3. Flows, stock positions and accounting rules

Part A - Introduction

3.1.

The basic elements of Australia's GFS system are its measures of the economic flows to and from in-scope units, and the economic stock positions held by those units. Although GFS provides economic measures, the GFS system uses accounting based rules to govern the ways in which these basic elements are recorded.

3.2.

This chapter discusses flows, stock positions and the accounting rules used in GFS. This chapter also examines derived measures for GFS, the netting of flow and stock positions and consolidation.

Economic flows and stocks

3.3.

Paragraph 3.1 of the IMF GFSM 2014 describes economic flows as monetary expressions of economic actions and effects of events that result in changes in economic value within an accounting period; and economic stocks as measures of economic value at a specific point in time. All of the entries recorded in GFS are either economic flows or economic stock positions and are integrated, meaning that all changes in stock positions can be fully explained by the flows which occur during the respective reporting period. Each stock position in GFS can be explained by the following formula in Box 3.1 below.

Box 3.1 - GFS stock position formula

Economic stock positions in GFS can be measured using the following formula:

\(S^0 + F = S^1\)

where:

\(S^0\) = the value of a specific stock position at the beginning of a reporting period;

\(S^1\) = the value of the same stock position at the end of a reporting period; and

\(F\) = the net value of all related flows during the period.

3.4.

The formula in Box 3.1 simply shows that the value of any stock position held by a unit at a given time is equal to the cumulative value of all flows affecting that stock position that have occurred since the unit first acquired the particular type of asset or liability. The GFS framework analyses all the economic flow and stock positions during a reporting period to derive net worth and other measures.

3.5.

The term 'economic stock positions' is often referred to simply as 'stocks' or 'assets and liabilities' in GFS. Likewise, the term 'economic flows' is often referred to simply as 'flows' in GFS.

Part B - Economic flows

3.6.

Economic flows are defined in paragraph 3.4 of the IMF GFSM 2014 as the creation, transformation, exchange, transfer, or extinction of economic value. They involve changes in the volume, composition, or value of a unit’s assets, liabilities and net worth. A flow can consist of a single event, such as the receipt of a tax payment from a taxpayer, or can relate to the cumulative value of a set of events over the accounting period, such as the continuous accrual of interest expense on a government bond.

3.7.

There are two types of economic flows recognised in the GFS system. These are known as:

- transactions; and

- other economic flows.

Transactions

3.8.

A transaction is defined in paragraph 3.5 of the IMF GFSM 2014 as an economic flow that is an interaction between institutional units by mutual agreement or through the operation of the law, or an action within an institutional unit that is analytically useful to treat like a transaction, often because the unit is operating in two different capacities. In this context, mutual agreement is intended to mean that there was prior knowledge of the flow and consent given by each unit to enter into the transaction, but does not necessarily mean that the units entered into the transaction voluntarily.

3.9.

Paragraph 3.5 of the IMF GFSM 2014 also states that some transactions (such as the payment of taxes) are enforced by law. Despite their compulsory nature, tax payments are regarded as mutually agreed interactions between the government and taxpayers, and are therefore treated as transactions. This is because there is collective recognition and acceptance by the community of the legal obligation to pay taxes. Similarly, the actions necessary to comply with judicial or administrative decisions may not be undertaken voluntarily, but because they are taken with prior knowledge and consent of the parties involved, these too are considered transactions in GFS.

3.10.

The GFS system also recognises as transactions, certain flows that occur within in-scope units where a unit is viewed as operating simultaneously in two different economic capacities. Therefore, flows such as depreciation are recorded as transactions in GFS because the unit who owns the relevant asset is seen as simultaneously acting as both the owner of the depreciating asset and as the consumer of the service provided by the asset. Another example of an internal or intra-unit flow which is recognised as a transaction in GFS is the run-down of inventories in calculating non-employee expenses or use of goods and services.

3.11.

The types of unit interactions intended to be excluded from the definition of a transaction in GFS include events such as the illegal seizure or destruction of a unit's property by another unit.

3.12.

All transactions can be recorded as either exchanges or transfers in the GFS system.

Exchanges

3.13.

An exchange is defined in paragraph 3.9 of the IMF GFSM 2014 as a transaction where one unit provides a good, service, asset, or labour to a second unit and receives a good, service, asset or labour of the same value in return. Compensation of employees, purchases of goods and services, the incurrence of interest expenses, and the sale of an asset such as an office building are all considered to be exchanges in GFS.

3.14.

Exchange transactions do not include entitlements to collective services or benefits, which are considered to be transfers. This is because the amount of collective service or benefit that may eventually be receivable by an individual unit is not proportional to the amount payable. Taxes and non-life insurance claims are examples of such transactions classified as transfers due to the collective nature of the benefits.

Transfers

3.15.

A transfer is defined in paragraph 3.10 of the IMF GFSM 2014 as a transaction in which one institutional unit provides a good, service, or asset to another unit without receiving from the latter any good, service, or asset in return as a direct counterpart. This type of transaction is also referred to as being 'unrequited', or a 'something for nothing' transaction. Transfers can also arise where the value provided in return for an item is not economically significant or is much below its current market value. General government units engage in a large number of transfers which may be compulsory or voluntary in nature. Government grants, government subsidies, non-life insurance claims and taxes are all considered to be transfers in GFS.

3.16.

Paragraph 3.13 of the IMF GFSM 2014 states that taxes are treated as transfers in GFS, even though the units making these payments may receive some benefit from services provided by the government unit receiving the taxes. For example, in principle no one can be excluded from sharing in the benefits provided by collective services such as public safety. In addition, a taxpayer may even be able to consume certain individual services provided by government units. However, it is usually not possible to identify a direct link between the tax payments and the benefits received by individual units. Moreover, the value of the services received by a unit usually bears no relation to the amount of the taxes payable by the same unit.

3.17.

Paragraph 3.14 of the IMF GFSM 2014 also specifies that there is uncertainty if the contributing unit will receive any benefits and, if it does receive benefits, they may bear no relation to the amount of the premiums previously paid. Non-life insurance claims are also treated as transfers in GFS. This type of insurance entitles the units making the payment to benefits only if one of the events specified in the insurance contract occurs. That is, one unit pays a second unit for accepting the risk that a specified event may occur to the first unit. Non-life claims are considered transfers because in the nature of the insurance business, they distribute income between policyholders to those who claim, as opposed to all policyholders who contribute.

3.18.

In GFS, transfers may be either current or capital in nature.

Capital transfers

3.19.

Capital transfers are defined in paragraph 3.16 of the IMF GFSM 2014 as transfers in which the ownership of an asset (other than cash or inventories) changes from one party to another; or that oblige one or both parties to acquire or dispose of an asset (other than cash or inventories); or where a liability is forgiven by the creditor. Capital transfers are typically large and infrequent, but capital transfers cannot be defined in terms of size or frequency. Cash transfers involving disposals of non-cash assets (other than inventories) or acquisition of non-cash assets (other than inventories) are also considered to be capital transfers. A capital transfer results in a commensurate change in the stock position of assets of one or both parties to the transaction.

3.20.

A transfer in kind without a charge is a capital transfer when it consists of:

- the transfer of ownership of a non-financial asset (other than inventories);

- the forgiveness of a liability by a creditor when no corresponding value is received in return; and

- major non-recurrent payments in compensation for accumulated losses or extensive damages or serious injuries not covered by insurance policies.

3.21.

A transfer of cash is a capital transfer when it is linked to (or conditional on) the acquisition or disposal of a non-financial produced asset by one or both parties to the transaction.

