Methods changes during the COVID-19 period

The COVID-19 period provided us with unprecedented times, which meant that the Australian Bureau of Statistics (ABS), like other National Statistical Organisations, had to review and where necessary make changes to methods to ensure the quality of ABS statistics during this period.

From March 2020, the Australian Bureau of Statistics (ABS) responded rapidly to meet Australia’s data needs and strategic priorities during the COVID-19 pandemic. This required the ABS to review existing methods and frameworks, develop new methods, pursue new public and private sector data sources, produce new insights and engage more frequently with international organisations. In addition to this some periodic surveys had to be delayed (e.g. six yearly Household Expenditure Survey) as atypical data would have been collected.

By the start of 2022:

- Achieving survey responses to key economic surveys remained challenging because of COVID-19, as businesses reduced staffing capacity and/or worked from home and reliance on face-to-face household data collection was impacted by COVID-19 public health orders. The ongoing cooperation of businesses and households who responded to ABS surveys during this difficult period was greatly appreciated.

- With the co-operation of public and private sector data providers, the ABS gained access to new de-identified data sources such as Single Touch Payroll, and bank transaction data, which we used in core economic statistics (e.g. National Accounts) as well as developing new insights (e.g. monthly turnover and household spending indicators).

- Trend series continued to be suspended. The reinstatement of trend series will continue to be reviewed on a case-by-case basis, considering the stability of the trend series.

- Many data series continued to use forward factors for seasonal adjustment, with additional seasonal analysis being undertaken to monitor when concurrent seasonal adjustment could be reinstated.

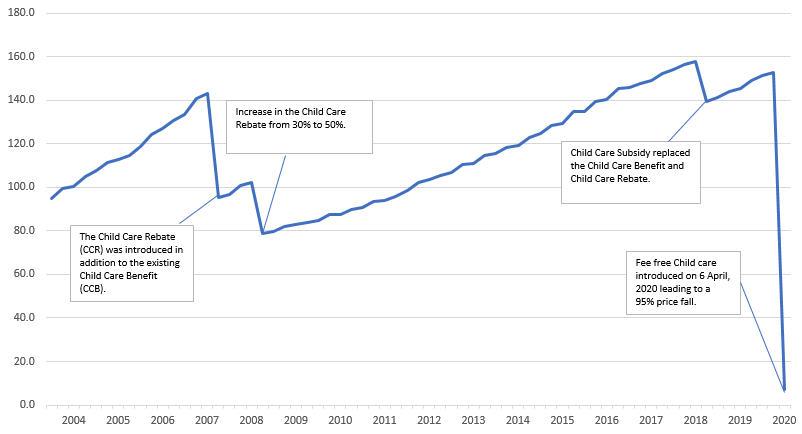

- As in the 2021 CPI annual reweighting, the 2022 CPI annual reweighting (published in December 2021) made use of additional data sources.

Further information on changes can be found on this page.

This page will be updated with key changes in the methods used to produce and disseminate ABS economic statistics during the COVID-19 period.