Financing resources and investment table

| Non-financial corps | Financial corps | Government | Households | Total national | Rest of world | |||

|---|---|---|---|---|---|---|---|---|

| Financing resources | ||||||||

| Net saving (a) | 36.1 | 3.1 | 5.1 | 12.5 | 56.8 | -23.2 | ||

| plus Consumption of fixed capital | 45.7 | 3.2 | 11.6 | 33.3 | 93.8 | - | ||

| Gross saving | 81.8 | 6.3 | 16.7 | 45.8 | 150.6 | -23.2 | ||

| plus Net capital transfers | 0.9 | 0.0 | -2.5 | 1.4 | -0.3 | 0.3 | ||

| less Statistical discrepancy (b) | - | - | - | - | -17.2 | - | ||

| Total financing resources | 82.7 | 6.3 | 14.2 | 47.2 | 167.6 | -22.9 | ||

| Uses of financing (investment) | ||||||||

| Capital formation | ||||||||

| Gross fixed capital formation | 63.1 | 3.3 | 30.4 | 49.2 | 146 | - | ||

| plus Changes in inventories | -1.2 | 0.0 | 1.5 | -1.5 | -1.3 | - | ||

| plus Net acquisition of non-produced non-financial assets | -0.4 | - | 0.3 | - | - | - | ||

| Total capital formation | 61.5 | 3.3 | 32.2 | 47.7 | 144.6 | - | ||

| plus Financial investment | ||||||||

| Aquistition of financial assets | 49.6 | 82.5 | 28.5 | 55.5 | -46.8 | -65.5 | ||

| less Incurrence of financial liabilities | 31.8 | 60.2 | 50.0 | 55.4 | -65.5 | -46.8 | ||

| Net Financial investment (Net lending (+) / net borrowing (-)) | 17.7 | 22.3 | -21.5 | 0.1 | 18.7 | -18.7 | ||

| less Net errors and omissions | -3.5 | 19.2 | -3.4 | 0.6 | -4.3 | 4.3 | ||

| Total investment | 82.7 | 6.3 | 14.2 | 47.2 | 167.6 | -23.0 | ||

- nil or rounded to zero

(a) Net saving for the rest of world is the balance on the external income account.

(b) The statistical discrepancy is not able to be distributed among the sectors.

Financial market summary table

| Amounts outstanding, Mar-22 | Transactions, Jun-22 | Other changes, Jun-22 | Amounts outstanding, Jun-22 | ||

