This release contains preliminary data from the 2019-20 Survey of Income and Housing (SIH). The SIH collects information on household income, wealth, housing costs and financial stress from Australian households over the financial year.

Final SIH estimates for the full financial year are published in Household income and wealth, and Housing occupancy and costs. Preliminary quarterly estimates in this release will provide a more immediate insight into the financial impact of the Coronavirus (COVID-19) pandemic on Australian households.

To support comparisons of the June 2020 quarter with earlier time periods, most tables in this release combine previous quarter estimates from 2019-20. Due to the smaller quarterly sample size, estimate reliability should be considered when comparing results (see the Methodology page for further guidance).

Estimates in this release are not seasonally adjusted. Previous cycle SIH data from 2017-18 is adjusted in real terms, using changes in the Consumer Price Index.

To see more measurements and impacts of COVID-19 on the economy and society please visit our COVID-19 page.

Assessing the impact of COVID-19 and limitations on June 2020 quarter data

The impacts of COVID-19 on household finances are likely to be underestimated in the June quarter as:

- Reference periods for particular items may fall outside the June quarter. For instance, a wage or salary reported may refer to a payment made before the introduction of COVID-19 restrictions.

- Survey questions were developed prior to the introduction of COVID-19 payments and changes to eligibility for other government payments. Questions about JobKeeper payments, the Coronavirus Supplement and the government early access superannuation scheme were not specifically included. It was however, still possible for respondents to report on these schemes.

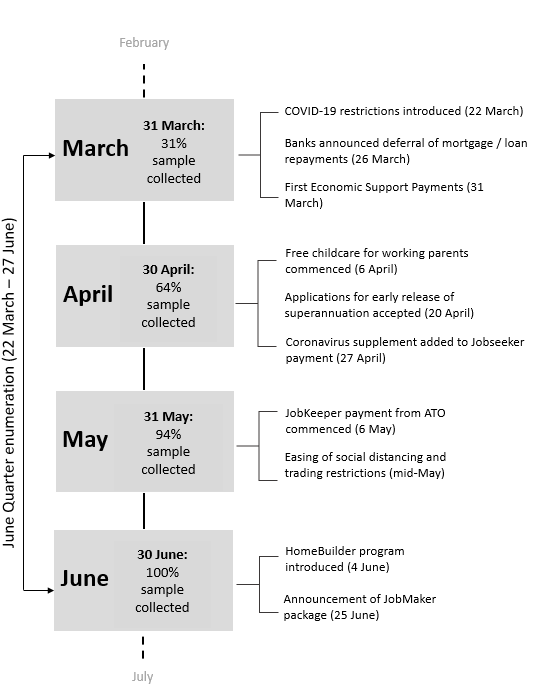

- Nearly one third (31%) of the sample had been collected before the announcement of COVID-19 government support payments, and more than half had been collected prior to the commencement of support schemes. Results have not been adjusted to account for the date of survey completion.

Events timeline, June 2020 quarter

Image

Description

Additional questions to clarify COVID-19 payments, and early access to superannuation, have been included for the 2020-21 collection, and will be available in future releases.