Current transfers

3.22.

Current transfers are defined in paragraph 3.17 of the IMF GFSM 2014 as all transfers that are not capital transfers. Current transfers directly affect the level of disposable income and influence the consumption of goods or services. That is, current transfers reduce the income and consumption possibilities of the donor and increase the income and consumption possibilities of the recipient. For example, social benefits, subsidies and food aid are current transfers.

3.23.

Paragraph 3.18 of the IMF GFSM 2014 states that it is possible that some cash transfers may be regarded as capital transfers by one party to the transaction and as current transfers by the other party. In order to ensure that a donor and a recipient do not treat the same transaction differently, a cash transfer should be classified as capital for both parties even if it involves the acquisition or disposal of an asset, or assets, by only one of the parties. When there is doubt about whether a transfer should be treated as current or capital, it should be treated as a current transfer.

Combinations of exchanges and transfers

3.24.

Some transactions appear to be exchanges but are actually combinations of an exchange and transfer. Paragraph 3.11 of the IMF GFSM 2014 states that in such cases, a transaction should be partitioned (see explanation in paragraph 3.31 to 3.32 of this manual for the definition) and recorded as two separate transactions, one that is only an exchange and one that is only a transfer. An example of this type of transaction is where a general government unit sells an asset at a price that is clearly less than the market value of the asset, or at a price that is clearly above the market value of the asset. In this example, the transaction should be divided into an exchange at the asset's market value, and a transfer equal in value to the difference between the sale price and the market value.

Monetary and non-monetary transactions

3.25.

The GFS system also includes transactions in which the final consideration is cash (known in GFS as monetary transactions), as well as transactions in kind (known in GFS as non-monetary transactions).

Monetary transactions

3.26.

Monetary transactions are defined in paragraph 3.8 of the IMF GFSM 2014 as those in which one institutional unit makes a payment (or receives a payment), incurs a liability (or receives an asset), to (or from) another institutional unit stated in units of currency. In GFS, all flows are recorded in monetary terms, but the distinguishing feature of a monetary transaction is that the parties involved express their agreement in monetary terms. For example goods or services are usually purchased (or sold) at a given number of units of currency per unit of the good or service. All monetary transactions are interactions between two institutional units, recorded as either an exchange or a transfer (see paragraphs 3.15 to 3.18 of this manual for the definition).

Non-monetary transactions

3.27.

Non-monetary transactions are defined in paragraph 3.19 of the IMF GFSM 2014 as transactions that are not initially stated in units of currency. These include all transactions that do not involve any cash flows, such as barter, in kind transactions, and certain internal transactions. For GFS purposes these transactions must be assigned a monetary value because GFS records flows and stock positions expressed in monetary terms. The entries therefore represent values that are indirectly measured or otherwise estimated. The values assigned to non-monetary transactions have a different economic implication than do monetary payments of the same amount, as they are not freely disposable sums of money. Nevertheless, to have a comprehensive and integrated set of accounts, it is necessary to assign the best estimate of current market values to the items involved in non-monetary transactions.

3.28.

Paragraphs 3.21 to 3.25 of the IMF GFSM 2014 give the following examples of non-monetary transactions:

- Barter transactions - where two units exchange goods, services, or assets other than cash of equal value. For example, a government unit may agree to trade a parcel of land in an industrial area to a private corporation for a different parcel of land that the government will use as a national park, or between nations governments may trade strategic natural resources for another kind of product or service.

- Remuneration in kind - this occurs when an employee is compensated with goods, services, or assets other than money. Types of compensation that employers commonly provide without charge or at reduced prices to their employees may include meals and drinks, uniforms, housing services, transportation services, or child care services.

- Other payments in kind - these occur when payment is made in the form of goods and services rather than money. A payment to settle a liability can be made in the form of goods, services, or non-cash assets rather than money. For example, a government unit may agree to settle a claim for past-due taxes if the taxpayer transfers ownership of land or non-financial produced assets to the government.

- Transfers in kind - these may be used to increase efficiency, or to insure that the intended goods and services are consumed. For example, aid after a natural disaster may be more effective and be delivered faster if it is provided in the form of medicine, food, and shelter instead of money. Also, a general government unit might provide medical or educational services in kind to ensure that the need for those services is met.

Rearrangement of certain GFS transactions

3.29.

Some transactions are modified in macroeconomic statistics to properly reflect their underlying economic nature and substance more clearly. The following definitions and discussions regarding rerouting, partitioning and reassignment appear in paragraphs 3.28 to 3.30 in the IMF GFSM 2014, and have been reproduced below.

Rerouting

3.30.

Rerouting records a transaction as taking place through channels that differ from the actual ones, or as taking place in an economic sense when no actual transactions take place. Rerouting is often required when a unit that is in fact a party to a transaction does not appear in the actual accounting records because of administrative arrangements. Two kinds of rerouting often occur:

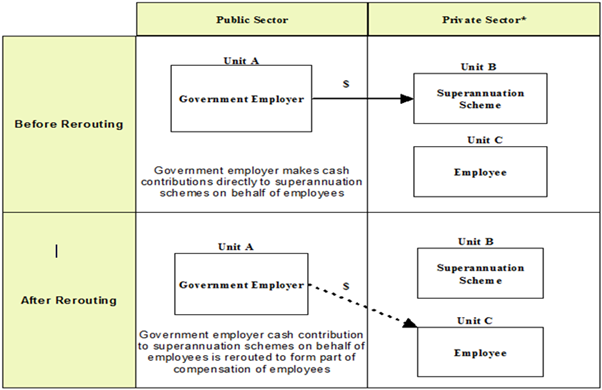

- In the first kind of rerouting, a direct transaction between unit A and unit C is recorded as taking place indirectly through a third unit B. For example, if government employees are enrolled in a superannuation scheme, accounting records may show the government unit making employer contributions directly to the superannuation scheme on behalf of its employees. However in macroeconomic statistics, these contributions are part of the compensation of employees and should be recorded as being paid to the employee. In such a case it is necessary to reroute the payments so that the government is seen as paying the employees, who then are deemed to make payments of the same amount to the superannuation scheme. As a result of the rerouting, these contributions are included as part of the employee expenses of government - see Diagram 3.1 below.

Diagram 3.1 - Rerouting of government employer contributions to superannuation schemes.

- In the second kind of rerouting, a transaction of one kind from unit A to unit B is recorded with a matching transaction of a different kind from unit B to unit A. For example, when a non-resident SPE of government borrows abroad, transactions should be imputed in the accounts of both the government and the non-resident SPE as if the SPE has extended a loan to government, and government has invested the corresponding amount in the SPE. This rearrangement of the transactions reflects government’s involvement in the non-resident SPE which would otherwise not be captured in government accounts.

Partitioning

3.31.

The IMF uses the term partitioning to refer to situations where a single transaction is recorded as two or more differently classified transactions. Partitioning may be required in cases where it is logical from an accounting perspective to collect data as a single transaction, but for GFS purposes the transaction must be split into two or more transactions to be correctly recorded for economic purposes.

3.32.

An example of where partitioning may be appropriate in GFS is when a general government unit acquires an asset at above or below its current market price. If the acquisition of the asset by government is part of a competitive process, then the asset can be said to have been acquired at the current market price and no partitioning is required. However, if the acquisition of the asset is a deliberate action by government (e.g. as part of a bailout operation) and there is clear evidence that the amount paid for the asset is above or below the market value of the asset, then the transaction is partitioned into an exchange transaction to record the market value of the asset, and a transfer transaction under assets acquired below market value (ETF 1152, TALC, COFOG-A, SDC) and the difference would be recorded as assets donated (ETF 1262, TALC, COFOG-A, SDC).

