have employer/employee relationships with the scheme participants, activity in a 'Work for the Dole' scheme is not considered to be engagement in an employee job.

Accordingly, the labour force status of persons participating in 'Work for the Dole' schemes is determined according to economic (work-related) activity undertaken in the survey reference period. They are classified either as unemployed or not in the labour force, depending on whether they actively looked for, and were available to commence work, in the survey reference period.

General job-search assistance programs

Various government programs have provided assistance to job-seekers. Interaction with these programs may constitute actively looking for work, and therefore impact on a person’s labour force status.

Up to June 2014, as well as being registered with any other employment agency, being registered with Centrelink as a jobseeker was considered to be an active step. In July 2014, being registered with Centrelink was removed, while being registered with a Job Services Australia provider was added.

In July 2015, Job Services Australia was replaced by the “jobactive” program. As the names of employment programs may change in the future, the question wording was updated to remove any explicit references to agencies or programs and now refers to the generic "employment agency".

Programs in remote areas of Australia

Community Development Employment Projects (CDEP) was a scheme of the Australian Government which provided local employment opportunities for Aboriginal and Torres Strait Islander communities. Under the scheme, Indigenous communities and organisations could receive a grant, similar in value to the collective unemployment benefit entitlements of participating community members, to undertake a wide range of community development projects. Individuals could choose whether or not to participate in the scheme, by which they would forgo their unemployment benefits in exchange for paid employment. The work in which they might engage was determined by the community or organisation, and included activities such as housing repairs and maintenance, artefact production, road works, market gardening, fishing and other business and cultural activities.

Under the CDEP scheme, the community met all legal responsibilities to its workers, including the provision of award wages and conditions, workers' compensation insurance, and income tax liabilities. Accordingly, an employment relationship was deemed to have existed between the community (employer) and the members of the community undertaking work (employees). Participation in the scheme was considered to have been engagement in a paid employment job, and participants were classified as having been employed.

From July 2009 onwards, the CDEP scheme was discontinued in non-remote locations where the economy is well established. Individuals in these communities who were formerly paid wages under CDEP instead received alternative income support benefits.

Unless they had another form of paid employment, persons receiving income support benefits were not considered to have been employed. Instead, they were classified as unemployed or not in the labour force, depending on whether or not they were actively looking for, and were available to, work.

In remote communities, participants who joined CDEP prior to July 2009 continued receiving wages until June 2017, and continued to be classified as employed. New participants received income support benefits, and were treated as either unemployed or not in the labour force.

In July 2013, the Remote Jobs and Community Program (RJCP) replaced CDEP. Like CDEP, RJCP participants received income support payments, and were treated as either unemployed or not in the labour force.

On 1 July 2015, the Community Development Programme (CDP) replaced the RJCP. The CDP has two objectives: helping people find work, and allowing them to contribute to their communities and gain skills while looking for work. Under this program, job seekers with activity requirements are expected to do up to 25 hours per week of work-like activities. Activities can take different forms that are suited to the job seeker, their community and the local job market. Job seekers can undertake formal training (as an opportunity to gain qualifications), or foundation skills training (e.g. language, literacy, numeracy and driver training) as part of their activity requirements. Like RCJP, CDP participants receive income support payments, and are therefore classified as either unemployed or not in the labour force.

Students