This release contains preliminary data from the 2020-21 Survey of Income and Housing (SIH). The SIH collects information on household income, wealth, housing costs and financial stress from Australian households over the financial year. This issue presents data collected from the December collection quarter.

This cycle was collected online or via telephone interviewing only. There was no face-to-face interviewing conducted due to COVID-19 restrictions. Because of this changed methodology, a smaller quarterly sample size, and the impact of COVID-19 restrictions on the Australian population, care should be exercised when making comparisons with 2019-20. The Methodology page provides guidance on considering estimate reliability.

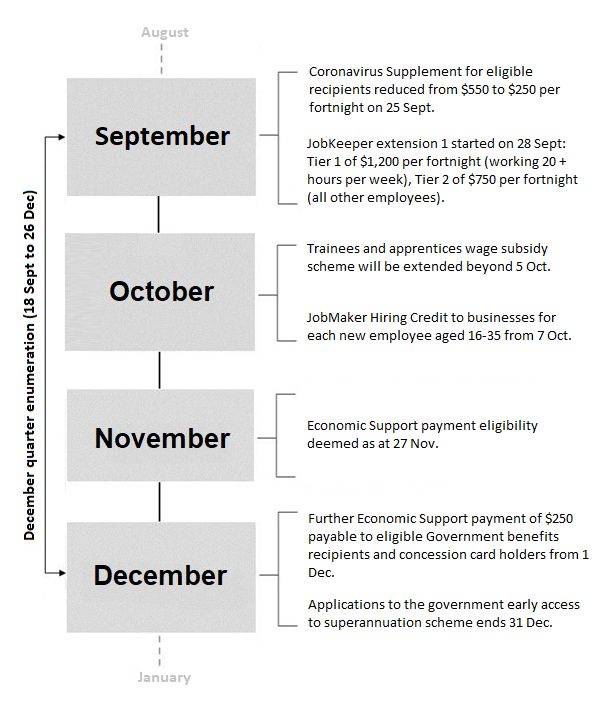

Events timeline, December 2020 quarter

Image

Description

Final SIH estimates for the full financial year are published in Household income and wealth, and Housing occupancy and costs. Preliminary quarterly estimates in this release will provide a more immediate insight into the financial impact of the Coronavirus (COVID-19) pandemic on Australian households.

Data for December 2019 is adjusted in real terms, using changes in the Consumer Price Index.

To see more measurements and impacts of COVID-19 on the economy and society please visit our COVID-19 page.