Reassignment

3.33.

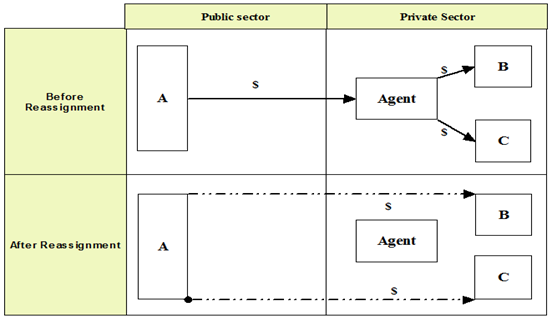

Reassignment records transactions arranged by third parties on behalf of others as taking place as if directly by the principal parties involved. Paragraph 3.30 of the IMF GFSM 2014 indicates that reassignment is required when one unit arranges for a transaction to be carried out between two other units, generally in return for a fee from one or both parties to the transaction. In this case, one unit acts as an agent for another unit. In GFS, the transaction must be recorded exclusively in the accounts of the two (or more) parties involved in the transaction and not in the accounts of the third party facilitating the transaction - see Diagram 3.2 below.

Diagram 3.2 - Reassignment of the transactions

Other economic flows

3.34.

In GFS, changes in the value of assets or liabilities that do not result from transactions are referred to as other economic flows. Other economic flows are flows that do not meet the definition of a transaction (see paragraph 3.8 to 3.12 of this manual for the definition). Paragraph 3.31 of the IMF GFSM 2014 describes other economic flows as those flows where the value of assets or liabilities change due to a naturally occurring event such as an earthquake, flood or fire. In these cases, the change in the value of the assets and / or liabilities need to be taken into account for GFS purposes even though they have not resulted from a transaction, and so they are recorded as other economic flows. Other economic flows are discussed in further detail in Chapter 11 of this manual.

3.35.

In GFS there are two major categories of other economic flows. These are described as holding gains and losses and other changes in the volume of assets and liabilities.

Holding gains and losses

3.36.

Holding gains or losses (which are also referred to as 'revaluations' in GFS) are defined in paragraph 3.33 of the IMF GFSM 2014 as changes in the monetary value of assets or liabilities resulting from changes in the level and structure of market prices, assuming that the asset or liability has not changed qualitatively or quantitatively. Holding gains or losses accrue purely as a result of holding an asset or liability over time, without transforming it in any way. Holding gains or losses can apply to any assets or liabilities held for any length of time during the accounting period. Any gains or losses made on the sale of assets are shown in output as holding gains or losses and not as GFS revenues.

3.37.

Holding gains and losses on assets and liabilities include changes resulting from exchange rate movements. The GFS basis for valuing stocks and flows is at their respective market values. Therefore in concept, holding gains and losses are continuously generated as market prices change with market activity, whether the holding gain or loss is realised or not. Holding gains or losses often occur on financial assets such as shares and securities that are traded on financial markets and are subject to exchange rate fluctuations.

3.38.

Further discussion on holding gains and losses may be found in Chapter 11 of this manual.

Other changes in the volume of assets and liabilities

3.39.

Economic flows that do not result from transactions or holding gains or losses are known as other changes in the volume of assets and liabilities (also sometimes referred to as 'other volume changes' in GFS). Other changes in the volume of assets and liabilities are events that bring about the addition of assets or liabilities to the GFS balance sheet or the removal (or part-removal) of assets or liabilities from the GFS balance sheet, and result in a change to GFS Net Worth.

3.40.

Economic flows due to other changes in the volume of assets and liabilities cover a wide variety of events. Paragraph 3.35 of the IMF GFSM 2014 lists the three most common categories of events that result in other changes in the volume of assets and liabilities. These are:

- Events that involve the appearance or disappearance of economic assets on the GFS balance sheet other than by transactions. In these cases, an other volume change is recorded when certain assets and liabilities enter and leave the GFS balance sheet through events other than by transactions. Examples include increases to the GFS Net Worth through mineral discoveries, or reductions in GFS Net Worth due to the unilateral writing off of bad debts by creditors.

- External events (exceptional and unexpected) that impact on the economic benefits derivable from assets and corresponding liabilities. Examples include the reduction of GFS Net Worth due to the destruction of assets by fire or some other catastrophe, or the depletion of natural assets (e.g. forests, fisheries) as a result of physical removal or use.

- Changes in classification. An example is when a change in the nature of the operations of a unit means it has to be transferred from General Government and reclassified as a Public Financial Corporation or a Public Non-Financial Corporation.

3.41.

Further discussion on other volume changes may be found in Chapter 11 of this manual.

Part C - Economic stock positions

3.42.

An economic stock position is defined as the total holdings of assets and / or liabilities at a certain point in time. Paragraph 3.36 of the IMF GFSM 2014 indicates that stock positions are recorded in the GFS balance sheet at the beginning of an accounting period and again at the end of an accounting period, and are connected by the economic flows which occur during the accounting period. All changes in the position of stocks are explained by transactions and other economic flows which take place during an accounting period.

3.43.

In order to measure stock positions, it is necessary to define the asset boundary for GFS purposes. In GFS, the boundary for assets is limited to economic assets from which economic benefits accrue to the owners. These economic assets are further split into financial assets and non-financial assets. In GFS, all liabilities are financial in nature and so this further distinction is not necessary.

Assets and liabilities

3.44.

An asset is defined in paragraph 3.42 of the IMF GFSM 2014 as a store of value representing a benefit or series of benefits accruing to the economic owner by holding or using the resource over a period of time. It is a means of carrying forward value from one accounting period to another. Paragraph 3.43 of the IMF GFSM 2014 specifies that only economic assets are recorded in the GFS system and they appear in the balance sheet of the unit that is the economic owner of the asset. Personal attributes such as reputation or skill, which are sometimes described as an asset, are not recognised as such in GFS.

Economic assets

3.45.

An economic asset is defined in paragraph 3.43 of the IMF GFSM 2014 as resources over which ownership rights are enforced and from which economic benefits may flow to the owners. The economic benefits derived from the ownership of an economic asset consist of primary income derived from the right to use, rent out, or otherwise generate income, and / or any holding gains that are realised by disposing of the asset. Paragraph 3.36 of the IMF GFSM 2014 lists the economic benefits that may be derived from an asset as including the:

- ability to use assets, such as buildings or machinery, in production;

- generation of services, for example, renting out produced assets to another entity;

- generation of property income (e.g., interest and dividends received by the owners of financial assets); and

- potential to sell and thus realise holding gains.

Ownership of assets

3.46.

There are two types of ownership recognised in GFS, legal ownership and economic ownership.

Legal ownership

3.47.

The legal owner of resources such as goods and services, natural resources, assets, and liabilities is defined in paragraph 3.38 of the IMF GFSM 2014 as the institutional unit entitled by law and sustainable under the law to claim the benefits associated with the resource. Sometimes the government may claim legal ownership of a resource on behalf of the community at large. To be recognised in the GFS framework, a resource must have a legal owner, either on an individual or collective basis.

Economic ownership

3.48.

The economic owner of resources such as goods and services, natural resources, assets, and liabilities is defined in paragraph 3.39 of the IMF GFSM 2014 as the institutional unit entitled to claim the benefits associated with the use of these resources by virtue of accepting the associated risks. In most cases, the economic owner and the legal owner of a resource are the same. Where they are not, it is understood that the legal owner has passed responsibility for the risk involved in using the resource in an economic activity to the economic owner as well as associated benefits. In return, the legal owner accepts another package of risks and benefits from the economic owner. In GFS, when the expression 'ownership' or 'owner' is used and the legal and economic owners are different, the reference should generally be understood to be to the economic owner.