|---|---|---|---|---|---|

| Currency and deposits | |||||

| Currency | 106.3 | 0.3 | - | 106.6 | |

| Transferable deposits | 2,227.4 | -1.7 | 12.0 | 2,237.7 | |

| Other deposits | 1,403.4 | 69.6 | 12.1 | 1,485.1 | |

| Short term debt securities | |||||

| Bills of exchange | 8.0 | -0.5 | - | 7.5 | |

| One name paper | 507.6 | 20.2 | 8.7 | 536.5 | |

| Long term debt securities | |||||

| Bonds, etc. | 3,215.9 | 112.6 | -97.5 | 3,231.0 | |

| Derivatives | |||||

| Derivatives | 915.2 | -244.7 | 590.2 | 1,260.6 | |

| Loans and placements | |||||

| Short term | 406.6 | 36.9 | 6.8 | 450.3 | |

| Long term | 4,342.0 | 101.3 | 8.5 | 4,451.9 | |

| Shares and other equity | |||||

| Listed | 2,710.1 | -4.3 | -358.5 | 2,347.3 | |

| Unlisted | 5,633.6 | 5.9 | -94.2 | 5,545.3 | |

| Insurance technical reserves | |||||

| Reserves of pension funds and life | 3,213.4 | 39.2 | -246.4 | 3,006.3 | |

| General insurance payments | 150.2 | -0.4 | 0.0 | 149.8 | |

- nil or rounded to zero

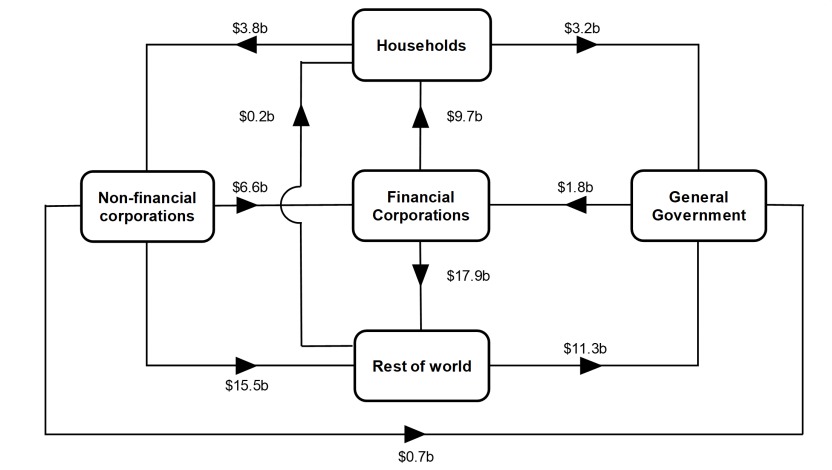

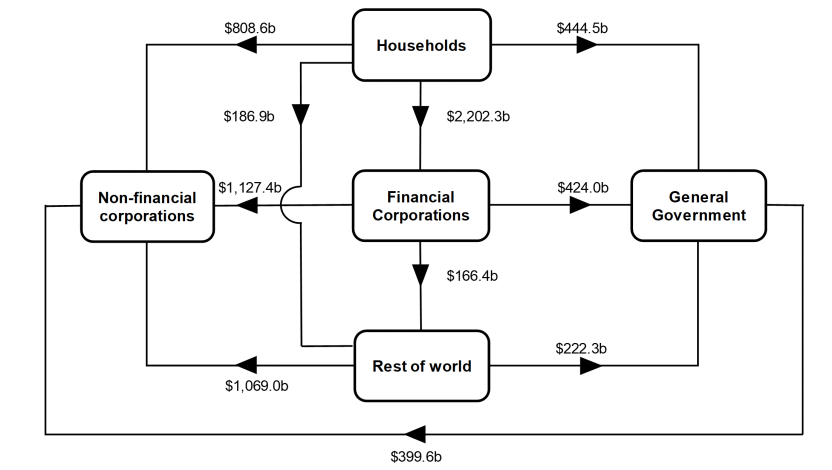

Flow of funds diagrams

Net transactions during June quarter 2022

Image

Description

Amounts outstanding at end of June quarter 2022

Image

Description

National investment

National investment increased $19.4b to $144.6b in the June quarter.

- General government investment increased by $10.3b to $32.2b driven largely by an increase in gross fixed capital formation in both state and local general government and national general government.

- Non-financial corporations' investment increased by $5.4b to $61.5b, driven largely by an increase in gross fixed capital formation in private non-financial corporations and public non-financial corporations. This was partially offset by a decrease in inventories in private non-financial corporations.

- Household investment increased by $3.3b to $47.7b, driven by an increase in gross fixed capital formation. This was partially offset by a decrease in inventories.

Financial investment

Australia was a net lender of $18.7b to rest of world (ROW). The main contributors were a:

- $26.4b withdrawal by ROW of deposits accepted by the central bank and authorised deposit taking institutions (ADIs)

- $22.5b in loans and placements lent to ROW

- partly offset by $40.8b ROW holdings of debt securities, driven mainly by bonds issued by national general government (NGG), ADIs, and securitisers

Funding requirements between resident ADIs and their ROW subsidiaries drove ROW loan borrowing from ADIs. ROW remains a significant holder of bond issued by both NGG and ADIs.

Households

Households' $0.1b net lending position was due to a $55.5b acquisition of financial assets, offset by a $55.4b incurrence of liabilities.

The acquisition of assets was driven by:

- $38.0b in net equity in pension funds

- $5.3b in deposits

While liabilities were driven by:

- $53.2b in loan borrowings

Deposit assets grew modestly as spending increased following the lifting of COVID-19 restrictions. Increased contributions into pension funds reflected continued growth in employment and additional personal contributions made by households prior to the end of financial year. Demand for home loan borrowing remained elevated this quarter reflecting continued momentum in housing markets from both owner-occupiers and investors.

Non-financial corporations

Non-financial corporations' $17.7b net lending position was due to a $51.5b acquisition of financial assets, offset by $33.8b incurrence of liabilities. The acquisition of assets was driven by:

- $45.9b in deposits

- $9.5b in equities

While liabilities were driven by:

- $18.0b in loan borrowing

- $13.6b in equities

The increase in non-financial corporations’ deposits reflect strong operating surpluses supported by favourable terms of trade. Loan borrowing by private non-financial corporations was driven by machinery and equipment investment with the agricultural and vehicle rental and hiring industries expanding their productive capacity.

General government

General government's $21.5b net borrowing position was due to a $50.0b incurrence of liabilities partly offset by a $28.5b acquisition of assets. Liabilities were driven by:

- $28.1b net issuance of bonds

- $18.7b in loans

The Commonwealth government continued to issue bonds over the quarter to finance government expenditure in national defence and transfers to state governments for natural disaster relief payments. Net issuance of bonds remained elevated during the quarter due to fewer bond maturities over the quarter. Funds raised by central borrowing authorities were passed on to their respective state and territory governments for capital expenditure on transport and health infrastructure.