3.49.

Paragraph 3.40 of the IMF GFSM 2014 states that the government may claim legal ownership of a resource on behalf of the community at large, such as territorial waters. If this is the case, the benefits also accrue to the government on behalf of the community at large. Therefore, the government is both the legal and economic owner of these resources. However, governments may share the benefits with other entities, but by virtue of accepting the majority of the risks, become the economic owner of a resource. For example, in the case of public-private partnerships (see Chapter 13 of this manual for definition); economic ownership can be vested with government when government accepts the majority of the risks.

Financial assets

3.50.

In GFS, economic assets are recorded in the balance sheet and take the form of financial assets or nonfinancial assets.

3.51.

Financial assets are defined in paragraph 3.48 of the IMF GFSM 2014 as economic assets which take the form of financial claims on other economic units and gold bullion held by monetary authorities as a reserve asset.

3.52.

A financial claim is defined in paragraph 3.47 of the IMF GFSM 2014 as an asset that typically entitles the owner of the asset (known as the creditor) to receive funds or other resources from another unit (known as the debtor), under the terms of a liability. Financial claims are unconditional in nature (like liabilities), and provide benefits to the creditor by acting as a store of value, or by generating interest, other property income, or holding gains.

3.53.

Financial assets differ from non-financial assets in that they generally have a counterpart liability, with the exception of monetary gold in the form of gold bullion held as reserve assets (see Chapter 8 and Chapter 10 of this manual for further discussion on monetary gold). Financial assets are the counterparts of the liabilities on which the claims are held. If one economic unit exchanges a particular set of benefits with another economic unit for future payment, a financial claim (and also a liability) is established in GFS.

3.54.

Financial assets include currency and deposits, debt securities, loans and placements, insurance, superannuation and standardised guarantee schemes, and other financial assets. Further discussion on financial assets may be found in Chapter 8 and Chapter 10 of this manual.

Non-financial assets

3.55.

All other economic assets are described as non-financial assets in GFS. Paragraph 3.50 of the IMF GFSM 2014 states that non-financial assets are further subdivided into non-financial assets that are 'produced' such as buildings, inventories, valuables (e.g. works of art), and non-financial assets that are 'non-produced' such as naturally occurring forests and fish stocks, and mineral reserves.

3.56.

Further discussion on non-financial assets may be found in Chapter 8 and Chapter 9 of this manual.

Liabilities

3.57.

A liability is defined in paragraph 3.45 of the IMF GFSM 2014 as being established when one unit (known as the debtor) is obliged, under specific circumstances, to provide funds or other resources to another unit (known as the creditor). In GFS, all liabilities are financial in nature and so they are not identified as financial and non-financial as is the case with assets. Liabilities are the counterparts to financial assets held by claimant economic units. This means that when a liability exists, the creditor has a corresponding financial claim on the debtor.

3.58.

Paragraph 3.45 of the IMF GFSM 2014 further states that as is the case with commercial accounting, a liability in GFS is commonly created through a legally binding contract specifying the parties involved and the terms and conditions of the payment(s) to be made, and is extinguished when the debtor pays the sum agreed in the contract. In GFS, liabilities can also be imputed to reflect the underlying economic reality of a transaction, such as the creation of a notional loan when an asset is acquired under a financial lease. In GFS, liabilities can also be created by the force of law such as those arising through taxes, penalties, and judicial awards.

Contingent liabilities

3.59.

As is also the case with commercial accounting, contingent liabilities are recorded in GFS with the exception that these do not appear in the core GFS balance sheet (other than explicit contingent liabilities in the form of financial derivatives and provisions for calls under standardised guarantees), but rather as a memorandum item to the accounts. The reason for this is because the government is not obliged to recognise a liability unless an event occurs which forces them to step in and accept liability.

3.60.

Contingent liabilities are defined in paragraph 7.251 of the IMF GFSM 2014 as obligations that do not arise unless a particular, discrete event(s) occurs in the future. Common types of contingent liabilities for general government units are guarantees of payment by a third party, such as when the general government unit guarantees the repayment of a loan by another borrower. In this case, the liability is contingent because the guarantor (the general government unit) is only required to repay the loan if the borrower defaults. Therefore for GFS purposes, a contingent liability will not appear in the core accounts of the general government unit unless, and until, the guarantee is called. However, the government needs to keep track of contingent liabilities to ensure it has an adequate reserve of funds prepared in case a guarantee is called. In order to do this, the details of significant contingent liabilities are recorded as a memorandum item to the GFS balance sheet.

3.61.

Further discussion on contingent liabilities may be found in Chapter 13 of this manual.

Part D - Accounting rules

3.62.

Although GFS is based on economic principles, the data that supports it are sourced from the accounting systems of Australian treasuries, the Department of Finance, directly from public sector units, and others. In Australia, the GFS is embedded into the Australian Accounting Standards via Australian Accounting Standards Board 1049: Whole of Government and General Government Sector Financial Reporting (AASB 1049). This standard applies to the Commonwealth Government, and each state and territory government.

3.63.

As is the case with commercial accounting, all entries in GFS are recorded in monetary terms through the use of double entry recording which captures debit and credit entries. In GFS, flows are recorded as revenue, expenses, and transactions in assets and liabilities, and stock positions are recorded as assets and liabilities. Similarly to commercial accounting, GFS employs the accrual basis of recording which means that transactions are recorded whenever economic value is created, transformed, exchanged, transferred or extinguished. The GFS reporting period also matches that of the accounting financial year and financial quarters.

3.64.

While there are many similarities between GFS and the accounting rules applied by businesses and governments in their financial reports, there are also some important differences. For example, commercial accounting systems do not always require assets and liabilities to be valued at market value as does the GFS system. Also, GFS values sales at gross value rather than the net of the cost of goods sold. Other differences in the GFS system include the identification of assets as either financial or non-financial in nature and all liabilities as financial in nature, whereas commercial accounting identifies assets and liabilities as current or non-current in nature.

Double-entry accounting in GFS

3.65.

The GFS system uses double-entry accounting for the recording of flows. Under this system, every flow gives rise to a minimum of two entries of equal-value, referred to as debits and credits. This principle ensures that the total of all debit entries and that of all credit entries for all transactions are equal, thus permitting the accounts for a unit or sector to be checked for consistency.

3.66.

By convention, debit entries are made for increases in assets and decreases in liabilities. Credit entries are made for decreases in assets and increases in liabilities. Changes to net worth arising from transactions are recorded as either revenues or expenses. Therefore, transaction entries that increase net worth (revenues) are credits, and transaction entries that decrease net worth (expenses) are debits. This can be demonstrated in Table 3.1 below:

| Event | Entry |

|---|---|

| Increase in Assets | Debit (+) |

| Decrease in Assets | Credit (-) |

| Increase in Liabilities | Credit (-) |

| Decrease in Liabilities | Debit (+) |

| Increase in Revenue | Credit (-) |

| Decrease in Revenue | Debit (+) |

| Increase in Expenses | Debit (+) |

| Decrease in Expenses | Credit (-) |

3.67.

Individual debit and credit entries are not usually made in Australian GFS, (as data are sourced from electronic downloads at an aggregated level), but are shown in Table 3.1 to demonstrate the double entry nature of the GFS system.

3.68.

Other economic flows can increase or decrease stocks or values of assets and liabilities, with the counterpart entries recorded directly as changes in net worth. In the case of the reclassification of assets or liabilities, a change will occur in the stock position of two categories of assets or liabilities but there is no impact on net worth. This is because an increase in one category of assets or liabilities is paired with a decrease in another category of asset or liabilities.

The balance sheet

3.69.

The GFS balance sheet is defined in paragraph 3.56 of the IMF GFSM 2014 as a statement of the values of the stock positions of assets owned and of the liabilities owed by an institutional unit or group of units, drawn up in respect of a particular point in time. A fundamental rule of the GFS balance sheet is that the total value of the assets always equals the total value of the liabilities plus net worth. Use of the doubleentry recording in GFS ensures that this relationship is correctly maintained.

Time of recording flows

3.70.

The time of recording of flows plays a very important role in GFS compilation. All flows are recorded on an accrual basis in GFS. This means that economic events are recorded at the time when they occur, irrespective of whether cash was received or paid (or was due to be received or paid), and flows are recorded whenever economic value is created, transformed, exchanged, transferred or extinguished. The recording of flows on an accruals basis also ensures that non-cash transactions, such as depreciation and transfers in kind, are included in GFS.

The timing of specific flows

3.71.

Applying the accrual basis of accounting to GFS is not always straight forward. For example, all taxes should be recorded when the activities, transactions, or other events occur that create the liabilities to pay taxes. In practice, information based on Australian Taxation Office tax assessments may be all that is readily available to government to serve as evidence that a taxable event took place, and these may have been submitted many months after the liability to pay the taxes had been created. Table 3.2 below provides some practical guidance for the timing of recording of specific flows, and is based on paragraphs 3.77 to 3.102 of the IMF GFSM 2014:

| GFS Flow | Recommended time of recording |

|---|---|

| Income taxes | Income taxes should be recorded in the period in which the income is earned, but in reality there may be a significant delay between the period that the income is earned and the time at which it is feasible to determine the actual liability. In practice, income taxes deducted at source (such as pay-as-you-earn taxes), are recorded in the period they are paid rather than earned. Other income taxes have to be recorded when there is documentary evidence of the amount of tax that has accrued. |

| Other taxes | Taxes on the ownership of specific types of property are often based on the value of the property at a particular point in time, but are deemed to accrue continuously over the entire year or the portion of the year that the property was owned (if less than the entire year). Similarly, taxes on the use of goods or the permission to use goods or perform activities usually relate to a specific time period, such as a license to operate a business during a specific period. |

| Fines, penalties and property forfeitures | Some compulsory transfers such as fines, penalties, and property forfeitures, are determined at a specific time. These transfers are recorded when the government has an unconditional legal claim to the funds or property, which usually is when a court renders judgment or an administrative ruling is published. If such judgment or ruling is subject to further appeal, then the time of recording is when the appeal is resolved. |

| Grants and other voluntary transfers | Grants and other voluntary transfers often have requirements or eligibility conditions attached to them. Examples are the prior incurrence of expenses for a specific purpose, the passage of legislation to authorise participation in a program, or the beginning of a period such as the start of a new financial year. Under an accruals basis, these transfers should be recorded when all requirements and conditions are satisfied. However in Australia, recipients of grants generally do not record them until they have control over the funds granted. |

| Dividends | Dividends are to be recorded as of the date that the associated share goes 'ex dividend'. The ex-dividend date is the date that the dividends are excluded from the market price of shares. |

| Withdrawal of income from quasi-corporations | Withdrawals from income of quasi-corporations and various voluntary transfers are recorded on the date that the payment occurs. |

| Transactions in goods and nonfinancial assets | Transactions in goods and non-financial assets (including by barter, payment in kind, or transfer in kind) should be recorded when legal ownership changes. If that time cannot be determined precisely, the time of recording may be when there is a change in physical ownership or control of the goods and non-financial assets. Change in ownership of goods acquired under finance lease are deemed to be acquired or disposed of when the lease is signed or economic control of the asset otherwise has changed hand. |

| Inventories | Inventory is often made up of materials and supplies held as input for producing goods and services, work-in-progress or finished goods held for resale or distribution. Additions to inventories are recorded when products are purchased, produced, or otherwise acquired. Withdrawals from inventories are recorded when products are sold, used up in production, or otherwise relinquished. Additions to work-in-progress inventory are recorded continuously as work proceeds. When production is completed, the production costs accumulated to that point are transferred to finished goods inventory. |

| Transactions in services | Transactions in services should be recorded when the services are provided. Some services and certain types of exchange transactions are supplied or take place on a continuous basis. For example, renting, insurance, and housing services are continuous flows and, in concept, should be recorded continuously for as long as they are being provided. Similarly, interest, compensation of employees, rent, some social benefits, and consumption of fixed capital occur on a continuous basis over a period. In practice, such activities are allocated to periods based on assumptions about the amount of the activities that occurs during each period. |

| Transactions in financial assets and liabilities | Transactions in most types of financial assets, such as securities, loans, currency and deposits, should be recorded when legal ownership changes. This date may be specified according to a contract to ensure matching entries in the books of both parties. If no precise date is fixed, the date on which the creditor receives payment, or some other financial claim, is the determining factor. For example, loan drawings are entered in the accounts when actual disbursements are made and financial claims are established, not when an agreement is signed. On practical grounds, public sector liabilities may have to take account of the time of recording from the viewpoint of the public sector unit. In some cases, the parties to a transaction may perceive ownership to change on different dates because they acquire the documents evidencing the transaction at different times. This variation usually is caused by the process of clearing funds. The amounts involved may be substantial, such as in the case of transferable deposits and other accounts receivable or payable. For transactions between government units, the date on which the creditor records the transaction should be the date of recording. The transaction date of securities (the time of the change in ownership of the securities) may precede the settlement date (the time of the delivery of the securities). Under these circumstances, both parties should record the transaction at the time ownership changes, not when the underlying financial asset is delivered. Any significant difference between transaction and settlement dates gives rise to accounts payable or receivable. In practice, when the delay between the transaction and settlement is short, the time of settlement may be considered an acceptable proxy. |

| Accounts payable and receivable | Some financial claims or liabilities, in particular the various types of accounts payable and receivable such as trade credits and advances, general accounts payable, and wages payable, are the result of a non-financial transaction and are not otherwise evidenced. In these cases, the financial claim is created when the counterpart transaction such as the purchase of a good on credit, and compensation of employees, occurs. |

| Holding gains and losses | The calculation of holding gains and losses starts when economic ownership over the assets is acquired. The signing of the contract fixes the current market price for the transaction. A unit can only incur holding gains and losses on the assets or liabilities over which it has economic ownership. Changes in price often have a continuous character, particularly in respect to assets for which an active market exists. In practice, holding gains and losses are computed between two points in time. The starting point in time for the recognition of holding gains and losses will be the moment at which:

|

| Arrears | Arrears are amounts that are both unpaid and past their due-for-payment date. If arrears occur, no transactions should be imputed, but the arrears should continue to be included in the same instrument until the liability is extinguished. Repayments of debts are recorded when they are extinguished in accordance with the accrual principle of accounting. Sometimes a debt contract can provide for a change in the characteristics of a financial instrument if repayments go into arrears. If this occurs, then the existing financial instrument should be reclassified to represent a new financial instrument through an other change in the volume of assets entry. This type of reclassification applies if the original debt contract remains, but the terms within it change. If a new contract is negotiated, or the nature of the instrument changes from one instrument category to another (for example, from bonds to equity), these events need to be recorded as new transactions. |

| Reclassifications | Reclassifications should be recorded when the change in the nature of the asset, liability, or entity occurs. Keeping records of reclassifications as they occur makes it possible to reconstruct supplementary time series based on the situation before the reclassification, if needed. |

| Other changes in the volume of assets and liabilities | Other changes in volume are recorded as these changes occur. For reclassifications, because the GFS is an integrated stock-flow framework, this requires that both the removal of an existing asset or liability from the original category and its inclusion in the new category are recorded at the same time. |

Source: Based on paragraphs 3.77 to 3.102, International Monetary Fund Government Finance Statistics Manual, 2014

The recording of flows over extended periods

3.72.

Several other transactions relate to flows that take place continuously, or over extended periods. For example, operating leases and depreciation accrue continuously over the entire period that a non-financial produced asset is used, and interest accrues continuously over the entire period that a financial claim exists. In GFS, these transactions should be recorded as if they are provided continuously over the whole period that the contract lasts, or the period that the asset is available for use. However in reality, as is the case for income taxes, the details of flows that take place continuously (or over extended periods) may not be available until the reporting date.

The cash basis of recording

3.73.

Under the cash basis of accounting, flows are recorded when cash is received or disbursed. GFS in Australia is recorded under the accrual basis of accounting which also enables the derivation of a statement of cash flows (called the statement of sources and uses of cash) as an integral part of GFS records. Information on cash flows assists in the management of liquidity and is crucial to the operation of any unit. In GFS, the cash basis of recording provides analytically useful information on the liquidity positions of government, which allows for liquidity management. However, it is difficult to assess the true financial position of a unit without an accrual based system of accounting because information on non-monetary flows such as arrears, depreciation, accounts receivable / accounts payable, and trade credits is missing in a pure cash system of accounting. Although useful for liquidity management and other analytical purposes, the pure cash basis of accounting does not fully record all economic activity and resource flows required in macroeconomic statistics.

Part E - The valuation of flows and stock positions in GFS

3.74.

In the GFS system, all flows and stock positions are measured at the current market price. Flows recorded in the GFS statement of operations should be valued at the market price on the date that the flow takes place, while flows recorded in the GFS Statement of sources and uses of cash should be valued at their monetary value at the time the cash flow occurred. Stock positions should be valued at the prices current on the balance sheet date or on the date that a change in the nature of the asset or liability occurs in the case of acquisitions, disposals or reclassifications.

3.75.

The market value is defined in paragraph 3.108 of the IMF GFSM 2014 as amounts of money that willing buyers pay to acquire something from willing sellers; the exchanges are made between independent parties and on the basis of commercial considerations only, sometimes called 'at arm’s length'. According to this definition, a market price refers only to the price for one specific exchange under the stated conditions. A second exchange of an identical unit (even under circumstances that are almost exactly the same), could result in a different market price.

3.76.

Paragraph 3.109 of the IMF GFSM 2014 indicates that when a price is agreed to by both parties in advance of a transaction taking place, this agreed (or contractual) price is the market price for that transaction regardless of the prices that prevail when the transaction takes place. Paragraph 3.110 of the IMF GFSM 2014 states that actual exchange values, expressed in monetary terms, are presumed to be the market prices in most cases. A market price is the price payable by the buyer after taking into account any rebates, refunds, adjustments, etc., from the seller.

The valuation of transactions

3.77.

All transactions in GFS are valued at current market value. Paragraph 3.111 of the IMF GFSM 2014 recommends that transactions in financial assets and liabilities are recorded exclusive of any commissions, fees, and taxes regardless of whether these are charged explicitly, included in the purchaser’s price, or deducted from the seller’s proceeds. The valuation of financial instruments (such as securities) differ from the valuation of non-financial assets (such as buildings or equipment, with the exception of land) because they exclude the costs of ownership transfer. This is because both debtors and creditors should record the same amount for the same financial instrument in each of their accounts. The commissions, fees, and / or taxes and similar payments for services that are necessary to acquire a financial asset or incur a liability should be recorded separately from the transaction under the appropriate categories of revenue or expense. A summary treatment of the costs of ownership transfer is demonstrated in Table 3.3 below:

| Type of asset | Treatment of COOT* | |

|---|---|---|

| Financial assets (and liabilities) | Financial assets (and liabilities) | COOT is recognised but it is not recorded as part of the associated financial asset (or liability) itself; instead, it is classified as a non-employee expense in the period of ownership change. |

| Non-Financial assets | Produced assets | |

| Land improvements | COOT on land is recognised here as an undistinguished part of land improvements, not in land. | |

| Inventories | COOT is not recognised. | |

| Other produced assets | COOT is recognised and it is recorded as an undistinguished part of the associated other produced asset itself. | |

| Non-produced assets | ||

| Land | COOT for land is recognised but it is not recorded against land itself; instead, it is recorded as an undistinguished part of land improvements, in the period of ownership change. | |

| Non-produced assets other than land | COOT is recognised and it is recorded against "COOT on non-produced assets other than land" (a category of fixed produced asset) for the purposes of deriving gross fixed capital formation and depreciation. However, it is included as an undistinguished part of the associated nonproduced asset for GFS balance sheet presentation purposes. | |

* These typically include commissions, fees, taxes and similar costs necessary to acquire the asset or incur the liability.

3.78.

Where market prices for transactions are not observable (such as for some barter or transfers in kind transactions), paragraph 3.112 of the IMF GFSM 2014 indicates that valuation based on market price equivalents may provide an approximation to market prices. In such cases, the market price of the same or similar items (when such prices exist) provide a good basis for applying the principle of market prices. Generally, market prices should be taken from the markets where the same or similar items are traded currently, in sufficient numbers and in similar circumstances. If there is no appropriate market in which a particular good or service is currently traded, the valuation of a transaction involving that good or service may be derived from the market price of similar goods and services by making adjustments to the price for quality and other differences.

Valuation of stock positions

3.79.

Stock positions should be valued at the current market value, as if they were acquired in a market transaction on the balance sheet reporting date (also known as the reference date). Current market prices are readily available for assets and liabilities that are traded in active markets. Paragraphs 3.113 to 3.116 of the IMF GFSM 2014 state that assets and liabilities that are not traded in markets (or are traded only infrequently), need to be valued according to their market value equivalent. For these assets and liabilities, it is necessary to estimate fair values that approximate market prices. The present value of future cash flows may be used as an approximation to market prices, provided an appropriate discount rate is used.

3.80.

Paragraph 3.125 of the IMF GFSM 2014 provides guidance on how to estimate the current market value of flows and stocks without the presence of an active market. This information has been reproduced in Box 3.2 below.

Box 3.2 - Estimation of current market values

In situations where the current market value of a flow or stock must be estimated, the following estimation guidelines may be applied:

- It may be possible to estimate the values of transactions based on values taken from markets in which similar transactions take place under similar conditions. The value of certain stock positions (primarily financial assets), may be estimated using market transactions involving similar assets that take place at the end of the reporting period.

- Flows and stock positions involving existing non-financial produced assets may be valued using the market price for similar new goods, properly adjusted for consumption of fixed capital and other events that may have occurred since they were produced.

- If there is no appropriate market in which a particular good or service is currently traded, the valuation of a flow involving that good or service may be derived from the market prices of similar goods and services by making adjustments for quality and other differences.

- The value of flows and stock positions of assets may be estimated on the basis of the historical or acquisition cost of the item, but must be adjusted for all changes that have occurred since it was purchased or produced. Examples of adjustments include those for depreciation, holding gains or losses, physical depletion, exhaustion, degradation, unforeseen obsolescence, and exceptional losses.

- Goods and services may be valued by the amount that it would cost to produce them currently. For market producers, the market value of a non-financial asset valued in this way should include a mark-up that reflects the net operating surplus attributable to the producer. For non-market goods and services produced by government units, no allowance should be made for any net operating surplus.

- Assets can be valued at the discounted present value of their expected future returns. This method is particularly prominent for a number of financial assets, natural assets, and intangible assets. For some financial assets, the present market value is established by discounting future payments or receipts to the present value, using the market interest rate. However, it may be difficult to determine future earnings with the appropriate degree of certainty, given that assumptions are also needed about the asset’s life span and the discount factor to be applied. Because of these uncertainties, the other possible sources of valuation described in the preceding paragraphs should be exhausted before resorting to this method.

Source: Paragraph 3.125, International Monetary Fund Government Finance Statistics Manual, 2014

3.81.

Paragraph 3.115 of the IMF GFSM 2014 lists some other valuation methods which may be analytically useful and appropriate to compare against current market values:

- Fair value - this is a market-equivalent value defined as the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction. It represents an estimate of what could be obtained if the creditor sold the financial claim or settled the liability.

- Nominal value - this is the amount that the debtor owes to the creditor at any moment in time. It reflects the value of the instrument at creation and subsequent economic flows, such as transactions, valuation changes (excluding market price changes), and other changes, such as debt forgiveness. Conceptually, the nominal value is equal to the required future payments of principal and interest discounted at the existing contractual interest rate. For financial instruments other than debt securities, equity, and financial derivatives, nominal value can be taken as a proxy for market value.

- Amortised value - this reflects the amount at which the financial asset or liability was measured at initial recognition minus the principal repayments. Excess payments over the scheduled principal repayments reduce the amortised value whereas payments that are less than the scheduled principal repayments or scheduled interest increase the amortised value. On each scheduled date, amortised value is the same as nominal value, but it may differ from the nominal value on other dates due to the accrued interest being included in the nominal value.

- Face value - this is the undiscounted amount of principal to be repaid at maturity. The use of face value as a proxy for nominal value in measuring the gross debt position can result in an inconsistent approach across all instruments and is not recommended. For example, the face value of deep discounted bonds and zero-coupon bonds includes interest not yet accrued, which runs counter to accrual principles.

- Written-down replacement cost - this is the current acquisition price of an equivalent new asset minus the accumulated consumption of fixed capital, amortisation, or depletion.

- Book value - this refers to the value recorded in the entities’ records. Book values may have different meanings because their values are influenced by accounting standards, rules, and policies, as well as the timing of acquisition, company takeovers, frequency of revaluations, and tax and other regulations.

- Historic cost - this reflects the cost of an asset at the time of acquisition.

Valuation adjustments in special cases

3.82.

Paragraphs 3.118 to 3.125 of the IMF GFSM 2014 provide the following guidance on special cases where valuation adjustments may be needed to reflect correct values of flow and stock positions:

- Where a unit sells an item and does not receive the corresponding payment for an unusually long time, and the amount of trade credit extended is large, then the value of the sale should be reduced by means of an appropriate discount rate and interest should be accrued until the actual payment is made.

- Where flow and stock positions are expressed in a foreign currency, flows need to be converted to their value in the domestic currency, at the rate prevailing at the moment the transactions or other flow takes place, and stocks need to be converted at the rate prevailing on the balance sheet date. The midpoint between the buying and selling rates should be used so that any service charge is excluded.

- Where the valuation in domestic currency of a purchase or sale on credit expressed in a foreign currency is different because the exchange rate changed in the interim, both transactions should be valued at their current market values as of the dates they actually occurred, and a holding gain or loss resulting from the change in the exchange rate should be recorded for the period or periods in which it occurs.

- Where a contract establishes a quotation period for a transaction in goods months after the goods have changed hands, the market value at the time of the change of ownership of the goods should be initially estimated, and revised with the actual market value when known. Market value is given by the contract price even if it is unknown at the time of change of ownership.

- Transfers in kind should be valued at the market price that would have been receivable if the resources had been sold in the market. In the absence of a market price, the donor’s view of the imputed value of the transaction will often be quite different from that of the recipient. The suggested rule of thumb is to use the value assigned by the donor as a basis of recording.

- Where a single payable/receivable refers to more than one transaction category, the individual flows should be partitioned and recorded separately. In such a case, the total value of the individual transactions after partitioning must equal the market value of the exchange that actually occurred.

Valuation of concessional or below market loans

3.83.

Some transactions may take place at implied prices that include a grant or concession which means they are offered at below market prices. This is the case with concessional lending arrangements entered into by government. Paragraph 3.123 of the IMF GFSM 2014 states that while there is no precise definition of concessional loans, it is generally accepted that they occur when units lend to other units and the contractual interest rate is intentionally set below the market interest rate that would otherwise apply. Concessional loans effectively include a transfer from the creditor to the debtor, and the degree of concessionality can be enhanced with grace periods, frequencies of payments and a maturity period favourable to the debtor. With the exception of concessional lending to government employees and concessional lending by central banks, concessional debt is recorded as a memorandum item in GFS. Further discussion on the treatment of concessional loans in GFS may be found in Chapter 13, and Appendix 1 Part B of this manual.

Valuation of other economic flows

3.84.

Apart from transactions, the change in the value of assets and liabilities between two reporting periods may also result in holding gains and / or losses, and other changes in the volume of assets and liabilities.

Holding gains and losses

3.85.

Holding gains and / or losses occur if the value of an asset or liability changes during the time that it is held without changing in quality or quantity, or otherwise transforming or altering the asset or liability in any way. Holding gains and losses are recorded between the beginning of the accounting period (or the time an asset was acquired or produced during the accounting period); and the end of the accounting period or the time an asset is relinquished or consumed.

3.86.

Holding gains and losses accrue continuously and apply to both non-financial assets and financial assets and liabilities in the statement of total changes in net worth (see Chapter 11 of this manual for further discussion). In GFS, holding gains and losses that occur during a reporting period are shown separately as flows related to the asset or liability in question. Since all financial assets (except monetary gold in the form of gold bullion held as reserve assets) are matched by liabilities (either within the domestic economy or with the rest of the world), it is important that holding gains or losses are recorded symmetrically. Table 3.4 below illustrates the recording of holding gains and losses.

| Asset increases in value while it is held | Holding |

|---|---|

| Liability decreases in value while it is held | Gain |

| Asset decreases in value while it is held | Holding |

| Liability increases in value while it is held | Loss |

Other changes in the volume of assets and liabilities

3.87.

Differences in the value of non-financial assets that are not explained by transactions or through holding gains or losses, are due to other changes in the volume of assets and liabilities. This is where the quality and / or quantity of an asset or liability is affected through events such as fires, floods, earthquakes, natural growth in stocks of biological assets such as fish or virgin forests, unilateral action (e.g. debt write-off or annexation of new territories) or changes to the classification or structure of an asset or liability.

3.88.

Paragraph 3.128 of the IMF GFSM 2014 indicates that in order to determine the valuation of the other changes in the volume of non-financial assets, the asset value needs to be examined both before and after the change in volume event so that any difference that is not explained by transactions or holding gains and losses is the value of the other volume change. Other changes in the volume of financial assets and liabilities are recorded at the current market equivalent prices of similar instruments. For all reclassifications of assets and liabilities, the value of both the new and old instruments should be the same.

3.89.

Further discussion on other changes in the volume of assets and liabilities may be found in Chapter 11 of this manual.

Part F - Derived measures

3.90.

In GFS, derived measures are obtained by performing arithmetic operations on values recorded for the flows or stocks of individual units / sectors. Paragraphs 3.141 and 3.142 of the IMF GFSM 2014 outline two types of derived measures as aggregates and analytical balancing items.

3.91.

Aggregates are summations of data relating to a class of flows or stocks of individual units / sectors. For example, tax revenues are the sum of all flows that are classified as taxes of a unit / sector. Aggregates and classifications are closely linked because classifications are designed to produce the aggregates considered to be most useful to users of GFS. In the GFS system, aggregates are produced after consolidation, which eliminates flows and stocks that occur between units contributing to the same aggregate.

3.92.

Analytical balancing items are economic constructs obtained by subtracting one aggregate from a second aggregate. For example, the GFS net operating balance is an analytical balancing item obtained by subtracting the expenses aggregate from the revenues aggregate. Analytical balancing items are a prominent feature of fiscal analysis because they provide a convenient summary of financial outcomes.

Part G - Gross and net recording of flows and stocks

3.93.

In GFS, flows and stock positions may be presented on a gross or a net basis. Paragraph 3.143 of the IMF GFSM 2014 states that the presentation of flows and stock positions on the gross basis means that the data is presented as the total sum of a flow or stock. The presentation of flows and stocks on the net basis means that the flow or stock is shown as the sum of one set of flows or stock positions minus the sum of a second set of a similar kind. An example of the gross and net basis of recording of flow and stock positions can be shown through the presentation of total tax revenue. When presented on a gross basis, the total tax revenue is the total amount of all taxes accrued. When presented on a net basis, the total tax revenue is the gross amount minus tax refunds and non-payable tax credits.

3.94.

The use of the terms 'gross' and 'net' are used in a very limited manner for GFS purposes. Apart from a few cases, the GFS classifications employ the word 'gross' and 'net' to indicate the value of variables before or after the deduction of depreciation. Paragraphs 3.143 to 3.151 of the IMF GFSM 2014 examine the gross and net presentations of flows and stocks as used in the GFS framework. Some of this information has reproduced in the points below:

- Revenues are presented gross of expense categories for the same or related category and likewise for expense categories. in particular, interest revenue and interest expense are presented gross rather than as net interest expense, or net interest revenue. Similarly, grant revenue and expense, and rent revenue from natural resources and expenses are presented as gross. Also, sales of goods and services are presented as gross of the expenses incurred in their production;

- Revenues are also presented net of refunds of revenues, and expense categories are presented net of inflows of expenses arising from erroneous or unauthorised transactions. For example, refunds of income taxes may be paid when the amount of taxes withheld or otherwise paid in advance of the final determination exceeds the actual tax due. Such refunds are recorded as negative tax revenues. Similarly, if monetary transfers paid in error to households are recovered, then such recoveries are recorded as negative expenses;

- Acquisitions and disposals of non-financial assets (other than inventories) are presented on a gross basis. For example, acquisitions of land are presented separately from disposals of land;

- Changes in inventories are presented on a net basis. That is, the change in inventories is presented as the value of additions less withdrawals. Acquisitions and disposals of financial assets are also presented on a net basis. For example, only the net change in the holding of cash is presented, not gross receipts and disbursements of cash. Similarly, liquidation of liabilities is netted against incurrence of liabilities;

- Holding gains and losses (also known as revaluations) are presented on a net basis. That is, the net holding gain for each asset and liability is presented, not the gross holding gain and the gross holding loss;

- Stocks of non-financial assets are presented net of depreciation, revaluations, depletion, and other changes since their acquisition;

- Stocks of financial assets and liabilities are presented net of revaluations and other changes since their acquisition; and

- Stocks of the same type of financial instrument held both as a financial asset and a liability are presented on a gross basis. For example, a unit’s holding of bonds as assets is presented separately from its liability for bonds.

Part H - Consolidation

3.95.

Consolidation is the process of eliminating intra-group flows and stocks from aggregates for a group of units for which statistics are to be presented. In the GFS system, data are consolidated whenever they are presented for a group of units. In Australian GFS, data have to be consolidated for many different groups of units, covering the nation as a whole, and each jurisdiction individually.

Intra-sectoral and inter-sectoral consolidation

3.96.

Intra-sectoral consolidation is defined in paragraph 3.155 of the IMF GFSM 2014 as the in-principle elimination of flows and stocks that occur within a particular group of units, a sector or subsector. An institutional unit requires consolidation when the unit has multiple funds and accounts to carry out its operations and there are flows and stock positions among those funds. Failure to eliminate intra-sectoral flows and stock positions results in aggregates that cannot measure interaction with outside units exclusively. An example of intra-sectoral consolidation is that which is undertaken within the central government, or within the public non-financial corporations subsector, or within a state / territory government.

3.97.

Inter-sectoral consolidation is defined in paragraph 3.156 of the IMF GFSM 2014 as the in-principle elimination of flows and stocks that occur between a particular group of units, subsectors or sectors. An example of inter-sectoral consolidation is that which occurs between central, state and local governments, or between the general government and public non-financial corporations, or between the general government and public financial corporations.

3.98.

Paragraph 3.157 of the IMF GFSM 2014 recommends that intra-sectoral consolidation is undertaken before inter-sectoral consolidation takes place, and states that for international statistical purposes the general government sector and each of its subsectors should be presented on a consolidated basis. It further states that consolidated data for public corporations should also be presented together with general government units for the consolidated total public sector.

3.99.

Because consolidation is performed in GFS under a double entry system of accounting (where credit entries are matched with debit entries of equal value), the adjustments to GFS data made through consolidation do not affect the GFS balancing items. Paragraph 3.166 of the IMF GFSM 2014 states that balancing items which are produced by simple aggregation are the same as those produced by consolidation due to the symmetry of the consolidation process. Therefore, when consolidated data produces different balancing items from the unconsolidated data, this is a good indication that recording errors have been made.

Consolidation groupings in Australian GFS

3.100.

In the Australian GFS framework, data are presented on an intra-sectoral and inter-sectoral consolidated basis for each of the consolidation groupings that appear in Table 3.5 below.

| Sector | |||||

|---|---|---|---|---|---|

| Level of Government | General Government (1) | Public Non-Financial Corporations (2) | Non-Financial Public Sector (1) + (2) | Public Financial Corporations (3) | Total Public Sector (1) + (2) + (3) |

| Commonwealth | |||||

| State / Territory | |||||

| Local | |||||

| State / Territory and Local | |||||

| Control not further defined | |||||

| National | |||||

| All Levels of Government | |||||

3.101.

In the Australian GFS system, data are consolidated whenever they are presented for a group of units. For example, each of the cells in Table 3.5 represents a grouping for which consolidated data must be produced. In addition, separate consolidation must be undertaken for each of the nine jurisdictions (including multi-jurisdictional units).

Conceptual guidelines for consolidation

3.102.

Consolidation requires the in-principle elimination of all intra-governmental and inter-governmental flows and stock positions among a group of public sector units or entities. Consolidation requires a review of the accounts that are to be consolidated in order to identify inter-sectoral and intra-sectoral flows and stock positions. Box 3.3 contains guidance as to the types of transactions, flows or stock positions that require consolidation, and has been reproduced from paragraphs 3.162 to 3.164 of the IMF GFSM 2014:

Box 3.3 - Practical guidelines for consolidation in GFS

1. Consolidation covers a range of categories of flows and stock positions that can vary in significance and value in GFS. The major transactions, in likely order of importance, are: